Summary:

- It has now been almost a year since Meta released its troublesome earnings report that unleashed a wave of selling pressure that haunted the social media giant until October.

- Turn the page a year later, almost to the date, and the pendulum has completely swung the other way, kicking the social media giant’s price up by almost 25% today.

- While it remains true that strong course-correcting actions were taken by Zuckerberg and his team, one might argue that the initially charted course largely stayed the same.

- The nuances between Dr. Strangelove and Mark Zuckerberg grow thinner by the day, as investors simply have to learn how to love his proverbial “red button” called the Metaverse.

- In the end, we can only appreciate Mr. Market and his willingness to offer us a piece of such a brilliant business as the FoA for the better part of the last year.

Chip Somodevilla

A cornerstone of the efficient market theory is that asset prices, or in our case, share prices, tend to appropriately reflect all available information at a given time, thereby limiting the capacity of an individual investor to effectively capitalize on the spread that may exist between the intrinsic value and the market price of a given individual security. In other words, the notion that “everything is always priced in” remains a strong one in modern investing.

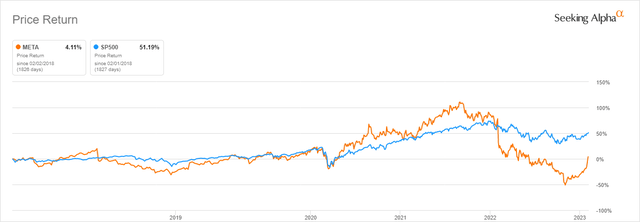

However, it is interesting to reflect back on the hypothesis if we are to take Meta’s (NASDAQ:META) price action over the course of the last year into consideration. In less than a year, the market went from being willing to price Zuckerberg’s social-media empire at $323 per share to kick the share price back to 2015 level double-digit prices, only to price it back to somewhere in between as of the writing of this article. This speaks volumes of the irrationality present in the markets today.

If the market is willing to swallow and spit out three-quarters of the company’s market capitalization, pricing what is essentially a social media monopoly at $240 billion at one point, the prudent capital allocator believes that Zuckerberg has little choice but to signal the irrationality back at the markets by announcing a $40 billion buyback, spending little more than one and a half year’s worth of free cash flow to buy-back almost 12% of the float. Is there a better way to signal to the market that common sense has been lost somewhere in between? Actions like these emphasize the fundamental strengths of the company and once again signal that the market has been substantially underestimated and the king of social media which in our view still represents one of the finest investment opportunities.

Meta vs S&P 500 5-year return (Seeking Alpha)

Reflecting on the “positive” earnings

It is truly an interesting story of how we arrived at this point. A business that had a market valuation of over $900 billion at the beginning of the year ended the same with a market cap of one-third of the former size. This was caused by the release of a very troublesome earnings report that brought forward a series of fundamental issues with the company’s business model. It served to unleash a wave of selling pressure that haunted Meta until last October.

Turn the page a year later, almost to the date, and the pendulum has completely swung the other way. A relatively strong earnings report given the ongoing circumstances has impressed markets and kicked the social media giant’s share price up by almost 25% in a single day. While we had a very eventful year, to say the least, one still has to ask, how much did things really change? While it remains true that strong course-correcting actions were taken by Zuckerberg and his team, one might argue that the initially charted course largely stayed the same.

The difficult macroeconomic environment still poses significant risks for the business, especially given the problematic ad market that haunts Meta’s top line. Given that Facebook and Instagram growth is slowing, the company is still forced to find new ways to monetize products like Messenger or WhatsApp. On the other end, TikTok’s influence grows as it seems to captivate users around the globe, just as Apple’s (AAPL) iOS privacy changes force the firm into overdrive in terms of spending their way around the problem. On top of all that, Mark Zuckerberg still likes and pursues his Metaverse project.

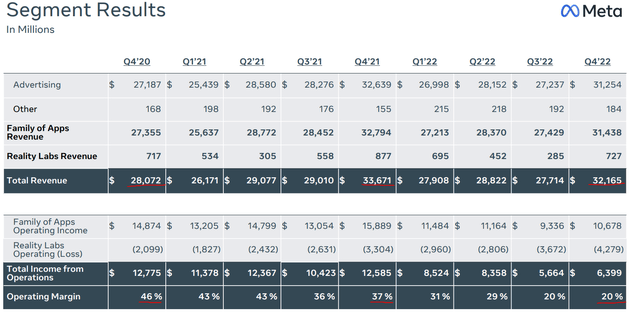

Segment Results (Meta Q4/FY ’22 Presentation)

