Summary:

- Apple Inc. reported a big double miss on its fiscal Q1 2023 earnings report.

- Apple is facing serious macro challenges.

- Apple is a quality company, but it’s not perfect, and it trades at a high valuation right now.

seb_ra/iStock via Getty Images

Article Thesis

Apple Inc. (NASDAQ:AAPL) reported fiscal Q1 2023 results that significantly underperformed estimates. Growth has turned negative, for one of the weakest performances among big tech companies so far this earnings season. Since shares are still pricey, they don’t look attractive going into a potential recession, I believe.

What Happened?

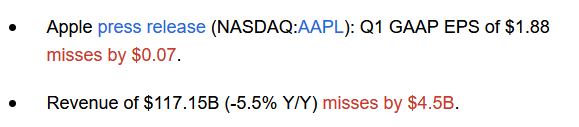

Apple reported its fiscal first-quarter earnings results on Thursday afternoon. The company missed estimates on both lines, and it wasn’t especially close:

Seeking Alpha

The company saw its revenue decline 6% year-over-year, missing estimates by 4%. EPS estimates trailed the consensus estimate by 4% as well. Not surprisingly, the market reaction has been negative, as shares trade down about 4% at the time of writing.

Apple’s Fiscal Q1: One Of The Worst Big Tech Quarters

The current environment isn’t the most beneficial one for major tech companies — they previously benefitted from the pandemic quite a lot, as home-schooling, work-from-home, and screentime-based hobbies were major growth drivers for Apple, Alphabet (GOOG, GOOGL), Microsoft Corporation (MSFT), Meta Platforms (META), and so on. However, the current environment isn’t as helpful.

In fact, there are some macro trends that are hurting the business performance of these large-cap tech players: consumers prefer to go out more and are spending less time at their homes and in front of their computers, tablets, or TVs. At the same time, high inflation and a potential recession are bad for the willingness of consumers to buy high-priced discretionary consumer goods, and businesses are less willing to spend heavily on advertisements.

It’s thus not really surprising to see that these big tech names have not reported overly attractive results so far this earnings season. Alphabet reported a 1% revenue increase, while Meta Platforms reported a 4.5% revenue decline. Microsoft grew its revenue by 2%, while Netflix (NFLX) reported a similar growth rate. None of that was too compelling, and yet, they all outperformed Apple, which saw its sales fall the most, by 6% year-over-year.

I believe that there’s a good explanation for that: Apple’s products are the most discretionary ones among these companies, thus consumers can save money easily by avoiding a new phone purchase. When consumers want to save money, keeping their old phone for an additional year is an easy choice. Cancelling Netflix saves less money and means that Netflix can’t be used anymore, while almost all phone functions are available from a 1,2, or 3-year-old iPhone. When consumers stop their Windows or Office subscription, that has a large impact on what they can do with their PCs — but prolonging one’s phone purchasing cycle has relatively few impacts on one’s life. I thus am not surprised to see that Apple has fared the worst so far this earnings season among these big tech companies when it comes to revenue generation.

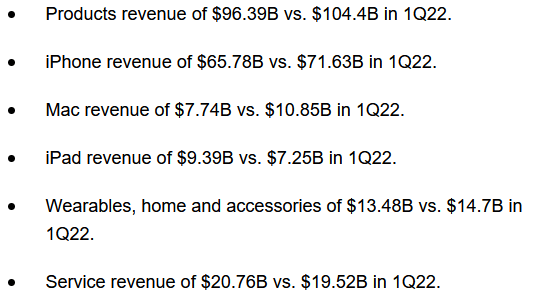

The fact that spending that is “easy to avoid” is being avoided the most is also seen in Apple’s revenues when we look at its different product categories:

Seeking Alpha

Service spending is the hardest to avoid, as this means that subscriptions can’t be used any longer. As a result, services revenue was up — app purchases are small, thus consumers don’t think about these purchases a lot, and getting rid of subscriptions hurts, which is why few consumers do it. But keeping existing hardware for a little longer before buying the next upgrade is a rather easy choice, as it means that consumers don’t really have to forego anything they’ve had so far (which is true when subscriptions are canceled).

At the same time, Apple’s hardware has sizeable price tags, thus these aren’t buy-them-without-thinking-too-hard-about-it purchases for most consumers. Hardware revenue, thus, performed a lot worse than service revenue. Mac revenue performed the worst on a relative basis — I do believe this is not surprising. Macs are Apple’s most expensive products, thus consumers that suffer from inflation and that are worried about a potential recession are especially likely to forego the purchase of such a big-ticket item.

The macro environment isn’t Apple’s fault, of course — it can’t control the fact that inflation makes consumers spend more money on food, energy, housing, and so on, which means they have less cash available for discretionary purchases. Apple also can’t control the Fed’s tightening path, which will possibly cause a recession, which hurts consumer spending further. It’s thus not Apple that is at fault for a difficult macro environment where Apple’s hardware-based sales are hurting, relative to more subscription-based companies such as Microsoft that are outperforming Apple. But the fact that Apple is not at fault for the macro environment does not mean that Apple’s shares should trade at a very elevated valuation forever.

