Summary:

- Meta’s cost-cutting and large share buyback are one-time fixes, not to be repeated.

- Management needs to directly address the Reality Labs spending disaster and pray for a stronger digital ad market later in 2023.

- This week’s spike above $190 a share has opened a golden opportunity to lighten up on Meta holdings, in my view.

Chip Somodevilla

I know this week’s Meta Platforms (NASDAQ:META) earnings report has been widely spun in a positive direction on Wall Street. It has the feel of a bullish turnaround story. A huge share buyback of $40 billion was announced (roughly equal to all cash and short-term investments held at the end of December), which should prop up the share quote for months, if not longer, at a higher price than would have been attainable on its own. In addition, some cost-cutting with 13% of the workforce recently laid off appears to appease many critics of the company, as operating sales stagnate and income slides. Low single-digit growth in user counts was also a welcome development.

What Makes Me Nervous?

For me, moving my rating of the company from Hold to Sell is the logical conclusion, following the rush of emotional buying on a mixed earnings report (if truth be told). Why do I view the glass as half empty, when investors rush to believe it is nearly full?

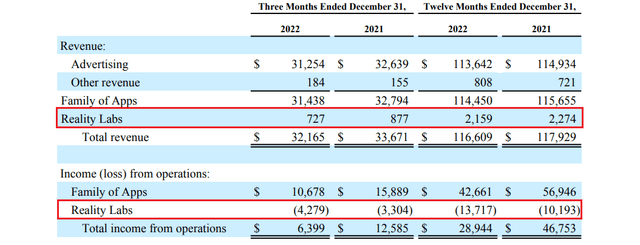

I can easily spin the Q4 2022 report in the other direction. For starters, the Reality Labs division continues to be an abject failure, losing another $4.3 billion in shareholder capital over the final three months of 2022 (boxed in red below). Founder and CEO Mark Zuckerberg’s pet project has been a major drain for Meta owners, many of whom would rather the company focus on its hugely successful social media Facebook and Instagram assets. Amazingly, Reality Labs revenue declined (boxed in red) at the same time as spending jumped vs. 2021, with no guarantee any significant interest by consumers and businesses is around the corner.

Meta Platforms, Q4 2022 Earnings Release

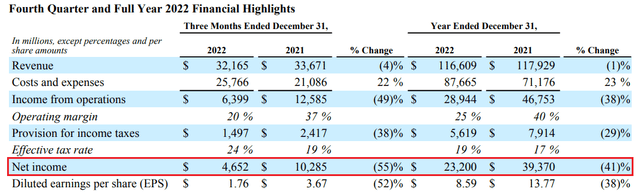

A mind-blowing increase of $10.7 billion in total research & development spending to $35 billion during 2022 happened concurrently as the online ad market took a major hit! The result was a -41% decline in company earnings for the year (boxed in red below). That’s not exactly something to get excited about.

Meta Platforms, Q4 2022 Earnings Release

For sure, being on the receiving end of a 25% pop in price during one trading session Thursday is something to celebrate. It’s honestly hard to envision the stock reversing lower back toward $150 in the coming months, refilling the monster price gap created. Yet, I believe that is what will play out as the U.S. economy struggles to grow this year, and the online ad market remains a difficult space to operate.

Weak Technical Trading Pattern

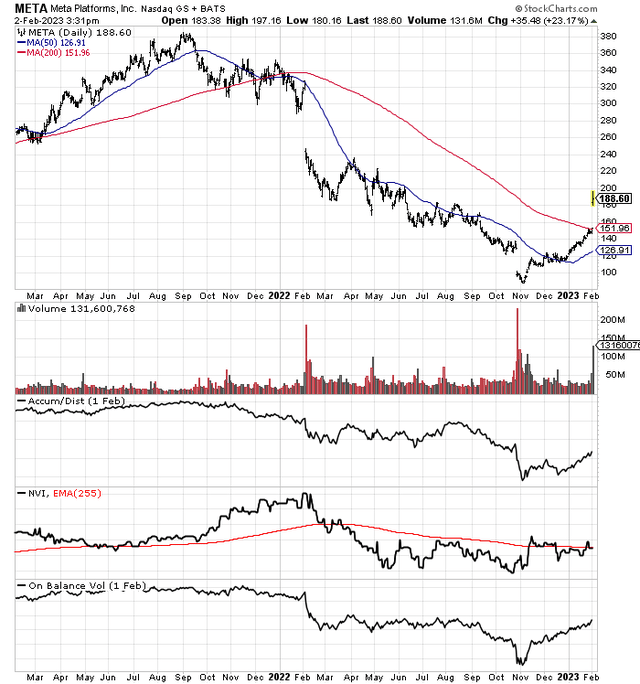

The momentum trading pattern was actually quite weak going into the earnings announcement. My read of the price spike is it is more of a “relief rally” from a deeply oversold condition. After a wicked -80% plunge in value, the double in price off November’s bottom has opened a chance for long-term owners to reevaluate if they want to continue as silent partners (effectively) in Zuckerberg’s technology business ambitions.

