Summary:

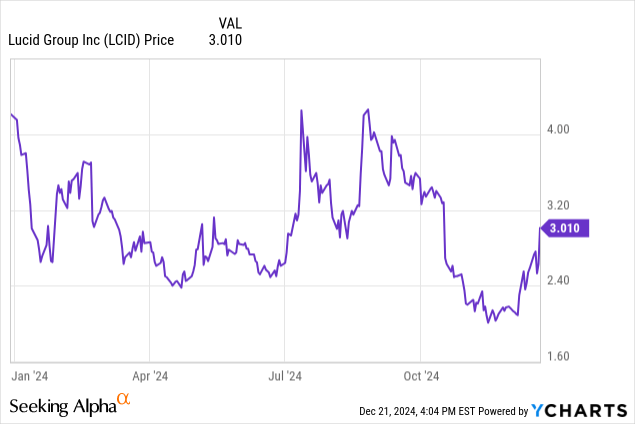

- Shares of EV maker Lucid have dropped ~30% this year on small unit volumes and massive gross margin losses.

- I’m initiating Lucid at a sell rating on its limited scale amid sharp competition from the likes of Tesla and Rivian.

- The company is targeting only 9k units produced this year, versus ~55k for Rivian and 2M+ for Tesla.

- Assuming constant burn rates, even after a recent investment from Saudi Arabia’s sovereign wealth fund, the company only has enough liquidity through early 2027.

- Meanwhile, the company will have to significantly step up capex and working capital ahead of its planned late 2026 mass market model, which will lag Rivian and Tesla’s launches.

hapabapa

The EV industry has been a hotbed of stock market interest and speculation this year, especially as Tesla (TSLA) soared to new heights on expectations that Elon Musk’s proximity to the incoming Trump administration will help secure benefits for the country’s top electric automaker. Rivian (RIVN) has also enjoyed substantial spotlight this year: despite manufacturing challenges, the company scored major financing deals from Volkswagen and the U.S. Department of Energy.

But what about Lucid Group (NASDAQ:LCID), the third largest pure EV maker in the U.S.? With a noticeable lack of major partnerships and sluggish EV demand sales amid huge losses, Lucid has seen a ~30% reduction in its share price to date.

In my view, Lucid’s underperformance is set to continue, and I’m initiating the stock at a sell rating.

Lucid May Not Resonate As Well With the Mass Market

To a large extent, the fate of the smaller EV companies is to survive long enough to produce at scale with a lower-priced mass-market model. Until then, both Rivian and Lucid are building their brand recognition on higher-end, low-volume models, which we can liken to Tesla’s earlier Model S and Roadster days.

Rivian has cemented its brand positioning around sleek, rugged outdoorsy vehicles, with its R1S and R1T vehicles as an SUV and mid-sized truck, respectively. Lucid, however, takes a different tack: it primarily touts the technology and efficiency advantage that it has over its competitors.

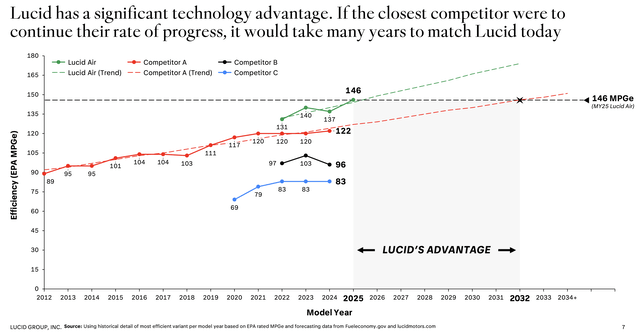

The chart below shows the company’s claim that, since launching the Lucid Air in 2022, it has maintained a substantial spread in energy efficiency (as measured by mileage per gasoline equivalent, or MPGe) over its competitors. The red line or “competitor A” is assumed to be Tesla.

