Summary:

- Alibaba remains a Strong Buy due to its aggressive investments in e-commerce and cloud computing, with a 74% potential upside.

- The company shows stable revenue growth and strong financials, despite a challenging economic environment and competitive pressures.

- Alibaba’s international expansion and innovative initiatives in AI and cloud computing are promising for future growth.

vivalapenler

My thesis

Alibaba stock (NYSE:BABA) demonstrated a notable bull run in late September-early October. This was in line with my previous call. However, the stock was unable to cement itself above the psychological $100 level and is currently notably cheaper.

Yet Alibaba is a very good company that still invests massively to improve its competitive position in e-commerce and cloud computing. The management is actively working to improve its ecosystem, and I see solid potential in its aggressive international e-commerce expansion, which appears optimistic. Additionally, developments in Alibaba’s cloud business are very encouraging. With the stock trading at a substantial discount, BABA remains a Strong Buy.

BABA stock analysis

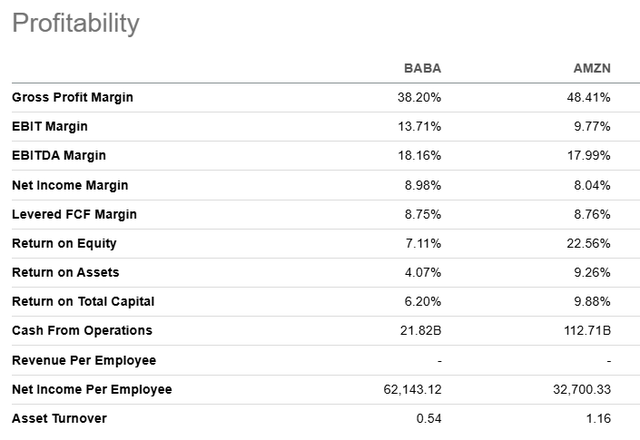

The company’s overall revenue grew by 5.4% YoY in FQ2 2025, demonstrating stability in a challenging economic environment. Free cash flow dynamic is not all positive but due to aggressive innovation investments, not due to fundamental profitability concerns. BABA’s profitability metrics look strong compared to the global benchmark, Amazon – the global undisputed trendsetter in e-commerce and cloud.

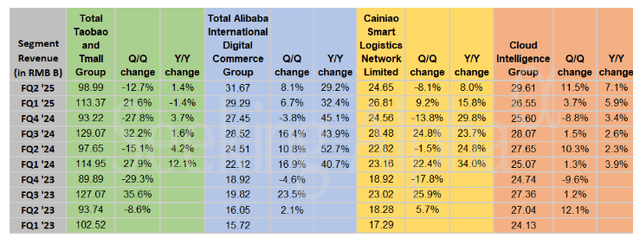

Alibaba’s major e-commerce business — including Taobao and Tmall — is still its lifeblood. During FQ2 2025 the segment delivered a modest 1.4% YoY growth. This stability amid China’s deepening economic slowdown demonstrates the enduring strength of Alibaba’s e-commerce ecosystem.

To drive growth in the e-commerce segment, Alibaba’s management has already started and is working on a number of initiatives. The interoperability with WeChat Pay is a good step to capture new users and streamline shopping. The company also released new monetization tools, such as GMV-based service fees and the merchant adoption of its AI-powered marketing tool Quanzhantui. The tool has already helped BABA to boost Singles’ Day sales.

Alibaba’s e-commerce business is also ramping up in the international arena. The company has officially launched operations in Morocco, marking its first site in Africa. The move aimed at supporting Moroccan companies’ exports to new markets especially in North America. The ability to reach customers across the Atlantic and to have a larger presence with Moroccan firms through Alibaba’s e-commerce platform and logistics network opens up potential new sources of income for Moroccan businesses and Alibaba. Morocco is a big country with growing economy and it is a promising market in itself. But also, reaching Morocco gives Alibaba a location advantage to reach out to other growing economies such as Algeria and Tunisia.

The company has also introduced Tao, a cross-border e-commerce service that caters to Japanese consumers. This platform has around 3 million products across various categories and localized features like Japanese customer service, special payment method and product recommendations. For readers’ information, Japan is the world’s third largest economy, so this is all good news.

