Summary:

- Adobe’s extensive product variety and quality, particularly in digital media and experience segments, offers unique marketing solutions, helping with market retention (current users) and further market share growth (new users).

- Adobe Inc. is strategically positioned to leverage AI, with its multi-pronged approach to drive growth in 2025 across Creative, Experience, and Document clouds.

- The company’s focus on AI integration and personalized solutions aims to enhance monetization and optimize margins, supporting long-term growth and market proliferation for the entire flow in the user funnel.

- However, with Adobe’s valuations to performance, rising competition in AI content generation and economic uncertainties.

- Overall, I recommend a “Hold” until Q1 2025 to further assess the early impacts of AI adoption and macro conditions in a more hawkish economy.

Justin Sullivan

Introduction – Stormy Macro Outlook

We are in a unique spot in the overall economy, and thus so are sensitive, cyclical sectors such as the technology sector. As always, headwinds and tailwinds clash once again, sending investors and consumers into cautiousness and uncertainty. The US economy has been on the track towards a soft landing, but CPI numbers appear to have stalled, rising to 2.7% in Nov, up from 2.6% in Oct according to recent numbers.

In terms of employment, even though absolute numbers in job growth bounced back from the revised 36,000 in Oct to 227,000 in Nov, this does not mean progress is made as Oct had extraneous factors such as hurricanes and the Boeing Strike. This is elaborated by the unemployment rate ticking up from 4.1% to 4.2% in Nov. The consensus remains that the labor market is at “sustainable full employment.” This ties into November’s improved consumer confidence index [CCI] due to consumers being “substantially more optimistic about future job availability, which reached its highest in almost three years” according to Dana M. Peterson, Chief Economist at the Conference Board. However, consumers were less optimistic about future income.

The elephant in the room came when the Fed cut rates by 25bps on Dec 18. This was not the issue, however, because Fed chair Jerome Powell announced this along with a hawkish outlook for rate cuts in 2025, which signaled reduced confidence in many further rate cuts, and signs of inflation becoming sticky. Core CPI inflation this quarter reaches 3.5%, the SP500 to fall over 2.87% overnight after the announcement and 10Y Treasury yields exceeded 4.5% to 4.51%. With such news priced in already, what is not priced in are Trump’s plans for immigration controls, personal and corporate tax cuts and tariffs on Mexico, China and more, which will serve a mix of tail and headwinds to the disinflation and soft landing that investors have been looking forward to. Thus, optimism in this “bubbly” market has fallen with the outlook for 2025.

In addition, the reliance on the magnificent 7 for the overall sector’s gains has reduced in the same time periods as they continued to increase in valuation and investors see room for profit making by cashing out some of their shares. Hence, it seems that company-specific news on supply and demand factors and earnings news will become the main source of motivation for investors to continue buying the mag 7 in the shorter term, rather than driven by those riding the wave with a hawkish economic outlook going into 2025.

Instead, I believe the game plan for long-term investors should include companies with unique services that have already adopted some form of artificial intelligence relatively earlier than their competitors for a first-movers advantage, but has a broad swathe of products yet to fully leverage on and monetize such AI capabilities, offering immense potential quality and value proposition in the medium to long term.

Adobe Inc. embodies this idea when it comes to its integrated tools for digital design across platforms. However, its share price continues to puzzle investors. For one, while most software stocks performed quite well in the year due to the AI hype, Adobe has been left behind this growth trend. Looking at year to date performance, share prices have actually fallen by 22%, hovering around the price range of $450 to $600. Earnings releases this year have led to erratic price movements post releases. In fact, prices slipped over 10% as well for Q1, surged upwards 14% for Q2 and plunged downwards again in Q3 amidst skepticism over its declining balance sheet health. Now soon after record Q4 results in terms of new digital media ARR, operating cash flows and RPO that drove revenues and cash flows, share prices yet again slipped over 12% due to an underwhelming 2025 outlook that came below estimates. Thus, it seems like economic forces, be it tail or headwinds, have less of an impact on Adobe’s prices as compared to investor sentiment when results are released.

What are Adobe’s plans, and is it time for investors to see past these fluctuations and lock in an opportunity for its growth as we approach 2025?

Company Overview

Adobe Inc. (NASDAQ:ADBE) (NEOE:ADBE:CA) is a leading software company known for its suite of innovative solutions in creative marketing to data analytics and work productivity/management. Its closest competitors would be Microsoft (MSFT), Google (GOOGL), Salesforce, Inc. (CRM) and Canva (private).

