Summary:

- Nu Holdings, founded in 2013, now serves 110 million customers across Brazil, Mexico, and Colombia, capturing 56% of Brazil’s adult population.

- Despite a 24% YTD stock increase, NU remains 29% below its October highs, presenting a compelling investment opportunity given its strong Q3 2024 results.

- Nubank showcases some of the best unit economics in public markets through compounding cross-selling opportunities to clients.

- I estimate a fair value of $22.69/share, which is more than double the current price.

Dilok Klaisataporn

Introduction

I initiated a position in Nu Holdings (NYSE:NU) or Nubank which is its operating name in early 2024 when I thought it was more reasonably priced. I am always on the lookout for what I call high quality “compounders” that are trading at a reasonable price.

This may seem misleading given that banking tends to be a fairly mature, low growth industry, but nothing could be further from the truth with Nubank. Nubank has actually been one of the greatest growth stories over the past decade and a major disruptor to the industry in Brazil, which has operated as an oligopoly structure for much of the last 80 years. This digital and retail bank was only founded just over a decade ago and now serves 110 Million active customers in Brazil, Mexico, and Columbia. Nubank also serves 56% of Brazil’s adult population.

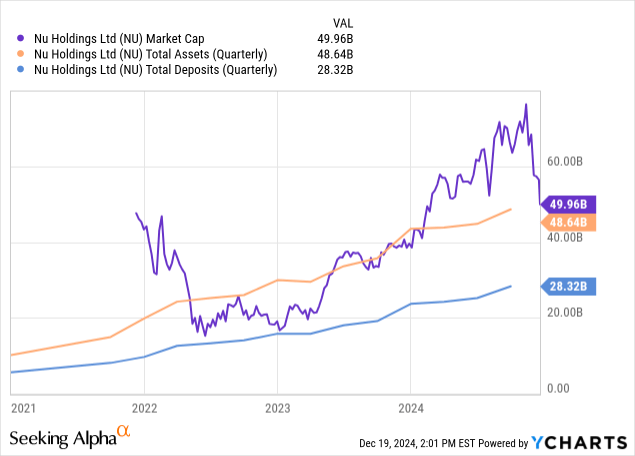

Nubank began in 2013 with $2 Million in seed financing from Sequoia Capital and from Kaszek Ventures (a preeminent VC firm in Latin America) and has grown to a $50 Billion Market Capitalization company with $48MM in assets and $28MM in deposits. This remarkable growth has been the result of taking advantage of rapidly rising incomes and demographic shifts in LATAM countries, combined with some of the best unit economics in financial markets.

Although the stock is up 24% YTD, it is 29% off its highs seen in October despite the company showing very impressive results in Q3 2024 and the company still has strong tailwinds to maintain their impressive growth.

History

Nubank was founded in Brazil in 2013 by David Vélez, who was born in Medellín, Colombia. He completed his MBA at Stanford University and held positions at Goldman Sachs and Sequoia Capital, which later provided Nubank their initial funding round.

Nubank is 100% digital and predominantly retail. It does not have physical branches and its main products are savings/chequing accounts, credit cards, consumer loans, insurance and investments.

Prior to when Nubank was founded, the banking industry operated in an oligopoly structure. This can be traced back to the 1930s, when LATAM countries adopted an economic policy of import substitution industrialization (ISI). These were protectionist policies whose aim was to reduce dependence on imported goods and promote local industry. These policies included high tariffs and import restrictions.

These policies largely concluded in the 1970s but had long-lasting effects as the damage had largely been done through regulatory capture. Large incumbent firms in key industries such as telecom, energy, transportation, and banking had already established close-knit relationships with local and federal regulators. The incumbents were not only benefitting from favourable regulatory policies that reduced competition but also cheap government subsidized capital.

As a result, key industries suffered from lack of innovation. The banking industry in particular was dominated by just a handful of incumbents, as there were only ~160 banks in Brazil in 2013 serving a population of over 200 Million. That’s over 1 Million people per bank. The U.S. for reference has about 5,000 banks serving 330 Million people, meaning each bank serves 66 Thousand people.

