Summary:

- AOS’s quarterly results were not good and both revenue and EPS were worse compared to Q3-2023.

- However, AOS’s investment thesis remains fundamentally intact, given its solid business model, strong financials and healthy balance sheet.

- The company has a lot to offer for dividend growth investors and scores good to excellent on the Seeking Alpha Quant dividend metrics.

- For those who are willing to look past the bad news and want to go for the long-term, AOS is a “BUY” at current prices.

Henrik Sorensen

Introduction

I don’t hide my love for boring stocks.

And I mean boring as a positive. Companies that achieve sustainable growth in the long-term and can convert this into healthy bottom-line profit and free cash flow. One of these companies is A. O. Smith Corp. (NYSE:AOS). The company has been around for 150 years and has managed to reinvent itself time and time again. AOS has a very good dividend growth track record. As it has done for the last 32 years, the company has once again increased its dividend, by 6%.

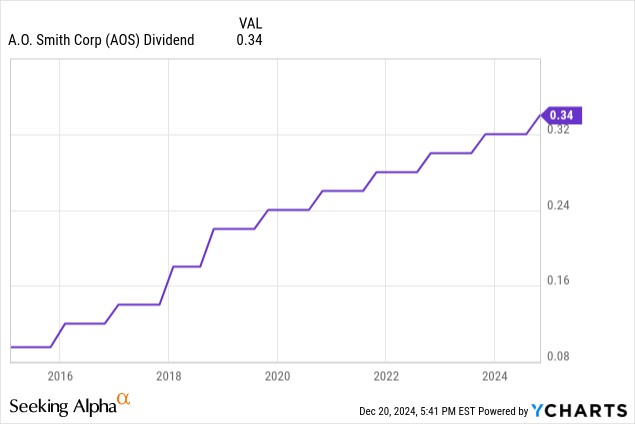

Dividend growth track record (Ycharts)

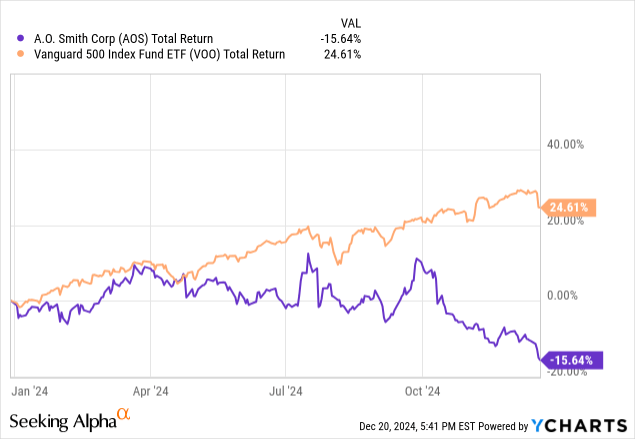

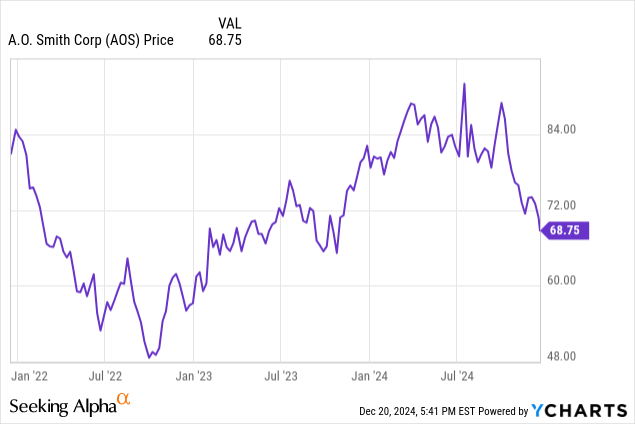

I think the company has the capability to keep raising its dividend in a sustainable way and in my view AOS has some serious dividend king potential. It is striking that in recent years dividend growth has clearly been slower than before. On the 29th of July I wrote my last article about the company and so far the thesis played out as expected. The disappointing results in combination with the volatility in share price have caused the price per share to drop by -18%.

Because of this AOS has significantly underperformed the S&P 500 on a YTD basis.

AOS vs S&P 500 (Ycharts)

However, I do think that AOS has dropped back to a reasonable valuation. I am also becoming more enthusiastic about buying more shares.