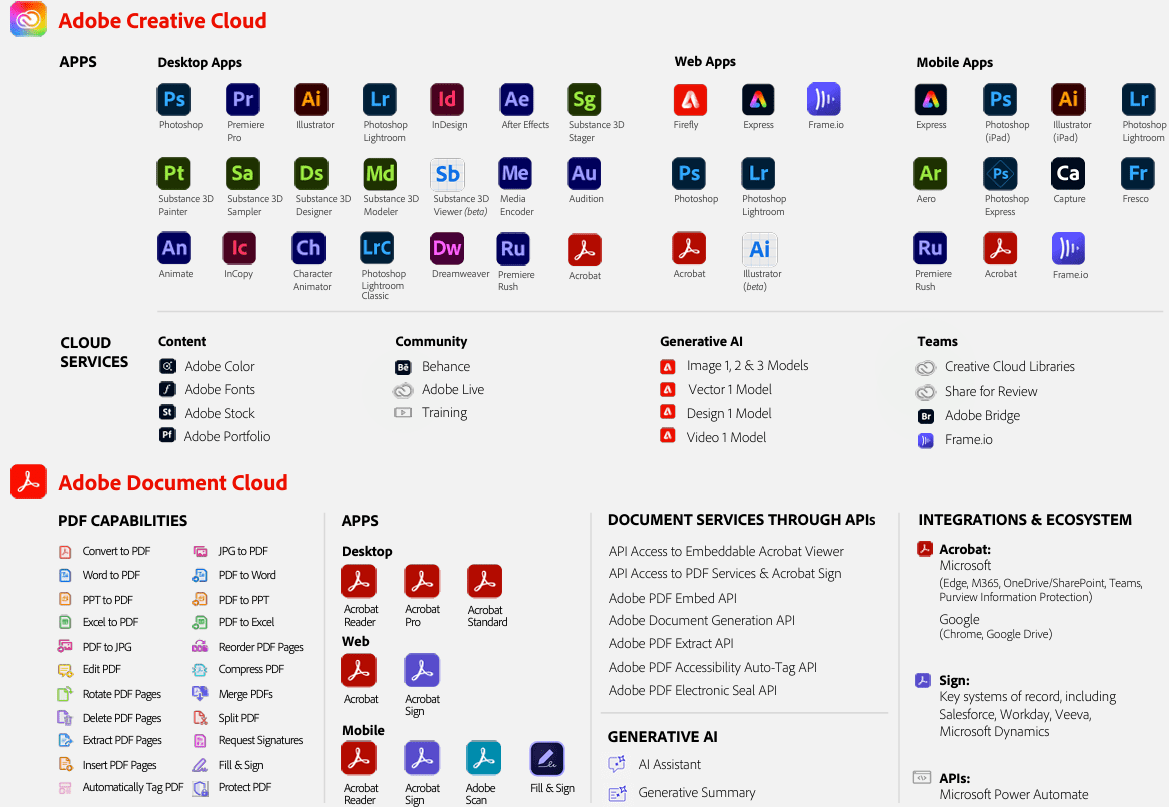

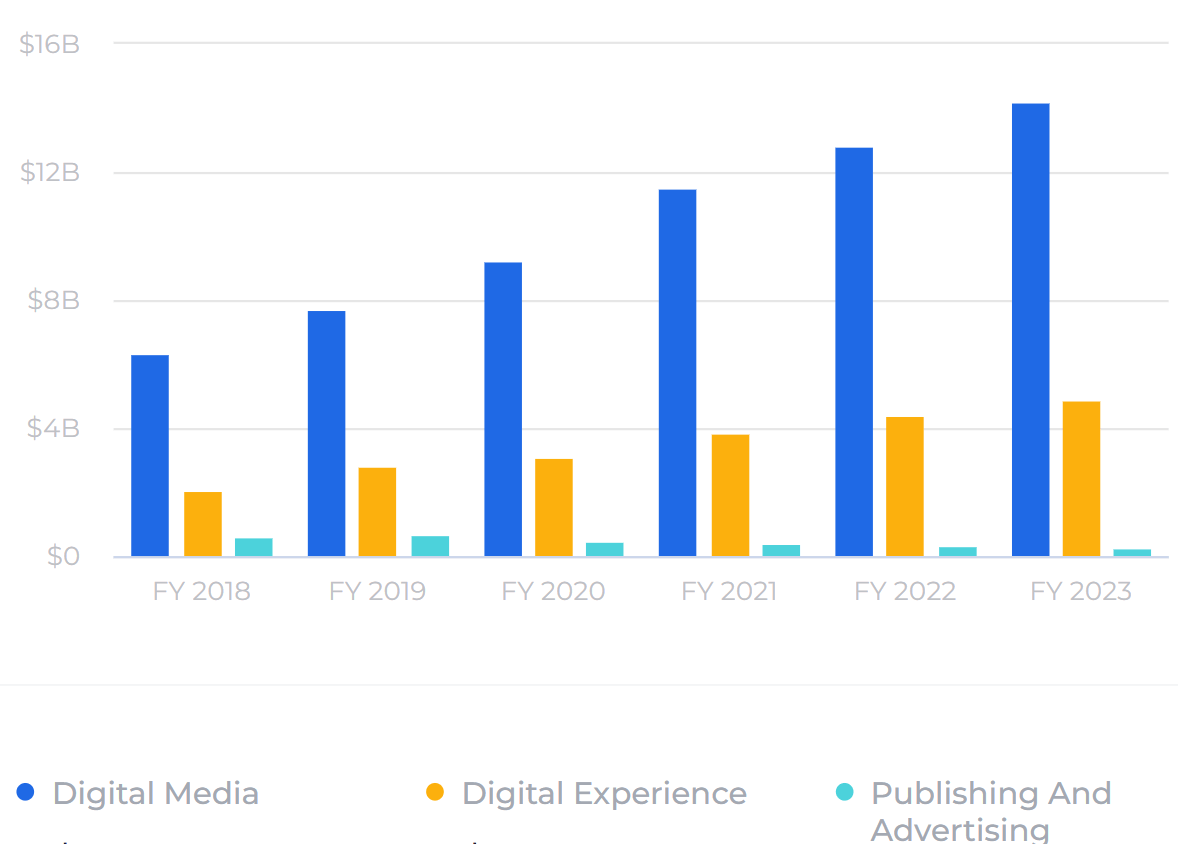

In total, it offers over 100 products, with key ones being: Photoshop, Premiere Pro, Illustrator, Stock, Express, Firefly, After Effects Lightroom, InDesign, Animate, Dreamweaver, Substance 3D, Acrobat and more. ADBE has 3 revenue segments: Digital Media, Digital Experience and Publishing & Advertising. Digital Media comprises the Adobe Creative and Document Clouds shown below, and is the main bulk of revenues at 74% in FY24.

Fig 1: ADBE’s Digital Media Segment, Consisting of the Creative and Document Cloud (Q4 Investor Datasheet)

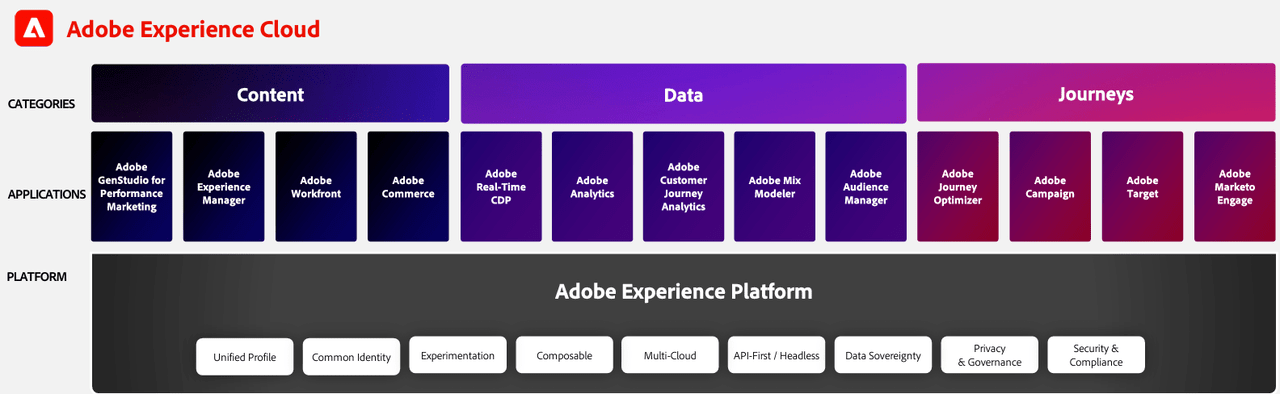

Next in revenue contributions is the Experience Cloud, specializing integrated online marketing and Web analytics products, bringing in 25% in FY24 revenue.

Fig 2: ADBE’s Digital Experience Segment Containing the Experience Cloud (Q4 Investor Datasheet)

Lastly, Publishing and Advertising is a much smaller revenue segment of 1%, which I will not be focusing on.

Fig 3: ADBE’s Publishing and Advertising Segment (Q4 Investor Datasheet)

This distribution of revenue by segment has remained largely consistent in the past 12 quarters, ADBE’s, it stands out in its benchmark applications used at a professional level, especially for the applications in the Digital Media and Experience segments.

