Summary:

- Quantum Computing Inc. has seen a significant stock surge, driven by a NASA contract and potential in quantum computing technology.

- QCi’s first-mover advantage and unique lithium niobate fabs position it well in a market with exponential demand for quantum computing.

- Despite $17M in YTD losses and share dilution, QCi’s potential in a multi-billion-dollar industry justifies its $2 billion valuation.

- I rate QUBT as a Hold due to share dilution concerns, awaiting more stabilization before considering a Buy.

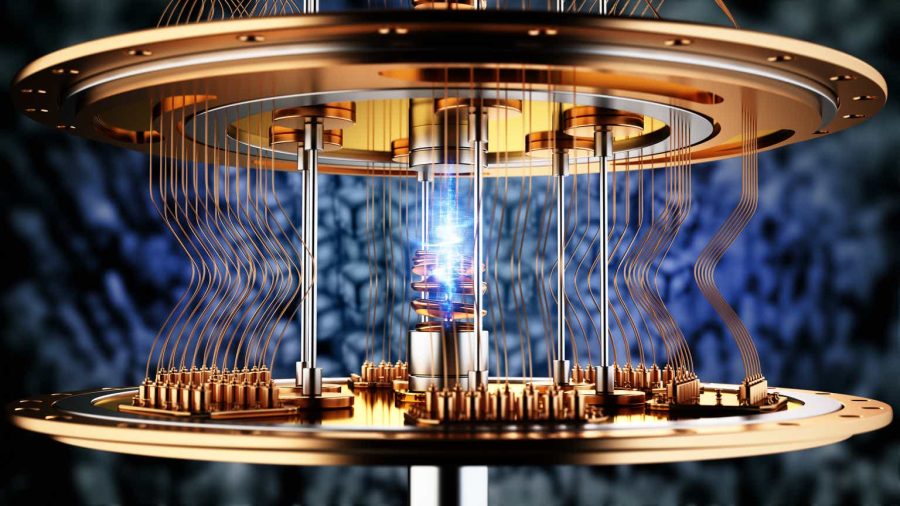

adventtr

Quantum Computing (NASDAQ:QUBT) (“QCi”) is a stock that blew up over the past week, seemingly out of nowhere.

Up almost 6x recently, clearly the market heard something that it likes. In this case, it was winning a contract with NASA

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.