Today we will look at the latest financial results to see whether AOS is worth buying for the long-term dividend growth investor.

Why invest in AOS?

For those who don’t know, AOS is a big player in water heaters, boilers and water treatment products.

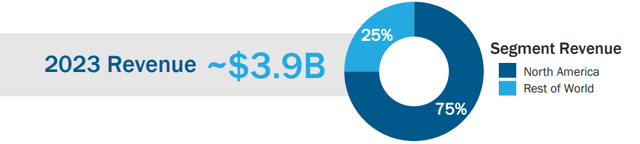

They are particularly large in the US, where they generate 75% of their total revenue.

AOS revenue mix (investor presentation)

What is very attractive about their business model is that 80-85% of revenue is recurring based on the replacement cycle of their products.

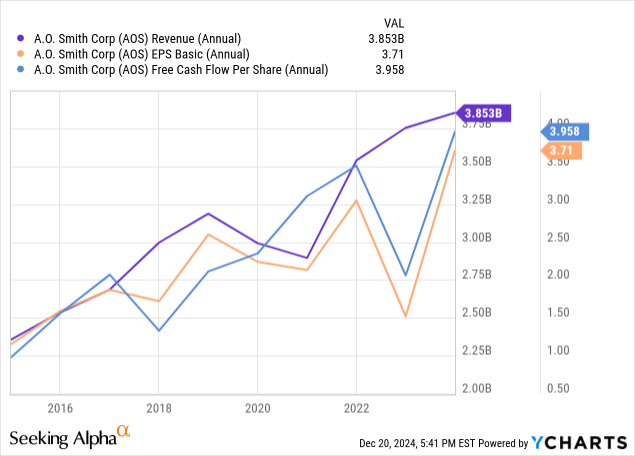

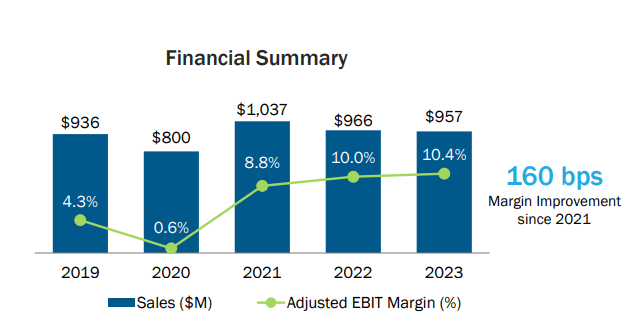

They have also grown steadily in revenue with a 10Y CAGR of 5%. Nothing spectacular. However, AOS knows how to turn revenue into profit, since they have grown their EPS with a CAGR of 12% and the FCF per share by 14.9% in the same period. This underlines the fact that the quality of earnings is very high, as free cash flow is often higher than net income.

AOS financials (Ycharts)

These past results are all well and good, but are there sufficient growth opportunities to achieve this in the future?

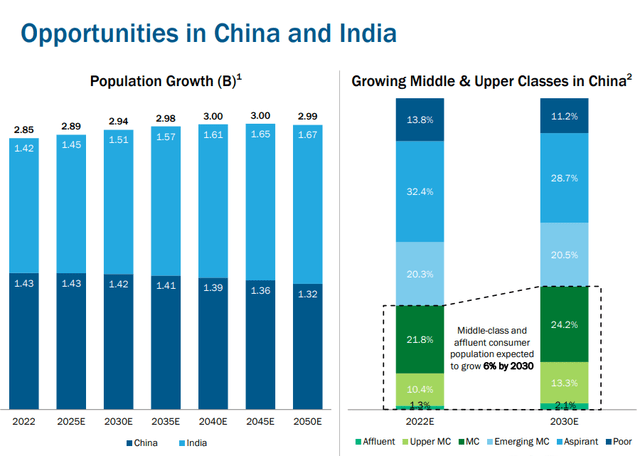

There are several secular growth trends that AOS can benefit from. It looks like there are opportunities in the emerging markets. China and India are focus points at AOS. It is estimated that the population in India will continue to grow significantly in the coming decades and that the middle class in China will become more prosperous in the long-term. This makes it more likely that expenditure on water treatment products will increase. AOS can also benefit from the generally increased concern about water pollution.

