Summary:

- Blackwell chips are expected to make up 80% of total deployments in 2025. But complex specifications are leading to supplier-led delays, likely extending production timelines.

- The revenue outlook is still strong. But I am not sure if the recent news on Blackwell delays have been fully reflected in consensus revenue estimates.

- NVDA stock valuations have gotten cheaper, whilst earnings expectations have remained stable; a good sign for bullish arguments.

- The bulls are holding up well on the technical charts vs S&P 500. The charts suggest the potential for outperformance.

- Expansions of NVIDIA’s TAM via a foray into the CPU market is an upside risk that is a key monitorable.

Olivier Le Moal/iStock via Getty Images

Performance Assessment

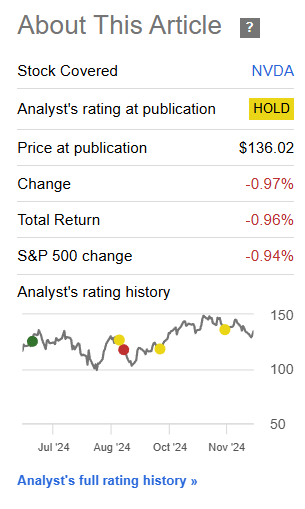

NVIDIA’s (NASDAQ:NVDA) performance has matched the S&P 500 (SPY) (SPX) (IVV) (VOO) since my last update on the stock.

Performance since Author’s Last Article on NVIDIA (Seeking Alpha, Author’s Last Article on NVIDIA)

This has been according to my expectations since I had rated the company a ‘Neutral/Hold’, which according to my ratings system (discussed in the last section of this article), expresses a view of performance in-line with the S&P 500.

Thesis

Over the last month, there have been some important updates to process and dissect to see whether a change in my bias on the stock is warranted:

- Complex specifications are leading to supplier-led delays for Blackwell systems.

- But the revenue outlook is still strong as major customers’ capex expectations remain broadly stable.

- Valuations have gotten cheaper, whilst earnings expectations have remained stable.

- The bulls are holding up well on the technical charts.

- Expansions of TAM via foray into the CPU market is an upside risk.

Complex specifications are leading to supplier-led delays for Blackwell systems

The GB200 NVL72 is a rack-scale system (modular way of building a computer for more customizable computing applications) that implements NVIDIA’s latest Blackwell technology (the latest, powerful GPU architecture used for AI, high-performance computing and gaming applications). GB stands for Grace-Blackwell (NVIDIA’s CPU is called Grace). The 200 in the name refers to the product line or generation associated with a specific configuration that allows for high-performance computing. And L72 in the name stands for Link 72 as it uses 72 Blackwell GPUs.

Now this product is set to make up 80% of total deployments of NVIDIA products in 2025. This is why the ‘Blackwell ramp’ is a big narrative around NVIDIA stock.

According to the semiconductor industry research firm TrendForce, the problem is that the product is so complex in its design specifications that NVIDIA’s suppliers are taking longer to adjust to meeting the quality standards. This is leading to expected delays in the shipment periods:

Production volume is anticipated to ramp up gradually from 1Q25 onward… 2024 year-end shipments are expected to fall short of industry expectations… peak shipment period for the GB200 full-rack system will be postponed to between Q2 and Q3 of 2025.

– TrendForce commentary on Dec 17 2024.

I view this as an incremental negative for NVDA stock as estimates for peak shipments get pushed out.

But the revenue outlook is still strong as major customers’ capex expectations remain broadly stable

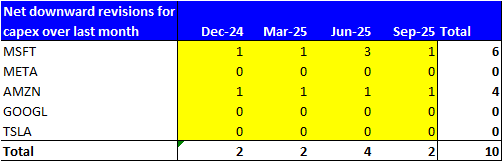

If we look at the capex expectations over the next year for major customers of NVIDIA (who make up almost 40% of overall revenues), there are not too many downgrades in spending outlooks:

Net downward revisions for capex over last month among NVIDIA’s major customers (Capital IQ, Author’s Analysis)

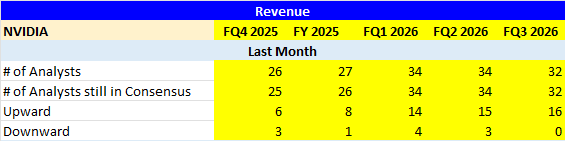

Perhaps this is contributing to Wall St analysts’ optimism on NVIDIA’s revenues over the next year, as evidenced by broad-based upward revisions:

NVIDIA Revenue Upgrades by Wall St Analysts (Capital IQ, Author’s Analysis)

Whilst this is a positive sign, I do have a doubt about whether the latest news about Blackwell production delays is reflected in the revenue revisions, since that data is only 3 days old. Also giving reason for caution on NVIDIA’s Q4 FY25 revenue execution is the fact that there are reports of orders for NVIDIA’s H20 (Hopper) GPUs being softer in Nov’24 and Dec’24.

