Summary:

- Apple Inc. misses on top and bottom lines.

- Production issues and currency headwinds were known.

- Numbers could have been much worse.

Nikada/iStock Unreleased via Getty Images

After the bell on Thursday, we received fiscal first quarter results from technology giant Apple Inc. (NASDAQ:AAPL). For months now, we’ve been talking about weak results coming in as the company’s iPhone production was severely impacted in China due to the Coronavirus. In the end, the fiscal Q1 results looked quite bad when you see the headlines, but I don’t see this as a reason for investors to panic.

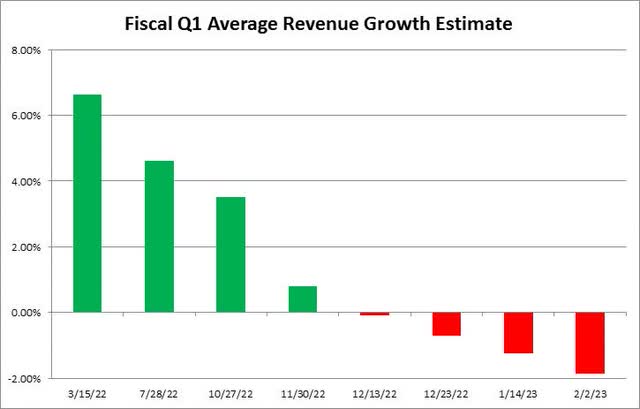

Back in December, I detailed how street analysts were calling for Apple revenues to decline in the holiday quarter. This was despite the company having 14 weeks in the fiscal period due to how the calendar fell, providing extra sales time compared to the year ago period. In the chart below, you can see how Street estimates kept coming down over time.

Apple Q1 Revenue Estimate (Seeking Alpha)

Worries kept increasing recently because of two items. First, the U.S. dollar had strengthened quite a bit over its year ago levels, adding a headwind to Apple’s overall results. The greenback has since weakened, but much of that came after the quarter ended. This should shift to a tailwind as we move throughout 2023 if the dollar stays where it currently is.

The major problem for Apple, though, in the December period was the shutdown at Foxconn’s iPhone plant in Zhengzhou, China. Production was only at about 20% of normal at the end of November, according to one analyst report I previously discussed, and got back to around 30% by mid-December. When you are selling smartphones that cost $800 and up, even losing a few million units in the quarter can mean billion in revenues.

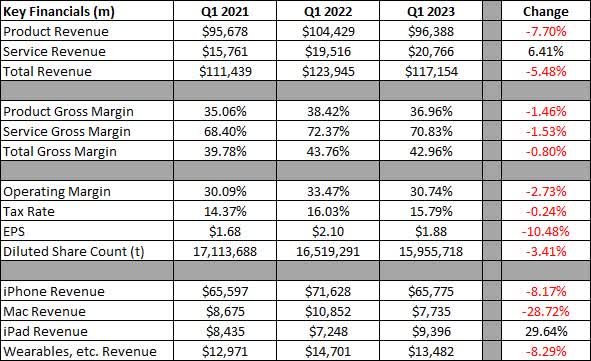

Overall, here’s how Apple’s results looked against the prior two fiscal Q1 periods. The year-ago change for percentage categories is the actual percentage change, not the rate of change as for revenue, EPS categories, etc.

Apple Q1 Results (Company Filings)

Apple missed the average street estimate for Q1 by about $4.5 billion. Well, the iPhone itself was down $5.85 billion over the year-ago period. The company also missed when it came to the Mac, but that miss was about the same size of the beat that the iPad had, so those two basically cancelled each other out. Wearables and other revenues were also a little light, but some of that might be attributable to Apple not getting as many add-ons with iPhone sales being down. The Services segment saw slowing growth, but actually beat Street estimates.

Overall, gross margins declined, but were basically in-line with street estimates. Margins had soared in recent years, and there certainly were a number of inflationary pressures out there. Losing a few million very profitable iPhone sales easily hurts your margin profile. The bottom line missed by 7 cents, but I don’t think that was too bad when you consider how bad the overall revenue miss was, especially given the iPhone number.

We have to remember here that Apple is not going out of business anytime soon. The company saw over $30 billion of free cash flow in the quarter. While that’s down a bit from last year’s $44 billion, some of it was the timing of working capital items, along with the decline in net income. Nearly $20 billion was spent on share repurchases, as management continues the greatest capital return plan in corporate history.

Going into the report, the average price target on the street was $168. Even if that comes down $5 to $10, you’re still talking about decent upside from the $145 level seen in the after-hours session. With production facilities back online, and China reopening in a big way, Apple’s sales should do better as we work through this year. On the conference call, management stated that Q2 should see a better growth profile. I also think the 2023 iPhone cycle will be a lot more impressive because last year’s two entry level models didn’t get chip upgrades as Apple further differentiated the product line.

In the end, Apple Inc. missed street estimates, but I don’t see this as a big surprise. We knew the dollar was strong, and we knew that the major iPhone production plant was significantly impacted during the quarter. Apple still managed to do over $117 billion in revenues and post a $30 billion profit, and yet investors seem to be disappointed. The business environment should improve a little as we move through 2023, especially in China, and Apple Inc. management is already talking about brighter days, so AAPL stock remains a good long-term hold in my opinion.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.