Summary:

- Google/Alphabet Q4 2022 results were mixed, as indicated by the volatile share price, but we believe our investment case is progressing.

- Advertising revenues fell in dollars but likely grew by around 2% excluding currency despite difficult macro.

- Cost cuts have started and more are promised, but with slow and vague targets. A key investor is openly pushing for more cuts.

- Generative AI is likely an opportunity, ChatGPT is not a threat, and YouTube Shorts is growing views despite TikTok and Reels.

- With Google shares at $107.69, our reduced forecasts indicate a total return of 81% (22.6% annualized) by 2025 year-end. Buy.

JHVEPhoto

Introduction: Why Is Alphabet Stock Down?

Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) (“Google”) released Q4 2022 results on Thursday (February 2) evening. Shares initially fell 5% in after-market trading yesterday (after a 7% gain during the day), and are down 1% at $107.69 as of 11:40 EST today.

We initiated our Buy rating on Alphabet in January 2021. Shares have gained just 13% since then, after a decline of 26% since the end of 2021:

|

GOOG Share Price (Last 5 Years)  Source: Google Finance (03-Feb-22). |

(Alphabet has two classes of publicly-traded shares, A and C, with the same economic rights and similar prices; in this article, we refer to Class C share prices only.)

Q4 2022 results were mixed. Year-on-year, advertising revenues fell 3.6% in dollars but likely grew by around 2% excluding currency despite difficult macro. EBIT was down 17%, partly due to one-offs, and EPS was down 31%, partly due to mark-to-market investment losses and a higher tax rate. On costs, Alphabet has cut 6% of its headcount and promised further improvements, but with relatively slow and vague targets. Alphabet faces relatively few structural risks, with generative AI likely to be a positive, and YouTube Shorts is growing fast despite TikTok. Alphabet shares are at 21.8x 2022 EPS and a Free Cash Flow Yield of 2.3%. Our investment case is unchanged, but we have reduced our forecasts. We now expect a total return of 81% (22.6% annualized) by 2025 year-end. Buy.

Alphabet Buy Case Recap

We believe Alphabet can deliver a low-teens EPS CAGR on average for the foreseeable future.

The main driven behind EPS growth is a low-teens revenue growth generated by multiple businesses. We believe digital advertising in general and Google in particular will continue to grow faster than GDP over time. Search and YouTube are unique franchises with entrenched market positions, and the Google Network continues to show strong growth.

Google EBIT should grow faster than revenues over time, because it is a platform business with natural operational leverage. Google Cloud has been modestly loss-making by design, and should turn profitable eventually. EPS should grow faster than EBIT thanks to share buybacks. The value of Google Cloud and Other Bets, both currently loss-making, are not reflected in EPS-based valuation estimates.

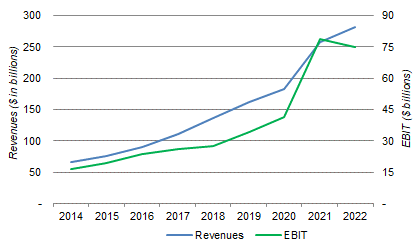

During 2022, revenue growth decelerated to levels lower than historical averages, after the strong boost from COVID-19 in 2020-21, and earnings declined because costs were decelerating less quickly than revenues:

|

Alphabet Revenues & EBIT (2014-22)  Source: Alphabet company filings. NB. Revenue figures excludes hedging gains & losses. |

Q4 2022 results showed a continuation of these dynamics, but also early results of management actions to counter them.

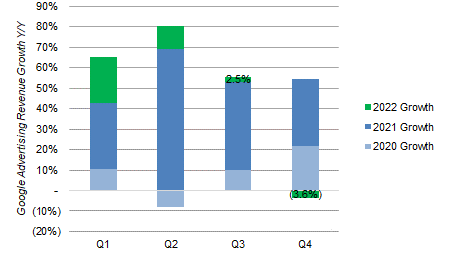

Ad Revenue Grew Around 2% Excluding FX

Including currency, Google Advertising revenues fell 3.6% year-on-year, compared to growth of 2.5% in Q3; in U.S. dollars, Q4 advertising revenues were 56% above 2019, compared to 61% above in Q3:

|

Google Advertising Revenue Growth by Quarter (Since 2020)  Source: Alphabet company filings. NB. Growth rates include the impact of currency. |

Assuming the same 6 ppt gap between reported and local currency growth for group revenues (+1% and +7% respectively), Google Advertising revenues likely grew by about 2.4% year-on-year excluding currency.

