Summary:

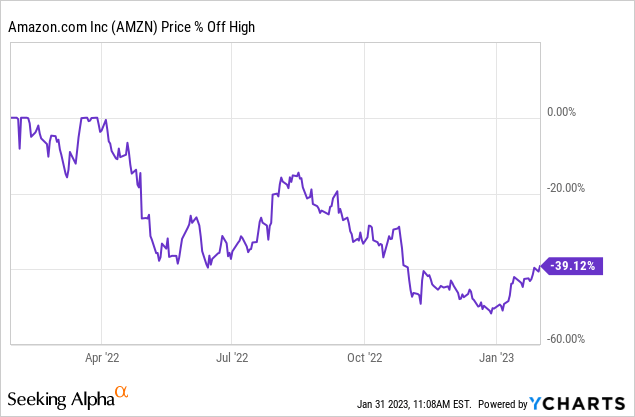

- Amazon has had a year to forget in 2022, with shares tumbling 40% as the company struggled against inflation and a faltering economy.

- Amazon’s crown jewel, AWS, continued to shine, but growth appears to be slowing.

- All in all, shareholders should expect a fairly dismal earnings report when Amazon releases its Q4 results later this week.

- Yet, the long-term thesis for Amazon remains on track, and I believe shares are now priced extremely attractively.

- I think it’s time for some short-term pain and long-term gain for Amazon shareholders.

hapabapa

Investment Thesis

Amazon (NASDAQ:AMZN) is a global business operating in a whole host of industries, from ecommerce and logistics to game streaming and audiobooks. It is most well-known for its Amazon ecommerce marketplace, and in particular, the Amazon Prime subscription, which gives members access to next-day (or even same-day) delivery, access to the Prime Video streaming service, and other benefits depending on your region.

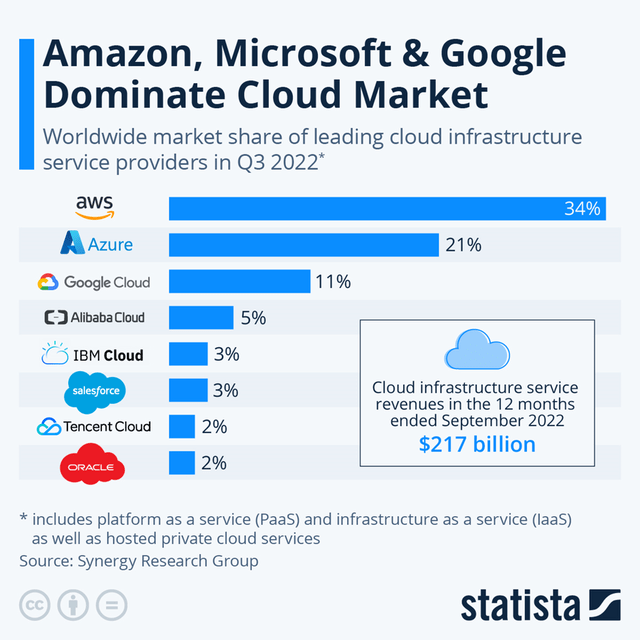

However, my personal investment thesis for Amazon doesn’t centre on any of these things – it is mainly focused on Amazon’s industry-leading cloud storage offering, AWS. This division of Amazon has been growing at a rapid rate, boasts incredibly strong margins, and is the leader in an industry that should only get larger.

So, my investment thesis is this: AWS is a fast-growing, highly profitable business with powerful moats. This should propel Amazon to new heights, and I think AWS would be a great standalone business in its own right. The additional bonus with Amazon is everything else; this is a company with innovation running through its veins, and there’s no telling which of their next avenues could create the next AWS for the business. Amazon also has plenty of potential to expand on its retail margins, which will provide an additional boost to the bottom line in the future.

Unfortunately, the past twelve months have been difficult for Amazon shareholders. The stock has tumbled by 40%, wiping away hundreds of billions of dollars from its market capitalisation, as the e-commerce tailwinds of 2020 and 2021 turned into big headwinds during 2022.

