Summary:

- Super Micro Computer lost more than half of its value in the last six months.

- The company is currently in the middle of an accounting scandal that could result in the delisting of its stock from Nasdaq.

- Even if Super Micro Computer overcomes all the current challenges that it faces, its upside could still be limited because of the recent poor performance of its business.

bunhill

The accounting scandal that began a few months ago has tarnished Super Micro Computer’s (NASDAQ:SMCI) stock, which is currently trading close to its 52-week lows. Although some might think that the worst for the company is behind it, we believe that any potential upside is not worth opening a position at this stage. Super Micro still faces some major risks that in our opinion make its stock uninvestable right now.

This Has Been A Rollercoaster

After the impressive performance in the first half of 2024, Super Micro’s stock lost all of its momentum in the second half of the year and depreciated by over 50% in the last six months. The real troubles first started in late August when a popular research firm Hindenburg published a bearish report on the company. In the report, Hindenburg accused Super Micro of failing to comply with the sanctions and export controls and highlighted various governance-related issues. The report also stated that Super Micro is engaged in continued proper revenue recognition. This is something that the company was already doing in the past and it resulted in the delisting of its stock from Nasdaq in 2018 and a charge by the Security and Exchange Commission in 2020.

Shortly after the report was released, the U.S. Department of Justice opened a probe against the company that is still ongoing. After that, Super Micro’s auditor Ernst & Young resigned, which spooked the market and prevented the company from releasing its earnings report on time. This has led to Nasdaq sending Super Micro a non-compliance letter, which created a new delisting risk. Following all of that, Super Micro was also removed from the Nasdaq 100 and its stock continues to trade in a distressed territory.

Super Micro’s performance (Seeking Alpha)

The good thing for Super Micro in all of this is that Nasdaq extended the reporting time for the company, which now needs to release all the missing quarterly and annual filings by February 25, 2025. If that doesn’t happen, then we’ll likely see a delisting of its shares from the exchange like it was a few years ago.

However, even if there have been no wrongdoings and Super Micro overcomes all the current legal and regulatory challenges, the upside for its shares could still be limited.

Last month, the company already released its preliminary Q1 earnings results, which showed that its revenues are expected to be between $5.9 billion and $6 billion. This is below the Wall Street consensus of $6.79 billion and also below the company’s initial guidance of between $6 billion and $7 billion. If the final report for the period comes out with the same numbers, then the disappointing sales numbers along with the inability to reach its own forecast might indicate that Super Micro’s growth opportunities are limited.

From the publicly available reports, we know that Elon Musk’s xAI firm recently started to pull orders for the AI servers from Super Micro to Dell (DELL). It appears that Nvidia (NVDA) has been doing the same thing recently, while Citi (C) named Dell and HP Enterprise (HPE) as the biggest winners in this situation. Even Super Micro’s preliminary outlook for Q2 indicates that the company is expected to generate only between $5.5 billion and $6.1 billion in revenues, below the consensus of $6.79 billion. There are also reports that Super Micro is now looking to raise additional capital, which suggests that the company might have liquidity issues as orders are being canceled. This is why the company’s upside indeed could be limited even if Super Micro overcomes all the challenges that it currently faces.

Potential Upside Ahead?

There are still several positive things that need to be considered. After the accounting scandal happened, Super Micro launched an internal investigation, which found no misconduct. More importantly, Super Micro agreed with the recommendation of the committee behind the investigation to replace its CFO and said that it doesn’t expect any restatement of its previous earnings reports.

Super Micro has also hired BDO USA as its new auditor to review the company’s financial data and approve all the necessary earnings reports before February 25. If the reports come out on time, then Super Micro would likely be able to avoid delisting, which could give a boost to the share price despite the disappointing performance of the business in the recent quarter.

In addition, as the AI-server market is expected to grow by 55% and be worth $252 billion next year, Super Micro might have an opportunity to improve its performance next year and exceed the expectations that were recently given by the company along with the preliminary data. This could also boost the share price next year.

The Real Value of Super Micro Computer

When it comes to valuing Super Micro, we used the currently available data that the company previously reported due to the lack of alternatives. This is something that investors need to keep in mind in light of the recent accounting scandal.

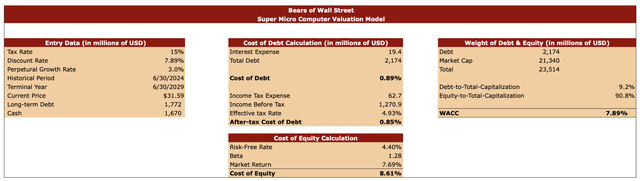

The tax rate in our model is 15%, which is below the current corporate tax rate in the United States. Given that under the Trump administration we could see another tax reform that lowers corporate taxes, we believe that it makes sense to use a rate that’s lower than today’s standard rate when forecasting the company’s performance for the next few years. The perpetual growth rate is 3%, which is similar to the historical GDP and inflation rate. We value Super Micro when it’s trading at $31.59 per share and the cash and long-term debt data was taken from the latest available earnings report.

The discount rate in the model is 7.89%. We arrived at that rate by calculating Super Micro’s after-tax cost of debt using mostly its TTM data, and the cost of equity. For the cost of equity calculation, we used the risk-free rate of 4.40%, beta of 1.28, and the market return rate of 7.69%. We then weighted the company’s debt and equity to arrive at our discount rate.

Super Micro Computer’s valuation model (Bears of Wall Street)

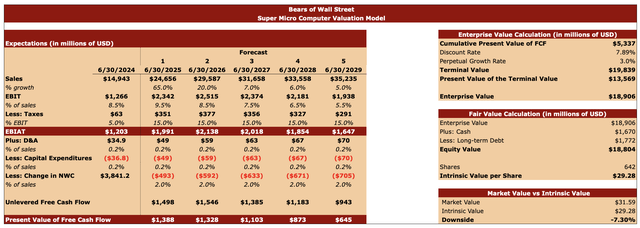

In the forecast table below, our sales and EBIT assumptions are mostly similar to the overall consensus for the next couple of years. After that, we expect a gradual normalization of growth rates across the semiconductor industry to more stable levels once the chip capacity issues caused by AI-related demand are resolved. The bottom part of the forecast table mostly aligns with Super Micro’s historical performance and doesn’t have a significant impact on the FCF calculation.

With all of those assumptions, our valuation model shows that Super Micro’s enterprise value is $18.91 billion, which is close to Seeking Alpha’s enterprise value estimates. We then calculated Super Micro’s equity value by adding cash to the enterprise value and subtracting the long-term debt. In our case, Super Micro’s equity value is $18.80 billion. We then dividend the company’s equity value by the number of its outstanding shares and figured out that Super Micro’s intrinsic value is $29.28 per share, which is below but also fairly close to the current market price at the time of this writing.

Super Micro Computer’s valuation model (Bears of Wall Street)

Final Thoughts

Our valuation model clearly shows that even if all the previously reported numbers are correct and the current outlook along with the street assumptions are realistic, Super Micro’s stock is still not a good investment. As the AI hype train appears to be losing steam while the number of growth opportunities is limited, giving Super Micro a rating of SELL is the most appropriate thing to do right now.

We also think that there are much better semiconductor names on the market right now that are not in the middle of an accounting scandal. In our opinion, long-term investors should rather look for them than bet on a speculative play like Super Micro, which already lost more than half of its value in the last six months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.