Summary:

- Despite mixed Q3 results, CRM’s stock surged due to the launch of Agentforce, which signed 200 deals in its first week.

- Agentforce 2.0, with advanced features and integrations, positions CRM to capitalize on the booming Enterprise AI market, projected to grow significantly.

- Valuation suggests a 22.5% upside, with a price target of $421, driven by Agentforce’s traction and CRM’s strategic acquisitions enhancing data quality and security.

- High stock-based compensation and potential weakening demand for Agentforce are key risks, but I maintain a Buy rating, and make CRM my top pick for 2025.

Eoneren/E+ via Getty Images

Investment Thesis

The last time I wrote about Salesforce (NYSE:CRM) (NEOE:CRM:CA), back in July 2024, I analyzed the company’s Q1 performance and argued why the growth potential of the company’s AI tools has taken a hit due to enterprises’ reluctance to adopt AI. I had a BUY rating on the stock.

Since the article was published, the stock has gained 42.6%, significantly outperforming the S&P 500, which gained 12.4% during the same period.

In this article, I dissect the company’s Q3 earnings report as well as the progress that the company has made with its latest AI tool, Agentforce. I also examine whether the latest AI offering of the company has enough potential for long-term growth.

A Snapshot of Salesforce’s Q3 Performance

It was a mixed quarter for CRM in my opinion. While Q3 revenues of $9.44 billion were up 8.3% y/y and beat analyst estimates by $97.6 million, non-GAAP EPS of $2.41 missed analyst estimates by $0.04 despite being up 14.2% y/y. Current remaining performance obligations (CRPO) were back to registering double-digit growth, jumping 10% y/y, and coming in at $26.4 billion. Non-GAAP operating margins came in strong at 33.1% and the company generated free cash flows of $1.78 billion, jumping 30% y/y.

The near-term guidance was hardly encouraging. More specifically, for Q4, the company expects non-GAAP EPS to come in between $2.57 and $2.62, lower than the consensus estimates of $2.65. Q4 revenues are projected to come in between $9.9 billion and $10.1 billion, again falling below the analyst estimates of $10.5 billion. For the full-year, while the company did raise its guidance, it still fell short of consensus. FY25 full-year revenues are expected to come in between $37.8 and $38 billion, with the midpoint of the guidance being barely above the consensus estimates of $37.86 billion. Full-year FY25 non-GAAP EPS is expected to come between $9.98 and $10.03, with the midpoint of $10.01 once again falling short of street estimates of $10.11.

Despite a mixed quarterly performance and an unimpressive guidance, shares jumped post the earnings report and finished the session up nearly 11%. While it has given up much of the gains since, MTD, the stock is still up 4.14%.

Agentforce Could Put CRM on Top of the Enterprise AI Mountain

I have been critical about CRM and its management in the recent past. This is because they talked a lot about AI potential with nothing tangible to show for it. All of that changed in the third quarter, when the company launched its flagship AI tool, Agentforce.

After a lot of doubts surrounding the earnings potential of AI in the enterprise software world, a lot of companies in the sector are starting to see the potential translate into growth. And CRM has certainly been one of the biggest beneficiaries of this shift. The company, during the first quarter, launched Agentforce, which are AI-powered virtual agents that are designed to enhance support for both customers and employees. Unlike traditional chatbots, these AI agents operate independently, “relying on company’s data to make decisions and complete tasks without human involvement.”

There was a lot of excitement, as usual, from CRM CEO Marc Benioff during the earnings call about Agentforce. However, unlike past quarters, the excitement was backed by data. More specifically, Mr. Benioff announced during the earnings call that within a week of its launch, the company had already signed 200 Agentforce deals, which included the likes of FedEx, Adecco, Accenture, and IBM. And he said that the pipeline for Agentforce remains strong going into Q4. Unlike traditional AI agents, given that Agentforce is trained on up to 300 petabytes of data that CRM manages, the degree of hallucination is expected to be very low compared to its peers, which should help the company to attract more customers. The quality and the breadth of data available to CRM is also set to become more enhanced thanks to the company’s recent acquisition of Zoomin. Zoomin is a leading provider of unstructured data, and given that unstructured data is an essential “fuel” for LLMs, this acquisition should further enhance the quality of CRM’s AI-agents and further reduce the degree of hallucination. Moreover, the company also acquired Own Company, which should allow CRM to “strengthen data security, privacy, and compliance,” yet another key area that potential enterprise AI customers seek out in their AI models.

Furthermore, last week, the company launched Agentforce 2.0, which the company plans to roll out in February 2025. The second version of Agentforce comes with workflow integrations that allow for more effective customization, as well as the ability to seamlessly connect with Slack, Tableau and MuleSoft. Agentforce 2.0 will also be equipped with “Advanced Reasoning,” and Retrieval-augmented generation (RAG), via the company’s Atlas Reasoning Engine, which makes the new version of Agentforce more accurate and more sophisticated than the previous version. The higher degree of accuracy, thanks to RAG, and the higher number of integrations, should make it easier for CRM to pitch Agentforce to customers. And Agentforce 2.0 is coming in at the right time. According to Precedence Research, the Enterprise AI market is expected to grow from $14.5 billion in 2024 to approximately $560.7 billion by 2034, which translates to a CAGR of 44.1%. Given the tremendous demand seen for the first version, the advanced features of Agentforce 2.0 should place CRM in a very strong position to capitalize on this exponential growth and seize a significant chunk of the market.