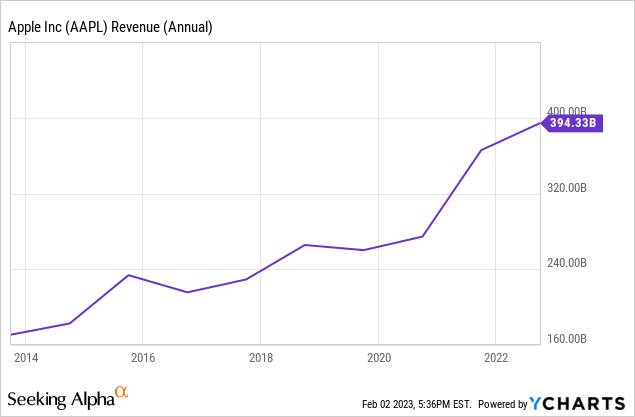

Apple has seen down years and no-growth years in the past as well. Overall, the revenue trend has been upward, but the last two years aren’t very representative of Apple’s historic business growth. As shown earlier, the pandemic was a boon for Apple, whereas its sales growth has been rather moderate in prior years, with some ups and downs in between:

That’s not really surprising — after all, Apple mostly is a hardware consumer goods company, and those tend to experience ups and downs, while growth generally isn’t outrageously high. And that can work out well for shareholders if shares are purchased at reasonable valuations. That’s where one of Apple’s current issues comes from: AAPL stock is too expensive, and one might argue it’s almost priced for perfection.

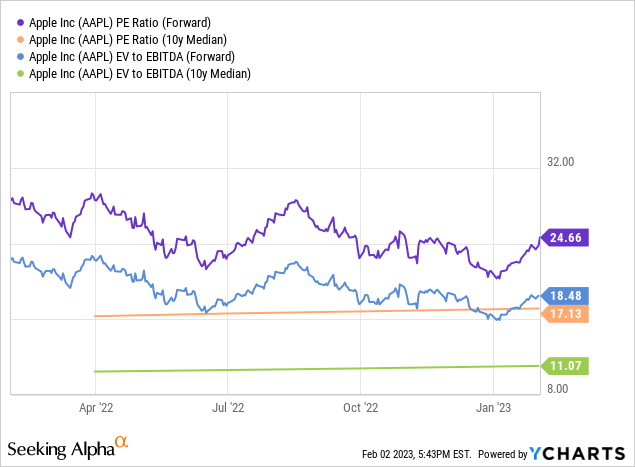

When an at least somewhat cyclical hardware consumer goods company that is mostly active in more or less mature markets (the smartphone market isn’t growing much these days) is priced for perfection, that can cause considerable downside potential. Apple clearly is experiencing major headwinds from the macro environment right now, as inflation and an economic downturn hurt its sales potential due to consumers becoming more reluctant to buy high-priced tech products. If Apple was valued at 10x earnings or 15x earnings, that wouldn’t be a major issue — but Apple is going into this downturn at a historically high valuation:

Apple currently trades at a 44% premium to its long-term average earnings multiple, while the premium to its long-term average EV/EBITDA ratio is even larger, at 67%. I believe that the EV/EBITDA multiple is more telling, as it accounts for changes in debt usage and for the changing size of Apple’s cash position. But even a 44% premium to its historic net profit multiple is pretty sizeable. Keep in mind that these calculations use the current EPS estimates for this year, which will surely get revised downwards over the next couple of days as analysts factor in the weaker-than-expected results for fiscal Q1 2023 into their models. EPS downward revisions thus seem likely, which will result in an even higher valuation, all else equal.

In short, we have a situation where Apple’s consumer-focused business model is facing major headwinds. And yet, at the same time, shares are historically pricy. I do believe this does not make for an attractive combination — pressure on Apple’s share price in the foreseeable future would not be too surprising.

Of course, if the market rallies, e.g., due to Fed pivot hopes, Apple would most likely climb as well. But if that does not happen, Apple is at risk of performing badly, I believe.

Final Thoughts

Apple Inc. is not a bad company at all — I am a user of some of its products and have been a shareholder in the past. But it is a company with vulnerabilities, as the consumer-facing business of selling discretionary goods is vulnerable to an economic downturn, showcased by the rather bad business growth performance Apple has shown for the most recent quarter. This holds true in absolute terms, and also on a relative basis versus other big tech names.

Since Apple Inc. is trading at a pricey valuation while the macro environment is moving against the company, I believe Apple is not an attractive investment at current prices. AAPL is a quality stock, but a too-expensive one that will face headwinds in the current adverse macro environment. The double miss on Apple Inc.’s fiscal Q1 earnings hurts — the market reaction has, unsurprisingly, not been positive.

Disclosure: I/we have a beneficial long position in the shares of GOOG, META, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!