Summary:

- KLA Corporation is a leading semiconductor equipment provider with strong financials, negligible net debt, and high returns on capital, making it a high-quality equity.

- Despite its strengths, I recommend a Hold due to significant revenue exposure to China and potential impacts from US-China trade tensions.

- The stock has retrenched 30% from its all-time high, and investors should await clarity on support levels and upcoming earnings before taking action.

- KLA’s valuation is reasonable, but geopolitical risks and trade restrictions could materially impact future earnings, warranting cautious monitoring of the situation.

JHVEPhoto/iStock Editorial via Getty Images

Introduction

KLA Corporation (NASDAQ:KLAC) is a leading American semiconductor capital equipment provider. KLA is a market leader in systems for advanced inspection, metrology and computational analytics in the chip manufacturing industry. The firm as it is currently constructed is the result of a merger in 1997 between KLA and Tencor.

The firm holds a leading position in process control systems which are responsible for ensuring the quality and yield of the manufacturing process. In layman terms, their machinery checks for defects in chips, which helps their large customers such as TSMC (NYSE:TSM) ensure quality control and hence boost yields of processed silicon wafers. Given the highly competitive nature of the business it is imperative for firm’s like TSMC to ensure the highest quality control for customers to continue winning orders.

KLA has all the traits of a high quality equity I would be interested in owning. It operates in a market which is cyclical but which has exhibited significant growth over time, in particular as the chip manufacturing business has become more complex as chip sizes continue to shrink. KLA boasts negligible net debt and has a rock solid balance sheet rated A- by S&P (NYSE:SPGI). KLA has very high returns on capital and better profitability metrics when compared to its closest peers. When adjusting for growth the firm’s valuation looks quite attractive.

Despite this host of positive factors I am recommending a Hold for the present moment. My rating is based on concern regarding the huge revenue exposure KLA has to China and the associated uncertainty that further trade restrictions or tariffs between the US and China might have on KLA’s prospects.

Secondly the stock have sold off significantly in the past six months and now the price action is making a second attempt at a key support level for the stock. With an earnings release due in January and a new incoming US administration, I would exhibit caution on KLA , at least in the near-term, despite the clear quality of the underlying business.

Technical Analysis

Looking at the long term price action for KLA we see the stock made an all time high just short of $900 in July this year and the stock has retrenched by over 30% since then. Recent sell off looks as though it may form a double bottom but we are still awaiting confirmation of this.

Zooming into a daily time frame we see a clear bottom has been forming just above the $600. This is the second attempt at this important price level in the last few weeks, with a wedge pattern loosely forming from the high side. I would caution investors to hold fire on any further action in KLA until this near term struggle between buyers and sellers is resolved. A break below the $600 support level would leave a situation where the next major support level is all the way down at $500.

Conversely if buyers hold the line at $600 and we get incrementally better news for the stock, potentially on their earnings call in January. The holding of support coupled with better than expected earnings might serve as the appropriate buy trigger for those investors comfortable with balancing the quality of KLA’s business with the risks associated with high sales volume in China. My recommendation is not to rush at this time and await greater clarity before either initiating a position or topping up existing ones.

Profitability and Balance Sheet

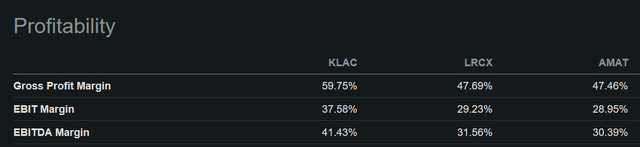

The quality of a business will shine through over time in its financial metrics and KLA is a classic example of this. Looking below at KLA vs two of its closet peers in large cap semiconductor equipment Applied Materials (NASDAQ:AMAT) and Lam Research (NASDAQ:LRCX), we see meaningfully better profitability for KLA.

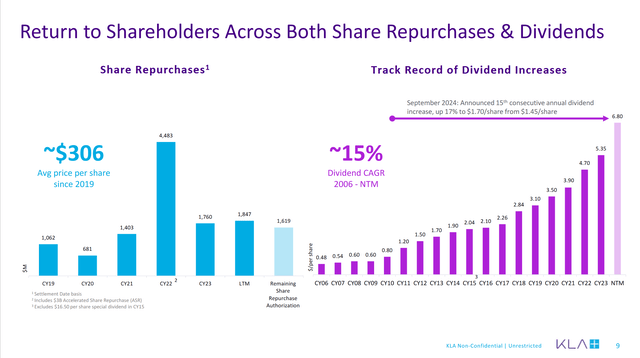

Another trait I always like to see in a stock is the use of capital to reduce the outstanding share count. Over the past decade KLA has deliver about a 2% annual share count reduction which has been a helpful boost to the bottom line. Additionally, the firm has balanced its capital allocation between dividends and buy backs, providing benefit also to those investors with a preference for cash returns.

