Summary:

- TSMC is poised for 25%+ revenue growth in 2025, driven by robust AI demand, N2 chip debut, and overseas fab production ramp.

- The debut of N2 nodes in H2 2025, featuring GAA advanced nanosheet transistors, will significantly enhance performance and power efficiency.

- TSMC’s market share and pricing power will increase with a 10-20% price hike for N2 & N3 wafers, offsetting overseas fab ramp costs.

- Despite potential smartphone and PC market weakness, strong demand from AI accelerators and ASICs will support TSMC’s revenue and margin growth.

BING-JHEN HONG

Introduction

TSMC Initial Coverage (Seeking Alpha)

It’s been over 2 months since I initiated coverage on TSMC. As TSMC will report its Q4 and FY 2024 results next month, I think it is an appropriate time before Christmas to shed some light on TSMC’s potential 2025 performance ahead as we progress towards a new year.

Since I last published my article, TSMC has been up by almost 9% in total return, outperforming the S&P 500 by nearly 6%. Looking ahead, I expect TSMC to continue its outperformance in 2025 due to robust demand from AI customers, the debut of N2 chips and overseas fab production ramp, which should support 20%+ Revenue growth and higher gross margins (above 57% in 2025).

TSMC is expected to meet high-end revenue guidance in Q4 2024 and high double-digit revenue growth in 2025

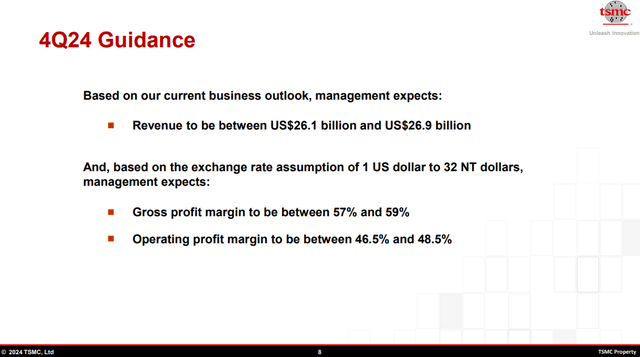

In the Q3 2024 Earnings Call, TSMC recorded a revenue of around $23.5 billion, up 36% YoY and a Gross Margin/Operating Margin of 57.8%/47.5%, respectively.

Q4 revenue guidance is expected to be around $26.1-26.9 billion, and Gross Margins are expected to range around 57-59%, with Operating Margins around 46.5-48.5%.

In October and November alone, TSMC delivered around NT$314B ($9.62B) and NT $276B ($8.46B) of revenue, up 29.2% and 34.0%, respectively, which they delivered 68% of the Q4 guidance expectations. If the trajectory continues, TSMC will likely meet the high end of their Q4 revenue guidance.

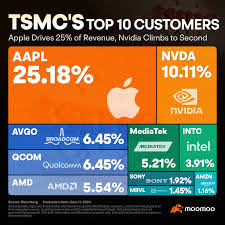

Looking forward, I expect TSMC to grow their revenue by over 25% in 2025, driven by continuous strong demand for N3/N5 nodes from AI GPU customers like Nvidia and AMD, and other ASIC customers including Broadcom and Marvell, alongside cyclical recovery of chips demand for N7 mature nodes, including for Wifi7 modem chip designs, but partly offset by muted demand from AI PC and Apple smartphones in 1H 2025 due to potential consumer demand weakness.