Investment Thesis:

I believe that ADBE has its strong points in its variety and quality to capture further market share, prime position to capitalize on AI and deepen its moat through personalization as well as greater opportunities for monetization through the value it brings, helping future margins and financials. However, given currently volatile market conditions, uncertain reception to its future pipeline, competition in new capabilities like video-to-text, I give ADBE a “Hold” rating until Q1 25, where its solid cash flows and consistent stock buybacks could position it for great upside in 2025.

Should stronger signs of reception to new features and pricing related programs (tiering) emerge, I Q1 would be a solid “Buy” period before it further performs in the creative marketing and productivity spaces.

Thesis 1: Variety And Quality of Applications Offered Generates Both Retention and Momentum To Capture Further Market Share

As mentioned, ADBE is known for is its extensive reach and influence in terms of industry-grade applications. With an estimated 58% market share in the application development industry, ADBE’s closest competitors range from Microsoft Azure and Office (for customer experience management, work management and collaboration) to Canva (for graphic design and basic video editing). The fact is that ADBE has industry grade products across a wide variety of design and productivity fields, yet is niche enough to have no direct overlaps in utility to its strong competitors. Hence, ADBE remains essential for companies in their marketing objectives, from individuals to small businesses to large enterprises like Procter & Gamble and Nestle.

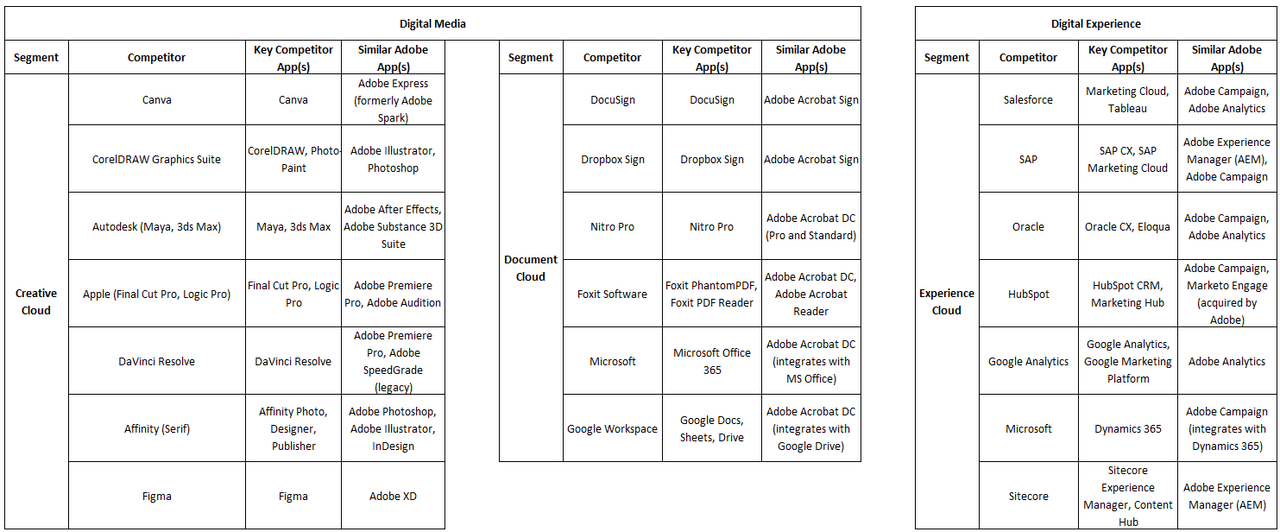

Fig 4: Digital Media and Experience Clouds and Competitor Apps (Author)

The types of competitors are different in each segment. First, let’s look at “Digital Media.” For the Creative Cloud, competitors such as Autodesk, Affinity, and DaVinci Resolve offer similar functions to specific Adobe apps, especially After Effects, Photoshop, and Premiere Pro, respectively. In addition, products such as Dropbox, DocuSign, Microsoft Office, and Google Workspace perform similar roles to Adobe Acrobat. This segment especially has individual applications by smaller competitors for functions like video editing (Premiere Pro), Photo Editing (Photoshop) and other designs (Illustrator). I believe that what makes it stand out beyond quality for corporate and enterprise level designs is the quality catered to individuals and smaller companies via mobile and web platforms (Fig 1) as it looks deeper into more accessible channels beyond desktop apps for new users. This contributes to the “top and middle of funnel” portions of the user engagement journey, specifically attracting new users and smooth onboarding through engaging tools.