We see this as a solid performance in the context of difficult macroeconomic conditions. As CEO Sundar Pichai described on the earnings call:

“After a period of significant acceleration in digital spending during the pandemic, the macroeconomic climate has become more challenging … Our revenues this quarter were impacted by pullbacks in advertiser spend and the impact of foreign exchange”

Alphabet’s 3.6% ad revenue decline in Q4 was 0.6 ppt better than the 4.2% in the Meta Platforms (META) Q4 2022 results, though Alphabet’s 5 ppt sequential deceleration from Q3 (from +2.5% to -3.6%) was much worse than Meta’s 0.5 ppt (from -3.7% to -4.2%), likely reflecting Meta headwinds (especially Reels) that were present in Q3 but receded by Q4.

A review of segmental performance tells the same story.

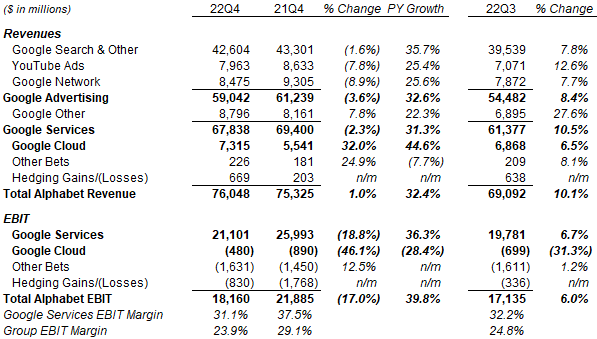

Alphabet Revenues & EBIT By Segment

Alphabet’s segmental figures show a generally solid business, albeit affected by currency and other macro headwinds; all segments had strong prior-year comparables, where revenues grew by between 22% and 45% year-on-year.

|

Alphabet Revenue & EBIT by Segment (Q4 2022 vs. Prior Periods)  Source: Alphabet company filings. |

Search & Other revenues fell 1.6% year-on-year in dollars but grew “moderately” excluding currency. The growth reflected increases in the Retail and Travel verticals (likely a post-reopening rebound), “offset partially” by a decline in Finance (attributed in prior quarters to higher interest rates dampening the demand for lending products).

YouTube Ads revenues fell 7.8% year-on-year and likely fell by a low-single-digit excluding currency. Management attributed this to “a broadening of pullbacks in advertiser spend in the fourth quarter.” Such advertiser pullbacks were first observed in Q2 and were then attributed to an “idiosyncratic” mix of factors, including supply chain and inventory issues at customers, as well as the Russian/Ukraine conflict (which impacted European macro).

YouTube Shorts has continued to grow, reaching average daily views of 50bn+, up from the 30bn figure disclosed on the Q1 2022 earnings call last April. This means time spent on YouTube is likely to have continued growing (as stated on the same Q1 call), despite the continuing presence of TikTok and the growth of Meta’s Reels.

Google Network revenues fell 8.9% year-on-year and likely fell by a low-single-digit excluding currency, with the decline attributed also to “a broadening of pullbacks in advertiser spend in the fourth quarter.”

Google Other revenues grew 7.8% year-on-year, with “strong” growth in YouTube subscription and hardware revenues, offset by a reduction in Play (app store) revenues following a voluntary halving of fee rates by Alphabet during 2022.

Google Cloud revenues grew 32.0% year-on-year, decelerating from 37.6% in Q4, but ahead of the 31% reported by Microsoft’s Azure and the 20% reported by Amazon’s (AMZN) AWS (albeit on a smaller base).

Google Services EBIT fell by 18.8% ($4.89bn) year-on-year, much more than the 2.3% decline in revenues, due to cost increases. A significant part of this is due to one-offs, including $1.2bn in hardware inventory-related charges that “reflect ongoing pricing pressures and changes in expected future inventory needs,” and an unspecified accrual to litigation charges. Excluding these, Google Services EBIT likely fell by 10-15% in Q4 (much better than Meta’s 46%).