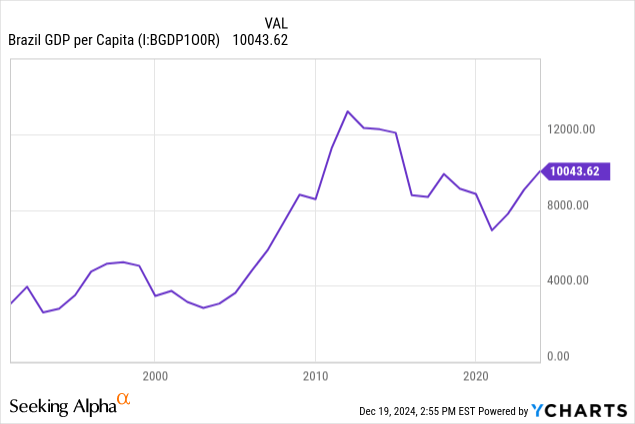

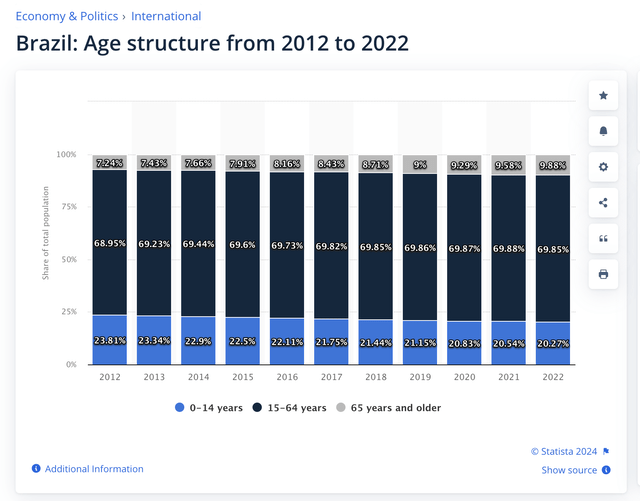

The oligopoly structure in Brazil led to banks being disincentivized to taking credit risk outside their most creditworthy customers. Those that had no credit or poor credit were either overlooked or received abysmal customer service through long wait times on telephone lines and disinterested representatives when they went into the branch. This led to a drastically underserved population that was seeing rapidly rising incomes, a fairly young population (only 10% of citizens being over 65), and rising mobile usage over the previous couple of decades.

Brazil Age Structure (Statistica)

To my last point, Brazil has among the highest mobile usage in the world, as citizens spend an astounding average of 9 hours a day on their phones. It is also the second-largest WhatsApp market in the world at 130 Million after India.

With these factors at play, 2014 was as good a time as any for Nubank to launch their first flagship product, the Nu credit card, which is distinctly purple and a no-fee credit card. It ran as an end-to-end mobile-first experience that was completely customer-centric. This product generated 3 Million customers in just three years generating sufficient scale to launch banking, debit card, insurance and investment products, which came between 2018 and 2020. Nubank launched in Mexico in 2019 and in Colombia in 2020 with their Nu credit card product, but even today these are small markets compared to their Brazilian market.

The company launched its IPO on the NYSE in 2021 raising $2.8 Billion at an equity valuation of around $45 Billion. At the time, Nubank had 52 Million customers. Berkshire Hathaway (BRK.B) participated in the IPO and still owns a ~2% stake in Nubank. Despite Nubank’s rapidly rising revenues and customer acquisition, this was an unusual investment decision for the insurance giant, given that Nubank was barely profitable at the time.

The Business

One of the interesting things about Nubank is that if you compare their results from one quarter to the next, it can almost look like you’re analyzing two different companies. That is because the business is growing so quickly and is evolving at such a rapid pace. The current quarter tends to be the most accurate representation of the current state of the business. Understanding this caveat, there are three ways Nubank generates revenues.

66% of revenue is generated from interest earned on loans that are made to their clients either via their credit card product or through their consumer loan products. Average APR on credit cards is 260% and 50% in Mexico and Columbia relative to 20% in the U.S. Average APR on personal loans in Brazil is 50% relative to 7-12% in the U.S. This is because interbank rates are around 13.5% in LATAM markets, so everything just bases from there. The credit markets are still very underdeveloped, and such a small part of retail financial services that it is easier to gauge.

16% is generated from fees and commissions, but mostly consists of interchange fees. Interchange fees are Mastercard (MA) charges to merchants for transactions that happen on their network. On average, Mastercard charges around 2.25% on transactions, of which Nubank gets to keep roughly half.

The remaining 18% of revenue is generated from excess capital that gets invested in financial assets, it is essentially float. These financial assets consist of short-term government and corporate bonds. The borrower currently has $28MM in deposits and $11MM is in these assets, which is more than one third of the deposits. This is unusual for a bank as most banks would prefer to deploy as much as possible into higher yielding assets while staying within Basil capital requirements, but this amount of capital is well in excess of regulatory requirements.

There are multiple reasons for this. First, with being a fast-growing company, the capital structure hasn’t normalized. They are holding excess capital to support their growth initiatives in Mexico and Columbia and possibly other LATAM countries. Second, credit card receivables which are a $12 Billion balance as of Q3 2024, are financed by merchants in Brazil, which frees up capital. There is an odd regulation in Brazil that gives credit card issuers about 30 days to make good on their payables to merchants. So if a cardholder uses their credit card to buy something, the customer has that amount of time to send the funds to Nubank. Conversely, Nubank also has 30 days to pay the retailer. So by the time Nubank needs that money, they would theoretically have already received it from the cardholder. So even though Nubank carries the credit risk of these credit cards, they don’t finance it. This is not a luxury North American banks enjoy, as card issuers usually pay merchants within 2 business days.

