Summary:

- Applied Materials shares have dropped 22% since I last wrote about them, but I still believe AI-driven DRAM demand will boost their growth, making the stock a strong buy.

- New AI models like OpenAI’s o3 require more memory, driving up DRAM demand and powering Applied Materials’ sales of fabrication and manufacturing equipment.

- Despite Wall Street’s bearish outlook, Applied Materials’ valuation is 32% lower than the sector median, yet its forward revenue growth is 10% higher.

- With significant DRAM demand from AI advancements, Applied Materials is poised for substantial growth, offering a compelling opportunity with 46.42% upside potential.

Monty Rakusen

Co-Authored by Noah Cox and Brock Heilig

Investment Thesis

Shares of Applied Materials (NASDAQ:AMAT) have fallen roughly 22% since the last time I wrote on the key equipment maker for DRAM (Dynamic Random-Access Memory) manufacturers. A big driver for the selloff has been the perception by the market that overall industry DRAM growth is going to slow significantly next year, which means the company will have an issue scaling up at sales of fabrication and manufacturing equipment.

Some parts of the industry are definitely set to slide backwards or sharply decelerate. I tend to disagree with this line of thinking. My post earnings research I put out yesterday on DRAM manufacturer Micron (MU) is showing that the industry in certain places is about to see growth accelerate, not decelerate (in the AI DRAM categories). The reason is because new AI GPUs need more memory than they did before, they sport powerful large language models. This is a huge benefit to Applied Materials as manufacturers need to scale up production to handle this new demand.

This new DRAM technology that producers like Micron manufacture requires new tooling to make this possible. With DRAM manufacturers like Micron sold out on their advanced DRAM capacity till late 2025, there’s still an immense opportunity for Applied Materials to benefit.

With this, I continue to believe Applied Materials shares are a strong buy.

Why I’m Doing Follow-Up Coverage

One of the biggest reasons I was so bullish on Applied Materials when I last wrote on them in September was mainly because I believe the incredible, noticeable improvements in LLM development means that the use cases for AI are set to accelerate from here.

The heart of my thesis during my last coverage (and now) is that new AI models (such as o3, which came out this week as I am writing this) are instrumental for DRAM growth. This is powering Applied Material’s growth as new AI models require much more memory on chips. When models have higher DRAM usage, global DRAM manufacturing increases. This clearly benefits one of the world’s largest DRAM tooling manufacturers.

Unfortunately, performance hasn’t lived up to my expectations. We have yet to see strong results come through in earnings as companies, like Applied Materials, transition parts of their business away from stagnating parts of the semiconductor manufacturing supply market. This doesn’t mean I’m bearish, however.

I actually continue to believe we’re on the precipice of an immense AI acceleration, with new multistep reasoning models proving time and time again that core DRAM usage is going to accelerate. Shares have fallen off over the last few months, and I think this presents investors with a unique opportunity, with fundamentals well outpacing the current valuation. The new o3 model this week was the catalyst. This is why I’m doing follow-up coverage.

DRAM Should Be Strong In 2025 Thanks To Game-changing o3

One of the key findings from the research I published last time was that the latest and greatest AI models, now OpenAI’s o3 Large Language Model (LLM), were going to be far more data intensive, but far more reliable. In essence, as I focused on last time, AI models are going to need more memory to be able to operate at this significantly higher reasoning level.

This need for extra memory is where I still believe Applied Materials fit in well. As I mentioned before, we learned a lot this week on where these models are going (and the evidence that DRAM demand should continue to be strong).

