Summary:

- The bear case for Exxon Mobil Corporation is based upon projections that in the past have been inaccurate.

- Analysts “forever” revise quarterly earnings and then still miss them. So a two-year projection even by consensus is not reliable according to research.

- Psychological research has shown that it is possible to have too much information so that decisions actually get worse with more information.

- Exxon Mobil Corporation management originally aimed to double earnings over about 6 or 7 years or so. A year like 2022 will speed up the process and eventually lead to a revised forecast.

- Exxon Mobil Corporation’s production growth will likely accelerate towards a 10% annual growth rate.

Philiphotographer

(Note: This article was in the newsletter on February 1, 2023.)

One of the more interesting things about any cyclical recovery is the sheer number of opinions about how Exxon Mobil Corporation (NYSE:XOM), and in fact much of the oil patch, is now fully valued or even overvalued. This is based upon the earnings forecast.

Exxon Mobil Earnings Forecast And Immediate History Of Beats And Misses (Seeking Alpha Website February 1, 2023.)

One of the things to note from all the “beats and misses” is that analysts rarely get the quarterly earnings correct. David Dreman in his book “Contrarian Investing Strategies: The Psychological Edge,” wrote that the more information available to us as investors, the more likely we are to go wrong. That is probably counterintuitive. But the fact is there is only so much information that our brains can process. If you have too much information for the brain, it obviously does no good. Many times, there is too much information available about stocks for us to process.

The result is really shown above. Analysts with plenty of information and resources at their disposal are forever adjusting earnings. Even with that, as shown above the beats and misses are really analyst earnings that turned out to be incorrect when the actual earnings were announced.

Once you see all of the information above, the next conclusion of the book is logical. The further out earnings are projected, the less reliable those projections are. Analyst estimates, which are not real accurate (as shown above) to begin with, obviously become fairly misleading over time.

This industry, in particular, has low visibility. If analyst earnings are something less than accurate on average, then they will not do much better with an industry as volatile as oil and gas.

In the case of oil and gas, the industry has had a very rough time since really 2015. The earnings projections shown above are a reflection of that rough time. In some ways, that is really good, as it is keeping speculative money out of the industry. As long as that is the case, then this recovery is going a lot further than the one in 2018. Now prices are volatile with low visibility. But most fundamental demand projections exceed supply in the long term. That is not a long-term bearish scenario for oil and gas prices.

Management Goals

The original goal obviously got a boost from the current fiscal year. More money means that management can do more things sooner. That is very likely to happen with Exxon Mobil Corporation.

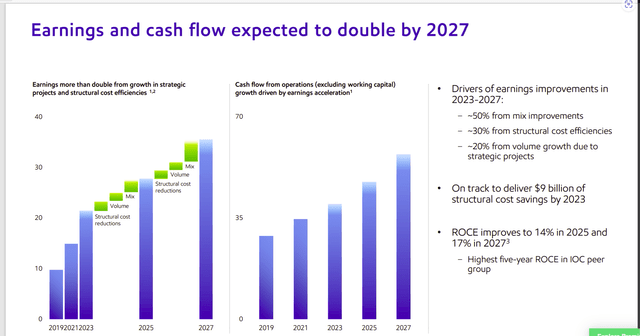

Exxon Mobil Plan To Grow Earnings (Exxon Mobil Corporate Plan Update December 2022, Corporate Presentation)

Even though a plan like this assumes far less volatile pricing, most managements take a gift like this past fiscal year and use it to further any growth plans.

There was growth despite some dispositions noted in the fourth quarter report. More importantly, Exxon Mobil Corporation management has plans to continue to grow.

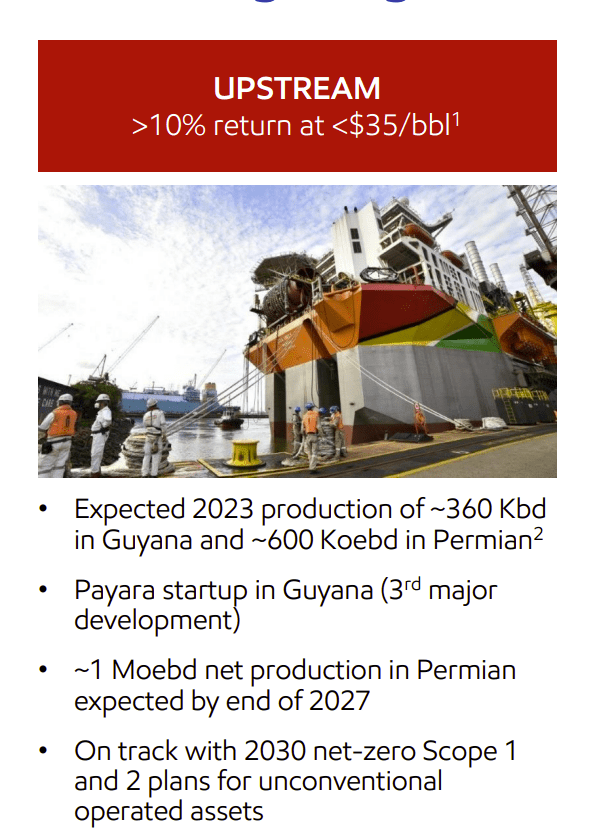

ExxonMobil Upstream Earnings Growth Plans For The Future (Exxon Mobil Fourth Quarter 2022, Earnings Slide Presentation)

The key is that new production is low-cost production. The Permian operation is far easier to ratchet up (and down) the activity because each well can be an independent project. Right now, management discusses Permian growth roughly in the 20% range. That is quite a rate of growth for a company the size of Exxon Mobil Corporation.