For the Document Cloud, even with big competitors with packaged products such as the Microsoft Office 365 suite and Google Workspace suite, Acrobat greatly complements these work-related services with its first-in-class PDF software. This does not directly compete with MS Office or Google Drive functions, since document management is one out of many key components to work/productivity capabilities that MSFT or GOOGL offer.

Fig 5: Adobe Revenues By Segment (WallStreetZen)

Currently, the Americas is the largest creative software market and will remain so until 2030 based on estimates. Future market insights do suggest an overall 8.2% CAGR for the next 10 years, roughly 7.8% in the Americas, 11% CAGR in Asia and a 6.7% in the United Kingdom. As the American market becomes saturated, I believe the Asian and EMEA geographical segments of ADBE will have great room to run on top of AI integration in software. Q4 results indicate momentum in emerging markets and the adoption of Firefly services in the enterprise, deliberately targeting such future trends.

Next, the “Digital Experience” segment is a stable segment, contributing 10% YoY growth in revenues. When it comes to retention of current customers, enterprise customers are a key demographic, as 85/100 Fortune 100 companies patronize such solutions. Similar to the Creative Cloud, the Experience Cloud under “Digital Experience” has specific competitors in data analytics and marketing scattered throughout the 3 categories (Fig 2) that are larger in size. Despite this, notable drivers of subscription revenue in this segment was led by Adobe Experience Manager, Journey Optimizer, Real-Time-Customer Data Platform (CDP), Customer Journey Analytics and Workfront; 2/5 of which have direct overlap with competitor applications (Fig 4). Coupled with increased bookings for the latest GenStudio solution under the “Content” category, this emphasizes how ADBE continues to develop with (a) competitors in certain digital solutions, and (b) new apps for performance marketing generating fresh interest.

This is not to mention the high barriers to entry for newer competitors to enter the market considering the well-established customers ADBE has secured, the complexity of its apps and the approximately 40 million total subscribers it has.

Thus, I believe that current plans to compete with these types of competitors are strategic and effective. The extensiveness of integration ADBE offers in marketing solidifies its already wide moat for market proliferation, a priority for ADBE. The nature of their software-as-a-service (SaaS) model entails strong annual recurring revenue (ARR), but at the same time opportunities to draw new subscribers through AI value-add (top and mid-funnel), elaborated further in thesis 2.

Thesis 2: ADBE is in a Prime Position To Capitalize on Artificial Intelligence, Offering a Wider Product Array and Deepening its Moat Through Further Personalization

AI is a massive theme that ADBE is positioning itself towards. The steady integration of AI technologies across the apps in the segments is giving ADBE an even further lead compared to its competitors.

As shared in the Q4 earnings call:

Adobe has a unique opportunity to capitalize on the breadth of these solutions to further optimize our integrated go-to-market field organization. We are expanding our enterprise go-to-market teams to sell these integrated solutions that cut across Digital Media and Digital Experience, globally under the new GenStudio umbrella. We have seen early success for this strategy that included Express and Firefly Services in Q4. As we enable our worldwide field organization in Q1, we anticipate acceleration of this pipeline throughout the rest of the year and beyond.

Firstly, a focus on longer-term market proliferation. As shown, the Firefly model generator, including imaging, vector, design, and video (most recently in October) is ADBE’s ticket towards scaling artificial intelligence capabilities in its Creative, Experience and Document Clouds. Even when launched in Q4, firefly-powered generations across tools exceeded 16 billion, with increasingly more generations each month. This already highlights the demand and interest generated from the AI models, providing more efficient content generation for customers, both enterprises and individuals. To break down the Creative Cloud growth further, beyond the top-end Creative Cloud portion of Photoshop, Premiere Pro, Illustrator etc., the back-end is also being focused on through a “proliferation play” for longer-term growth via Acrobat and Express. This has enabled integrations with productivity apps such as ChatGPT, Google, Slack through the Express marketplace, greatly increasing reach to users.

Under the Experience Cloud, these models are already being integrated into GenStudio, integrating the 3 clouds together, combining “creative expression with enterprise activation.” According to management, it “becomes a more holistic solution as we go into FY ‘25 and accelerate that” to extend their end-to-end supply chain solution in hopes of accelerating growth in the year to come. Here, personalization also comes in the form of localization for regional marketing teams thanks to GenStudio’s multi-language capabilities, enabling content creation at scale that “account for cultural nuance while maintaining brand standards.” This makes geographical expansion of ADBE’s services even easier with the help of AI

Secondly, David Wadhwani, President of Digital Media mentioned in the earnings call that Adobe wants to balance market proliferation with short-term monetization as it expands its product offerings, particularly in lower-end markets with tools like Adobe Express, Lightroom, and Acrobat. This refers to generating immediate financial returns by converting free users to paid ones, as well as further tiering options as they continue to develop their capabilities. In turn, customers are given more flexible options of bundles based on their software needs.

