Summary:

- Alphabet Inc. reported results that missed estimates on both lines.

- Google’s revenue miss largely was the result of macro issues, but its profit miss was the result of overly high cost increases.

- The company will have to prove it’s able to become more efficient.

sutthirat sutthisumdang

Article Thesis

Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) (“Google”) reported its fourth quarter earnings results on Thursday afternoon. The company missed estimates on both lines, and while the company is still highly profitable, growth has been underwhelming and margins are moving in the wrong direction. In the long run, GOOG looks like a pick with massive potential, but the company will have to show it is serious about cost-cutting going forward.

What Happened?

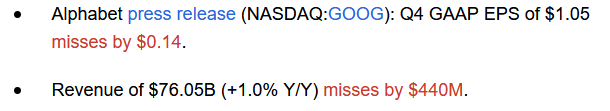

On Thursday afternoon, Alphabet released its fourth-quarter and full-year 2022 earnings results. These were the headline numbers:

Seeking Alpha

The company missed earnings per share estimates by around 15%, and revenues grew less than expected as well. At just above 0.5%, the revenue miss wasn’t very meaningful in relative terms, however, despite sales coming in more than $400 million below forecasts. The market’s initial reaction to the double miss was pretty negative, as GOOG trades down 5% after hours at the time of writing. That’s a very different reaction compared to the 20% gain Meta Platforms (META) experienced after reporting its Q4 results one day earlier.

Still Highly Profitable, But Some Issues

Delving into the results, let’s start out with something positive: Alphabet is still very profitable. The company generated $13.6 billion in net profit during the period, or ~$54 billion annualized. During all of 2022, Alphabet was even more profitable, as its full-year profit came in at $60.0 billion. This makes Alphabet one of the most profitable companies in the world, and naturally, there is no reason for concern when it comes to the company’s ability to self-fund future growth, etc.

On the other hand, it is important to note that Alphabet’s profits came in well below the level seen in the previous year’s quarter — net income declined by 34% year-over-year, from more than $20 billion in Q4 of 2021. How did that happen? Several factors were at play.

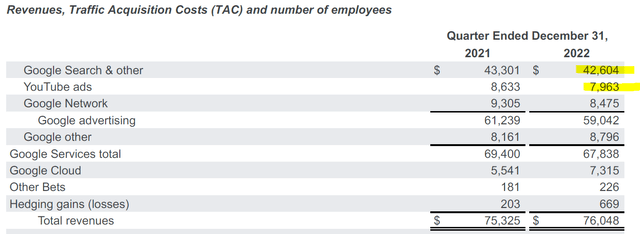

First, Alphabet’s business growth was rather underwhelming. Currency-neutral revenues were up 7% year-over-year, which is not equal to a standstill, but which isn’t especially exciting, either, considering inflation is high and when we account for Alphabet’s (former) status as a high-growth tech titan. The unspectacular business growth rate was the result of a pretty weak ad environment:

Google Search and YouTube ads both experienced declining revenue on a year-over-year basis. The declines weren’t especially large, but this was nevertheless a far-from-great result. The macro-environment plays an important role here. Consumers are squeezed by inflation, which is why their spending on discretionary goods such as electronics, apparel, and similar items has declined.

The businesses that sell these items know about this and are thus less willing to pay top dollar for advertising space on Alphabet’s platforms – after all, defensive consumers will not spend a lot of cash on discretionary goods even if the businesses that sell them were to spend heavily on advertisements. Some businesses also have come under pressure from inflation and are thus keen to keep costs in control, while the ongoing economic downturn has also made some businesses reluctant to spend on advertising.

All in all, the macro environment is harsh for advertisers such as Alphabet, as inflation and a potential recession are bad for its business. The economy isn’t Alphabet’s fault, of course, thus the company shouldn’t be blamed too much for it rather weak top-line performance.

