Summary:

- AMD has good and stable management, which is becoming its core strength as Intel searches for another CEO.

- Most analysts are estimating close to $10 billion in AI revenue by AMD for 2025, which could be an underestimate as new chips are launched next year.

- The demand for these chips remains very strong and AMD provides a good value alternative to Nvidia’s AI chips.

- AMD stock is trading at less than 17 times the EPS estimate for the fiscal year ending Dec 2026 despite showing a strong EPS growth runway.

JHVEPhoto

AMD’s (NASDAQ:AMD) (NEOE:AMD:CA) excellent management team will gain attention as Intel (INTC) looks for yet another CEO. It is very important to have stable management with a clear vision of the direction of the company. Intel’s regular CEO changes over the past few years have led to different priorities and ended up hurting the growth potential of the company. On the other hand, since Lisa Su took over as CEO in 2014, AMD’s stock has increased by 50X. Over the last few quarters, AMD has quickly ramped up its AI segment, and it is in a good position to deliver strong results in 2025. In the previous article, it was mentioned that despite a modest earnings report, we could see better momentum in the near term.

AMD has continued to decline further and is now down 15% YTD compared to 25% returns shown by S&P 500. AMD has forecasted $5 billion in AI revenue for 2024. Most analysts have estimated close to $10 billion in AI revenue for 2025. However, this seems to be underestimated as AMD prepares to launch the next iteration of its powerful MI325 and MI350 series chips. The demand for AMD’s chips is very strong, and we could hear a few more big clients in the near term. Although the supply is constrained, AMD could deliver close to $14-15 billion in AI revenue for 2025.

AMD stock is trading at less than 17 times the EPS estimate for the fiscal year ending Dec 2026. This is despite the strong growth runway and estimates of more than doubling of the EPS in the next two years. AMD’s stock has not performed well in 2024, but we could see a big bullish momentum in the next few quarters if the company is able to beat the AI revenue forecasts.

Recent correction in AMD stock is overdone

AMD has corrected by close to 30% after the recent earnings call. This is a big correction despite decent earnings result by the company. One of the reasons hurting AMD stock is that Wall Street is expecting modest AI chip sales by AMD in 2025. Recently, Bank of America downgraded AMD as it forecasts the company losing market share to hyperscalers who prefer to use their own custom chips in the data center. The hyperscalers contribute close to 50% of Nvidia’s data center revenue and have been the key reason behind Nvidia’s massive revenue and EPS growth. Almost all hyperscalers are developing their own custom chips to use in their cloud business or other core computing needs. However, AMD still offers a good value to these hyperscalers due to significantly lower chip price compared to NVIDIA (NVDA) and more flexibility compared to Nvidia’s CUDA platform. AMD’s market share is also very small compared to Nvidia within the AI chip industry. This gives the company a great runway for growth, even if some hyperscalers choose their chips.

What can change Wall Street’s sentiment towards AMD? I believe the next earnings call will be very important which would give the management an option to lay out the AI growth plans for the next few quarters. It is likely that AMD will be able to beat Wall Street’s AI revenue estimates. If AMD can show a path towards $15 billion or higher AI revenue in 2025, it would lead to a rapid shift in sentiment, and we could see a massive bullish run in the stock.

Management should get a premium

AMD’s management under Lisa Su has been excellent. Usually, this factor is not mentioned by analysts, but it is becoming more important as Intel looks for another CEO after close to four years of Pat Gelsinger. Since Lisa Su joined AMD in 2014, AMD stock has increased 50X. There are very few instances in the corporate world where we have seen a similar dramatic change.

I believe the foundry strategy of Intel was a mistake. The foundry business requires tens of billions of dollars in capex and takes a very long time to deliver good results. Intel did not have that much time. There is also a question of opportunity costs. While Intel was busy in expanding its foundry business, it missed the AI opportunity.

AMD’s management has been more agile, and it quickly pivoted to the AI business once this segment was showing huge potential. It should be noted that AMD has been able to beat its own forecasts in terms of AI revenue. In late 2023, AMD announced that they estimate $2 billion of AI revenue for 2024. This increased throughout the year and in the recent earnings season the management announced that AMD will deliver $5 billion in AI revenue for 2024. Within a short span of 12 months, we have seen AMD’s AI forecast increase 2.5X. This shows the ability of the company to quickly ramp up the supply of its chips and gain a good customer base.