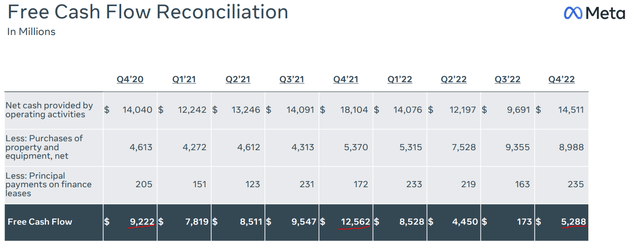

The financial aspect of the report offers us more of the same. Revenues are declining amid a difficult environment, with FX headwinds only adding further to the headache. For the fourth quarter and the entire year 2022, revenue was $32.17 billion and $116.61 billion, down 4% and 1%, respectively, from the previous year. Margins are getting thin as spending heads through the roof with Meta trying to launch the metaverse and circumnavigate the monetization and privacy-related issues from the Family of Apps at the same time. The operating margin is down by almost half year-over-year. Free cash flows were once again hidden underneath all of that spending, with the company clocking in at $5.3 billion for the quarter and $18.73 billion for the full year.

So, while I would overall argue that the report was in fact positive, other than the tone and a couple of important nuances, the situation is not significantly different from the one from last year. In other words, the argument here leans more toward last year’s crash being somewhat of an overreaction than the current jump being unwarranted. Be that as it may, one may only thank Mr. Market for the opportunity to buy such a great business at the prices offered in ’22 and turn the focus over to the true highlights of this year’s fourth-quarter results.

Free Cash Flow (Meta Q4/FY ’22 Presentation)

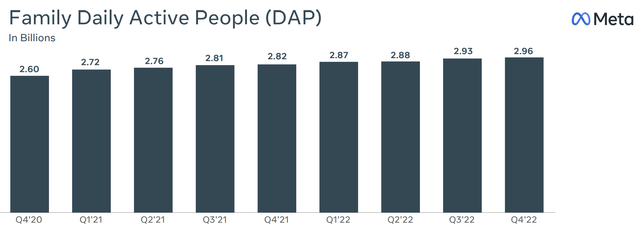

The growth of the app family has been slowing for a while now, and I’ve been waiting for it to reverse, but I’m always surprised by the results. The world’s population according to the latest reports is estimated to be close to or slightly over 8.00 billion people. From that number, some 5.16 billion of whom, or 64.50% have access to the internet, while 4.76 billion of them, or 59.50% are actively using social media. In a vague sense, we could define any of these three as Meta’s total addressable market.

As per the latest report, the company’s Family of Apps ecosystem managed to reach 2.96 billion daily active people (DAP) and 3.74 billion monthly active people (MAP). We are discussing a 78% penetration on a monthly basis and a 62% penetration on a daily basis. How many companies in the world can get behind such numbers?

Daily Active People (Meta Q4/FY ’22 Presentation)

It is truly fascinating to comprehend this statistic. From where we stand today, expecting any further growth from the Family of Apps would be simply asking for too much. I would be perfectly satisfied if Meta would simply work on new ways to monetize its platforms and enhance the current ARPP of the platforms, which at the moment stands at $8.63.

Another brilliant aspect of the earnings call worth discussing is that management seems to have finally listened to the growing outcry and has cut back on planned spending for 2023. Total expenses are expected to come in lower by some $3 billion, while planned CapEx has been cut back by some $4 billion. To draw a direct comparison, in 2022, $32.03 billion was spent on capital expenditures, nearly doubling from 2021.

We anticipate our full-year 2023 total expenses will be in the range of $89-95 billion, lowered from our prior outlook of $94-100 billion due to slower anticipated growth in payroll expenses and cost of revenue. We expect capital expenditures to be in the range of $30-33 billion, lowered from our prior estimate of $34-37 billion…Substantially all of our capital expenditures continue to support the Family of Apps.

Susan Li, CFO – Q4/FY ’22 Earnings Call

There has also been a lot of discussion about the quality and execution of the buy-back program. As we all know, the company began buying back significant amounts of stock in recent years, but the execution has been heavily criticized.

