Summary:

- Pfizer’s stock has underperformed, but management’s focus on R&D and cost efficiencies should boost margins and free cash flow, supporting a Buy rating.

- Despite political headwinds, PFE’s valuation at 9x 2025 EPS and a 6.5% dividend yield make it attractive for long-term investors.

- Management’s 2025 guidance indicates flat sales but improved profitability, with gross margins expected to reach the upper 70s, enhancing shareholder value and supporting its strong dividend payouts.

- Regulatory risks exist, but Pfizer’s deleveraging plans and strong cash flow generation should mitigate these concerns and support dividend growth.

no_limit_pictures

Investment Thesis

As an investor in Pfizer (NYSE:PFE), one of the world’s largest pharmaceutical companies, I am marginally disappointed, as other investors would be, that the company had another underwhelming year on the stock markets.

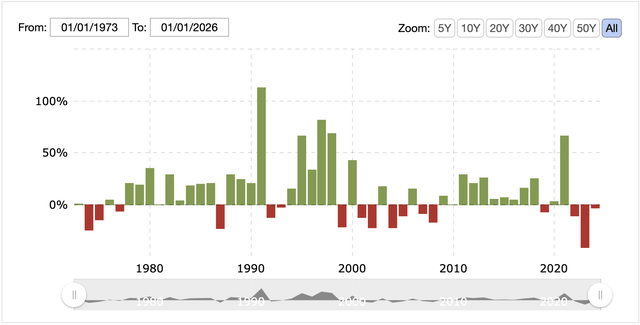

Pfizer’s stock is set to close out its third consecutive year in the red, down almost 3%, which puts the company in a strange position. Never has the pharma company remained in the red for three years in a row.

Exhibit A: Pfizer is set to close out its third year in the red, a first for the pharmaceutical company’s stock. (Macrotrends)

Windfalls from its COVID-era sales boom have been erased while the company, at the same time, misplaced its financial discipline on expensive M&A that impacted shareholder returns, leading to peak pessimism.

Management recently announced its 2025 guidance, which projected flat sales in 2025. But digging deeper into the guidance, I see that management aims to sharpen its R&D investments, which should immensely boost its margin profile and free cash-a strong step in the right direction.

In addition to the updated margin boost that I expect to see through the year, I believe the company’s fat dividend yield likely puts a floor in its stock, which makes Pfizer look attractive.

I reiterate my Buy rating on Pfizer.

Pfizer’s Post-Pandemic Research Efficiency Lagged – That’s Set To Change

I last published my research on Pfizer in April this year, where I remained optimistic on the company’s drug pipeline that could stabilize the company’s growth outlook as patent cliff-related headwinds persisted.

I valued Pfizer at ~$30 per share at the time of my last research note in April, and for most of 2024, that thesis did play out. Unfortunately, the U.S. presidential elections have created political headwinds for Pfizer that pressured the stock, leading to just ~7% returns since my note, which is far below my estimates.

The stance of the incoming U.S. administration on a variety of pharmaceutical areas (vaccines, for example) puts it at odds with many aspects of Pfizer’s business, leading to Pfizer erasing all its YTD gains this year.

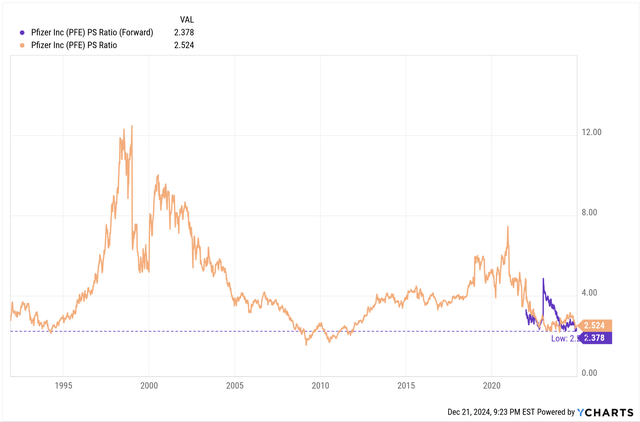

But I believe the political headwinds are being overblown at this point, and the sentiment prevailing the incoming administration’s stance indicates that the administration aims to pressure Pfizer’s revenues due to past stances on vaccines. As seen in Exhibit B below, investors now value Pfizer at just 2.4x forward sales, closer to its multi-decade lows.

Exhibit B: Pfizer’s stock trades at just 2.4x forward sales, closer to its multi-decade sales valuation lows. (YCharts)

The uncertainty on pharma regulation will pressure the stock for a few months but should clear soon.