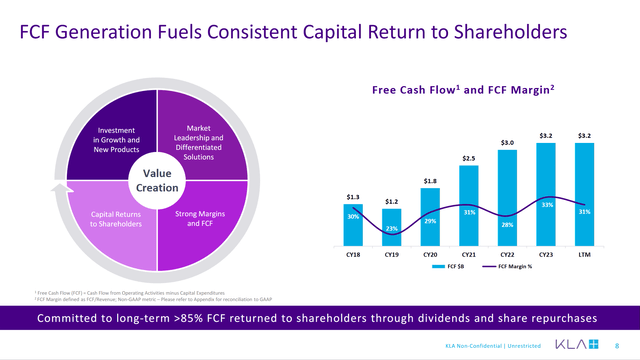

KLA’s cash generation is best in-class for the industry as the firm has consistently delivered a FCF margin in mid-20s and above. The company management have committed to returning over 85% of this FCF generated to shareholders through buy backs and dividends. I see this as exactly the type of attitude a management team should have, at the end of the day shareholders as owners in the business have the ultimate claim to cash generated by the company and management teams should recognize this. Too often ambitious CEOs engage in vanity project M&A which research shows destroys value more often than not.

Valuation

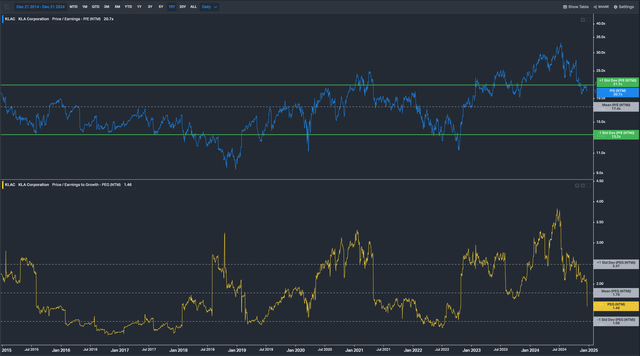

Taking a brief look at the current valuation, we see that KLA trades just shy of 21x forward earnings having fallen from a frothy 35x earlier this year. While the current valuation is a premium to the company ten-year average, when we adjust for growth using the PEG the stock looks to be trading at a reasonable level but not outright cheap.

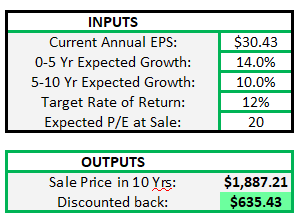

When I run my own DCF analysis on the stock I see the current pricing as anticipating roughly a 12% return for the stock. For the first stage of growth, I use the analyst consensus and stage two growth I reduce to 10% which is significantly lower than the firm’s current ten-year EPS CAGR of 21% and more in-line with the S&P 500 index average. I use a terminal earnings multiple of 20x which is in-line with the firm’s 5-year average, while it is higher the the firm’s ten-year average I see this as justified given the structurally higher ROIC the firm now generates.

As always we need to consider the risks and shortcomings to a DCF analysis. KLA’s future earnings growth will be impacted in large part by developments in the global semiconductor trade situation. If trade restrictions have already peaked, then it is highly possible my second growth stage is significantly underestimating the growth potential for the business. On the flip side, a ramping in trade restrictions to include many of KLA’s products would materially hamper future earnings and likely justify a lower terminal multiple.

Author

Risks

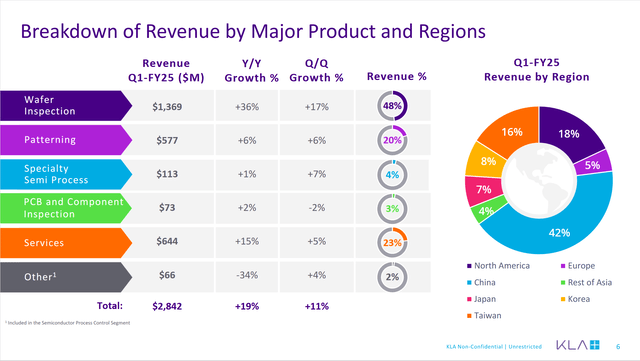

The most obvious risk KLA faces as a business is its position at the cross roads of geopolitics between China and the US. In its most recent fiscal quarter KLA generated over 40% of its revenue from selling equipment to Chinese fabs. Thus far export controls on semiconductors have been limited to the most advanced equipment which has had a greater impact on firm’s like ASML (NASDAQ:ASML) with their EUV lithography machines and more recently export controls pertaining to high-bandwidth memory or HBM.

One could make the case that KLA shouldn’t face the same level of risk given the nature of their product portfolio but given the ramping of trade tensions I think the environment is uncertain enough at present to give investors meaningful pause. The recent story of China opening anti-trust action against Nvidia (NASDAQ:NVDA) is the first example of them hitting back and potentially trying to damage western companies. KLA will need to navigate the current environment with great caution.

Conclusion

I am recommending investors adopt a Hold position on KLA at present. As laid out above the company has extremely attractive financial metrics and the firm’s valuation seems reasonable. With the stock price making a second attempt to push lower below a long term support level I see no reason for investors to jump the gun, with a preference for watching the price development closely ahead of upcoming earnings and any news from the incoming US administration.

KLA might warrant an upgrade to buy if we get more information regarding the geopolitical situation. If new US administration looks set to be pragmatic vis-a-vis the Chinese and work out a deal, that could give comfort that KLA’s portfolio focused on process control will be exempt from any semiconductor trade restrictions. On the other hand, if trade and technology hawks desire to completely derail Chinese efforts in semiconductor manufacturing then its possible KLA could find its China sales seriously at risk which I would see as thesis changing for the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.