Summary:

- Confidence in Apple Inc.’s ability to deliver another of its trademark solid quarters has been waning in the past several weeks.

- Global smartphone, PC, and tablet sales look soft. The better news is that Apple is likely outperforming its peers.

- Disproportionate weakness in share price around earnings could represent an opportunity to buy Apple Inc. stock at a discount.

Michael M. Santiago

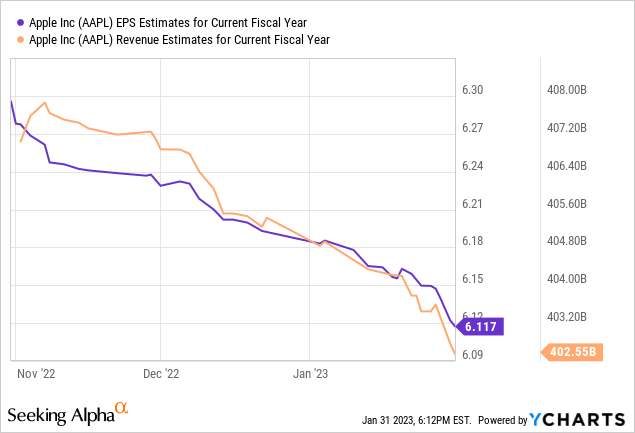

Apple Inc. (NASDAQ:AAPL) is scheduled to deliver fiscal Q1 results this Thursday, February 2 post-market. Confidence in Apple’s ability to deliver another of its trademark solid quarters has been waning in the past several weeks, as the current-year sales and EPS estimate revision chart below suggests. The Cupertino-based company is expected to have faced a laundry list of challenges in the 2022 holiday period.

Due to all the uncertainty, I find it speculative to have strong convictions about the performance of the company or its stock this earnings season. Still, I try my best at projecting the good and the bad of Apple’s quarter in the sections below.

At a high level, I believe the results and outlook delivered this week will be consistent with the idea that Apple remains one of the best houses in this otherwise dilapidated neighborhood that the tech space has become lately.

The good: iPad and FX

There is little question that the iPad will be the best-performing segment this quarter. The key driver of upside to previous-year sales should be the timing of the launch of the new iPad devices.

In October 2022, the new iPad Pro equipped with Apple’s new M2 chip saw the light of day. The YOY comparison against a fiscal Q1 of 2022 that was devoid of a similar product introduction should propel iPad sales growth much higher, following four consecutive quarters of contraction.

This is the first instance in which the “best house in a bad neighborhood” dynamic should be evident. For example, Microsoft Corporation (MSFT) has recently reported an astonishing 39% drop in GAAP-basis device sales in the holiday season, with the company’s Surface underperforming the expectations of CEO Satya Nadella and his team. With an arguably better product portfolio and an extra week of sales in the calendar, I doubt that Apple will perform poorly.

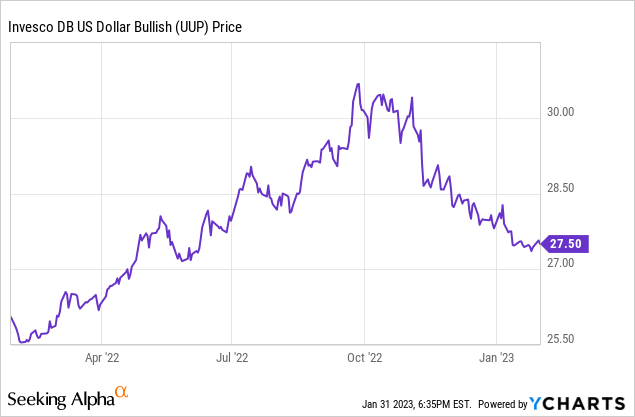

The other potential source of good news is foreign exchange. Last quarter, Apple’s CFO Luca Maestri warned of rarely-before-seen FX headwinds that could shave off nearly 10 percentage points in revenue growth. But as the chart below depicts, the U.S. dollar began to depreciate sharply almost immediately after Apple’s most recent earnings call, in late October 2022. Back to Microsoft, the Redmond-based company booked five percentage points in revenue growth tailwinds driven by the exchange rate, and Apple might do something similar.

To be clear, FX movements should not matter much, if at all, to any investment thesis on Apple. The better news is that at least the headline numbers might look much better than once feared. Expect, however, the earnings call debate to focus on how to parse out FX-neutral performance vs. pure exchange rate benefits to the P&L.

The bad: supply chain and services

Having said the above, I expect most of Apple’s earnings report to look ugly to most investors. The finger can be pointed east towards China: supply chain disruptions that some believe to have been largely resolved during the quarter are likely to wreak havoc, particularly within Apple’s iPhone segment. And the supply issue may be just the tip of the iceberg, as signs of economic fatigue and a slowdown in consumer spending could also have an impact on demand.

A few third-party research companies have at least reported that the iPhone is likely to have performed better than most peers. While Canalys believes that global smartphone shipments dropped by a sizable 17% last quarter, it also sees Apple gaining two percentage points in market share, for an implied YOY decline of 9% in shipments. Factor in some FX tailwinds and the extra week in the quarter (but also consider that the revenue mix away from iPhone Pro and Pro Max should represent a drag to average selling price), and maybe investors can justify hopes for better-than-expected segment revenues.

Lastly, Apple’s services segment could be another source concern. In my view, this high-margin and once-high-growth business (along with the company’s aggressive share buyback program) is largely responsible for Apple’s P/E having skyrocketed from the low double-digits in 2012 to around 23x today. But now, the segment is facing challenges.

In great part due to: (1) slower advertising spending impacting Apple’s ad business; and (2) soft consumer spending dragging App Store (particularly game-related) sales down, investors could witness the lowest service revenue growth rate posted in years, if not ever. Near-zero growth could be highly disruptive to investor sentiment, considering the rich 65% segment margins and YOY growth that reached above 25% as recently as fiscal 2021.

Don’t trade earnings, own the stock

All things considered, I would not hold Apple Inc. to high standards regarding fiscal Q1 performance. Still, I would be very skeptical of trading earnings, even from the bearish perspective, given all the unknowns surrounding the extent of Apple’s supply chain issues, the spending appetite of consumers, the impact of FX and the extended quarter on holiday period results, etc.

I maintain my position on Apple Inc. stock, one that is based on long-term convictions. I still believe that Apple is one of the best-managed companies in the world and one of the most appreciated by its customers. I think Apple Inc. is a stock to own for the long haul, and disproportionate weakness in share price around earnings could represent an opportunity to buy the stock at a discount.

Disclosure: I/we have a beneficial long position in the shares of AAPL, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Join EPB Macro Research

EPB Macro Research is a thriving community of investors seeking better risk-adjusted returns, while optimizing their portfolios to benefit from the next economic cycle. I invite you to join EPB, where you can read more about multi-asset diversification and participate in the discussions about the markets, the economy and investment strategies.