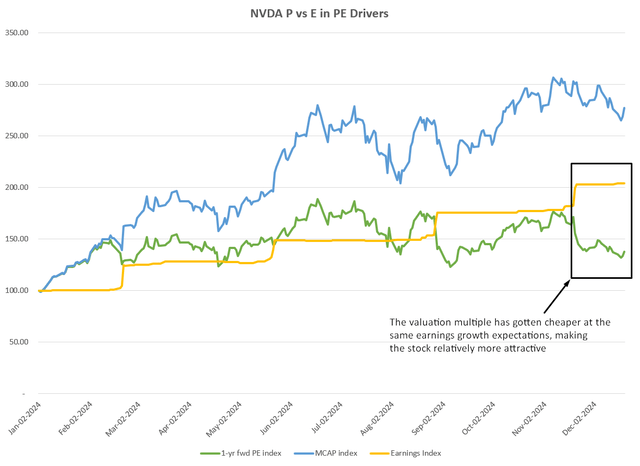

Valuations have gotten cheaper whilst earnings expectations have remained stable

NVIDIA P vs E in PE Drivers (Capital IQ, Author’s Analysis)

Over the past month, NVIDIA’s 1-yr fwd PE multiple has fallen, making the stock cheaper. Today, the 1-yr fwd PE is at 34.2x. Importantly, this cheaper valuation has not come at the cost of any degradation in the earnings expectations, as that has remained stable.

Hence, this is probably a good sign for the bulls.

The bulls are holding up well on the technical charts

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

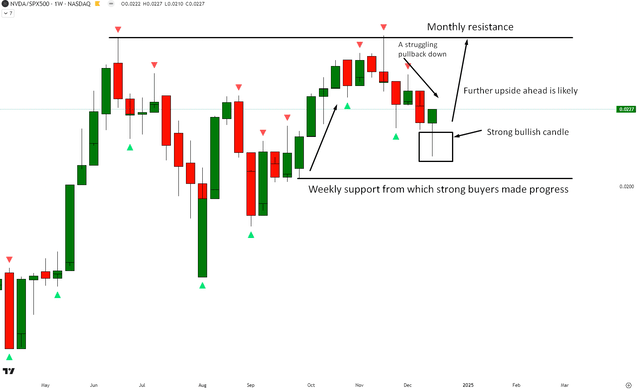

Relative Read of NVDA vs SPX500

NVDA vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

Relative to the S&P500, NVDA stock is posting a strong bullish candle to counter a weak pullback down amid broader uptrend momentum. My anticipation is for further upside and hence outperformance ahead toward the monthly resistance level.

Expansions of TAM via foray into the CPU market is an upside risk

There are speculations that NVDA may be entering the CPU market in 2025, which would expand its total addressable market (TAM):

we believe NVDA will announce a client-side CPU during 2025, opening up an additional ~$35B TAM.

– Truist Securities Analyst William Stein

My research suggests these speculations may not be unfounded as there are developments wherein NVIDIA is building more powerful GPUs

speed of accessing important data on the fly could be up to 60% faster, while potentially using roughly 20% less power while doing so… This will drastically increase the number of parallel computations the GPU can handle.

– Tom’s Guide Managing Editor of Computing – Jason England

And I suspect this helps it create a powerful CPU + GPU that was talked about by an NVIDIA partner who said an Alienware gaming laptop using NVIDIA’s CPU + GPU is happening. Another corroborating sign is that NVIDIA is set to launch its first PC CPU in 2025.

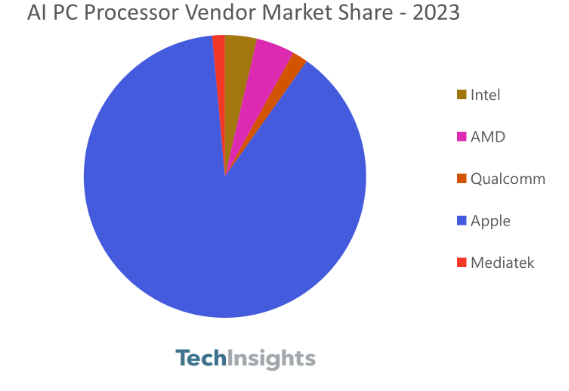

Overall, these developments are a source of upside risk for NVIDIA. To track how well NVIDIA penetrates this market, I am going to try to keep track of market share data and commentary from competitors such as Intel (INTC), AMD (AMD) and Apple (AAPL):

AI PC Processor Vendor Market Share (Tech Insights)

Takeaway & Positioning

Blackwell chips are a big focus for NVIDIA stock, as its shipments are expected to make up 80% of total deployments next year. According to recent news, the complexity in making these chips is something NVIDIA’s suppliers are having some hiccups in, which is leading to delays in expected production. Moreover, there are some reports of softer Hopper orders in Nov’24 and Dec’24, which may hinder Q4 FY25 revenue delivery. Yet, the stock has been seeing revenue upgrades by Wall St analysts as there are few downgrades in the capex estimates of its major customers. However, I am doubtful about whether the Street has fully baked in the impact of the recent Blackwell delays into their revenue estimates. Hence, I have a more cautious view of the stock’s Q4 FY25 revenue performance.

On the brighter side of things, valuations have gotten cheaper without any major downgrade in earnings expectations. There are also some signs that NVIDIA may enter the CPU market, expanding its TAM by ~$35 billion. And the chart technicals vs the S&P500 point bullish.

Considering these pros and cons, I am finding it hard to change my stance just yet. Hence, I retain my ‘Neutral/Hold’ stance.

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P500 on a total shareholder return basis, with higher than usual confidence. I also have a net long position in the security in my personal portfolio.

Buy: Expect the company to outperform the S&P500 on a total shareholder return basis.

Neutral/hold: Expect the company to perform in-line with the S&P500 on a total shareholder return basis.

Sell: Expect the company to underperform the S&P500 on a total shareholder return basis.

Strong Sell: Expect the company to underperform the S&P500 on a total shareholder return basis, with higher than usual confidence.

The typical time-horizon for my views is multiple quarters to more than a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VOO, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.