Thus, I believe that management has a multi-pronged approach to drive ADBE’s growth through its Digital Media revenue segment in the year to come, be it through market proliferation or short-term monetization of its millions of subscribers across apps and clouds. This aligns with their priority on “the annual book of business growth” rather than quarterly according to CFO Daniel J. Durn, focusing on this transformational phase and gaining traction before developing Firefly further, both as a standalone platform and a foundation to catalyze other products (that are also integrated through GenStudio). Overall, they are certainly in a good position in terms of helping a host of enterprises personalizes their content at a large scale through quality APIs and ease of custom model creations. This poises ADBE to reap the potential of AI towards software marketing, work, and productivity-related capabilities for customers of all sizes in future.

Thesis 3: Increasing Opportunities for Monetization, Optimizing Margins to Fund Future Plans

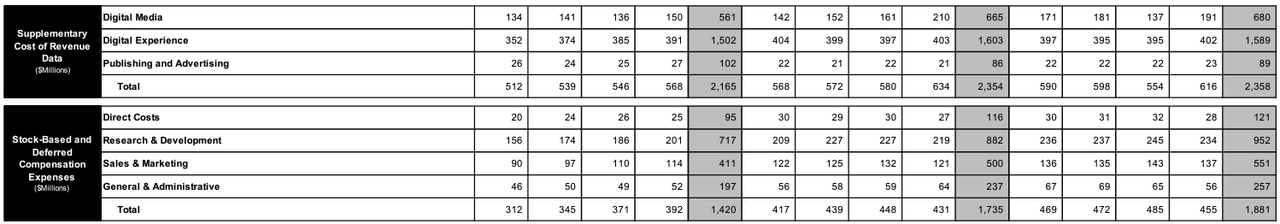

Fig 6: Quarterly Revenue Segment Distribution (Q4 Investor Datasheet)

As a subscription services company leveraging on AI, ADBE still has a lot of room to innovate its software. This means an emphasis on proliferation is vital, as capturing more consumers early on and then releasing more and more attractive features will keep subscribers loyal and enhance recurring revenue. Thesis 1 showcased how Firefly as well as applications on mobile and web serve as “top and mid-funnel” awareness and onboarding of both free and paid users, and it comes full circle at “bottom-funnel” conversion and retention to proceed with greater monetization in the future. On ADBE’s end, its cloud infrastructure has already been laid out, so the costs of developing its future features are not significant in terms of R&D, S&M, G&A costs being largely consistent in the past 2–3 years.

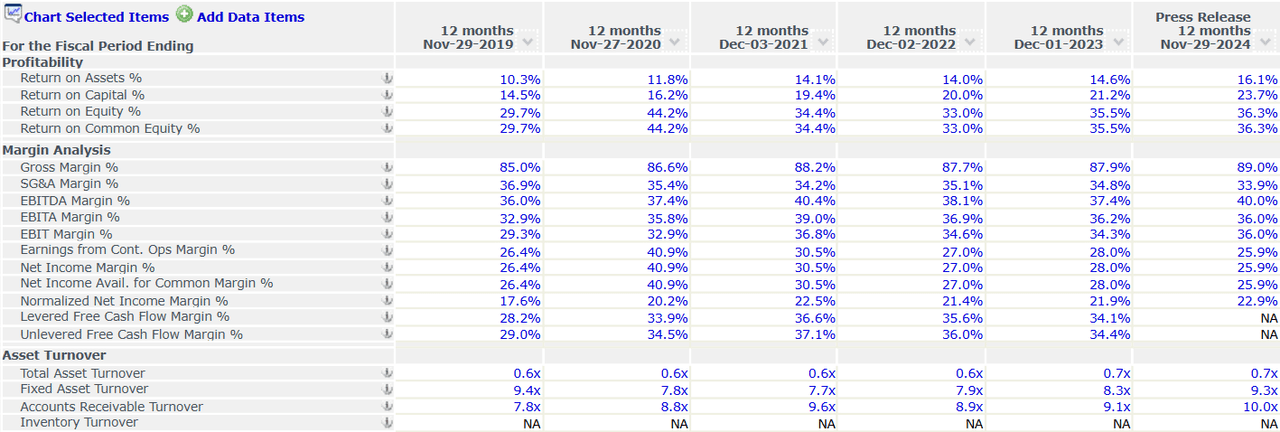

Profitability and Margins of ADBE (CapIQ)

FY24’s results are notable since it has been considered an experimental/transitional year to integrate AI assistant, launch new Firefly Models, yet most margins (less net income margins) have either improved or remained the same for ADBE’s profitability versus prior years.