One of the things lost in the discussion is that management sold roughly $5 billion of non-core (and likely high cost) production. Anyone who is assuming that the corporate cost structure will not change has really got to review what just got sold and what is likely to get sold.

More importantly, management is replacing that sold non-core production (that is high cost) with lower cost production. Each year, this process will move forward the corporate goal of lowering the average breakeven cost. That will increase company profitability at lower oil and gas prices. It will be a gradual process. But it backs up the management idea that profitability is going to increase over time even in the absence of growth. Helping this process along was a little bit of low-cost growth.

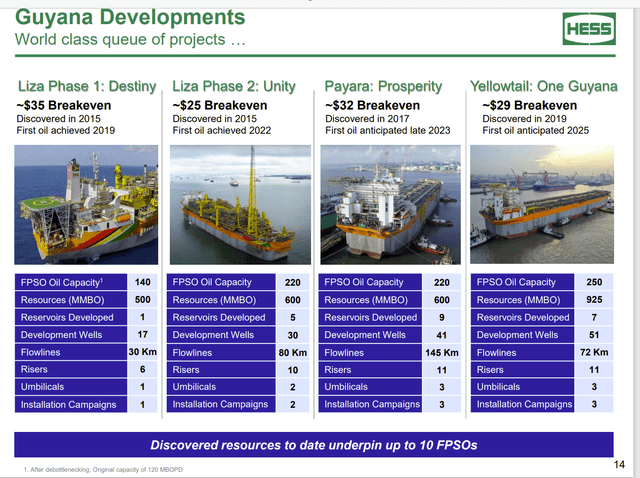

Hess Presentation Of Guyana Partnership With Exxon Mobil FPSO Plans And Approvals (Hess Corporate Presentation At Goldman Sachs Global Energy And Clean Technology Conference)

Not only is Exxon Mobil replacing the high-cost production with lower cost projects. But as shown above, this partnership has world-class lower-cost projects. Now, any large project, including this one, gets off to a slow start, but those FPSO’s shown above are soon going to be coming one a year.

Furthermore, there are other partnerships. Both Hess Corporation (HES) and Exxon Mobil have announced discoveries with other partnerships that are being evaluated either in Guyana or in neighboring Suriname. Now it is going to take about 5 years (at least) for those discoveries to get to the point where FPSO’s will be coming online. But it is also clear that there are more potential growth projects on the way both here and in other countries.

The Guyana partnership alone is largely expected to be about half of Exxon Mobil’s production by decade’s end. Given the size of Exxon Mobil, that is quite a statement, and it makes the Guyana discovery one of the largest in modern times.

Any company the size of Exxon Mobil has to start “years ago” planning for steady growth. Therefore, the growth this year, even in the low single-digits, is probably a sign that this management intends to get that growth rate up to about 10% over time through a series of large projects.

That is going to lead to a revaluation of the stock.

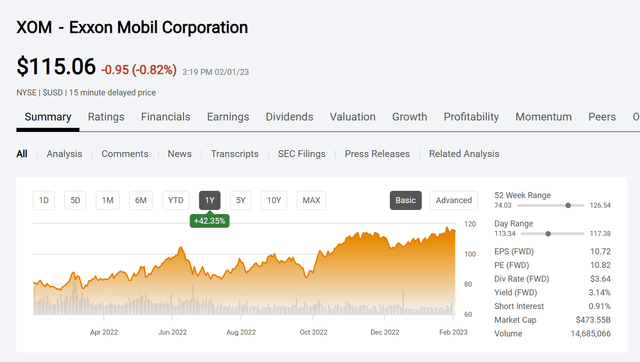

Exxon Mobil Common Stock Price History And Key Valuation Measures (Seeking Alpha Website February 1, 2023)

Clearly, the full-price argument is based upon declining earnings. However, management has a goal to grow earnings even though that growth is based upon lower commodity prices in the period shown above. But when a fiscal year like the current one comes along, this management simply sped up the process. For example, more ships could be added to Guyana and indeed another drill ship was added early in the fiscal year. The result was the most discoveries in a year ever.

But the other thing is the compaction of the time between FPSO deliveries. There appears to be a goal of one FPSO a year probably beginning with the 2025 delivery. That is a project that is likely to continue to grow more in the future because discoveries have not stopped (which would put an end to future growth).

Similarly, the Permian position has plenty of room for years of growth. Management is also exploring in Brazil and other parts of the world in the hopes of finding another Guyana. But all of this took years of planning. Now that the process is underway, shareholders should expect growth to accelerate, and that growth will be coming from lower cost (with very low breakeven points) projects.

Maybe everything will not come together exactly meaning there may be a time of pricing weakness before all the improvements boost the price of the stock more. But I have never been much of a market timer. I tend to be buy-and-hold until the story changes. Exxon Mobil Corporation stock is likely to be one of the better growth stories for a large company in the decade ahead.

Even though there will be commodity pricing years that are relatively down, the Exxon Mobil Corporation story is now one of income and growth. Personally, I believe that this will be a very different company by the end of the decade because of that income and growth story. So, for a buy and hold investor, Exxon Mobil Corporation is just getting started and there is far more to come. It is very likely that by the end of the decade, the current Exxon Mobil Corporation stock price will be a memory.

Disclosure: I/we have a beneficial long position in the shares of XOM, HES either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

I analyze oil and gas companies like Exxon Mobil and related companies in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.