Beating 2025 AI estimate

Most of the future growth for AMD will come from its AI business, and it is very important to gauge the correct potential of this business. An earlier Market Watch report mentioned that Susquehanna analyst Christopher Rolland has estimated that AMD could deliver $9 billion in AI revenue in 2025 while $11-$12 billion is “unlikely”. Oppenheimer’s Rick Schafer has mentioned that $10 billion would be a “stretch number”. Piper Sandler’s Harsh Kumar has estimated $10.2 billion in AMD’s AI revenue in 2025. Most of the estimates range close to $10 billion and if AMD can deliver a higher AI revenue in 2025, it could significantly boost the sentiment.

Two important factors working in AMD’s favor are flexibility and value. AMD offers greater flexibility to hyperscalers who do not want to get tied to Nvidia’s CUDA platform. The CUDA platform of Nvidia is mentioned as a strong moat for the company, but it can also end up limiting the options for the customers. Another important factor is value. Nvidia’s H100 costs 4X the cost of competing AMD chips. The hyperscalers order thousands of these chips, and getting a better value for these chips is very important to maintain their own margins and gain an advantage over competition.

AMD will ramp up the sales of MI325 and MI350 series in 2025. This can give a strong tailwind to the company’s AI revenue. If AMD gets close to $14-$15 billion in AI revenue in 2025, we could have the stock deliver very strong bullish momentum. The company has regularly been beating the market estimates and its own projections in terms of AI revenue. It is likely that AMD could perform better than the consensus market estimates in the AI segment in 2025.

Trajectory of EPS growth

Rapid AI chip sales will inevitably help in boosting the margins and EPS of AMD in the next few quarters. The consensus estimate is that AMD will see EPS growth of 55% next year and another 38% in 2026. This should increase the EPS to $7.05 for fiscal year ending Dec 2026. At this EPS, the forward PE multiple is less than 17 which is very modest for one of the key AI players in this industry.

Figure: Forward EPS projection of AMD. Source: Seeking Alpha

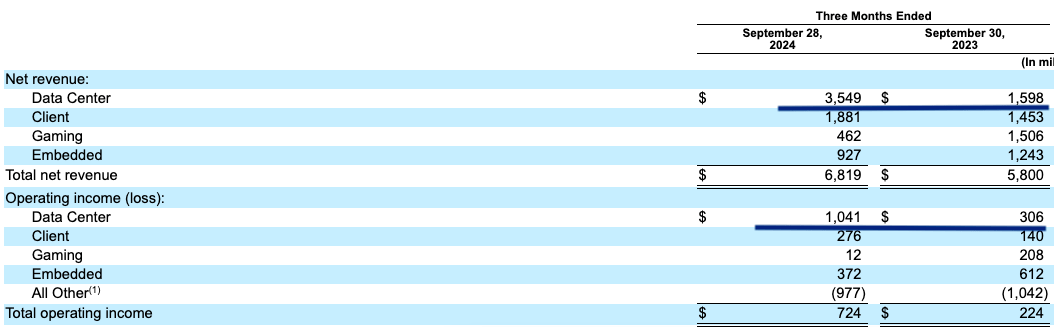

AMD’s revenue and operating income are already seeing an inflection as the revenue share of its Data Center segment increases. Despite the poor performance of Gaming and Embedded segment, the overall revenue grew from $5.8 billion in the year-ago quarter to $6.8 billion in the recent quarter. This is due to the Data Center segment, which more than doubled revenue to $3.5 billion in the recent quarter compared to the year-ago quarter.

AMD Filings

Figure: Increase in importance of Data Center segment. Source: AMD Filings

The operating income saw a bigger impact in the recent earnings, which shows the juicy margins in the Data Center business.

There are a lot of tailwinds for the AI segment of AMD, and it could beat the market estimates in 2025. This can improve the operating income and EPS trajectory for the next few quarters, making AMD stock a good option at the current price.

Investor Takeaway

AMD’s strong and stable management has been able to deliver better results over the last few years compared to Intel. AMD has also made better strategic decisions by focusing on AI business, unlike Intel, which tried to ramp up the expensive foundry business. Most analysts have estimated close to $10 billion in AI revenue for AMD in 2025. This is likely to be underestimated as the company ramps up the next iteration of its AI chips.

AMD provides flexibility and value to hyperscalers which increases the attraction of its AI chips. The PE multiple for fiscal year ending Dec 2026 is less than 17 which is quite modest for a company rapidly growing its EPS and which is a core part of the AI industry.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.