Google Cloud EBIT shrunk by 46% year-on-year even as management continued to prioritize growth.

Other Bets made an operating loss of $1.63bn in Q4 2022. This included Deep Mind, which will be restated in future quarters as part of Alphabet’s corporate costs, “reflecting its increasing collaboration” with various Alphabet businesses.

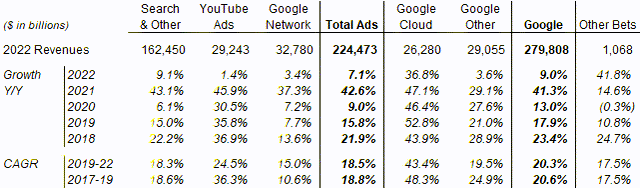

Long-Term Revenue Growth Continuing

For full-year 2022, Google Advertising revenues grew by just 7.1%, below 10% for the first time since 2020:

|

Alphabet Growth Rates by Segment (2018-2022)  Source: Alphabet company filings. |

The deceleration in ad revenue growth in 2022 was partly due to currency, and partly due to the strong growth in 2021. In fact, Google Advertising revenues had a similar CAGR of around 19% for 2019-22 as whole as it did for 2017-19, with Search having the same CAGR in both periods, YouTube Ads growing less quickly (but still at a 24.5% CAGR) and Google Network growing faster (at a 15.0% CAGR).

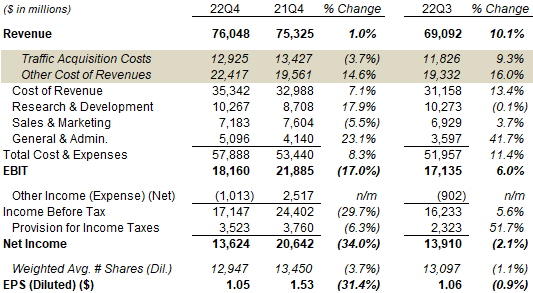

Alphabet Group P&L Headlines

Alphabet’s group P&L for Q4 2022 is below. EPS fell 31% year-on-year, much more than the 17% decline in EBIT:

|

Alphabet Group P&L (Q4 2022 vs. Prior Periods)  Source: Alphabet company filings. |

Q4 already showed the early results of better cost management. Compared with Q3, R&D costs were sequentially flat; Sales & Marketing costs were up 3.7%, likely due to seasonality (related to the holiday season); General & Administration costs were 23.1% ($956m) higher, likely due to the higher litigation charge accrual mentioned above.

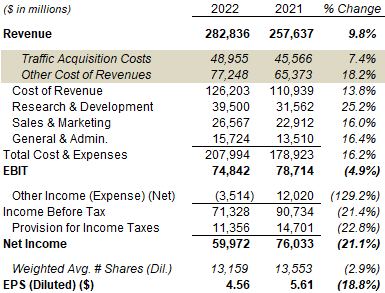

Alphabet’s group P&L for full-year 2022 shows a similar picture, with EBIT fall 4.9% year-on-year but EPS falling 18.8%:

|

Alphabet Group P&L (2022 vs. Prior Year)  Source: Alphabet company filings. |

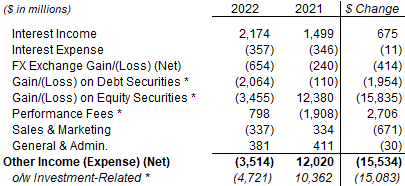

The difference between the two is a $15.5bn swing in “Other Income,” of which $15.1bn is due to related to Google’s investments in both debt securities (where it parks its cash) and equity securities (including its strategic investments), offset by lower accruals in performance fees:

|

Alphabet “Other Income” (2022 vs. Prior Year)  Source: Alphabet results release (Q4 2022). |

(A higher tax rate also contributed to the EPS decline in Q4, though not to that for the full year.)

The year-on-year declines in Alphabet’s EPS are in large part one-off and do not reflect its operational performance.

More Cost Savings To Come, Probably

Alphabet has started reducing cost growth and promised further savings, but with relatively slow and vague targets.

Q4 2022 headcount of 190k grew by just 3.5k sequentially, down from the 12.7k in Q3 and 10.1k in Q2. A reduction of 12k was announced on January 20, equivalent to 6% of the workforce, comparable to that announced at Microsoft (10k, or 5% of the workforce) though smaller than that at Meta (11k, of 13%).