Alibaba’s logistics division, Cainiao Network, has launched a new economy sea freight route connecting Ningbo, China, to Bangkok, Thailand. This is another positive development that helps in improving the reach of Alibaba’s Tmall and Taobao platforms. The path is also faster than 15 days and has reduced shipping by nearly 50% from US$2.6/kg to US$1.4/kg.

All these initiatives from the management are quite formidable in their ability to deliver a more consolidated and optimized e-commerce ecosystem that can potentially drive a higher number of consumers and sales.

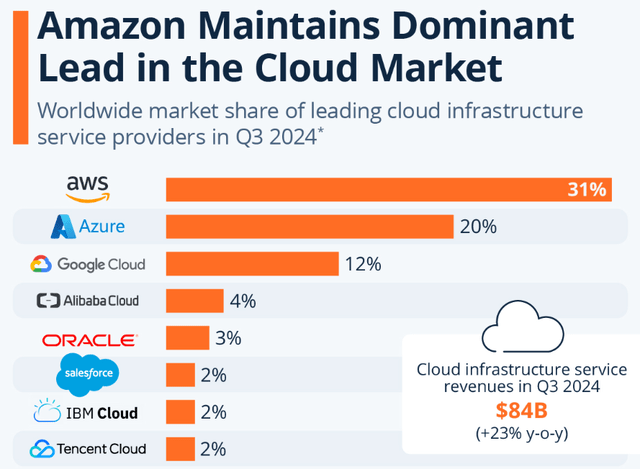

Turning to Alibaba’s prospects in AI and cloud computing, recent developments have been particularly promising. The Cloud Intelligence Group has shown accelerating revenue growth over the last few quarters. Revenues from public cloud products and AI-related product revenue are thriving. Alibaba remains China’s largest cloud provider, and confidently keeps the fourth spot in the global market.

Alibaba Cloud’s success is further validated by its recognition as a Leader in the Forrester Wave Public Cloud Platforms Q4 report. According to the report, the company’s focus on serverless computing beyond AI, packaging its cloud-native infrastructure into more accessible offerings for developers and operators are likely to payoff.

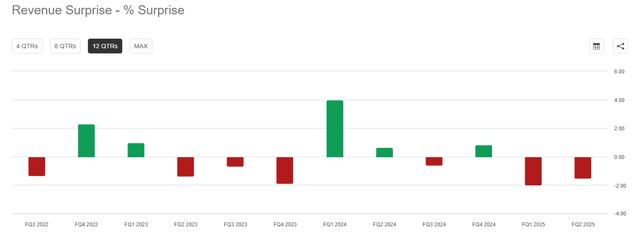

To drive growth in cloud and AI, Alibaba’s management is implementing several core initiatives. The company is investing heavily in AI infrastructure, particularly in AI-optimized chip technologies such as GPUs. Alibaba has also launched new AI-focused initiatives, including an enhanced incentive program and an AI partner accelerator program. These programs aim to drive the growth of global partners and accelerate the deployment of AI technologies. By building a dedicated AI partner ecosystem, Alibaba is creating a robust foundation for sustained growth in this critical sector.

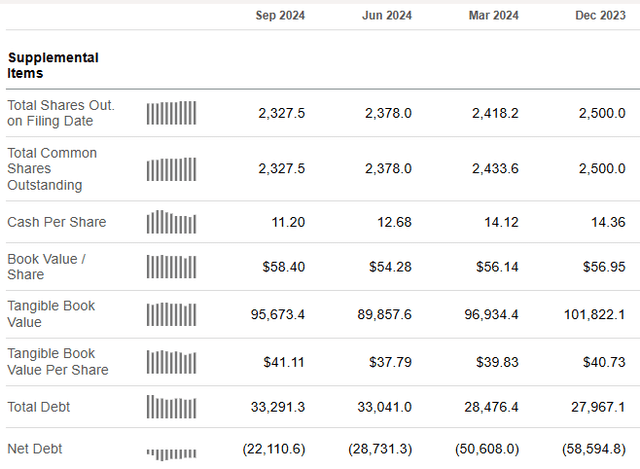

Alibaba’s balance sheet is a fortress, and the company is still in a substantial net cash position even after aggressive investments in R&D. Therefore, I am highly confident that Alibaba has more than enough financial resources to support all growth initiatives, which will highly likely result in enhanced value for shareholders.

