Summary:

- Nvidia’s shares have corrected lately, which creates an engagement opportunity for long-term investors.

- Google’s quantum computing breakthrough highlights rapid technological progress, which is also going to benefit Nvidia’s dominant position in the AI GPU market.

- NVDA’s free cash flow could reach $100B/year in 2025, with potential for significant shareholder returns through dividends and stock buybacks.

- The chip design firm is expected to achieve double-digit annual EPS growth for the foreseeable future and could benefit greatly from the rise of AI factories.

- The Company’s strong product roadmap and innovation potential make it a compelling long-term investment.

BING-JHEN HONG

Nvidia’s (NASDAQ:NVDA) shares have corrected lately amid waning enthusiasm for semiconductor companies and markets sliding lower after last week’s Fed commentary about federal fund rates. However, Nvidia, in my opinion, could be a top investment for FY 2025 as the company starts to scale its Blackwell GPU. Additionally, Alphabet (GOOG) announced a quantum computing breakthrough with its Willow chip that promises significant technology enhancements for the entire chip industry, including the Data Center market. I believe Nvidia’s correction is a unique buying opportunity, as shares are firmly locked into a long term up-trend that could extend for many years into the future.

Previous rating

I rated shares of Nvidia a strong buy after the semiconductor company reported third fiscal quarter earnings and issued a reasonably strong guidance for the fourth fiscal quarter: Nvidia: Grossly Undervalued. My bullish sentiment was driven in large part by my high expectations for Nvidia’s Blackwell GPU launch, as well as the fact that Nvidia has a strong history of execution. Further, Nvidia announced a $50B stock buyback, which provides support for the firm’s share price. With Google recently making a major quantum computing breakthrough, the market for accelerated computing is also set to accelerate, which clearly could benefit Nvidia.

Blackwell GPU, quantum computing breakthrough and Rubin release

Google was in the news recently due to a major achievement in quantum computing, highlighting that computer chips are seeing accelerating potency when it comes to processing power: according to Google, its quantum computer chip, dubbed Willow, managed to complete a math problem that it took other super computers ten septillion years to complete.

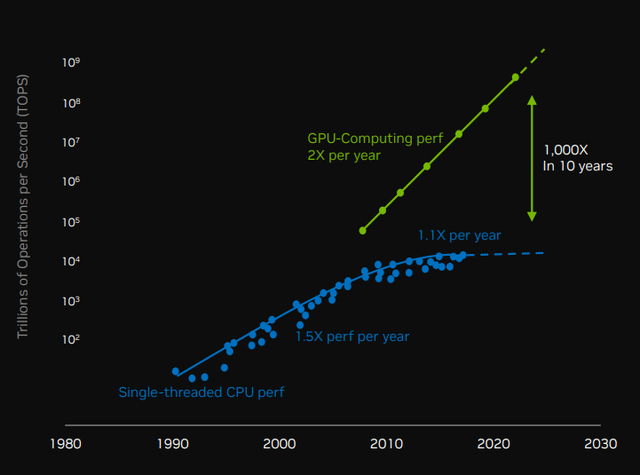

This achievement is truly unprecedented and highlights just how quickly technological progress is happening these days. With advancements in computer processing technology, the industry is also likely at the cusp of transformational change in the GPU market, which is Nvidia’s bread and butter. The semiconductor firm dominates the industry with a market share in excess of 90% and is a major beneficiary of soaring demand for AI GPUs. Most importantly, just like Google, Nvidia sees a tremendous growth opportunity in accelerated computing. Nvidia, as an example, projects that GPU performance is set to growth exponentially—by 1,000X within 10 years—creating a huge upgrade opportunity for Nvidia and its large Data Center customers.

Three reasons stand out why Nvidia is set to benefit from a massive surge in productivity gains:

- Upgrade and refresh cycles are set to shorten drastically, potentially allowing the company to increase its GPU shipments volumes much more rapidly in the past. Nvidia and AMD have both already announced that they are going to move to 1-year product release cycles in order to allow their customers to benefit from the latest technological achievements

- With more and more AI-capable chips to be released in a shorter period of time going forward, upgrade cycles are going to be shorter, which could benefit average selling prices. Since the market is currently experiencing a supply shortage for AI-optimized GPUs, price trends are likely going to be highly in favor of GPU designers and manufacturers.