2025 TSMC Highlight 1: Debut of N2 process nodes in H2 2025 and More A16 Development Progress

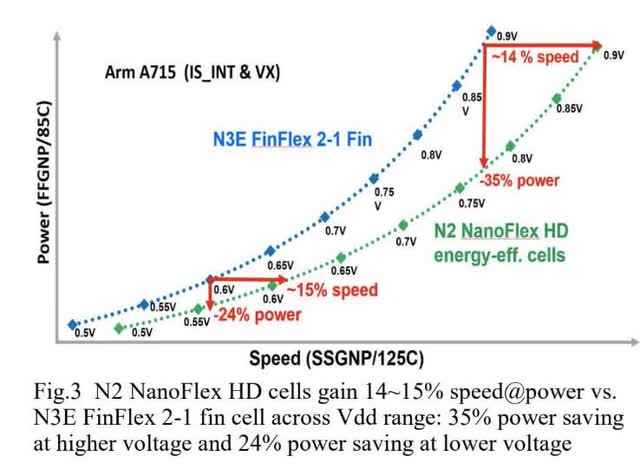

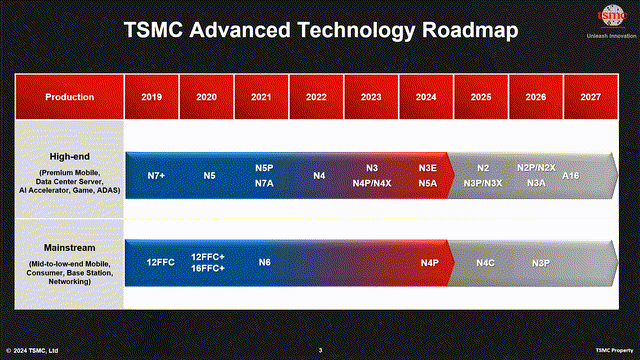

TSMC will debut its 2nm chip (N2 processors) in the H2 2025, which investors have long been waiting for. The N2 node will deliver around 15% performance improvement, 30-35% better power efficiency, and around 1.15x transistor density compared to the previous gen N3 nodes.

Another highlight for TSMC’s N2 nodes is that it will replace existing FinFET transistors and feature new gate-all-around (GAA) nanosheet transistors, allowing chip designers to adjust their channel width to improve performance and power efficiency. Additionally, N2 will feature NanoFlex design-technology co-optimization capability (DTCO), enabling designers to develop cells with minimum area and enhanced power efficiency or cells optimized for maximum performance.

Currently, TSMC’s N2 yields have exceeded 60%, significantly better than a struggling Intel 18A (10% Yield) and Samsung Foundry (20% Yield), suggesting volume production could likely scale in H2 2025 without major delays or impediments.

TSMC Advanced Nodes Roadmap (TSMC)

Whereas for A16 processor nodes, it is expected to be launched in H2 2026. It will incorporate a Superpower Rail Delivery (SPR) nanosheet for backside power delivery, with 8-10% performance improvement and 15-20% better energy efficiency than N2 nodes.

Overall, many customers, including Apple, Nvidia, AMD, Broadcom and OpenAI, have indicated strong interest in TSMC’s N2 nodes in 2025. However, I think revenue for N2 won’t be meaningfully materialized until Q3/Q4 2025 only when the first batch of customers like Intel, MediaTek and Apple adopt N2 processors before AI accelerator customers follow.

Highlight 2: AI demand remains robust, especially from AI accelerators & ASICs, but I remain cautious on smartphone & PC markets

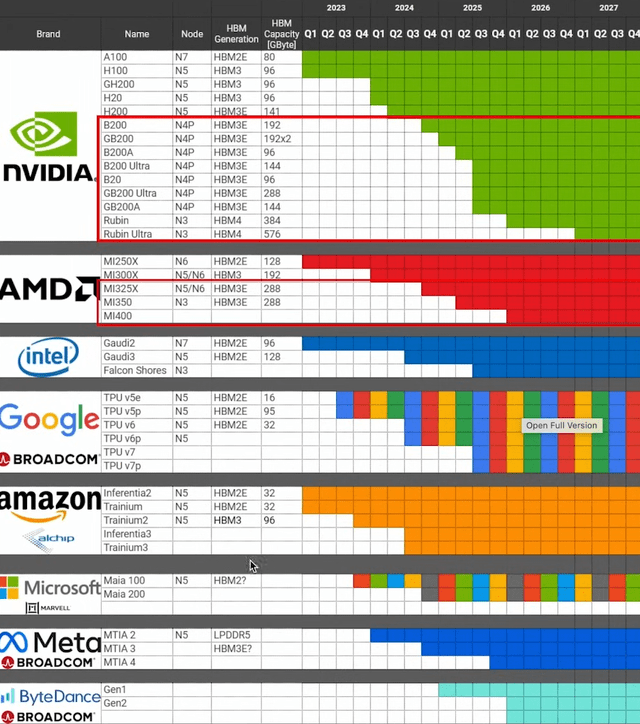

TSMC AI Accelerators & ASIC Customers (LinkedIn)