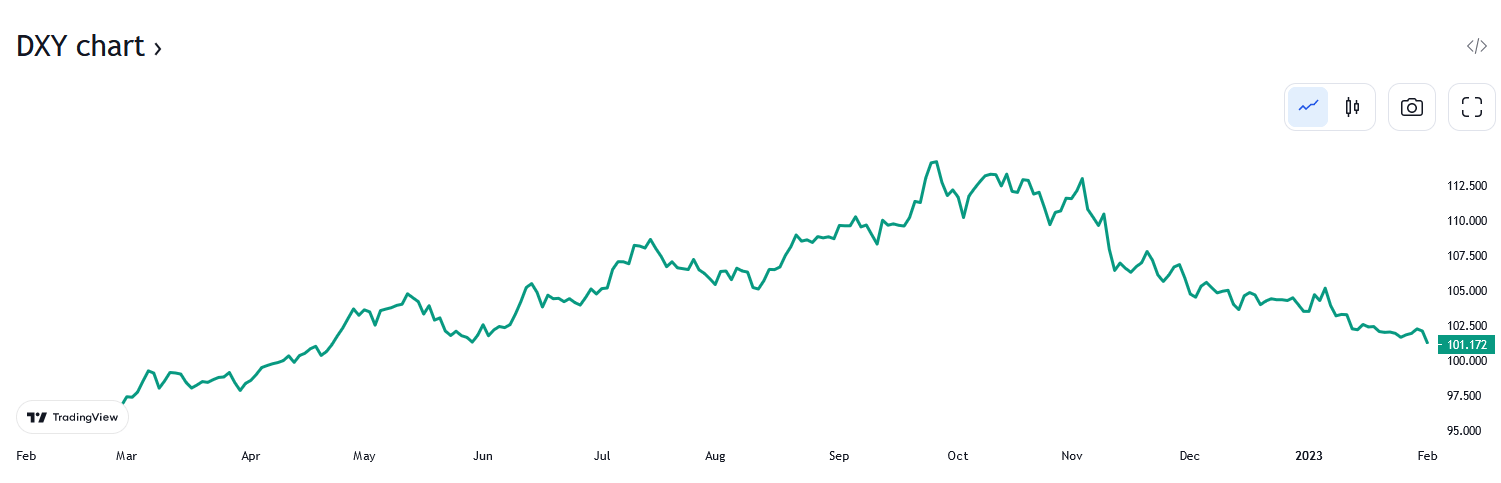

Another factor for the lowish revenue growth rate is the strong U.S. dollar. The U.S. dollar was considerably stronger in Q4 2022 relative to one year earlier against currencies such as the euro, the yen, and so on, which is why Alphabet’s vast non-U.S. revenues were worth less once denominated in USD. Currency rate headwinds resulted in a currency-neutral revenue growth rate of 7% being turned into a reported revenue growth rate of just 1% – the delta between these two, of 600 base points, is quite meaningful. The good news is that the U.S. dollar will not strengthen forever – it has, in fact, stopped strengthening in the second half of 2022:

tradingview.com

The above chart shows that the U.S. Dollar index peaked in October 2022 – not surprisingly, Q4 results were negatively impacted by currency rate changes to a large degree. In recent weeks, however, the U.S. dollar has weakened. If it remains where it trades today, currency rate headwinds will wane throughout the first half of the current year, and in the second half of the current year, currency rates would be a tailwind for U.S.-based companies including Alphabet. There’s no guarantee that currency rates remain how they are today, but it seems pretty likely to me that currency rates will be less of an issue going forward.

The two biggest factors for revenue growth being rather weak are thus macro items that are not controlled by Alphabet — a global economic slowdown that causes lower ad spending, and currency rate movements.

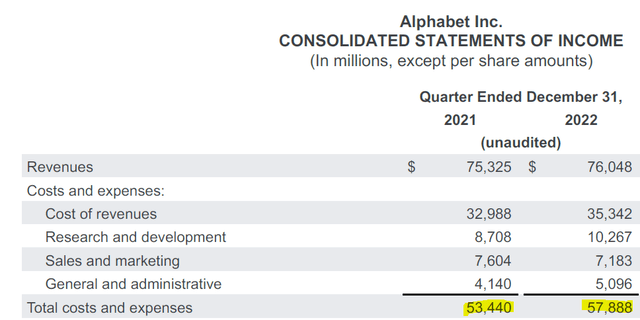

But does that mean that the things that were under Alphabet’s control during the period went well? Unfortunately, that’s not really the case. While GOOG couldn’t control the headwinds for its revenue, it was able to control its costs, and the company did not perform well in that area.