Lucid MPGe vs. peers (Lucid Q3 investor presentation)

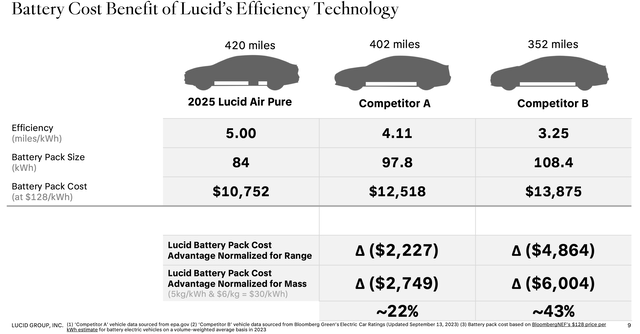

The company further goes to demonstrate, as shown in its most recent investor presentation, that its Lucid Air benefits from a lower battery pack size and a lower pack replacement cost. Lucid has designed its battery packs to be modular, and function synergistically with the rest of the drive system to generate industry-leading efficiency.

Lucid battery efficiency (Lucid Q3 investor presentation)

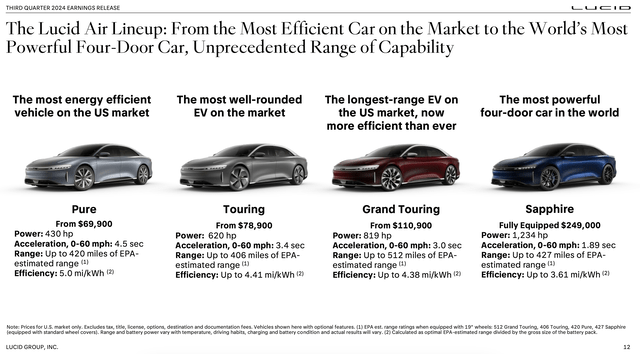

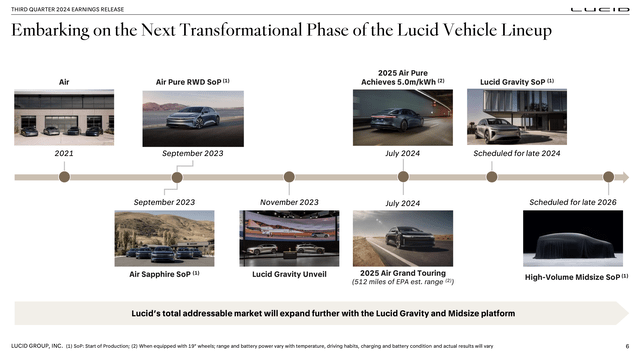

The company’s current lineup is shown below:

Lucid roadmap (Lucid Q3 investor presentation)

But the question is: how soundly will Lucid’s brand resonate with the mass market? Lucid, in my view, has built up its early-adopter customer base that appreciates and geeks out over Lucid’s tech superiority. But in my view, the mass-market adoption of EVs that were poised to start seeing in the next few years (especially as Tesla unveils its long-awaited Model Q, its new mass market vehicle that is supposed to be priced even below Model 3) will be dominated by the two metrics that more casual consumers care about most: affordable price and decent driving range.

Does Lucid have the runway to get there? It’ll be a very tight sprint

The chart below, meanwhile, shows Lucid’s planned product roadmap. Lucid’s high volume, mid-sized vehicle is currently planned for late 2026.

Lucid roadmap (Lucid Q3 investor presentation)

Immediately, investors should be warned that Lucid’s mass market product will lag behind its major rivals. Tesla’s Model Q will launch sometime next year, while Rivian will launch its anticipated R2 vehicles (priced at $45k, substantially below the current $70k R1 variants) in early/mid 2026. In the land grab for market share in the mass market, Lucid will be a year behind its biggest rival.

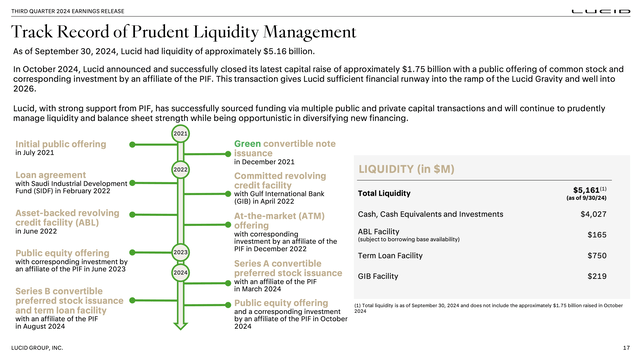

The other question is: does Lucid even have the capital to reasonably get there? As of Lucid’s most recent quarter, the company had $4.0 billion of cash left on its balance sheet, plus another ~$1.1 billion of borrowing capacity. In October it raised an additional $1.75 billion through a mix of a secondary share offering and an increased direct investment from the sovereign wealth fund of Saudi Arabia, the PIF.