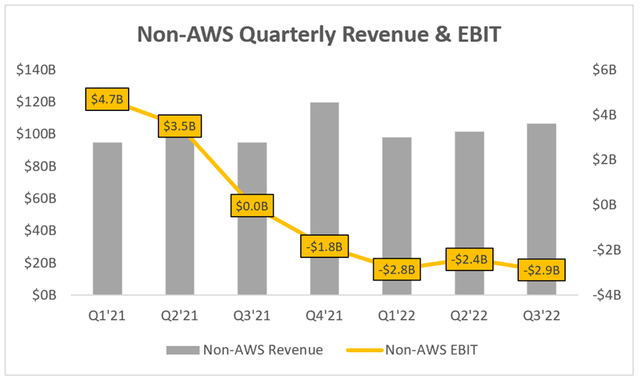

Perhaps most concerning for investors is the substantial cash burn that Amazon’s retail division has been going through, as the company appeared to over-expand during the heightened demand during lockdowns.

As demand normalised and the economy now appears far weaker, Amazon’s non-AWS business found itself facing higher cost pressures across its fulfilment network thanks to higher energy prices and overall inflation. Couple these increasing costs with a lowering of demand, as consumers feel the pinch of a tighter economy and are also no longer solely reliant on ecommerce for their shopping, and it’s clear to see why Amazon has been hurting this year.

Whilst the weaker economic conditions look set to continue, there have been some bright spots when it comes to inflation cooling down. I’m not expecting a stellar quarter from Amazon, but perhaps it will start to reduce the cash burn from its retail division as some cost pressures begin to ease up.

With that said, here’s what I’ll be looking out for when Amazon reports its Q4’22 earnings.

Amazon’s Latest Expectations

Amazon is set to report its Q4’22 results on Thursday, February 2 after the market closes, and there are several key items that investors should keep their eyes on.

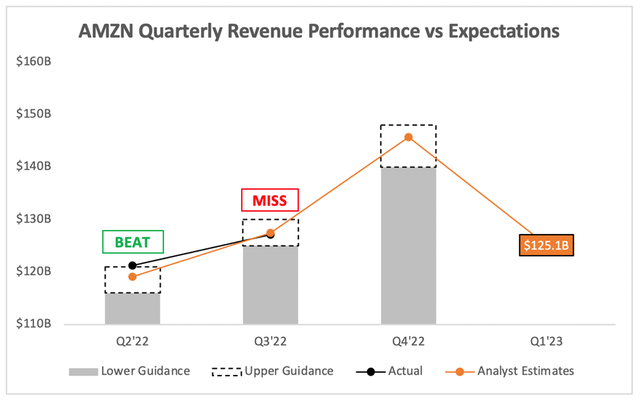

Starting with the headline numbers, where analysts are expecting Q4’22 revenue of $145.8B, representing YoY growth of 6.1%. This falls slightly towards the upper end of management’s $140-$148B guidance offered up in Q3.

Looking ahead to Q1’23, analysts are expecting Amazon to deliver revenue of $125.1B, which would represent YoY growth of 7.5%.

It will be interesting to see if Amazon will be able to please Wall Street when it gives its forward guidance – I believe that we’re currently in a market where companies like Amazon meeting expectations will be rewarded, given the substantially lower expectations from the investing community.

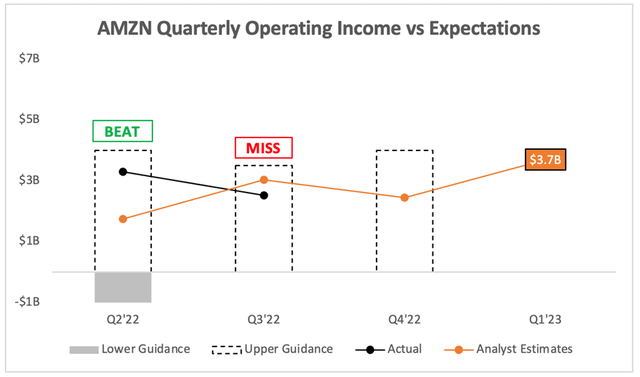

Moving down the income statement, analysts are expecting Amazon to deliver an operating profit of $2.45B, representing an EBIT margin of 1.7%, and a 29% YoY decline from Q4’21. This also falls slightly above the midpoint of management’s $0-$4B guidance offered in the prior quarter.