This is interesting because it not only speaks to the popularity of their bank account, but it also speaks to the level of prudence that they’ve been using to manage their loan portfolio.

The Magnificence of the Unit Economics

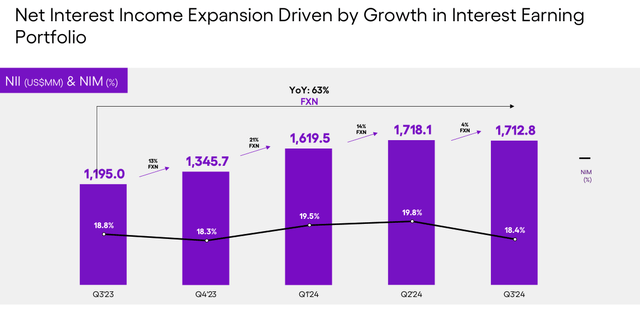

A good way to assess Nubank’s profitability is to use traditional banking profitability metrics such as NIM, efficiency ratio and ROE and then use those to compare against the large incumbents such as Itaú Unibanco (ITUB) or Banco do Brazil (OTCPK:BDORY). NIM tends to best demonstrate pricing power as it speaks to the spreads that can be generated between the cost of deposits and the return generated from lending that capital.

Larger banks tend to have an advantage here and especially when it comes to their cost of deposits because they have a larger network of branches and ATMs. They also have a wider array of products. They tend to provide a better a one-stop shop experience, and are perceived to be safer for storing one’s money. This is exemplified by what happened post Silicon Valley Bank Collapse, when there was an influx of savings moving into the larger U.S. banks despite the fact that the regional banks were offering yields on savings as much as 180 basis points higher.

The point is a smaller bank attracting deposits to provide credit has to be much more competitive with their pricing as consumers tend to see the products as more commoditized rather than differentiated. In the first few years, Nubank’s NIM was 7-10% as they had to offer cheaper loans and higher deposit rates, but these NIMs were feasible for them to continue growth as they didn’t have the overhead of running branches.

In recent quarters, Nubank’s NIM actually exceeded that of ITUB and BDORY at 18-20% whereas the other two have yielded 14-16%. To be fair, ITUB and BDORY have more exposure to mortgage, auto, and payroll loans which tend to be secured lending, whereas Nubank has more exposure to unsecured lending. Nubank’s credit cards account for ~73% of their portfolio and total unsecured is 82%, which will be higher yielding but provides no recourse in the event of default. Nubank’s secured lending portfolio is really only payroll deductible loans. Despite their product mix, this is still an impressive feat which speaks to their user experience and design interface as it provides customers a strong value proposition that fuels their profitability.

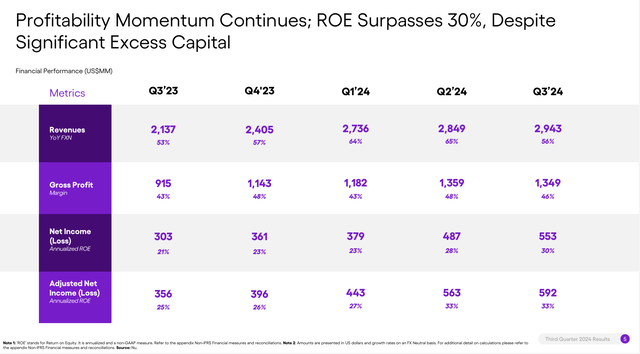

Q3 2024 Investor Presentation (Nubank)

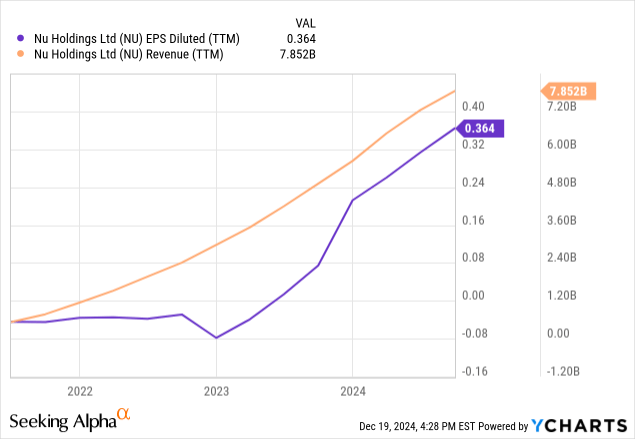

If we look back to their IPO in 2021, they had 52 Million customers, so have slightly more than doubled that amount to 110 Million as of Q3 2024, which is three years later. Revenue at the time of the IPO was $1.6 Billion. Revenues are on pace to exceed $11 Billion for 2024 YE, which is growth of 7X over three years. This is in part because of higher pricing on lending but also the power of their unit economics.