Emerging market opportunities (AOS investor presentation)

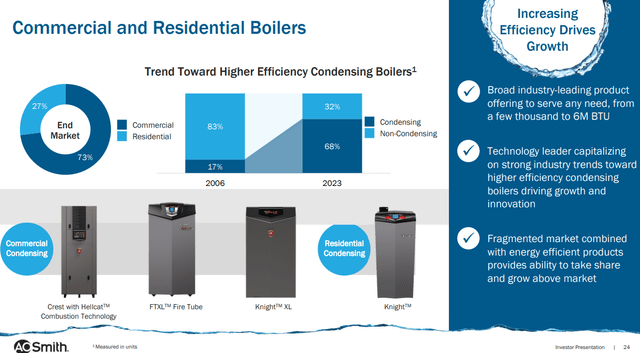

Secondly, there is an increasing demand for energy-efficient products. This means that buildings need to be upgraded so they can achieve, for example, maximum energy/water efficiency and durability. As one of the market leaders in North America in the residential and commercial market in water heaters and high-efficiency boilers, AOS should benefit from it.

Trend towards energy efficient products (AOS investor presenation)

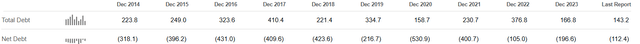

The company has an excellent balance sheet.

AOS debt development (Seeking Alpha)

AOS had a negative net debt over the past 10 years, but it should be noted that the cash and equivalents have decreased somewhat in recent years, which has a negative effect on the net debt. However, things are still looking really good.

The interest expenses are also very low if we compare them to the EBIT. This makes the interest coverage ratio 61.7 ($740,9 million / $12 million), which confirms that they are perfectly able to meet their financial obligations.

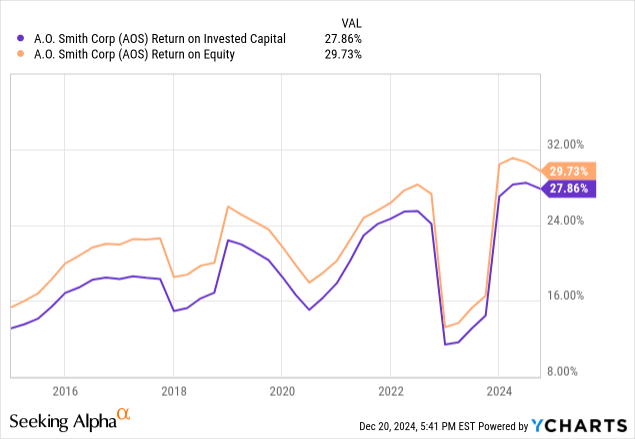

I am also very pleased with the way the company allocates its capital. The ROIC and ROE of AOS are high-class. With cyclical companies, it is important to look at the bottom of the cycles, and even there AOS knows how to create sufficient value.

ROE and ROIC (Ycharts)

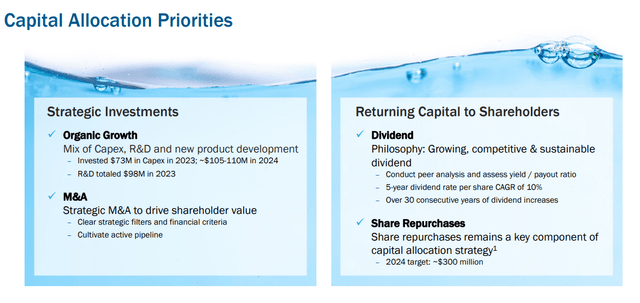

They also have a very clear capital allocation framework.

Capital allocation Strategy (AOS investor presentation)

A decent portion of capital will be invested to further grow the company. This will be a mix of organic and inorganic growth in the form of M&A.

Sufficient capital also continues to flow back to the shareholder in the form of dividends and share buybacks.

Personally, I think AOS could do something with the timing of the share buybacks. Nevertheless, with the current market cap of $9.92 billion, the current share buyback program of $300 million in FY 2024 translates into a buyback yield around 3%.

Add to this the dividend yield of almost 2% and we are talking about a total shareholder yield between 4.5-5%.