Intrinsic value calculation

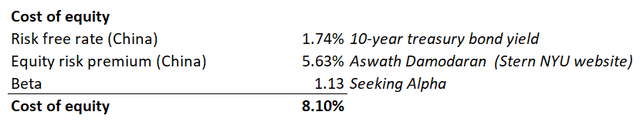

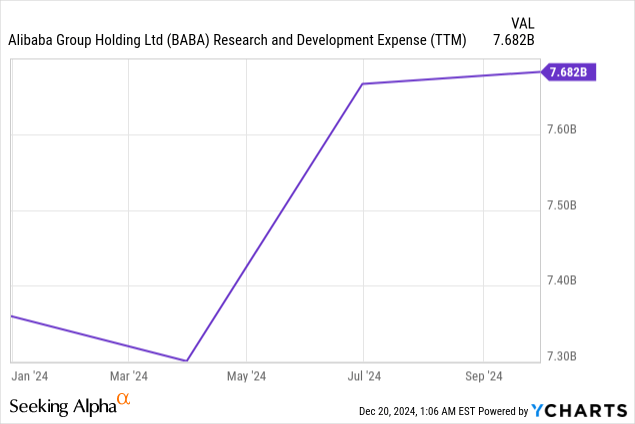

Since my assumptions will be levered free cash flow, the discount rate for my DCF will be BABA’s cost of equity which is 8.10%. Cost of equity was calculated according to the CAPM method.

So, the reason I am using levered free cash flow margin rather than unlevered FCF margin is because it directly captures the cash flow left over for equity holders after interest payments and fits in with shareholder value. Alibaba’s levered FCF margin in the TTM period stands at 8.75%, which is below the average of the last 5 years. I therefore do not later apply the growth of this metric.

Wall Street analysts are quite conservative about Alibaba revenue growth rates, projecting mostly single-digit revenue growth rates by FY 2034. Being conservative is a must for a DCF model so I’m using these Wall Street numbers. My perpetual growth rate assumption is also conservative at 2%.

Once I added all of the above assumptions to DCF model, my intrinsic value per share is $147, 74% higher compared to the current share price.

What can go wrong with my thesis?

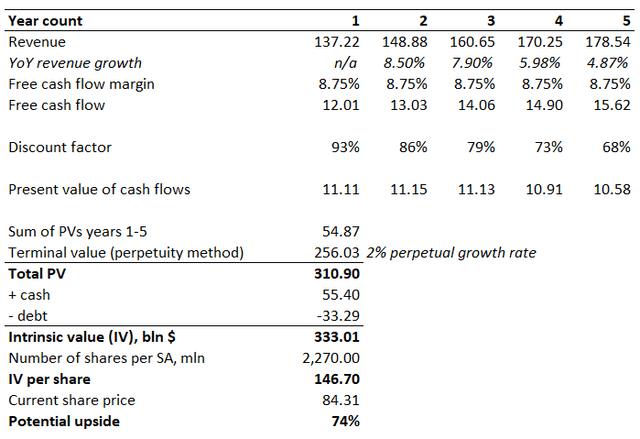

Alibaba’s quarterly results against consensus forecasts were far from ideal over the last several quarters. While underperforming in terms of the EPS has been relatively rare, BABA’s actual revenue was below consensus five times over the last twelve quarters. A weak revenue surprise record does not enable the stock to take earnings reports as bullish catalysts to the share price. Investors should be on the lookout for it because any bad quarterly earnings report can be a powerful negative event that initiates a sell-off.

The competition in Chinese e-commerce industry is fierce and intensifying. Rivals such as JD (JD), PDD Holdings (PDD), and emerging players are also quite aggressive in expanding their footprints. This could ultimately challenge Alibaba’s market position and dilute its market share.

Summary

Alibaba remains a Strong Buy for me. The management is firing on all cylinders to drive innovation in its e-commerce and cloud businesses, which is a smart strategy given the strong secular tailwinds in both domains. The stock remains significantly undervalued, with a 74% potential upside.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.