Management has promised further savings, but in vague and mixed comments. For example, CFO Ruth Porat appears to have committed to growing costs less than revenues over time:

“When we talk about being focused on delivering sustainable financial value, that obviously means that expense growth cannot be growing ahead of revenue growth”

Further comments indicate that management is looking into more fundamental ways to “re-engineer the company’s cost base in a durable way,” as CEO Sundar Pichai put it. Porat set this out in more detail:

“On expense growth, we have a very strong commitment to, we can’t keep emphasizing, durably re-engineer our cost base, and that will benefit all of the segments across Alphabet … Slowing the pace of hiring as a starting point, product prioritization across Google, …improving economics in hardware, as we focus intently on the Pixel line and cost structure, then using AI and automation to improve productivity for operational tasks, as well as for the efficiency of our technical infrastructure … managing our spend … with suppliers and vendors and then optimizing how and where we work, and you saw part of that with the real estate consolidation”

Specifically on Google Cloud, management declared they “remain very focused” on the “path to profitability.”

However, it is unclear how much in savings or margin improvements management is actually targeting, management is only explicitly targeting a “slowing” of costs growth, not its reduction, and the full impact will not be visible until 2024 (and possibly not even then). Again, to quote Porat:

“Our efforts to deliver a durable re-engineering of our cost base in order to slow the pace of operating expense growth. We expect the impact will become more visible in 2024”

On costs, we take comfort from the general trend towards better cost efficiency in the Technology sector, including the involvement of high-profile activist investors in several key stocks, including PayPal (PYPL) and Salesforce (CRM)). Alphabet itself is already facing pressure from one longstanding investor, TCI, whose founder and CIO has publicly called for both a 20% cut in Alphabet’s headcount and employee compensation to be “materially” reduced. TCI has been an Alphabet investor since 2017 and owned $6bn+ of stock as of November 2022.

2023 Outlook

Alphabet did not provide much in specifics in its 2023 outlook. On revenues, management seemed to be hinting that 2022 growth rates were low due to unusual factors, thus implying a return to higher growth in 2023, but they also talked about “ongoing” macro headwinds. There is likely too much macro uncertainty for predictions.

The only explicit outlook figures are for CapEx, expected to be “”generally in line with 2022,” and restructuring charges, expected to be $1.9-2.3bn for severance and $0.5bn for office consolidation in Q1.

Depreciation charges are expected to see a $3.4bn benefit from another accounting estimate change of the useful lives of server and other equipment (the last change was in 2021 and generated a $2.6bn benefit).

For 2023, we assume 5% in revenue growth and costs equal to the 22Q4 run-rate, which imply a 10% ($6bn) Net Income decline year-on-year. A small reversal of the 2022 investment losses ($5.5bn) give a flat Net Income overall.

Generate AI As Opportunity, Not Threat

Generative AI, as represented by the high-profile ChatGPT app, is not a threat but an opportunity for Alphabet.

We do not believe ChatGPT will threaten Google Search. Google has a well-established, possibly unsurpassable lead in data about websites and its users, and we believe its generative AI technology is at least as good as ChatGPT. Any product that ChatGPT can be built into, Google can do better. For ChatGPT to be a threat, therefore, it must be a product that is not only better than Google Search but also impossible for Alphabet to replicate while maintaining its current economics. Some people argue that ChatGPT can win over consumers by presenting a single “best” answer instead of the multiple links that consumers today get from Google Search. We do not believe this is realistic – for purchase-related searches that carry most ad loads, the definition of a “best” answer is subjective and consumers will prefer choice.

Alphabet management comments on the call support our view. Google is already using Large Language Models (“LLLs”) (the sort that power ChatGPT) to help advertisers target brad matches rather than exact key words, which can improve conversions in advertising campaigns by an average of 35%. Alphabet will be making its own LaMDA (“Language Model for Dialogue Applications“) and PaLM (“Pathways Language Model“) language models publicly available “in the coming weeks and months,” and will “very soon” allow people to “interact directly with our newest, most powerful language models as a companion to Search in experimental and innovative ways.” It is also working to bring LLLs to Gmail and Google Docs.