The whole reason why investors have been hyper-bullish on the AI revolution has been due to its potential to transform industries and unlock productivity. At the start of this year, as I mentioned earlier, there were major question marks regarding the speed with which this transformation will happen due to AI. Investors certainly questioned the companies’ massive capex spend, when it became apparent that the AI revolution might take longer to transpire. However, as we near the end of 2024, the productivity gains are starting to be clear among enterprises, thanks to the rise of “digital labor.” With Agentforce 2.0, however, those gains are expected to see an exponential growth, which makes CRM, in my opinion, the number one beneficiary of the Enterprise AI revolution today.

Valuation

|

Forward P/E Approach |

|

|

Price Target |

$421.00 |

|

Projected Forward P/E Multiple |

34.7 |

|

Projected FY25 EPS |

$10.47 |

|

Projected PEG Ratio |

2.19 |

|

FY26 Projected Earnings Growth |

15.8% |

|

Projected FY26 EPS |

$12.12 |

Source: Company’s Q3FY25 Press Release, LSEG Data (formerly Refinitiv), Seeking Alpha and Author’s Calculations

CRM, according to LSEG Data, currently trades at a forward P/E of 31x, in line with Microsoft (31.2x), but significantly cheaper than the likes of Snowflake Inc (174.5x) and ServiceNow (65.4x). Relative to its historical multiple, the stock currently trades around the midpoint of its median 2-year forward P/E (26.4x) and its 5-year forward P/E multiples (34.7x). Given the potential of Agentforce, however, and the fact that it is already gaining significant traction among the company’s clients, as evidenced by the fact that it has already signed 200 Agentforce deals inside one week of its launch, in my opinion, the company deserves a higher multiple than where it is currently trading at. As such, I have assumed the company’s 5-year forward P/E multiple of 34.7x for my calculations, higher than my previous estimate of 27x.

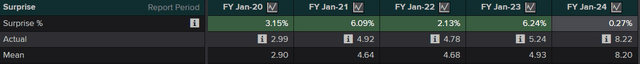

Management, as mentioned earlier, now expects full-year FY25 non-GAAP EPS to come in between $9.98 and $10.03. The midpoint of the guidance fell short of the consensus of $10.11. The company, however, has exceeded analysts’ full-year EPS estimates in the last five years. The magnitude of the beat, on average, has been 3.58%. In line with the past, assuming the company beats the FY25 analyst EPS estimate of $10.11 by 3.58%, then the company’s FY25 EPS would come in at $10.47, which is what I have assumed for my calculations.

LSEG Data (formerly Refinitiv)

According to Seeking Alpha, the company currently trades at a forward PEG ratio of 2.19, in line with its 5-year average. At this ratio and assuming a forward P/E multiple of 34.7x, FY26 earnings growth would come in at 15.8%, in line with its long-term average growth, according to LSEG Data. As such, I have assumed this earnings growth for my calculations, which results in a projected FY26 EPS of $12.12, higher than my previous estimate of $11.20.

A forward P/E of 34.7x and a projected FY26 EPS of $12.12 results in a price target of $421, which represents an upside of about 22.5% from current levels. This is a significant increase from my previous PT of $302. This can be attributed to the additional growth that I factored in on account of the impressive traction seen for Agentforce, which I believe to be a game changer for the company in the Enterprise AI arms race. I am maintaining my BUY rating on the stock.

Risk Factors

The high stock-based compensation continues to be a concern for me and remains a risk to my bull case. It jumped 18.3% in Q3 and came in at 8.7% of the revenue. Management, during the earnings call, announced that FY25 full-year stock-based compensation would be about 8.4% of the full-year revenue. Until they bring this ratio down significantly, it should be a cause for concern for investors, in my opinion.

The other risk factor to my bull case is the uncertainty surrounding the traction of Agentforce. For now, demand remains very strong and there is every reason to remain bullish on the potential of CRM’s flagship AI tool. However, should the long-term demand weaken for whatever reason, it would be a major hit to the long-term growth of the company.

Concluding Thoughts

Despite a mixed quarter, CRM’s stock jumped nearly 11% post its earnings performance. And that is all down to its latest AI offering, Agentforce. The company launched the AI agent in Q3 and within a week, managed to sign 200 deals involving this agent. Moreover, last week, the company launched Agentforce 2.0, which is equipped with the company’s Atlas Reasoning Engine that has RAG capabilities, thereby enhancing the accuracy of the AI agent. The company’s acquisitions of Zoomin and Own Group are also expected to enhance the quality of data on which Agentforce would be trained, as well as enhance the privacy and data security, all key factors that should position CRM to capture a significant chunk of the growth in the Enterprise AI market. Finally, given that Agentforce 2.0 is integrated with the likes of Tableau, MuleSoft, and more importantly, Slack, it allows CRM to pitch the AI-agent as part of the entire CRM platform. I don’t recall any other company, which is currently capable of “platformization” of its AI tools, which puts CRM in a unique position. From a valuation perspective, there is considerable upside from current levels.

CEO Marc Benioff couldn’t resist taking a shot at rival MSFT during the earnings call, and while in the past, I have considered this to be a completely unnecessary gimmick, when I look at the growth potential of Agentforce due to the reasons outlined in this report, I am of the opinion that the dig is certainly backed by substance this time. Agentforce, especially its latest version, is also the reason why I am making CRM my top pick for 2025.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2025 Long/Short Idea investment competition, which runs through December 21. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in CRM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.