Summary:

- With its AI-based applications, Palantir has a strong economic moat in the government segment and a narrow moat in the commercial segment.

- My estimate is 28% growth for the next 3 years, higher than the consensus, driven especially by their commercial segment.

- The stock is significantly overvalued based both on a relative and on an absolute valuation, with a fair value of $38.16 compared to the current price of $74.21.

- For existing investors, selling a covered call is recommended now due to high implied volatility and high interest rates.

- A call with expiration on Aug’25 offers a higher return and a lower break-even compared to a Jan’25 call, but the second is better for a stagnant price because it can be rolled forward.

Sundry Photography

Article Thesis

Artificial Intelligence is undoubtedly the most relevant trend of this decade. Until this year, especially infrastructure, pick-and-shovels companies led by NVIDIA thrived. But starting with 2023, with the spark given by ChatGPT, AI software has gained more traction and is estimated to have a compound annual growth rate—CAGR of about 30%, with other sources providing close estimates.

There are several types of companies involved in AI software. For example, titans like Google are developing and using different AI models to optimize their core businesses, like Internet search, programmatic ads, cloud computing, autonomous vehicles. There are also smaller AI companies mostly focused on one area, like OpenAI with their ChatGPT (although they did have other AI developments).

In this context, Palantir (NASDAQ:PLTR) is a pure AI company with their main focus on AI, which also managed to develop and implement at scale multiple AI models and applications.

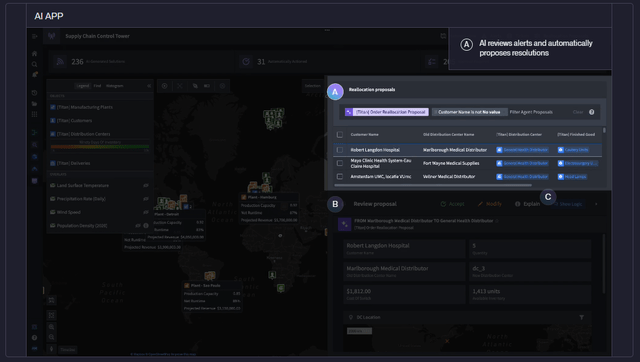

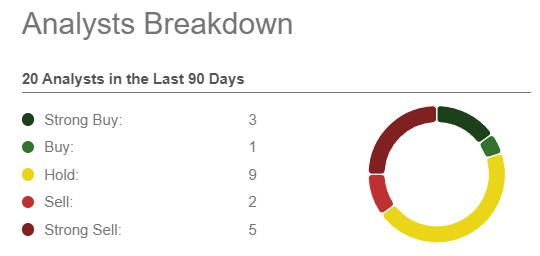

Palantir Wall St. Ratings (Seeking Alpha) Quant Rating (Seeking Alpha)

But it’s particularly difficult to say today if the stock is a buy or a sell candidate.

At a first glance, we see analysts widely spread from Strong Buy to Strong Sell, while Seeking Alpha Quant Rating is showing excellent scores for Growth, Profitability and Momentum, but the lowest score for Valuation.

Which part of the scale hangs heavier? Or is there a better option, other than Buy, Sell or Hold?

Business Analysis

Palantir powers real-time, AI-driven decision-making in the most critical commercial and government contexts around the world. Palantir’s vision is to revolutionize the way data is used to drive innovation and decision-making.

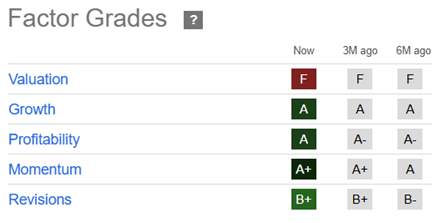

The key factor contributing to achieving and scaling operational impact is their software architecture revolving around ontology. The Ontology automatically integrates the relevant data, logic and action components into a modern, AI-accessible computing environment, unlocking the rapid development of operational applications with AI teaming, in addition to conventional business intelligence and analytical workflows.

Platform Overview (Palantir)

While Palantir is not the first company working with large amounts of data integrated from different sources of different types, let’s take a look in a little more detail at the Logic level. This level encapsulates their AI models (in fact, it can be either their own or imported models).