New Anti-Trust Lawsuit No Game Changer

The U.S. Department of Justice and several state attorneys general launched a new civil anti-trust lawsuit against Alphabet in January, alleging that Google monopolizes key advertising technologies used by publishers and advertisers.

We are relatively relaxed about this lawsuit for a number of reasons. One, because we believe Alphabet management has the integrity and access to legal expertise to act lawfully at all times. Two, because the remedies explicitly sought by the lawsuit, including damages and the divestiture of Google’s Ad Manager and ad exchange, are limited in scope. In the event of a legal defeat, we believe there will be some damage but not enough to change our investment case.

U.S. regulators are involved in lawsuits against perceived anti-trust behavior on a number of fronts, and Alphabet is far from the only target. We also take comfort from Meta’s legal victory this month against the FTC on its proposed acquisition of virtual reality start-up Within Unlimited (the FTC is appealing).

Valuation: Is Alphabet Overvalued?

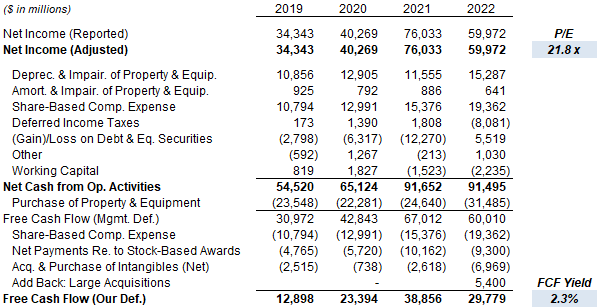

With shares at $107.69 as of 11:40 EST, Alphabet stock has a 21.8x P/E and a 2.3% FCF Yield:

|

Alphabet Net Income & Cash Flows (2018-22)  Source: Alphabet company filings. NB. $5.4bn for the acquisition of Mandiant in Sep-22 excluded from FCF. |

The P/E multiple and FCF Yields are both indicative only, as they contain too many moving parts.

The P/E multiple is based on 2022 earnings that include the impact of one-offs such as $5.5bn of losses on investment securities and higher litigation charge accruals, and is detracted by losses in Google Cloud and Other Bets.

The gap between the $60.0bn Net Income figure and our $29.8bn FCF figure is primarily due to CapEx exceeding depreciation and amortization by about $15.6bn, tax payments related to equity awards of $9.3bn and increase in deferred income taxes of $8.1bn, offset by $5.5bn of non-cash investment losses. The cashflow related to deferred income taxes is likely one-off, and payments related to equity wards may fall with cost cuts.

Share buybacks totaled $59bn in 2022, equivalent to 4% of the current market capitalization. The average share count was down 3.7% year-on-year as of Q4 2022.

Alphabet Stock Forecasts

We reduce our 2023 forecasts and exit multiples to reflect worse-than-expected macro headwinds.

Our key assumptions now include:

- For 2023, Net Income to be flat (was up 10%)

- From 2024, Net Income to grow at 12.5% each year (unchanged)

- From 2023, share count to fall by 2.5% a year (unchanged)

- P/E at 30x at 2025 year-end (was 35x)

- No dividends (unchanged).

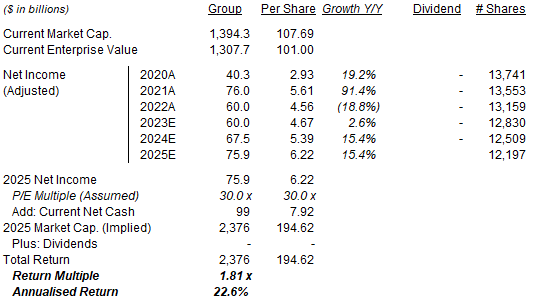

Our new 2025 EPS forecast is $6.22, 6% lower than before ($6.61):

|

Illustrative Alphabet Return Forecasts  Source: Librarian Capital estimates. |

With shares at $107.69, we expect an exit price of $195 and a total return of 81% (22.6% annualized) by 2025 year-end. Our returns are roughly split 50/50 between earnings growth (from a 2022-25 EPS CAGR of 11%) and an upward valuation re-rating.

Conclusion: Is Alphabet A Buy?

We reiterate our Buy rating on Alphabet stock.

Disclosure: I/we have a beneficial long position in the shares of GOOG, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.