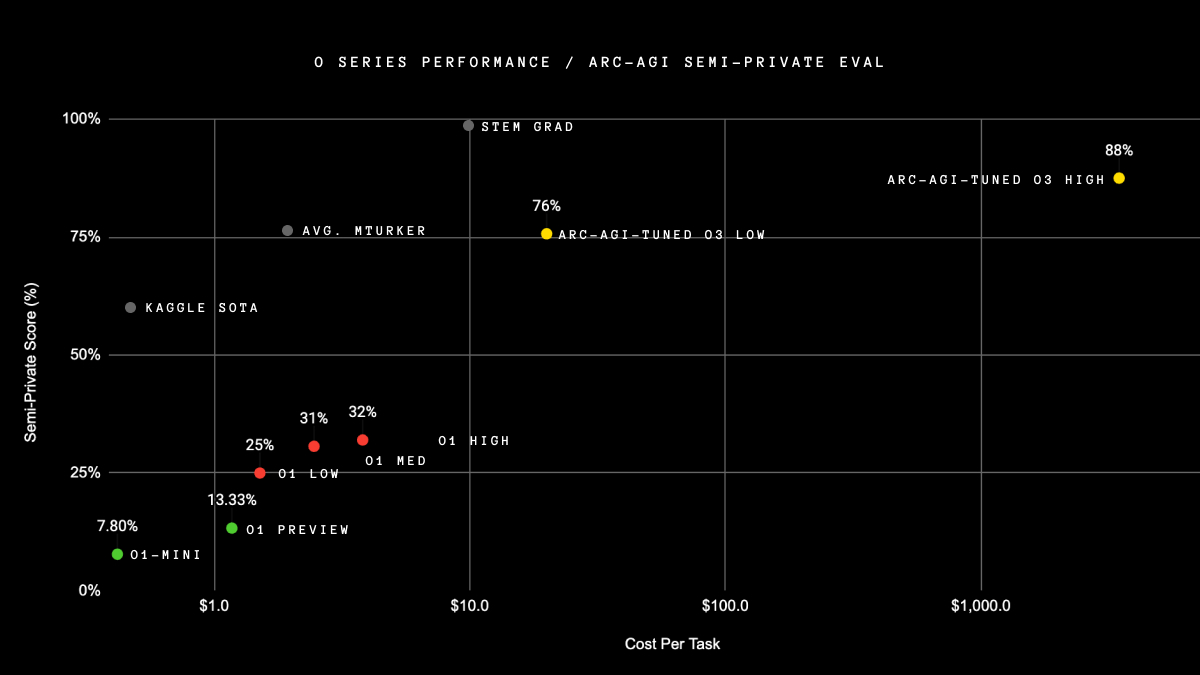

With OpenAi’s new o3 model, cost per task has gone up a lot. Like multiples of where it was before.

o Series Model Performance ( François Chollet/Twitter)

With this, o3 has a cost optimization problem. It’s such a complex model that it takes GPUs a long time to run enough computations to get an output. This time function is what drives up the cost. Increasing memory on GPUs can lower the time it takes for a GPU to complete a task however as this helps GPUs do more with each computation pass as it works to do inferencing for LLMs.

During an industry conference on December 4th, Applied Materials CFO Brice Hill discussed how the great opportunity ahead will benefit the company in 2025 and beyond.

There’s a growth year for Applied — five years in a row of growth for Applied,” Hill said. “As we look into ’25, if there is any maturity in the spending of ICAPS, then the question is, will leading — will that demand on leading be strong enough to grow the business? We don’t guide that, but that’s certainly what we’ve been seeing in Q4 and Q1. It’s still growth quarters for the Company. Our Q4 was a growth year-over-year. Our Q1 is a growth year-over-year in our guide. So we think it’s that dynamic that’s the strongest pull in the market right now.

Despite this optimism, Wall Street analysts are still quite bearish on the company, which doesn’t make sense to me. Morgan Stanley recently downgraded its position on Applied Materials, explaining that 2025 will be a “transition” year for the market.

Following record [wafer fab equipment] in 2024 lead by DRAM and China, we forecast 2025 to be a transition year,” analysts at the firm wrote. “The longer-term secular drivers of [wafer fab equipment] market growth are intact as supply chain diversification remains top of mind and semiconductor capital intensity is not declining. However, end-markets matter and so does equipment purchase timing, and with declining DRAM ASP and significant pull-forward of Western equipment by Chinese players, we expect 2025 to be a transition year as companies digest capacity build from the prior year.

The DRAM market is growing, though. Applied Materials President and CEO Gary Dickerson talked about it during a Q4 earnings call in November.