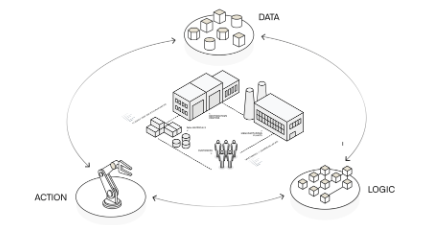

Generative AI and NLP couldn’t miss because they are the stars of recent years, and Palantir came with their AIP Platform last year:

But there are many other models that we can find here, which date back to before 2000 (only there was no Palantir back then to give them a powerful meaning):

- Machine learning models used for pattern recognition (think of all the security use cases), predictions (think of all the preemptive maintenance use cases, and not only) or classifications.

- Optimizations: think of load optimization, risk minimization and many others. While Palantir can also include imported models, I think there might be areas here where some better optimization models are not openly available, or still very difficult to solve at scale, like the Travelling Salesman Problem.

- Decision Support Systems based on business rules (which are, of course, based on data and other models), including probability calculations.

Finally, the action layer contains decisions (based on data and models) taken either by the AI or by human operators which can support operators by putting future decisions in the context of past choices.

Palantir has two reportable segments:

- Government (about 55% of total and growing at 24% YoY) – growth did not stop in this segment, Palantir has just been granted FedRAMP High Authorization and has just extended Army Vantage partnership.

- Commercial (about 45% of total and 29% growth YoY) – we can see that growth is higher in this segment, and I expect it to go even higher because they have only touched the tip of the iceberg here.

Competitive landscape and economic moat

Their closest competitor is C3.ai (AI), with solutions for many of the use cases that we saw at Palantir, including for Government agencies, where Palantir has usually been the go-to supplier of AI software platforms. Some people called them “cheap imitators”. While I can agree they are cheap compared to Palantir, with an unprecedented lack of profitability, it is not clear how they could be imitators, pretty sure they have their own architecture, their own patents etc. That means competition in a free market, the first comer does not take all.

Two other competitors are Alteryx and Databricks, but I would call them lower-level competitors, better fit for smaller organizations. They have limitations in data integration, less or simpler AI models and applications, more basic security features and some scalability issues.

And I would not be surprised if the competition increases in the coming years, perhaps from very deep pocket behemoths like Microsoft, Google or Amazon. For now, Palantir has a very strong market recognition, being ranked No. 1 Vendor in AI, Data Science, and Machine Learning in 2024 by Dresner, or named a Leader in the 2024 Forrester Wave for AI/ML Platforms.

In this context, I think that Palantir earned a strong economic moat in the Government segment, based on the deep ties they have already built. Government agencies operate with extremely sensitive data, and it’s unlikely they will take very high risks to switch to a competitor.

I think they only have a narrow economic moat in their Commercial business. The more complex an organization, the stronger the moat based, again, on sensitive data and high switching costs for very complex systems.

And while an economic moat should eventually translate into a ROIC (Return On Invested Capital) in excess of Cost of Capital, a better indicator for a company in this growth stage is DNRR (Dollar Net Retention Rate), which was 118%, an increase of 400 basis points from last quarter.

Financial Analysis

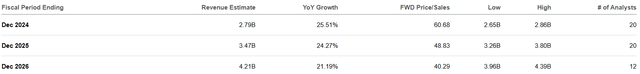

For full year 2024, the company raised revenue guidance to between $2.805 billion and $2.809 billion, close to a 26% growth YoY, driven especially by U.S. Commercial, with a growth rate of more than 50%. For 2025 and 2026, the consensus is for slightly decelerating growth:

Consensus Revenue Estimates (Palantir)

However, Bank of America raised the next three-year Government growth to 29% from 24% and their next three-year Commercial growth to 34% from 32%. While I think that such growth acceleration in the Government segment might be too much for three years in a row, I definitely think that companies have just begun to turn to AI to grow margins and their estimated Commercial growth might be well-founded. Therefore, my model is somewhere more than consensus, but less than Bank of America.

In terms of profitability, Gross Margin is 81% and increasing. This is a good indicator for the high scalability of their business model, Palantir surpassing many SaaS companies.

The R&D margin is at 17%, what I consider an optimal level, healthy, but not very spicy. It’s also decreasing a little bit YoY, and I think that can continue. Due to their high growth, they can afford a healthy increase in R&D and, at the same time, a margin reduction.

The S&M margin is at a relatively high level of 29%, although decreasing 5 bps YoY, and they expect that “sales and marketing expenses will increase in absolute dollars as we continue to invest in our potential and current customers”. However, I think this expense will grow at a slower pace than R&D.

I find especially their G&A margin a bit too high at 20% (although with a similar big 5 bps improvement YoY), and that’s mostly because of SBC (stock-based compensation). I think this expense will have the lowest growth, once the company grows in scale.