In 2025, Nvidia will continue its shipments of Blackwell GPUs between Q4 2024 and Q1 2025 to cloud customers, which will utilize TSMC N4P nodes. There have also been rumors that Nvidia will accelerate its next-generation GPU architecture – the Rubin launch date is as early as H2 2025, 6 months ahead of schedule, which leverages TSMC’s 3nm technology N3P for dice.

Whereas for AMD, which I have previously covered, the MI350X GPU will debut in H2 2025, featuring TSMC’s N3P nodes, and I expect the subsequent MI400X GPU cadence to utilize N2 technology in 2026.

Finally, ASIC customers from Broadcom and Marvell have recently become a hot topic for investors. Broadcom’s recently released FY24 AI revenues were $12.2 billion, up 3-fold year-on-year. JPM expects Broadcom’s revenue to grow to $17 billion-$18 billion (40% Y/Y) in FY25. Jefferies even expected Broadcom’s AI chip revenue to reach $60 billion by 2027, highlighting strong growth potential in the ASIC market.

For instance, Broadcom has partnered with Google to co-develop Google’s next-gen TPU v6 5nm AI accelerator ASIC. In the future, Google’s TPU v7, which is expected to launch in H2 2025, would likely utilize TSMC’s 3nm technology.

Amazon AWS’s partnership with Marvell Technologies for its Next-Gen AI Training Chip Trainium 3 will also debut in 2025, utilizing TSMC’s 3nm technology.

Overall, TSMC remains extremely well-positioned to harness pockets of opportunities from the conventional GPU AI Accelerator market and the infant & rapidly expanding ASIC market. I expect HPC will likely take up more than 60% of the revenue share for TSMC in 2025 and continue to grow at 30-40% in 2025. AI customers will likely provide additional growth tailwinds to 3nm technology in 2025.

TSMC Customers (Moomoo)

While we are seeing strong customer booking for TSMC 3nm/2nm technology, I am cautious of TSMC’s PC & Smartphone revenue being less potent than the market expects in 1H 2025. For instance, Apple is seeing some demand weakness for its iPhone 16, prompting me to remain cautious about the growth prospect of TSMC’s upstream smartphone segment. Apple’s next-generation iPhone 17 (A19 Chips) will likely remain on 3nm instead of 2nm technology, citing concerns over high costs. I expect TSMC’s 2nm technology will only debut in 2026 on Apple’s M5 A20 chips.

For CPU & PC Markets, some weakness has been observed in the AI PC market, so the upgrade cycle has been delayed to H2 2025. However, we are seeing most CPU designers, including Intel’s Nova Lake, utilizing N2 technology in 2026 due to ambiguities over 18A from Intel foundry and Qualcomm’s Snapdragon Elite Gen 2 & 3 leveraging TSMC’s 3/2nm technology in 2025/26 due to limited foundry options.

Samsung might also plan to outsource Exynos 2500 chip production for its Samsung Galaxy S25 Smartphone to TSMC due to low wafer yields from Samsung Foundry.

Overall, I think TSMC’s growth catalysts will likely come from the HPC Segment as I am cautious about downstream weakness from smartphone & AI PC customers, which might signal less robust revenue growth than the market expects from smartphone segments from TSMC in H1 2025.