Today’s upmove brings Meta’s stock price back to the same level as June, but still down a whopping -50% from September 2021.

StockCharts.com – Meta Platforms, 24 Months of Daily Price & Volume Changes

More Sell Logic

Here’s my bottom-line assessment. Investors and Wall Street analysts are overreacting to the cost-cutting and share buyback ideas. My gripe is once the $40 billion in cash is spent to repurchase shares, there are no guarantees this financial flexibility will return in the future. My estimate is shareholder equity would be reduced by a good $32 billion from $126 billion at the end of December, assuming prices paid are $188 per share (not including the positive effect of new income coming in the door during 2023). Plus, tangible book value could decline from around $105 billion to $73 billion, all other variables staying the same.

Against the current equity value approaching $500 billion, this $73 billion net hard asset number starts to look quite insignificant (7x price to tangible BV), especially considering the valuation argument at November’s bottom of $250 billion in market trading worth vs. $105 billion in tangible book value (2.5x ratio), largely centered in risk-free cash.

The “last” piece of the financial engineering puzzle left to cut is the crazy investment in Meta’s virtual-reality project. This should have been the first place to cut fat, not the last, which is the main reason I would sell and avoid Meta Platforms for the time being. Zuckerberg is effectively dumping loyal employees and spending tens of billions in past profits to prop up the Reality Labs division and the stock price (pumping Zuck’s net worth over the short run).

In my opinion, if you wanted to draw out the wrong way to react to 2022’s struggles, it would be the Zuckerberg response over the last three months. I don’t trust his judgement, and he owns majority voting control of the company, through special voting shares.

The risks to Meta ownership are: (1) a recession appears this year, hurting online advertising demand and company sales further, (2) intense competition from social media and online platforms might prevent company growth from beating basic inflation increases in the world economy, and (3) Zuckerberg doesn’t really care about slashing Reality Labs’ expenditures, keeping pressure on earnings far into the future.

What’s fascinating to me is he just pushed through an increase in authorized share counts to pay employees with stock instead of cash. The 8% to 10% share buyback (reduction) announcement yesterday was clearly not enough for whatever Zuck is planning next for the company. Maybe a large dilutive acquisition is on deck?

Share-based compensation rose to nearly $12 billion last year, meaning Meta needs to spend the same amount annually just to keep outstanding ownership unit counts from rising (diluting existing owners if you don’t repurchase this minimum number). In essence, we are looking at a $28 billion share buyback equal to roughly 6% of equity capitalization at $188 per unit.

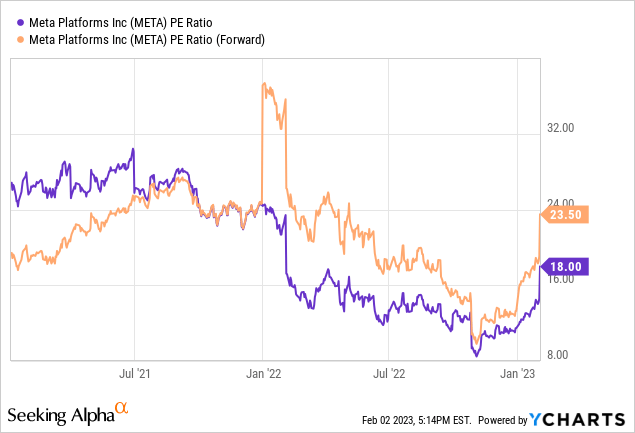

18x forward and 23x trailing EPS are not exactly cheap for a struggling business, either. Sure, 10x future results under $100 per share in November were defendable with some mathematical argument. I placed a Hold rating on the company at the time, because of the chance for a sharp price rebound on cost-cutting potential at the company. Nevertheless, paying double for the stock now has quickly stretched the low valuation thesis. With existing cash promised to be used on buybacks and tons of employees kicked out that actually produced value for the operating business, the easy ammunition to quickly engineer even higher quotes and a healthy growth business has been exhausted.

YCharts – Meta Platforms, Price to Earnings, 2 Years

Final Thoughts

My view is absent an improving economy, prices close to $200 do not offer much underlying logic for ownership, unless the Reality Labs mess is confronted and defeated. Zuck has to slash virtual-world losses by at least half (running at $14 billion annualized now) sooner rather than later. If he is able to do such, $250 a share is a real-world possibility. Otherwise, Meta Platforms may be stuck between $200 and $140 for the rest of the year.

Had the Metaverse idea never been acted upon (getting tens of billions in cash back), I figure the Meta stock quote would be trading comfortably between $250 and $300 today. So, if you are bullish and holding the stock, you are betting the digital ad market improves with a growing economy, Meta will slash spending on Reality Labs, or the virtual-reality push will be a roaring success in 2023-24. I believe all three variables have a low probability of success.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations, and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks or estimates herein are forward looking statements and are based upon certain assumptions and should not be construed to be indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author’s opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author’s best judgment at the time of publication, and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.