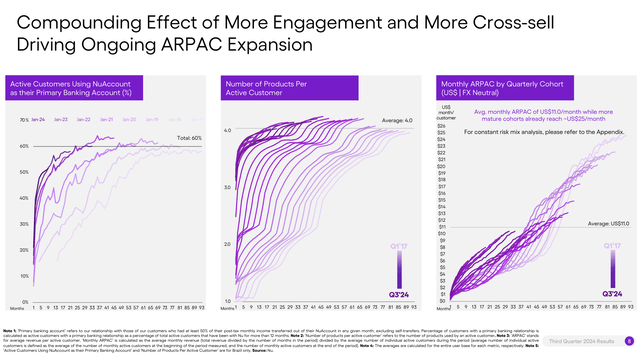

To illustrate this, the customers generate US $11/month in ARPAC (average revenue per active customer) and more mature customer cohorts generate ARPAC of $25/month. As much as 31% of active customers are from cohorts more recent than 2022 and on average have two or less products. Nubank could generate as much as $5.7 Billion from these more recent cohorts just from cross-selling and won’t require additional customer acquisition. Newer cohorts are also adopting multiple products at a faster rate than older cohorts as it took older cohorts more than four years to get to the average APAC of $11/month whereas new cohorts are only taking half that time.

Q3 2024 Investor Presentation (Nubank)

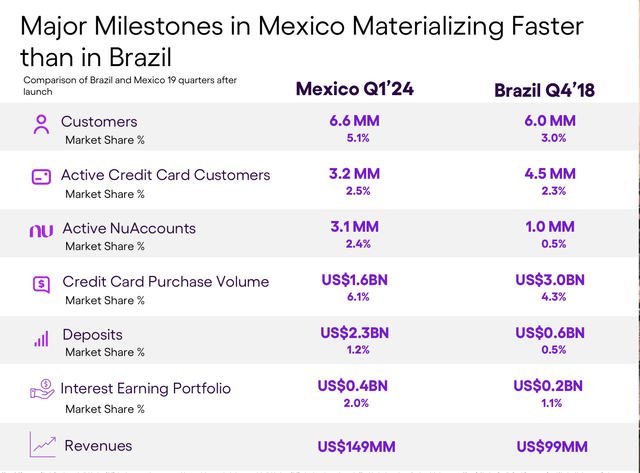

Although revenues from Mexico only account for 5% of the total, in the four years since they entered that market they have 5% of all customer market share, 6% of credit card purchases, and 1.2% of deposits. It took Nubank more than 5 years to reach these milestones in Brazil, so is seeing increased customer penetration in their new markets, which will drive greater revenue growth.

Q1 2024 Investor Presentation (Nubank)

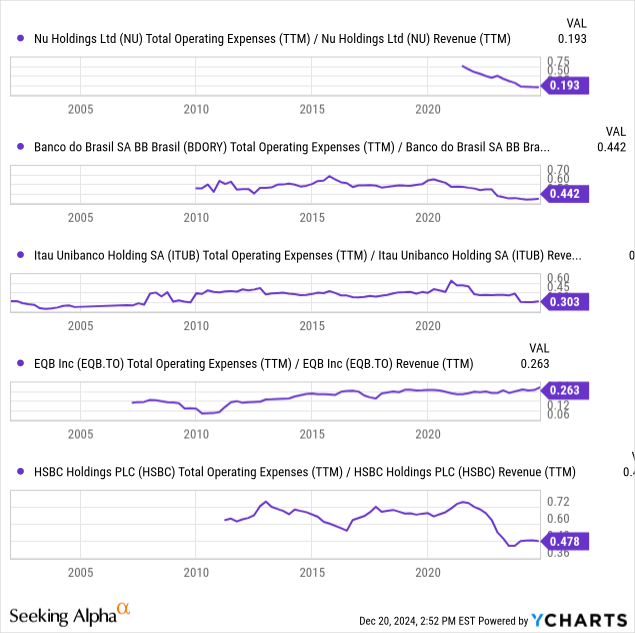

So that’s the revenue side of the business, now looking at the cost side, most notably Efficiency Ratio. This metric demonstrates operating leverage. The Efficiency Ratio is OPEX divided by Interest revenue (much like operating margin, except higher is worse). Selling “money” can be one of the most scalable businesses in the world, but your profitability is dictated by marginal costs of serving clients in a branch occupied office. Compensation usually makes up the largest operating expense, as people tend to be the least scalable.