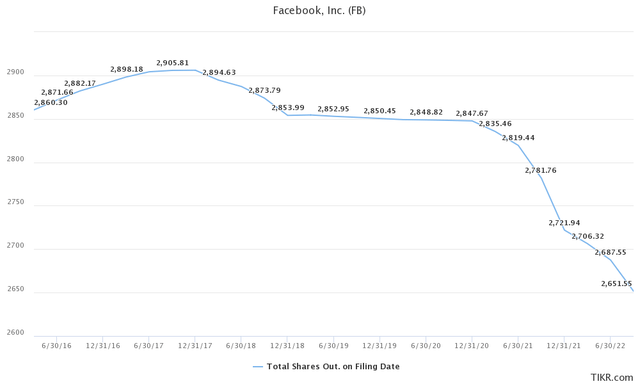

Shares Outstanding (TIKR Terminal)

Management caught most of the heat by “wasting” dozens of billions on buybacks while the company traded in the $200-300 range, which in retrospect looked terrible given the price action as of late. Still, not many would be willing to argue against the $6.91 billion spent on repurchasing Class A common stock in the fourth quarter, which rounds up the entire year’s number to $27.93 billion.

The shares’ outstanding figure peaked back in the fourth quarter of 2017 when Meta revised its course and committed to strong and dedicated share buyback programs. The effects of the programs are clearly visible and felt by the shareholders, unlike perhaps what is the case with some other high-ranking tech companies, without wanting to point any fingers. Meta bought back some 10% of the float, considering it currently reported 2.62 billion shares. With an additional $40 billion in his toolbox, Mark Zuckerberg should be able to buy back roughly 12% of the float, assuming no further upside action occurs.

Still an attractive valuation

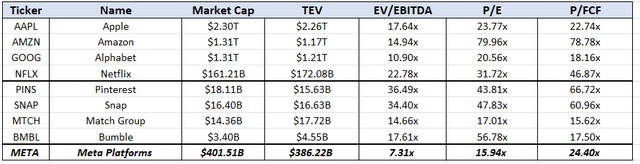

After putting the disastrous year behind them, the company has become one of the best-performing stocks in 2023, up nearly 52% year to date and 115.90% since its October lows. To draw a comparison, the S&P 500 (SPY) posted a refreshing 8.69% positive year-to-date result. Even after such a huge jump to almost $200 per share, Meta’s valuation remains one of the most attractive aspects when contemplating a possible investment in the social media behemoth. After essentially doubling in price in little more than a couple of months, the market is valuing the company at a relatively attractive 7.31x NTM EV/EBITDA, 15.94x NTM P/E, and 24.40x NTM P/FCF, at least given average analyst expectations.

I want to discuss my management theme for 2023, which is the Year of Efficiency. We closed last year with some difficult layoffs and restructuring some teams. And when we did this, I said clearly that this was the beginning of our focus on efficiency and not the end. And since then, we have taken some additional steps, like working with our infrastructure team on how to deliver our roadmap while spending less on CapEx…But my main focus is on increasing the efficiency of how we execute our top priorities. So I think that there is going to be some more that we can do to improve our productivity, speed and cost structure. And by working on this over a sustained period, I think we will both build a stronger technology company and become more profitable.

Mark Zuckerberg, CEO – Q4/FY ’22 Earnings Call

Meta vs Competitors Valuation (Author Spreadsheet IQ Capital Data)

But from my point of view, with Zuckerberg placing the emphasis back on “efficiency,” these estimates might ultimately prove to be somewhat conservative. The consensus places Meta far below the average of the “FAANG” stocks such as Alphabet (GOOG), Amazon (AMZN), or Netflix (NFLX), but also, perhaps more interestingly, far below “newcomers” in the social media space such as Pinterest (PINS) or Snap (SNAP). This indicates that there is likely some further upside to be unlocked as Mr. Market realigns its views on the social media giant.

Closing Arguments

Stanley Kubrick’s 1964 award-winning cult classic “Dr. Strangelove How I Learned to Stop Worrying and Love the Bomb,” tells us a story about what could happen if the wrong type of person gets to push the wrong type of button and how the rest of us simply have to find a way to live with it. In relation to our little situation, one might conclude that investors have simply grown fond of and learned to appreciate all the particularities and challenges that surround Mark Zuckerberg and his proverbial “red button,” called the Metaverse. In the same manner, in which the characters from the previously mentioned comedy have to learn to live with the outcomes of the catastrophe, Meta investors will have to cope with the fact that the Metaverse is here to stay, at least for the upcoming decade.

That is the only way we could get hold of the Family of Apps ecosystem, which in our analogy might serve as the proverbial mine shafts, allowing the rest of us to endure a decade of potentially wasted capital. Still, one might further conclude that Zuckerberg proved time and time again that he is a much more efficient leader than the market gives him credit for. His somewhat unlikable personality, combined with a laser-sharp focus on his pet project, attracted a storm of negative coverage and threw the focus of the discussion from what really matters. Various scandals over the years have not helped much either. When we collapse things down to the bottom line, we find a fundamentally undervalued business serving more than 3 billion people daily across the world that carries significant upside potential and seems to be valued by the market at 60 cents on the dollar.

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.