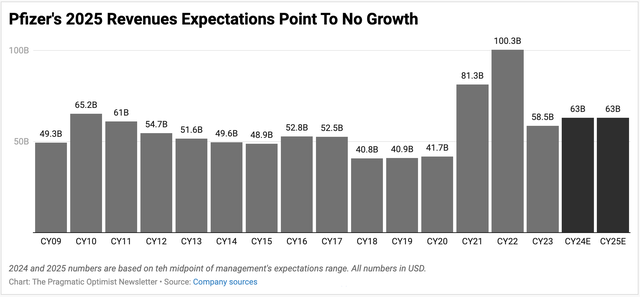

Pfizer’s management aimed to change some of that sentiment by issuing its updated 2025 guidance last week. The guidance called for 2025 sales to be in the range of $61-64 billion, which points to sales being flat in 2025. The forward guidance by management calls for a much more stable revenue base, lapping the last two years of volatile COVID revenues.

Exhibit C: Pfizer is expected to post revenues of ~$63 billion in 2025 unchanged from what it expects to deliver in 2024. (Company sources)

This outlook would have been boring in my view if not for the updated profitability outlook that points to some form of acceleration in its margins.

As most investors know, pharma companies, such as Pfizer, heavily invest R&D and capital resources into developing drugs and building a pipeline of innovation that deploys a growth ramp for their future growth. In some cases, companies might also divert capital to acquire pharma IP by either buying licenses or acquiring the company and its R&D teams entirely. With its Seagen acquisition, Pfizer aimed to fast-track its drug pipeline, which is heavily weighted towards oncology-related therapy. But that acquisition turned out to be more dilutive than accretive, which leaves the company to lean heavily on its drug pipeline.

Exhibit D: Pfizer’s drug pipeline has 108 registrations of which at least 20 of them are focused in the oncology area and are in the final stages of evaluation or registration. (Pfizer)

Per October data, the company has registered 108 drugs in its pipeline, of which 34 drugs, or a third of the pipeline, are either in the final phases of evaluation or in registration. Of those 34 drugs, at least 20 of them are focused in the area of oncology. Pfizer recently received accelerated approval for its Braftovi drug, a treatment for metastatic colorectal cancer. All these drugs have come from years of R&D investments and capital that has been invested by Pfizer.

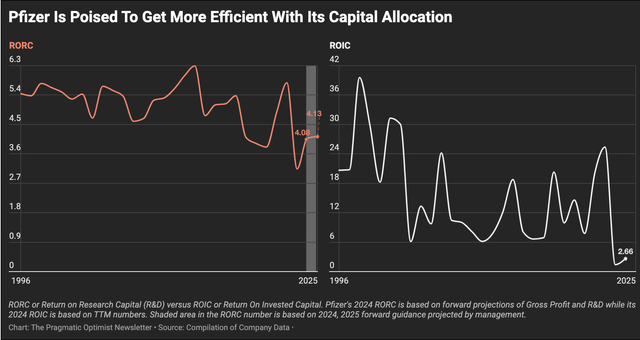

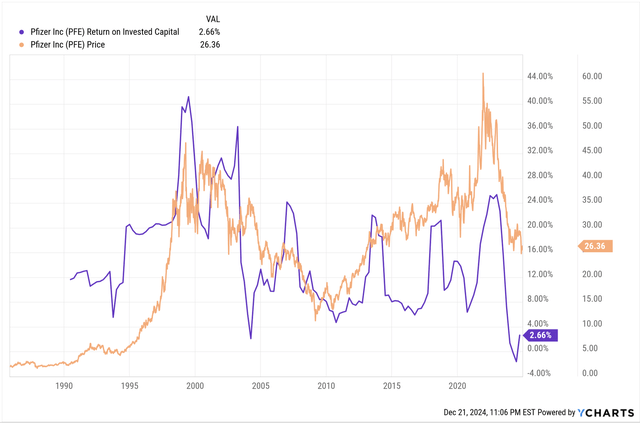

Unfortunately for Pfizer, the efficiency of those R&D investments and capital has been poor, leading to dismal returns on its investments. I monitor these investments with two metrics. One is the Return on Invested Capital or ROIC, that most investors are familiar with. The other is the Return on Research Capital, or RORC, which compares Pfizer’s gross profits to the previous year’s R&D expenses. With RORC, I try to observe if Pfizer was able to deliver higher revenues after adjusting for gross costs, based on the R&D expenses they made in the previous year at the very least.

Exhibit E: Pfizer’s RORC and ROIC metrics have been at their worst ever but appear to be trending higher over the course of next year. (Company sources)

As can be seen, 2023’s RORC of 3.4x implied the company was able to return gross costs-adjusted revenues of just 3.4x 2022’s R&D, which was its worst ever since 1996. The same can be said about ROIC, which looks at the efficiency of net operating profit after tax. These performances in ROIC and RORC also coincided with Pfizer’s worst return on the stock market in 2023, as noted in Exhibit A.

But Pfizer’s management has strongly signaled at changing that.

In the 2025 outlook, management hinted at stronger profitability metrics. On the call to discuss the 2025 outlook, management sounded upbeat about expanding these metrics by expecting higher gross margins. Here is management’s response to a question about 2025 gross margins:

Clearly, upper 70s from a gross margin perspective is a target for us and it is attainable.