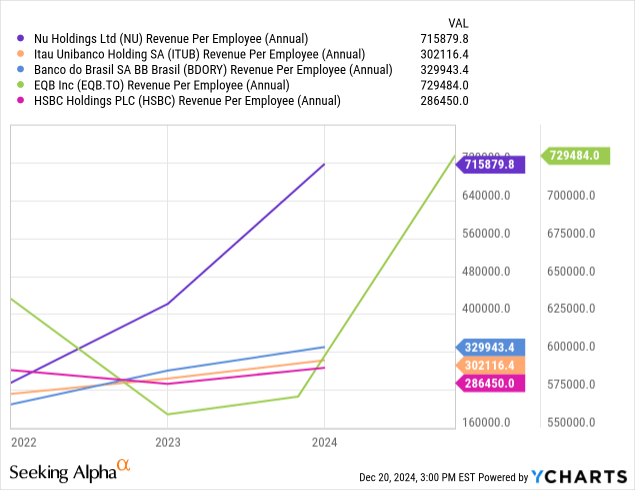

Nubank has the lowest Efficiency Ratio between its large Brazilian-based competitors ITUB and BDORY and has been almost 20% lower the past few quarters. I throw in Equitable Bank (EQB:CA) being a Canadian based digital bank and HSBC (HSBC) being a bulge bracket global bank for greater illustration, but Nubank still has the lowest ratio.

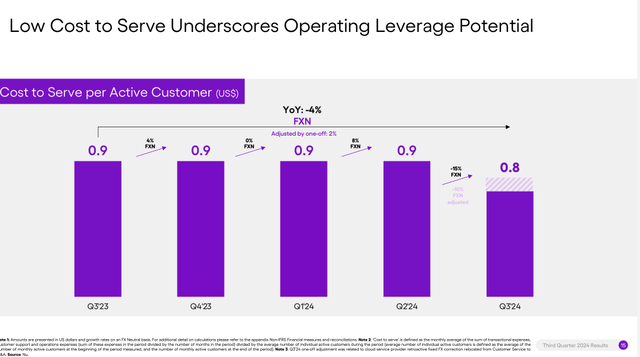

As we can see, Nubank is benefitting more from operating leverage than the above peers. This is because of their cost to serve per active customer (CSAC) which is the aggregate of transactional expenses, customer support and operations expenses in a period divided by the average number of individual active customers during the period. Nubank has managed to keep this KPI fairly constant at US $0.90 per active customer in recent quarters, and even reduced it to US $0.80 per active customer in the most recent quarter. This is because a representative sitting in a city like São Paulo can just as easily service a client locally as it can a client based in Rio.

So you have a situation where ARPAC is growing 10-11% per quarter while the CAC doesn’t change.

Q3 2024 Investor Presentation (Nubank)

Nubank has ~7,000 employees, which means one employee serves 15,000 to 16,000 customers. Conversely, larger banks have one employee only serving up to 1,000 employees and as little as a couple of hundred. We can see below that Nubank and EQB which are the two digital banks, generate at least twice the revenue per employee of the larger branch oriented bank.

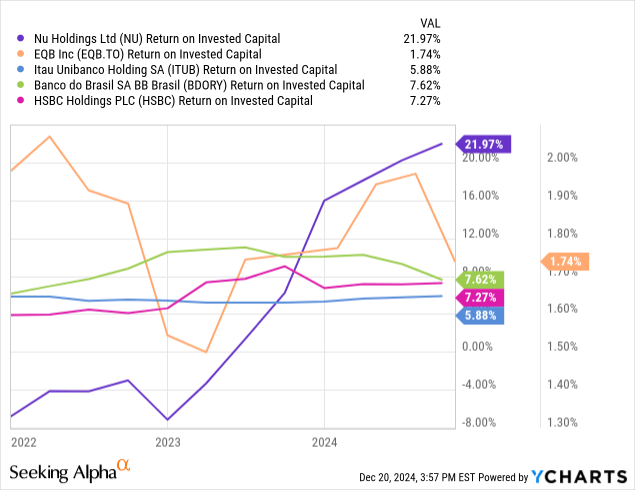

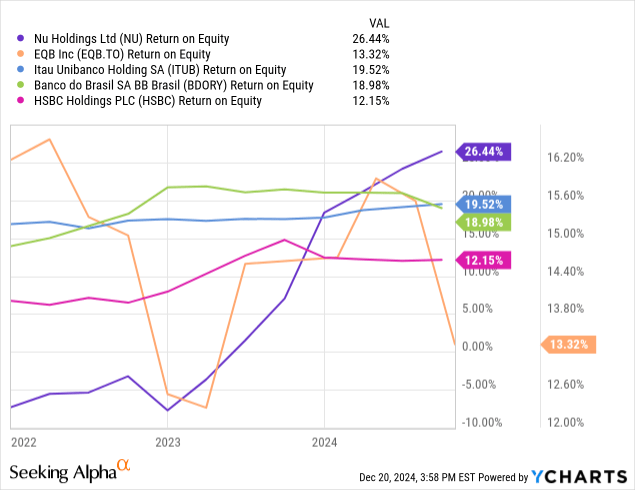

ROE and ROIC tend to be the best metrics for determining how well a bank allocates capital. In Nubank’s earlier years, its ROE definitely lagged its peers, as it had to be more competitive with its pricing. Since mid-2023 as it has realized greater scale advantages than its competitors and its ROE and ROIC has stormed right past them and keeps increasing. Nubank would have probably caught up earlier if not for sustained losses in the Mexico and Columbia prior to 2023 YE, whereas, in 2024, they were closer to breaking even. As mentioned earlier, they carry a large number of deposits that are not deployed into higher rate assets, so as their capital structure normalizes to that of larger banks, we should expect an uptick in their ROE and ROIC.