Palantir easily passes the Rule of 40, if we take the combined revenue growth and Free Cash Flow margin, we have a score of about 63. However, if we take EBITDA margin, they only score about 41.

I think that FCF margin might be a better indicator than EBITDA margin in this phase. While I find SBC overall high (about 20% of revenue), there has been a clear improvement in the last two years, and I expect that to continue with a larger scale. And with no debt and growing profitability, the company has substantial financial flexibility.

Fair Value

Probably the best multiple used for SaaS stock comparisons is growth-adjusted EV / Sales. The median EV/sales/growth FWD is about 0.6x, while for Palantir, this is a staggering 2.03x (and that if I take my estimate of 28% growth next year, higher than consensus).

But this comparison is not entirely fair, not many companies in that basket enjoy such an economic moat and (non-GAAP) profitability like Palantir. OK, let’s compare it with Microsoft (MSFT), with a EV/Sales/Growth FWD of about 0.9x. Still more than double!

If we look at Palantir’s five-year averages, today’s Price/Sales of 60x is almost triple compared to the average of 21.1x. No matter how we put it, we arrive at the same conclusion: a significant overvaluation.

For an absolute valuation, I use a DCF (Discounted Cash Flow) model in three stages.

For Stage I (2025–2029), my assumptions are:

- Revenue growth 28% next three years driven by Commercial, then 22%

- Gross profit margin 81%

- R&D growth constant at 20% (lower than revenues)

- S&M growth constant at 12%

- G&A growth constant at 6%

- Income tax at 18% (different jurisdictions), although it might vary.

For Stage II (2030–2033), I model the following:

- Revenue growth decelerating from 20% in 2030 to 10% in 2033

- EBIT margin constant at 44% (from 43% in 2029)

For Stage III, I model 4.5% growth in perpetuity. The higher that I modeled until now is 4% for SaaS companies, acknowledging the higher growth that software will have in perpetuity compared to GDP. However, for Palantir I will make an exception, and I will model 4.5%. This is a true AI company, and I don’t doubt that AI will have a clearly higher growth rate for the foreseeable future.

Finally, I use a 10% WACC (weighted average cost of capital), consisting entirely of Cost of Equity. I find Beta very unreliable in this case, so I start, as usual, from 11% (that I use in this period for SaaS no moat companies), then I subtract about 0.75 for economic moat (between narrow and wide) and another 0.25 for their financial flexibility.

The resulting fair value is $38.16, about half compared with the current price of $74.21, signaling again a significant overvaluation. We can further run a sensitivity analysis by varying WACC and growth in perpetuity:

|

Fair Value |

WACC=9% |

WACC=9.5% |

WACC=10% |

WACC=10.5% |

WACC=11% |

|

Growth=3.5% |

39.44 |

36.18 |

33.41 |

31.03 |

28.96 |

|

Growth=4% |

42.63 |

38.79 |

35.59 |

32.86 |

30.52 |

|

Growth=4.5% |

46.52 |

41.93 |

38.16 |

35.00 |

32.33 |

|

Growth=5% |

51.39 |

45.76 |

41.24 |

37.53 |

34.44 |

|

Growth=5.5% |

57.64 |

50.55 |

45.01 |

40.57 |

36.93 |

Even in more optimistic scenarios, the stock still looks overvalued. It seems tempting for new investors to open a bear position; however, I would pass.

First, there is a powerful combination of economic moat and growth (and not just growth, but sustainable high growth). Let’s suppose that stock price will just wait Fair Value to catch up: with this growth, Fair Value would be close to $50 next year and about $63 in two years. But sometimes overvalued stocks can become even more overvalued, very overvalued stocks can enter bubble territory (remember COVID stay-at-home or meme stocks?), and this can happen even with fundamentally weaker stocks than Palantir.

Add to the equation that Palantir will be added to the Nasdaq-100 Index next week.

However, I admit that I am a little subjective (not a secret, since I am more bullish than the consensus). I was engaged with such technologies at an academic research level for about three-four years before Palantir, and I was thinking: why isn’t there a company that makes such models commercially available on a large scale? It seems that Alex Karp thought about the same, only that at a larger scale…

For existing investors, it seems a good moment to trim their position. However, I think I have a better option.