In DRAM, our revenues also grew significantly in fiscal 2024, up more than 60% year-on year, Dickerson said.

Compute memory is a critical technology for AI datacenters, and DRAM makers are accelerating their capacity plans especially in high-bandwidth memory, where high-performance DRAM dies are stacked and connected to a logic die with advanced packaging. The dies used in high-bandwidth memory are much larger than standard DRAM, which means that more than 3 times the wafer capacity is needed to produce the same volume of chips.

So this is where I think the big misnomer is. DRAM is growing (quite well, actually) on the back of these new AI models. With this, I think there’s a lot of room for Wall Street to be surprised to the upside. The valuation should benefit too.

Valuation

Despite what I see as an acceleration in the DRAM industry (that should push Applied Materials higher), the supplier of DRAM manufacturing technology trades well below the sector median on a forward Non-GAAP price-to-earnings ratio. The company trades at a forward Non-GAAP P/E of 17.08, which is 31.73% lower than the sector median of 25.01.

Seeking Alpha gives Applied Materials a grade of a B+ in this valuation category. This forward P/E of 17.08 is also 6.50% under the 5-year average of 18.26.

On the growth side, the story for Applied Materials is still strong. While the DRAM toolmaker appears to have a lower revenue growth number than some would expect at just 6.21% year-over-year, this is actually still more than 10% higher than the sector median of 5.64% year-over-year growth.

In essence, the company’s valuation is roughly 32% lower than the sector median in terms of their price-to-earnings ratio, but it’s also 10% higher than the sector median for forward revenue growth. This does not make sense to me. The market is rewarding a faster growing company with a lower P/E.

With this, I think Applied Materials should trade at the sector median forward price-to-earnings ratio. If we saw shares converge to this P/E of 25.01, up from 17.08, this would represent roughly 46.42% upside.

Risks

As Morgan Stanley laid out in their downgrade note to investors earlier this month, Morgan Stanley has turned more bearish on Applied Materials because they believe the wafer fab equipment market will be in a “transition” year in 2025. In essence, Morgan Stanley does not see the catalysts in DRAM that I am arguing for. The biggest bear thesis or risks to Applied Materials is that this massive increase in need for DRAM does not materialize.

In another downgrade article, one analyst wrote:

While we do still see some longer-term upside in the group and recognize this is a group that investors will want to revisit, we struggle with the setup into January earnings, as estimates still need to come down.

In essence, Wall Street continues to be bearish on Applied Materials and the sector as a whole.

These risks are valid, but what, I think, is key here is that these articles failed to address the new capabilities of these Large Language Models, and more memory will be needed in these GPUs.

The company discussed how it is the leader for this type of equipment on their website.

Applied is the leading provider of process equipment for compute memory, supplying a broad range of systems to all of the leading memory chipmakers. At IMW 2024, we will showcase advances in process equipment and technologies with four papers that highlight the importance of materials engineering to innovation across the entire memory hierarchy, from compute memory to storage and beyond.

This week, we saw definitive proof from OpenAI that DRAM is going to be key in the future. New AI models do incredibly well on benchmark tests (and push the limits of the definition of AGI). These models take more time to compute answers, but get better results.

Memory (DRAM) is the core of this. That’s why I am so optimistic.

Bottom Line

Although Applied Materials has faced a series of rating downgrades from a handful of Wall Street analysts, I still believe the company is in a good position to excel in 2025 on the back of strong DRAM sales. I think in the near future (really as soon as 2025), AI models are going to start needing far more memory on the GPUs they run on. This bodes well for Applied Materials.

As I discussed earlier, the company is set to acquire roughly 50% of the served addressable market (SAM) for DRAM production technology. They are only one of a handful that is going to excel with this rising trend. I think this is an exciting place to be as an investor.

With this, their forward Non-GAAP price-to-earnings ratio is significantly below the sector median, while the forward revenue growth is significantly above the sector median. With above-average growth, a strong 2025 catalyst, and a valuation below the sector median, I think there is a lot to be bullish on with Applied Materials.

With this, shares continue to be a strong buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMAT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (main account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.