Highlight 3: Price Hikes & Arizona Fab ramp

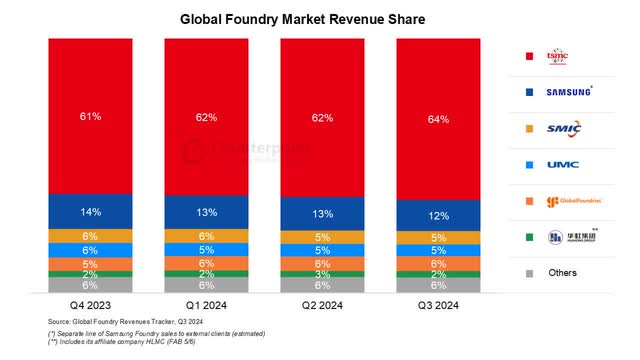

TSMC Market Share Q3 2024 (Counterpoint Research)

According to counterpoint research, TSMC’s market share in Q3 2024 stood around 64%, hitting the highest over the past few years. TSMC’s gap between SMIC & Intel & Samsung is expected to widen in 2025, hitting a market share of around 66-67% and over 90% market share for advanced nodes.

TSMC’s wide economic moat has translated into substantial pricing power, where they are raising prices for its N2 & N3 wafers by around 10-20% starting in 2025, harnessing around $25,000-30,000/wafer for N2 in 2025.

I believe that the price hike will partly offset the 2-3% gross margin dilution from overseas fab ramps. Most importantly, Arizona Fab 21 is expected to ramp up production volume in H1 2025 for 4nm chips, reaching productivity on par with Taiwanese compatriots, with first-movers being Apple, AMD & Broadcom, and I expect more Nvidia Blackwell chips to be produced in Arizona starting from H2 2025.

Overall, I think the production ramp-up of TSMC Arizona could alleviate some margin dilution pressures and allow TSMC to achieve around 57%-58% Gross Profit Margins in 2025, compared to 54-55% in 2024.

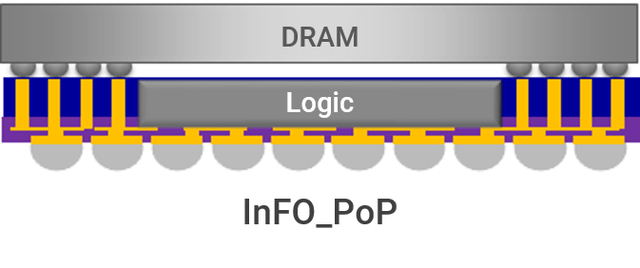

Highlight 4: New Advanced Packaging Technology FOPLP

FOPLP Packaging Technology (TSMC)

Another technology that I find interesting is the research & development of next-generation advanced packaging technology (Fan-Out Panel-Level Packaging) FOPLP technology. While TSMC’s current advanced packaging revenue only accounts for single digits of TSMC’s total revenue, it is expected to reach double digits by 2026/27.

TSMC’s advanced packaging technology is currently experiencing a capacity shortage to meet customer needs. Still, capacity expansion is doubling up from 30k/wafer per month in 2024 to around 70k/wafer per month in 2025 due to strong demand from Nvidia and AMD’s AI accelerators, which require CoWoS-L and CoWoS-S advanced packaging, respectively.

The development of FOPLP packaging technology could lower unit costs and increase packaging size, and I expect FOPLP to be widely adopted among AI Accelerators packaging in the future. While mass production is slated to begin in 2026, this could potentially alleviate the current advanced packaging bottleneck we are facing.