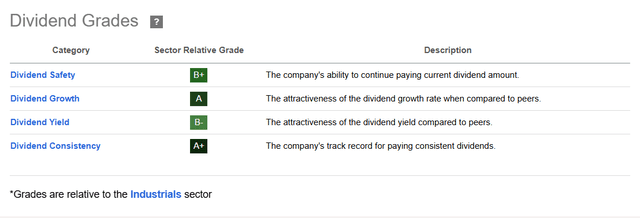

Speaking of dividends, AOS seems like a jack of trades when it comes to the different dividend metrics on the Seeking Alpha website.

Dividend Scorecard (Seeking Alpha)

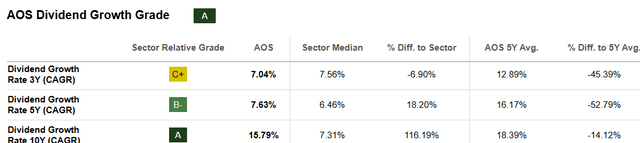

AOS scores well on Consistency and Growth. The company has been paying a growing dividend for 32 years in a row, so this is more than justified. The long-term dividend growth is also good, although the growth rate has decreased in recent years.

Dividend growth CAGRs (Seeking Alpha)

This has to do with the cyclical nature of the company and I expect larger dividend hikes in the future when the results start picking up.

For those who want instant income, a yield of 2% may be a bit low, but given the steady dividend growth it provides sufficient potential for the patient dividend growth investor.

The dividend is also very safe with a payout ratio of 33%.

Payout ratio development (Seeking Alpha)

Quarterly results

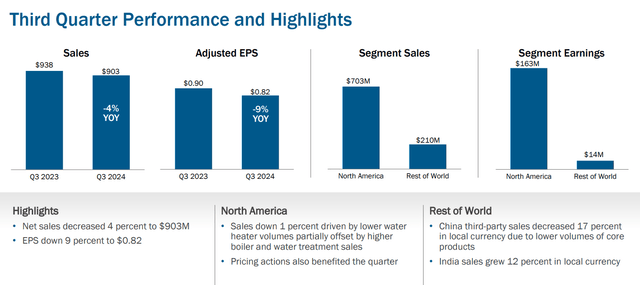

The Q3-2024 numbers were simply not good, since revenue was -4% lower compared to Q3-2023. EPS was also significantly lower compared to the same quarter last year (-9%).

Performance highlights (Q3-2024 investor presentation)

The two main reasons were the lower consumer demand in China and the lower water heater demand in North America. Despite the price increases in the water heater segment, this was not enough to compensate for the decrease in volume. China sales were significantly lower (-17%), due to the ongoing weak demand.

Some positive points were the double digit growth in the boiler segment (+15%), water treatment (+16%) and the strong growth in India (+12%). AOS is also growing faster than the market in India. With the acquisition of Pureit, they will try to gain a stronger position in the market of water treatment in South Asia and especially in India.

Unfortunately, these positives are small elements in the total sales mix that they had too little effect on the overall result.

Outlook

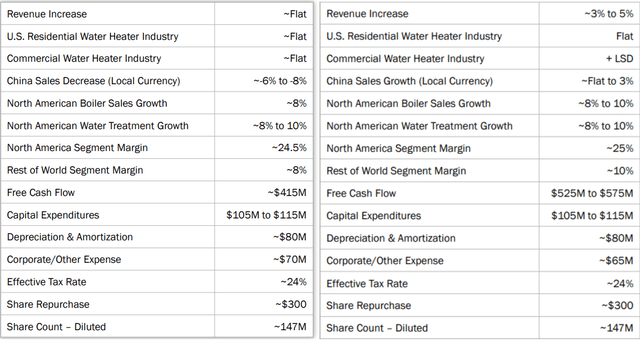

The outlook has been adjusted downwards on many aspects. These can mainly be found in the emerging markets. Despite the previously announced China Stimulus, AOS expects to see little of this in revenue or profit this year. It is striking that the results in the North America Segment remain good in FY 2024, which can be explained by the fact that water heater sales will probably improve from quarter over quarter.

AOS expects that the weakness in the market will continue until at least the end of the year. The FCF will also be lower and is expected to be approximately $415 million.

Outlook FY 2024 from Q2-2024 (left) and Q3-2024 (right) (AOS investor presentation)

Taking these results into account, I personally think it is very wise of management to only increase the dividend by 6%. This also fits AOS’s conservative nature. Despite these quarterly results, AOS continues to do what it does best, thinking about the long-term and being consistent.