Analysts remain more hopeful about Q1’23, with expectations for operating profits of $3.70B, representing a 3.0% EBIT margin and 1% YoY growth. It feels like, once again, forward guidance will be key for Amazon shareholders.

Besides the headline numbers, what else should investors be looking out for? As usual, I’ll be focussing on AWS – but, for the first time in a while, I think the non-AWS side of Amazon could be a bright spark in the year ahead.

AWS Provides The Foundation For A Catalyst

I’ve highlighted in plenty of previous articles just how important I believe AWS is for any investment thesis in Amazon, and the numbers below show exactly why.

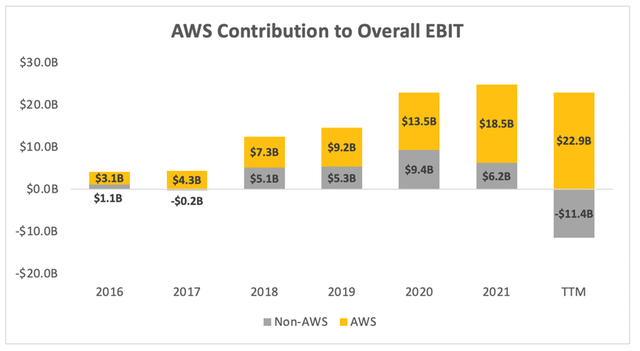

Whilst the non-AWS segment of Amazon has turned a fairly good operating profit over the past five years, AWS blows it out of the water.

In fact, despite the non-AWS divisions of Amazon losing $11.4B in EBIT over the past twelve months, AWS has made a $22.9B profit and has pulled Amazon’s overall financial results into respectable territory.

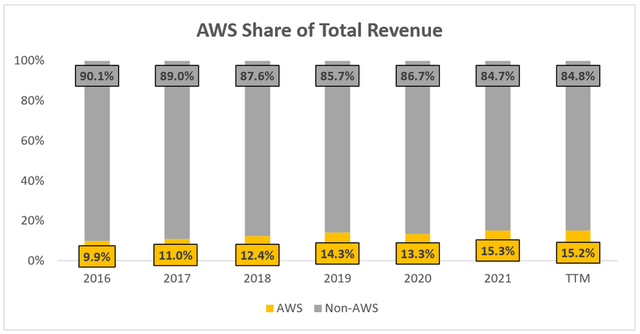

This is made all the more exciting when investors consider that AWS only makes up ~15% of Amazon’s overall revenue.

This contribution has continued to grow over time, with AWS becoming a more and more significant chunk of Amazon’s top-line. More importantly, a greater share of revenue for AWS will drastically improve Amazon’s overall EBIT margins and profitability.

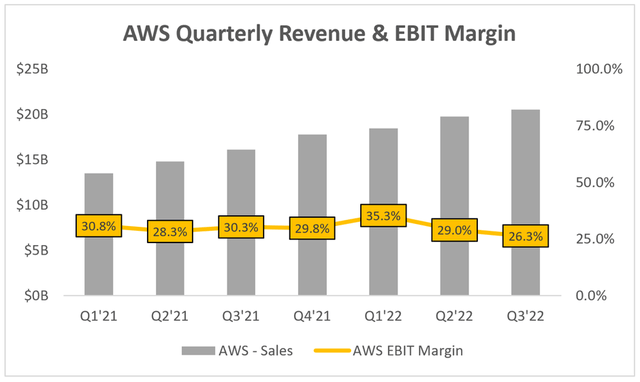

However, even AWS has not been immune to the difficult macroeconomic environment. Having delivered fairly consistent quarterly EBIT margins over the past couple of years, these margins fell sharply to 26.3% in Q3.

The macroeconomic environment probably won’t get better anytime soon, so I would just be looking for AWS to try and maintain a steady EBIT margin from Q3 into Q4.