Despite revenue being up $700 million year-over-year, Alphabet’s operating income dropped by a hefty $3.7 billion over the same time frame. That’s the result of a sizeable cost increase:

Total expenses were up $4.5 billion. If Alphabet was still a high-growth tech company, that might be justified. But a company that is generating barely any growth shouldn’t see its expenses grow this drastically, I believe. After all, investors want to see companies grow their expenses less than their revenues, and GOOG has done exactly the opposite. Overspending has been an issue for major tech companies for a while.

To some degree, this was market-induced, e.g., when it comes to engineers demanding higher compensation due to scarcity. But GOOGL also made some decisions that were purely its own fault, such as over-hiring. Growing the headcount considerably without adding a lot of revenue growth isn’t generating shareholder value, and Alphabet’s recent announcement of major layoffs suggests that the company did indeed hire too many employees in the past — otherwise, there would be no room to fire some of them.

Big tech, including Alphabet, has been getting inefficient and bloated to some degree, and that hurts profitability now. Statements from management and the recently-announced layoffs suggest that executives have realized that change is needed, but at least through the end of the fourth quarter, that hasn’t yet materialized. Here are some noteworthy statements from the earnings release:

We have significant work underway to improve all aspects of our cost structure, in support of our investments in our highest growth priorities to deliver long-term, profitable growth.

It’s good that management is clear about its rather weak performance on the cost side in the recent past. Accepting that things have to change is the first important step in actually improving operations, I believe. And Alphabet also has initiated some changes already:

In January 2023, we announced a reduction of our workforce of approximately 12,000 roles. We expect to incur employee severance and related charges of $1.9 billion to $2.3 billion, the majority of which will be recognized in the first quarter of 2023. In addition, we are taking actions to optimize our global office space. As a result we expect to incur exit costs relating to office space reductions of approximately $0.5 billion in the first quarter of 2023. We may incur additional charges in the future as we further evaluate our real estate needs.

Reducing the headcount by 12,000 employees that were seemingly not generating sufficient returns is a good step forward, I believe. This move will cause some one-time expenses in the current quarter, but that should be more than balanced out over the following quarters and years. Optimizing the office footprint also makes sense and should reduce run-rate costs, even if it means that some one-time expenses will occur.

Still, Alphabet has not reported any improving results yet, and it wouldn’t be surprising if some investors remain in “show me” mode, staying on the sidelines until Alphabet has started to report improving margins. So far, that has not happened, although management seems to be willing to work on this issue.

Alphabet has drawn down some of its net cash position, which totaled $100 billion at the end of the quarter, versus $126 billion one year earlier. This was largely the result of massive buyback spending, which totaled $59 billion or close to 5% of the current market capitalization over the last year, and which was partially financed via its net cash pile, with the remainder being financed by the company’s free cash flows.

Final Thoughts

Alphabet remains very profitable and continues to operate with a great balance sheet. Its brand is strong and growth in areas such as the cloud business is healthy. Macro headwinds have caused a not-very-exciting sales performance, however, and costs are climbing too fast. While GOOG has seemingly started to work on the cost issue in Q1, this has not yet materialized in reported results. Thus, it is understandable when some investors prefer to stay away until GOOG has proven it’s able to improve its efficiency.

Today, GOOG shares trade at 19x this year’s earnings, or at around 18x this year’s earnings when we account for the net cash position. That’s not very demanding. Investors that are willing to believe in a successful cost turnaround might find the current Alphabet Inc. valuation pretty attractive. I hold a position and am willing to wait for an improving cost and macro picture. If that does not happen in the foreseeable future, I’d have to rethink my Google position, however.

Disclosure: I/we have a beneficial long position in the shares of GOOG, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!