- As the design and manufacturing of new CPUs and GPUs gets more complicated and capital-intensive, established chip design companies like Nvidia may have a competitive advantage that in turn could lead to incremental market share gains. Nvidia has a history of developing chips, like H100 or Blackwell, that offer significant performance improvements compared to prior-gen models while significantly lowering power consumption… and ramping those products quickly. Companies that can serve shorter upgrade cycles efficiently could benefit from shorter lead times.

- AI factories, which are set to drive GPU-accelerated computing, are going to significantly raise demands on Data Centers and represent a trillion dollar market opportunity or Nvidia. Nvidia has said that it expect the emergence of AI factories to increase the GPU market opportunity to $2T.

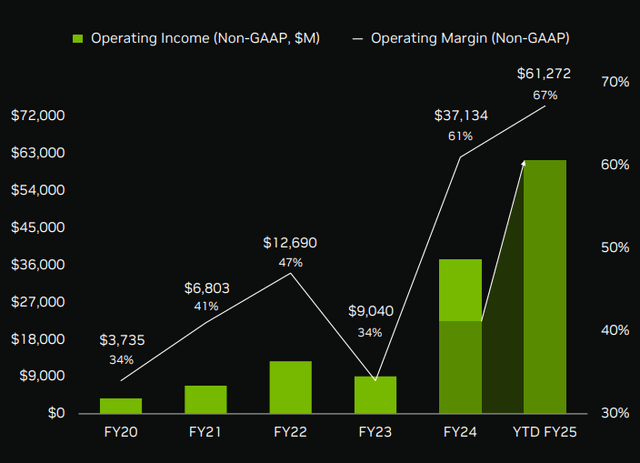

Nvidia is going to see a continual ramp in Blackwell in 2025—and chip platform Rubin in 2026—which is set to continue to grow the company’s top line and operating income. In fact, Nvidia generated a massive $61.3B in operating income in the first nine months of the current fiscal year (FY 2025), showing a 16X factor increase over the entire fiscal year of FY 2020. At its current run-rate, Nvidia could see $82B in gross profits on a full-year basis in FY 2025 which would reflect a total factor increase of 22X compared to FY 2020.

For next year, I continue to believe that Nvidia has massive potential to advance its top line and operating income, chiefly based off of accelerating growth in machine learning and gen-AI models. At its current rate of growth, it is entirely possible for Nvidia to generate more than $100B next year in both operating income as well as free cash flow.

Nvidia’s free cash flow is set to reach $100B/annually in 2025

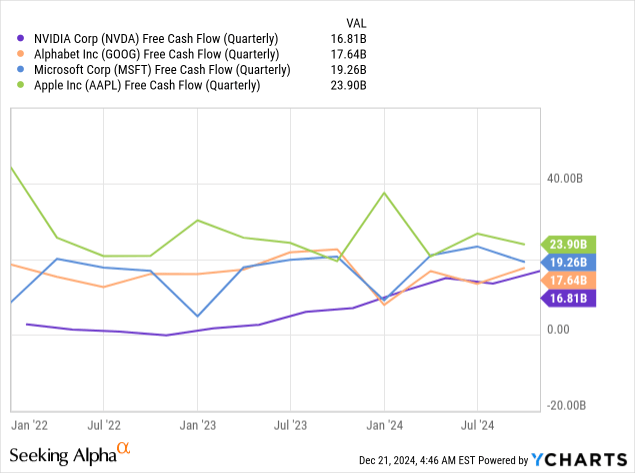

Earnings, and most importantly, free cash flow, can be distributed to shareholders as dividends and stock buybacks, so FCF is a key metric that is worth paying attention to. In Q3’25, Nvidia generated $16.8B in free cash flow… in a single quarter. On a run-rate basis, this means that Nvidia is on track to achieve ~$67B in free cash flow in the next twelve months, at the very minimum. Nvidia’s free cash flow surged 138% year-over-year in the third fiscal quarter, due to growing GPU product sales, and the company could even see an acceleration here if Nvidia’s Blackwell shipments ramp up nicely.

It is likely that Nvidia will see drastically higher free cash flows in the future, however, and the semiconductor company could cross the $100B per-year FCF threshold easily in 2025. I expect Nvidia’s free cash flow to increase 55–65% Y/Y in 2025. Based off of this estimate, Nvidia could be on track to achieve free cash flow in a range of $101–107B which would firmly establish Nvidia as one of the free cash flow-strongest tech companies in the world (~$25B in FCF/quarter) and on par with Google, Apple (AAPL) and Microsoft (MSFT).