Better than Your Shares, Sell A Covered Call

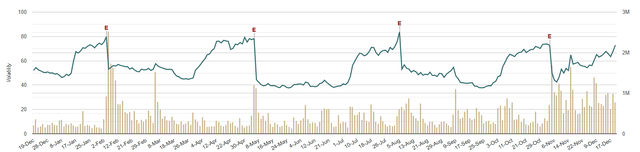

This is a very good moment to sell a covered call on Palantir, meaning sell a call option for every 100 shares. First, Palantir is intrinsically a high volatility stock, and this gives us a fatter premium when selling options.

Then, specifically for call options, in this period of high interest rates the price is higher (which is good because we want to sell a call) and we expect it next year to be lower with decreasing interest rates, even if by a little (which is good because we want to buy back our call).

Finally, these days Palantir has an abnormally high IV (implied volatility), which is usually seen only before earnings (probably because of the expectations of a Nasdaq-100 inclusion, coupled with the last comments from the Fed about interest rates trajectory). This is again good because it will increase option premiums:

Palantir IV (Market Chameleon)

With a few exceptions, I like to sell ATM (At-The-Money) call options because they have the highest extrinsic value. Regarding the duration, I usually like around six months for these volatile stocks, to have a good cushion in case of big movements up or down. However, due to the powerful combination of factors mentioned above, we are in a rare situation today where we could sell a high premium call with an expiration date before the next earnings date (estimated to be February 3, 2025). So, I give you two strategies:

- Strategy A: Sell a 75 PLTR Call Jan 31 ’25, for about $710

- Strategy B: Sell a 75 PLTR Call Aug 15 ’25, for about $1760

Let’s see how these two strategies fare, together with a simple stock position, in different scenarios at expiration:

|

Stock price |

100 shares |

100 shares -1 Call Jan 31 ’25 |

100 shares -1 Call Aug 15 ’25 |

|

$38.16 |

-48.6% |

-43.1% |

-32.6% |

|

$56.65 |

-23.8% |

-15.7% |

0% |

|

$67.15 |

-9.5% |

0% |

18.5% |

|

$75 |

1% |

11.7% |

32.4% |

|

$82.9 |

11.7% |

11.7% |

32.4% |

|

$98.3 |

32.4% |

11.7% |

32.4% |

Strategy B seems to be better, with the break-even significantly lower, at $56.65. On the upside, it beats a stock position until $98.3, for a maximum profit of 32.4% in less than eight months, even with a stagnant price, which is very important since the stock seems (significantly) overvalued.

The only “risk” of this strategy (compared to a simple stock position) is if the stock will have a significant rally above $100 until August, which can happen as I said in the previous section, although it would be a very strange behavior.

Strategy A has a break-even reduced to $67.15. On the upside, it beats a stock position until $82.9. But the power of this strategy is that the expiration is just before the earnings date and IV is higher before earnings (I expect it to be at least like today, likely even a bit higher, as we can imply from the above chart).

Suppose the stock price will be at the same level, on January 31’25 we could sell another call option for another about 40 days at maybe $800 or more. And after that, we could roll it again, and from three successive calls, we could have a fatter and faster premium than for Strategy A.

However, the drawback is that this strategy brings a significantly lower premium in case of big stock movements either up (so, we will be assigned at $75) or down (so, lower margin of safety).

Takeaway

Palantir powers real-time, AI-driven decision-making in the most critical commercial and government contexts around the world. I think that Palantir has a strong economic moat in the Government segment, based on deep ties, sensitive data and new partnerships, and a narrow moat in the Commercial segment, which is still in its early innings.

The outlook for 2024 is for close to 26% revenue growth, and the consensus is for slightly decelerating growth the next three years, while Bank of America sees a significant growth acceleration of over 30%. My model is for 28% growth in next three years, based on an acceleration in the Commercial segment, with more and more companies realizing the benefits these applications can bring.

Based on a DCF model with 10% WACC and 4.5% growth in perpetuity, I estimate a Fair Value of $38.16, giving a significant overvaluation, today’s price being almost double. The overvaluation seems even higher based on a comparison with SaaS companies or even with market behemoths like Microsoft, or with Palantir’s five-year averages. Even if I like the fundamentals, and I am more optimistic than the consensus, I pass.

For existing investors, they could even trim their position or sell a covered call, which is very powerful today due to a combination of high IV and high interest rates:

- A 75 PLTR Call Aug 15 ’25 has a maximum return of 32.4% in less than eight months for a stock price of $75 or above, and a break-even lowered at $56.65.

- A 75 PLTR Call Jan 31 ’25 has a maximum return of 11.7% in a little more than one month for a stock price of $75 or above, and a break-even only at $67.15. However, if the stock keeps the same level, we could roll the strategy forward, which could bring higher total return.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.