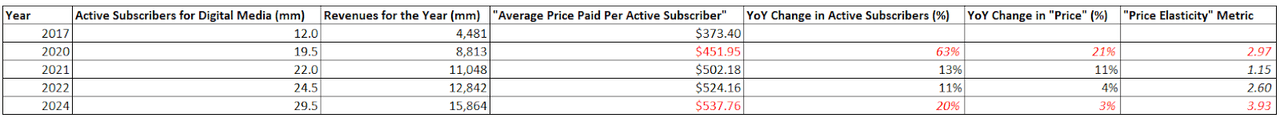

Furthermore, with regard to price sensitivity, ADBE seems to be striving for “value-based sales,” going beyond price and quantity measurements for its core demographic of creative professionals. There is a recognized price sensitivity among users, which affects both premium subscriptions and conversions to paid plans. To gauge this sensitivity, let’s focus on the Creative Cloud category, as I believe the Document cloud’s applications are more fundamental for work-related usage, and thus likely being price inelastic. Using estimated Creative Cloud user data, gross margin data and revenues from Digital Media between 2017 and 2024, I derive an “average price paid per active digital media subscriber”, and then tracked the changes in this price YoY with changes in active subscribers YoY (Less the values in red because of the jump from 2017 to 2020, and 2022 to 2024 which have been adjusted accordingly). Here, we can see that this “price elasticity” has been increasing since 2021, which does show signs in the right direction of reduced price sensitivity, and arguably making progress towards a more “value-based sales” model.

This entails more dynamic pricing as more innovations are added to ADBE’s apps, optimizing “bottom-funnel” retention via more variable pricing systems for customers of all sizes and budget.

“Price Sensitivity” Analysis (Author)

David Wadhwani explains this concept in the earnings call:

The price actually increases with core value because when we are introducing Firefly models into the mix, we get the opportunity to integrate them more into the flagship applications. And as I mentioned earlier with the Firefly web application, we have the opportunity to create more tiers across the creative products so that we can get people in the right plan for their needs.

Hence, such a model will allow ADBE to enact premium pricing by directly linking value to business impact, shifting the conversation from cost to delivered outcomes and acting as a strong lever to financials and margins. This future progression towards margin expansion with ongoing revenue expansion through market proliferation will better support ADBE’s AI integration plans, Firefly and beyond.