I am certainly not negative in the long-term and from an operational point of view, the company is not doing much wrong. However, it seems like we shouldn’t expect a positive surprise in the coming quarters.

Valuation

Let’s see if we can estimate whether AOS is attractively valued at the moment. In my written articles about the company, I have always used the DCF model. I think this model is still appropriate for the company, but today I would like to use the earnings growth model.

These are the most important variables:

- EPS growth

- Dividend yield

- Buyback yield

- Current and Final P/E ratio (multiple expansion or contraction)

The result is an estimated “expected” annual return and I will show you different scenario’s.

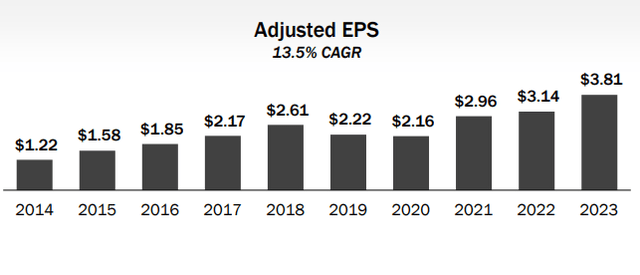

The current 10Y EPS CAGR is 13.5%.

10Y EPS growth CAGR (AOS investor presentation)

In my calculations, I do not necessarily assume that they will do this again in the next 10 years. In my calculations, I assume that they can grow their EPS by 6-8% over a period of 10 years. I expect that AOS will continue to do well in the US and that they can maintain their profitability. However, it will also depend on whether they perform well in emerging markets such as China and India in terms of profitability.

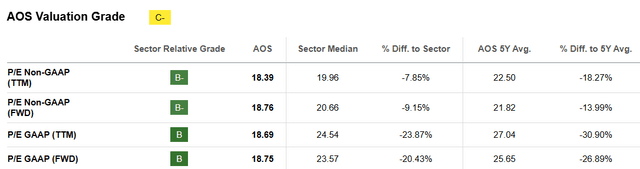

I have chosen a final P/E ratio of 20. AOS is a high-quality compounder that, based on the points mentioned earlier, deserves to trade at a premium. At the moment the P/E is 18, which is quite a bit below it’s 5Y average.

AOS valuation grades (Seeking Alpha)

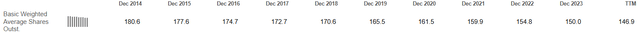

I used a dividend yield around 2% and on top of that, AOS has reduced its shares outstanding from 180 million to 146.9 million, which is a 10Y CAGR of -2%. At the moment they are buying back at a higher pace, but I like to be a bit more conservative, so I use a -2%.

Shares outstanding development (Seeking Alpha)

Finally, I use a personal hurdle rate of 12% as a minimum annual return I demand from my investment in AOS.

Earnings growth model (Google Spreadsheets , obtained from Atmos Invest)

Based on all variables used and assumptions made, we arrive at an “expected” annual return of 13% per year. If we use a more conservative assumption of 6% EPS growth, this leads to an 11% return.

Be sure to check for yourself whether you agree with my assumptions or your personal target return requirement.

Conclusion

AOS is moving towards an attractive price, and I’m starting to get excited again. Based on the fundamentals and valuation, this could be a good time to get in. It is not a screaming buy, but at this price you should be fine long-term.

Please note that there are several risks when investing in AOS. Can it drop any further? Yes, certainly, it would not be the first time that the share price has fallen close to 50% during a downtrend.

AOS share price volatility (Ycharts)

If the economy is going badly, this can certainly be the case, but AOS can withstand a blow given its strong financial position in my opinion.

Secondly, future growth will have to come partly from emerging markets. AOS has under performed here in recent years.

Emerging market performance (AOS investor presentation)

The question is whether this will be different in the future. The recovery of the Chinese economy could change things, but it is difficult to predict when this will happen.

What could also be a headwind is Trump’s reappointment, since he has less focus when it comes to climate goals.

Overall, I give AOS a “BUY” rating. Most importantly, if you plan to buy AOS, don’t think in quarters but in years!

Happy investing everyone!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AOS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.