Valuations: Not excessively exuberant, but not Pound-The-Table valuations either

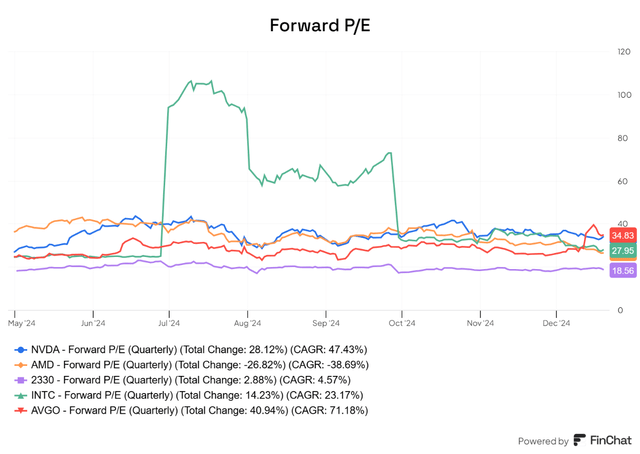

TSMC Forward P/E vs US downstream customers (FinChat)

Currently, TSMC domestic shares listed in Taiwan are trading at a Forward P/E of around 18.5x; if we factor in a 20% ADR premium, TSMC ADR’s forward P/E is around 22x, not excessively expensive compared to its downstream customers like Nvidia (34x), Intel (27.9x), AMD (26.4x) and Broadcom (34.8x) respectively.

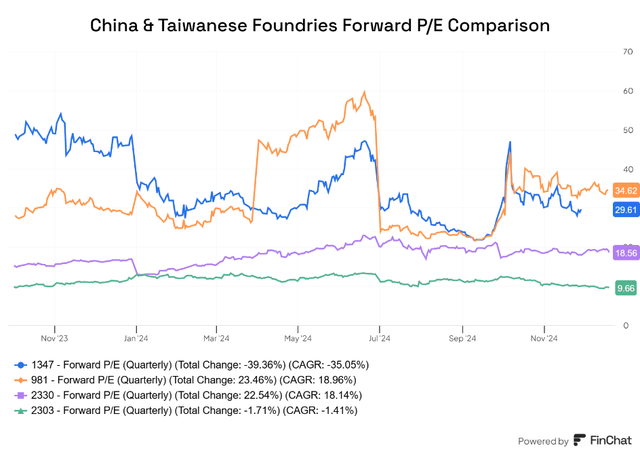

TSMC vs Chinese Foundries Forward P/E (FinChat)

If we take a look at Chinese foundries, including SMIC (981.HK) and Hua Hong Semiconductors (1347.HK), which specialize in mature nodes & processors, were trading at 34.6x and 29.8x forward earnings, respectively, primarily due to optimism of domestic substitution over foreign semiconductors.

TSMC, on the other hand, despite being the leader with 64% of the global foundry market share in advanced nodes, is trading at a forward P/E of 18.5x; I think the market pessimism is primarily due to the uncertainty over the future Trump administration, which has been quite hostile to TSMC and was threatening for potential tariff hikes.

Nevertheless, I think TSMC could still navigate this challenge with ease due to 1) Its strong pricing power, allowing it to shift potential tariff burdens to end customers, and 2) the CHIPS Act is a bipartisan act, revoking TSMC’s Arizona $6.6 billion subsidies and $5 billion of federal loan is counter-productive to Trump’s Bringing Manufacturing Home to America agenda. Possibly, given TSMC’s investments in Arizona & strategic importance of AI to US national security, I suspect that TSMC could circumvent potential US tariffs.

Should the market re-rate TSMC to a forward P/E of around 27x earnings (Average multiple), which I think is a fair multiple, coupled with an expected EPS of $8.93, this gives TSMC a potential target price of around $ 240/share, implying a possible 20% upside in 2025, which should allow TSMC to continue its outperformance in 2025.

Conclusions

Overall, I remain optimistic about TSMC’s business development in 2025 due to the debut of N2 technology in H2 2025, continued strong demand from AI accelerators & ASICs customers, alongside potential price hikes and capacity expansion, which provides a supportive backdrop for over 25% revenue growth and higher gross margins heading into 2025.

Currently, I have a full position at TSMC, and I am not pouncing at these levels. However, should TSMC fall into some left tail risks, i.e. lower revenue guidance in Q1 2025, etc, causing share prices to plummet, I would be willing to add more to my position as well when Mr. Market is fearful.

In essence, I expect TSMC shareholders to enjoy another fruitful year in 2025.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.