Risk 1: ADBE’s Valuations to Performance

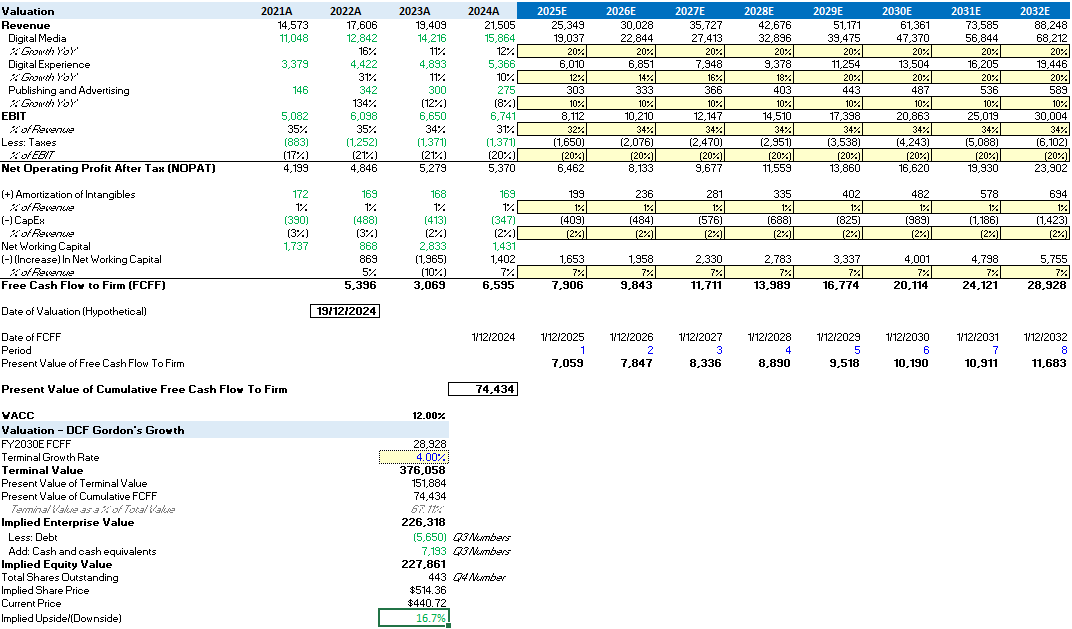

With just the positives in the theses above, I would have certainly labelled ADBE a buy. However, ADBE’s valuations say otherwise. Its forward P/E ratio of 28.5x, while still considered relatively less overvalued compared to competitors in the application software industry, is concerning when we look at the price performance of ADBE versus its competitors, especially in terms of the lack of compelling growth from the slightly above double-digit revenue growth YoY for ADBE. In my DCF analysis, I assumed a WACC of 12.0%, a terminal growth rate of 4.0% and gave more optimistic margins and assumptions for the revenue segments, especially for Digital Media and Digital Experience from the points discussed in thesis 1. Publishing and Advertising has been consistent and is a small portion of revenue. I assumed changes in net working capital would increase greatly since RPO numbers have been increasing consistently over the quarters, and thus net working capital in future years would reduce overtime. (Note that a cash flow statement for FY24 is not available yet, so I extrapolated the last 9 months values for capex and net working capital).

ADBE DCF Analysis (Author)

The terminal value forms 67% of total implied enterprise value, so the DCF is not too future dependent. Finally, implied upside is calculated to be 15.4% from the current price of $445. While this shows decent undervaluation and room for upside, assumptions have been generous to assume that ADBE’s pipeline of strategies will work, and its dominance in the AI to content marketing and work productivity domains shine through.

We can compare this to the guidance given for 2025 by management in the Q4 earnings call: For FY ’25, Adobe targets revenue of $23.30 to $23.55b (versus $25.3b in my model), a 46% non-GAAP operating margin (similar to prior years) and an 18.5% non-GAAP tax rate (versus 20.1% tax rate).

Hence, while I believe that the market has yet to price in the full potential ADBE brings to the table and that there is certainly room for growth for ADBE with the recent price falls, this growth will only accelerate if ADBE makes its mark with higher revenue growth, margins, and user uptake levels in 2025.

Risk 2: Competition and Timing

In the text to video realm, ADBE’s main competitor is SoraAI, which has made waves in its advancements in the past year. While it is still far from perfect and has yet to wow the market, it is still ahead of ADBE’s Firefly and other similar competitors such as Runway AI in terms of its capabilities and access to users. For instance, SoraAI offers up to 20 seconds of video generation at 1080p, while ADBE offers up to 5 seconds at 720p and is currently in beta waitlisting mode. If SoraAI improves quickly as user interactions further enhance its data-driven learning and optimization, gaining popularity, then ADBE risks losing early progress in this text-to-video market. Considering how sensitive investors are to pessimistic news on ADBE, if SoraAI’s user base expands greatly, especially for content creators to enterprises, then ADBE can see great downside risks.

Catalysts

Hard catalysts for the next 6–12 months would include crucial earning calls, especially Q1 and Q2, to assess the initial hype towards early-stage Firefly integration into apps in the Creative and Document Clouds. Another hard catalyst would be a revised 2025 outlook in Q1 and Q2 25, for better or worse. If the outlook is revised to improve in terms of revenues (recurring or not) and margins, then this would send a signal that ADBE’s true value is yet to be priced in.

For soft catalysts, it would depend on whether ADBE can consistently push out new features using its Firefly service. David Wadhwani pointed out that Firefly has “hit this level of escape velocity” to scale production and automation pipelines with personalization of content for enterprises, and that “we’re now integrating it more into the DX products” including GenStudio. If we see the other Data Experience products (Manager, Analytics, Real-time CDP, Workfront, etc.) make great progress in helping GenStudio with the content supply chain, and see big enterprise customer wins, then this would boost confidence in ADBE’s Experience Cloud expansion as well. I also believe that ADBE’s developments towards mobile are underrated, and could be tapped on as opportunities for expansion towards individuals and smaller teams due to the bonus accessibility and convenience it offers. David Wadhwani mentioned greater adoptions of freemium plans and more products to be introduced for mobile users, and unlock value yet to be priced into ADBE’s growth with the introduction of more Firefly integrations to the mobile platform, bringing additional AI value to them.

Conclusion

Overall, given the plans ADBE has for the future, it is up to how they continue to monetize and leverage on these AI integration advancements to generate greater revenue and margins beyond its currently stable, but not exciting data. As plans such as how generative credits would drive monetization to the Firefly model, how popular GenStudio will be and when the text-to-video model can be released have yet to be finalized, coupled with the recently pessimistic economic outlook for 2025 as inflation is expected to rebound, I give ADBE a “Hold” rating till Q1 25. Until then, investors should wait to see how the economic outlook and next quarter results pan out.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.