As a result of the strong unit economics, Nubank has generated mind-blowing revenue growth over the past few quarters, with sequential YoY revenue and EPS growth at 53-65% and 25-33% respectively. These numbers have almost rivalled that of Nvidia (NVDA) although their margins are not quite that strong and don’t have quite that level of pricing power.

Q3 2024 Investor Presentation (Nubank)

Valuation

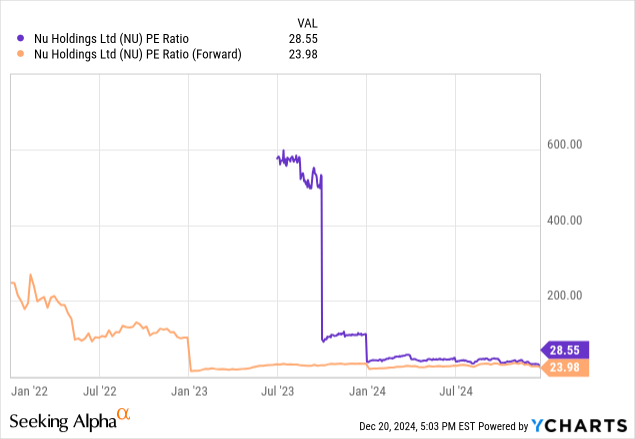

On the surface, Nubank has never really looked like a cheap stock, trading in excess of 100X earnings at various points. It has managed to grow into its valuation, with EPS growing 25-30% per quarter on a YoY basis, as it has reached tremendous scale. 24X forward earnings is very high for a financial institution, but Berkshire Hathaway bought in at an even higher valuation in 2021.

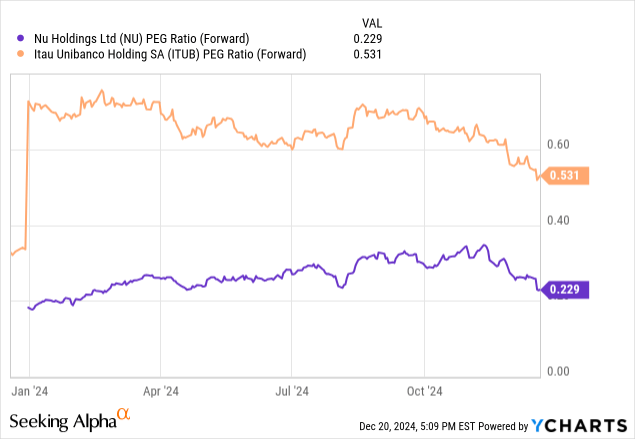

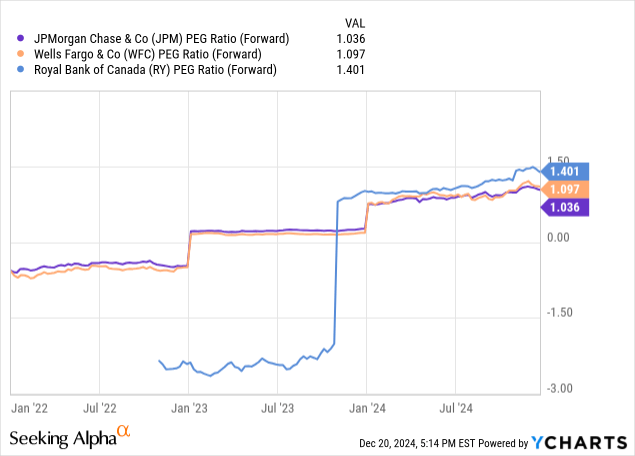

When we normalize this ratio for its growth however, the stock begins to look a lot cheaper, especially in comparison to ITUB at a forward PEG of 0.531. Using this as a fair PEG would imply that a fair P/E multiple for Nubank is actually 62X earnings and the fair value based on its TTM EPS of 0.364/share is $22.69/share which is more than twice its current price of $10.5/share.

Conversely, a more mature bank should have a PEG of 1.0 which would imply a fair value of $45/share. This may be on the aggressive side.