This was after management summarized their performance so far in terms of cost savings and outlook ahead:

We have also demonstrated good progress with financial discipline in 2024. We are working to realign our cost base in support of potential expanded margins. We achieved our goal of $4 billion in net cost savings by the end of this year and we expect an additional $500 million in net cost savings in 2025 with our previously announced cost realignment program. We also are already making progress with our plan designed to reduce manufacturing costs by $1.5 billion by the end of 2027.

Pfizer’s gross margins are currently ~70% TTM, expected “to be in the mid-70s for the full year [2024]” and projected to be in the upper 70s based on previously highlighted comments. Factoring these in, as shown in Exhibit E above, this indicates a strong floor in its margins, hence its cost efficiencies and hence, its stock price.

Here’s another way to observe the correlation between ROIC and its price.

Exhibit F: Pfizer’s correlation between stock price and ROIC. (YCharts)

Valuation Still Points to Upside

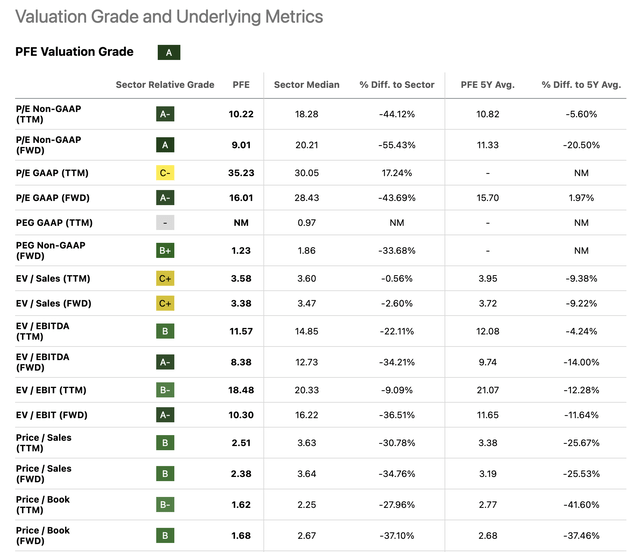

Per Seeking Alpha’s data, Pfizer currently trades at a forward valuation of just 9x 2025 adjusted EPS, which is at a 55% discount to the sector it operates in and a 21% discount to its own 5-Yr average.

Investors currently value it at 9x 2025 EPS, which management has said is expected to grow ~14% at the midpoint range. After accounting for the $3 billion in interest expenses due to debt servicing and no share dilution in 2025, Pfizer still looks undervalued at 9x PE.

Exhibit G: Pfizer’s valuation metrics point to a fairly reasonable valuation that indicates upside (Seeking Alpha)

I even noted the discount that the company’s stock is at when observing Pfizer’s valuation on a forward sales basis in Exhibit B above. I noted earlier how the company trades at a forward sales multiple of just 2.4x, which on a trend basis is far undervalued.

Even better is the company’s dividend profile, which looks extremely appealing to me. Pfizer’s recent dividend increase, by 2.4%, was a powerful move, in my opinion, raising the company’s forward dividend yield to 6.8% at the time it was published. The forward yield now stands at 6.5%. Management reiterated many times that they intend to support their dividend payouts by growth and deleveraging, which makes the yield even more appealing:

The good news actually both supporting our dividend and growing our dividend as well as de-levering are both very high in our priority list and fortunate for us as our business is able to generate enough cash flow to be able to do both in 2025.

Risks & Other Factors To Consider

As I noted earlier, the company is subject to regulatory risks that can pose a headwind for the company’s outlook next year if the incoming administration ramps up regulatory policies. As I noted earlier, I believe these uncertainties are being overblown, and I believe Pfizer’s management should work with the administration.

The company has hinted at deleveraging its business during the recent 2025 guidance cc. If management can pull this off, it would lower its gross leverage, which currently stands at ~2.4x, within the healthy range. Additionally, deleveraging would help in increasing payouts, reducing debt servicing costs, which would further improve the 9x forward earnings multiple I noted earlier. Management could use some strategies such as entity spin-offs to reward shareholders with more cash.

Per the last report, Pfizer currently holds ~$10 billion in cash+ST investments and ~$68 billion in debt. Pfizer’s debt carries favorable ratings by ratings agencies.

Lastly, Pfizer has more innovative drugs focused on Oncology, which may push out its performance as other emerging areas such as GLP-1 take wallet share. The Oncology market is expected to grow at ~6.4% CAGR, and I expect Pfizer to bring its revenue growth rates up to speed to match the industry CAGR over time based on its pipeline.

Takeaway

I believe Pfizer trades at an appealing valuation of 9x PE that does not fully account for the double-digit EPS growth expected next year. Revenues are expected to stay flat, but the company is looking to vastly improve its research efficiency, as noted by improving ROIC and RORC metrics, which at some point will change investors’ perceptions about the company.

Lastly, its +6.5% dividend yield is difficult to ignore, which likely indicates a bottom for Pfizer.

I reiterate my Buy rating on Pfizer.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2025 Long/Short Idea investment competition, which runs through December 21. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.