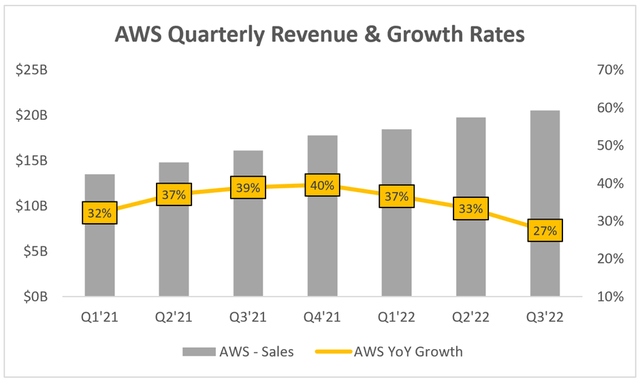

Unfortunately, the revenue slowdown for AWS is likely to continue, as the below trend shows exactly what’s going on.

AWS has seen revenue growth slow ever since Q4’21, and I expect this to continue into Q4’22.

So, a pretty dismal picture overall, but I am remaining very optimistic. Investing is a forward-looking game, and Amazon has two incredibly strong parts to its business that appear to be going through a temporary rough patch.

The ~$11 billion loss from Amazon’s non-AWS business will no-doubt swing back to at least breakeven in the next year or so, as the economic conditions and the business of Amazon start to normalise after these unusual few years. Remember, this side of the business was profitable in 2016, 2018, 2019, 2020, and 2021 – don’t be fooled into thinking it will be a perpetual cash burner.

Combine this potential bottom-line boost with AWS’s continued (even if slowing) growth, and Amazon could be seeing its EBIT surpassing $30B within a couple of years.

Why should investors care? Let’s take a look at the below valuation model for Amazon to find out what I think the future holds.

AMZN Stock Valuation

As with all high growth, innovative companies, valuation is tough. I believe that my approach will give me an idea about whether Amazon is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

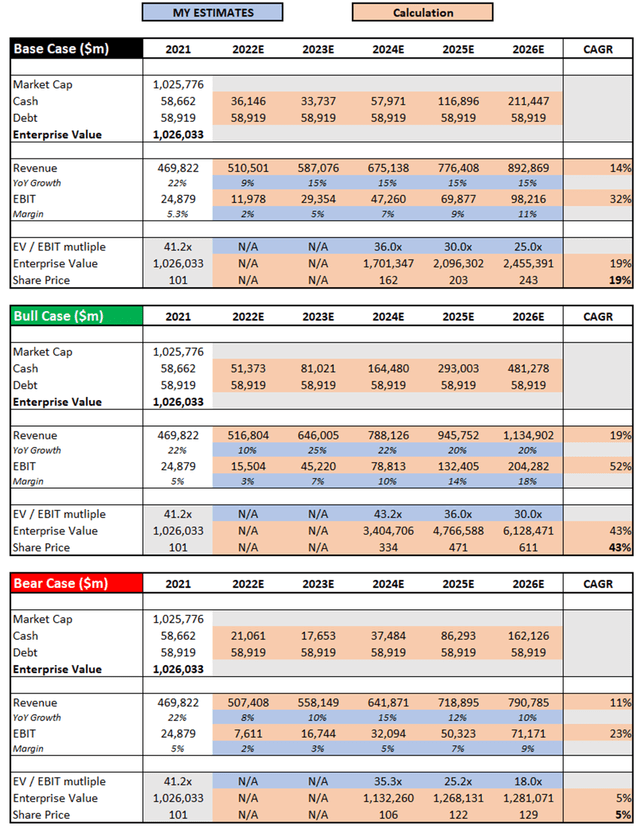

I have kept most assumptions similar to my previous article, with no substantial changes. Put all this together, and I can see Amazon shares achieving a CAGR through to 2026 of 5%, 19%, and 43% in my respective bear, base, and bull case scenarios.

Bottom Line

I’m certainly not expecting a great earnings report from Amazon this week, as I think the company will continue feeling some macroeconomic pain. But we are now in a market where businesses are not being punished for falling short of expectations; in fact, as long as companies’ earnings aren’t too bad, shares have been rising.

However, I don’t really care what the shares do after this earnings report; I believe that right now is a fantastic opportunity to add some shares of a high-quality business with multiple tailwinds and powerful economic moats at a rather attractive price.

For that reason, I will reiterate my previous ‘Strong Buy’ rating for Amazon.

Disclosure: I/we have a beneficial long position in the shares of AMZN, SHOP, ETSY, DOCN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.