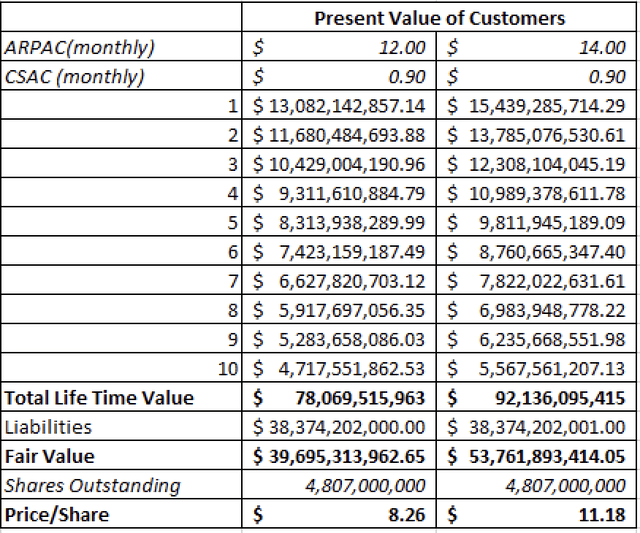

Nubank management uses a formula to determine the net present value that every dollar towards customer acquisitions generates. We can apply this same formula to assess Nubank’s “no growth” value to give us a sense of the downside protection. Nubank uses a 12% discount rate with a 10 lifetime value of the client. These assumptions are fairly conservative.

As ARPAC has grown significantly over the last couple of years as existing customers have quickly adopted multiple products, I feel using the average ARPAC of $11/monthly is too conservative. I assume they keep the same 110 Million customers and CSAC doesn’t change. This approach is similar to valuing the reserves of a commodity company.

Author’s Table (Company Filings)

As we can see, $8.26/share is the downside protection using an ARPAC of $12/month, which is 20% below the current price. Using an ARPAC of $14/month generates an $11.18/share price, which is more realistic and would actually suggest the stock is trading at a 7% discount to the lifetime value of Nubank’s current customers.

Customer acquisition costs have been on the rise the last couple of years but was $7/customer in 2022 and $8.80/customer in 2023, so have been able to recover these costs within 18 months. The lifetime value of a customer compared to the CAC can be over 70X, which is an incredible return on investment.

Risks

One risk is that client acquisition costs (CAC) have been rising since their IPO when looking at marketing costs relative to the change in active customers. These costs rose from ~$7/customer in 2022 to $8.80/customer in 2023, to $12.10/per customer in 2024 showing that marginal costs to acquire more customers are not decreasing, perhaps due to greater competition but also due to the fact that they don’t have the same “word of mouth” advantage in Brazil that they do in Mexico and Columbia. Management estimates the retail financial services market in LATAM is about a $200 Billion revenue pool, and they have 4% of that. Mexico and Colombia combined have a market of $122 Billion revenue, for which they have slightly less than 1% of the market. Through a combination of greater product offerings in Brazil and penetration into new markets, their contribution per client (CPC) which is ARPAC minus CSAC and CAC, should stay relatively constant if not improve it.

Management has indicated they are in beta testing for payroll loans in Brazil, which is the largest and one of the lowest risk asset classes in the consumer finance space and estimate a $14 Billion market. Management has determined they already have 31% of that market as existing customers, so don’t have to spend a lot on marketing in the near term to acquire customers. Nubank also does not yet offer mortgages or auto loans which can improve ARPAC with their existing customer base, should they introduce those offerings.