Lucid liquidity (Lucid Q3 investor presentation)

We note that Saudi Arabia has been the company’s most prominent partner, committing in 2022 to a long-term order of 100k vehicles (very similar to Rivian’s arrangement with Amazon to deliver a cumulative 100k electric delivery vehicles). In totality including the recent raise, the company has just shy of $7 billion in total liquidity.

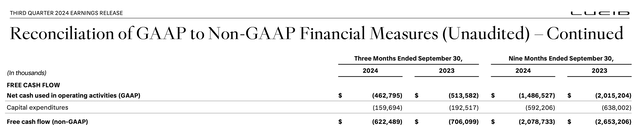

Meanwhile, in the company’s most recent quarter, Lucid burned through $622 million of free cash flow. Year to date, it has burned through $2.08 billion of cash, or an average burn rate of $693 million per quarter.

Lucid FCF (Lucid Q3 investor presentation)

Assuming a flat burn rate, Lucid has enough liquidity to stretch out for another 10 quarters: or through early 2027. Of course, converse to simple logic, as Lucid ramps up vehicle sales its burn rate is likely to pick up. That’s because of significant margin losses per vehicle at the moment.

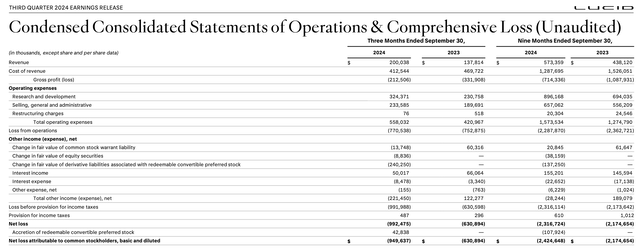

In Q3, the company generated a GAAP gross profit loss of -$212.5 million on revenue of $200.0 million. That’s a gross margin percentage of -106%. We note that Rivian has a gross margin loss in the ~40% range, but of course Rivian is at a substantially larger scale, on track to produce and ship ~50k cars this year versus Lucid’s 9k guidance target (Tesla, meanwhile, is shipping just shy of half a million units per quarter).

Lucid Q3 financials (Lucid Q3 investor presentation)

The company shipped 2,781 cars in Q3, so its ASP was $71,916, and its average gross profit loss per vehicle was ~$76k, excluding all operating costs. The company hasn’t yet provided a production target for 2025. Higher production volumes should mean higher efficiency on custom-machined parts and manufacturing lines, so Lucid should improve its gross margin percentages next year. But at the same time, higher volumes are almost certainly going to mean greater gross profit losses (in dollar terms and not margin) and higher cash burn.

The key point here is: using absolutely every single dime of its liquidity including drawing down on all debt sources, PLUS the very unlikely assumption of flat burn rates, barely gets Lucid to mid-2027. We also have to factor in the fact that ramping for mass-market production may require massive step-ups in capex to support new manufacturing lines, not to mention increased working capital to absorb inventory. To me, despite the appearance of billions on its current balance sheet, Lucid isn’t sufficiently capitalized to support its goals and will likely have to raise additional dilutive capital next year.

Upside risks and key takeaways

To me, the main “upside risk” to Lucid is if it succeeds in signing a technology license deal, which the company is actively exploring. The company’s advantage (per its own statements) are its technological prowess and battery efficiency: but it doesn’t have the manufacturing scale or the capital, on its own, to become a major player. Amid many large automakers like GM scaling back from EV design, licensing its technology for another automaker’s brands might be the way that Lucid monetizes its R&D to generate a profitable stream to revenue to finance its next-gen Lucid Air.

A large scale partnership could spark tremendous confidence in Lucid’s stock, similar to how Rivian jumped earlier this year when Volkswagen announced its $5.6 billion joint venture with Rivian. But as we can’t bank on the possibility of such a deal materializing, I’m content to sit on the sidelines for Lucid.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.