Nvidia’s valuation

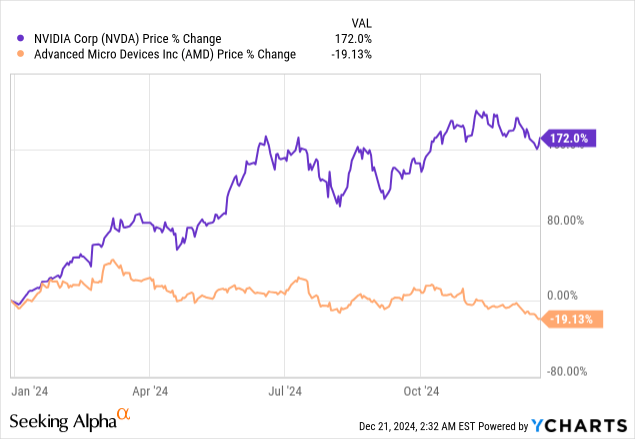

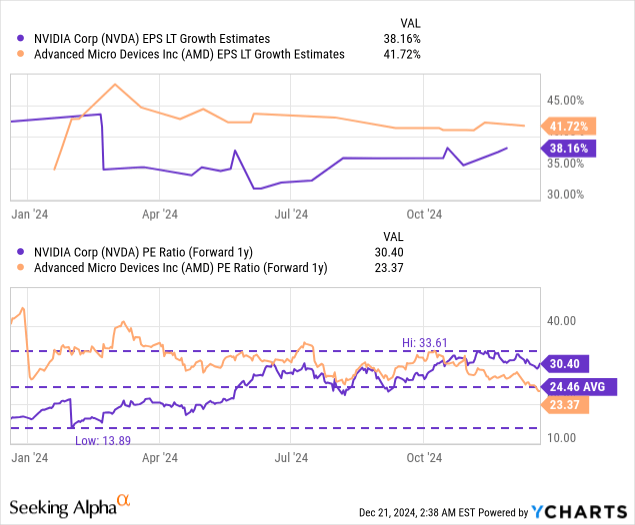

Nvidia is considerably undervalued given its long-term potential in the AI GPU market, this was my takeaway in my last work on the semiconductor company. The reason for my optimistic outlook for Nvidia relates to Nvidia’s dominant market position in the Data Center market and the rise of AI factories, which are set to propel demand for AI GPUs much higher. Currently, Nvidia is valued at a price-to-earnings ratio—based off of next year’s earnings estimates—of 30.4x, compared to 23.4X for Advanced Micro Devices (AMD).

AMD’s valuation has skidded as well lately, although the chipmaker reported strong third-quarter earnings and the semiconductor firm is in the early stages of a significant MI300X accelerator ramp. AMD could also be a beneficiary of Nvidia’s Blackwell shortage, explained here.

In my last work on Nvidia, I calculated a fair value of $315–350 per-share for Nvidia, if the company can grow its EPS at a 25% average annual rate over the next five years. I continue to see those estimates as very much realistic and achievable, and actually believe that Nvidia, given the accelerated computing opportunity, the rise in AI factories and the associated expansion in the total addressable market, could significantly outperform this estimate going forward.

Risks with Nvidia

Since the market is pushing relentlessly for AI-driven productivity gains, I believe it will be all but impossible for companies to resist aggressive spending on AI-optimized chips. Nvidia is going to benefit from this growth through faster product release cycles and likely up-trending average selling prices, given limited production capacity and a fast speed of technological development. What would change my mind about Nvidia is if the company saw a slowing free cash flow ramp or weakening demand over time for Blackwell or, in 2026, Rubin.

Final thoughts

While enthusiasm for Nvidia has waned in the last several weeks, and especially last week, Nvidia has the strongest product roadmap in years and Google’s leap in terms of quantum processing power implies considerable innovation potential for the GPU market as well. Nvidia is set to release its next-gen GPU, Rubin, in 2026 and could be a major beneficiary of accelerating technological progress in GPU technology.

Nvidia’s shares have dropped lately, which I believe creates an engagement opportunity for investors with a long-time horizon. Nvidia is set for multi-year growth in the market for accelerated computing through its top-shelf GPU products, and the chip enterprise is expected to keep growing its EPS at double-digits annually for the foreseeable future as well. I believe the risk profile is highly attractive and Nvidia could be a top performer in 2025 given the catalysts in its core business.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.