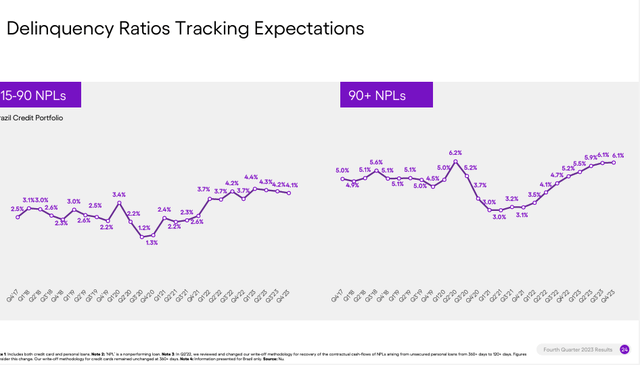

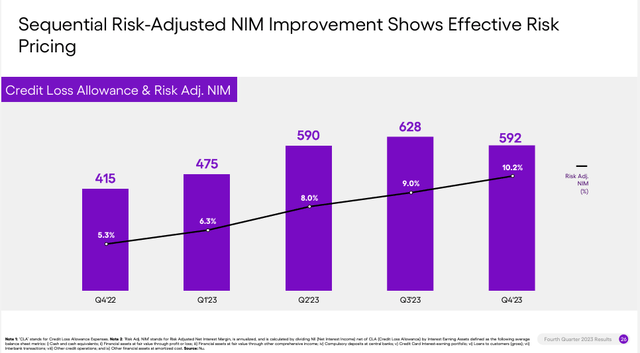

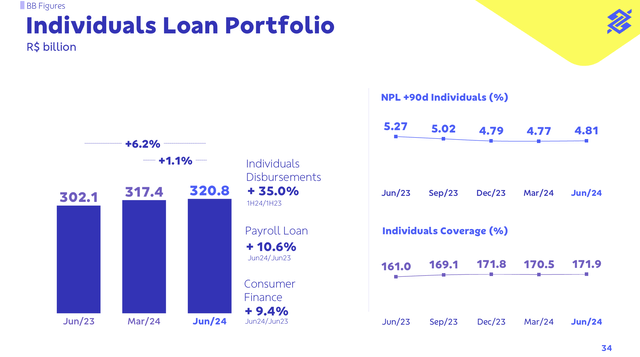

The larger risk is that 84% of their loan portfolio is unsecured loans and credit cards, so if the product goes into default, there is essentially no recourse and the balance gets written off unless there are external guarantees, which is often not the case. In addition, the majority of their loan book is customers in the middle class, which is 2-3X the minimum wage in Brazil. Despite the fact that customer acquisition has increased 17%+ over the past three years, 15-90 day Non-Performing Loans have remained steady. Risk-adjusted NIM (adjusted for increase in Credit Loss Allowance) has still increased in recent quarters despite the 90+ NPLs being on an uptrend, reaching a high of 6.1% in the most recent quarter.

Q4 2024 Investor Presentation (Nubank) Q4 2024 Investor Presentation (Nubank)

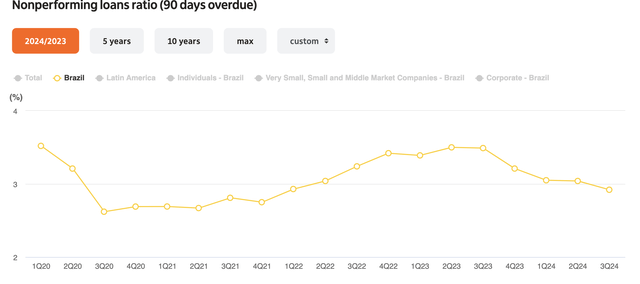

Below I compare these metrics to ITUB’s and BDORY’s personal banking portfolios. ITUB has performed a little better than Nubank with NPLs at 3-4% in recent quarters, BDORY has performed closer to NU at 4-5% in recent quarters. Keep in mind these institutions can sell delinquent loans to prop up results, which is a luxury Nubank does not have. This demonstrates Nubank is doing a favourable job in underwriting lower income and no credit customers.

Itau Bank (Q3 2024 Investor Presentation) Q3 2024 Investor Presentation (Banco do Brasil)

One advantage Nubank has over the larger incumbents is their structural edge with everything being digital. All touchpoints can be put into a credit algorithm. Over time, as Nubank iterates on its algorithm, they can be a leader in providing credit, so if you request a credit card or a limit, if those happen to be informative variables, then they can simply incorporate them into the next iteration of their underwriting algorithm. It is also very easy for them to back test for statistical significance with this data and run a new algorithm.

This also gives them a competitive advantage over the start-up fintecs that have been entering the LATAM markets by the hundreds, possibly thousands. These include Interbank in Brazil, Nequi and DaviPlata in Colombia, and Hey Banco and Clad in Mexico. These companies have every advantage Nubank had in getting the user experience right from the start.

The biggest thing is that you have to get the credit underwriting model right to survive. Asset light businesses like payment processing services, wallets, and debits are a popular entry point for fintechs start-ups as these services are generally high margin and require low start-up costs. Those profit pools eventually get competed away as they are generally viewed as commoditized services where the barriers to entry are low. The credit model is what is proprietary, and Nubank is years ahead in their data collection process, which has produced a more robust algorithm. There is a durability of that advantage because as new entrants are focused on gathering data, Nubank is focused on iterating data, which just widens the gap and becomes a virtuous cycle. As Nubank’s algorithm gets better, they get more market share because they’re extending more loans, which gets them more data and so on.

This is similar to how Netflix (NFLX) utilized the flywheel effect to win the streaming wars. They had managed the lowest customer churn for an extended period of time, which meant instead of spending on marketing to acquire customers like Disney (DIS) or Hulu was. They used those funds to produce more and better content, which in turn got them more customers and so on.

There is regulatory risk as well. I see this as less of an issue as Nubank has provided so much value to the financial ecosystem in Brazil by delivering credit to customers who might not have otherwise got it, and they are almost on the same side as regulators.

Conclusion

I am always on the lookout for these high-quality compounders with a competitive advantage and can reinvest earnings at high rates of return, but trade at a reasonable price.

I recommend this stock as a Strong Buy after the drawdown as you will be hard-pressed to find a company with stronger unit economics in public markets as management has guided this ship with little to no slips.

I also take comfort in the fact that Berkshire Hathaway has held this stock since the IPO and any investor who follows Warren Buffett and Charlie Munger knows their competence in the banking and insurance space is second to none (rest in peace Charlie). It should be noted that Berkshire Hathaway reduced its stake by 20% at around the time it reached its highs in October, but still owns ~2% of the company.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NU, BRK.B, NFLX, MA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.