Summary:

- Disney+ and the DTC segment is likely to achieve positive operating income before depreciation and amortization in the fiscal quarter ending June 30, 2024.

- New The Walt Disney Company films such as MCU movies for 2023 have great box office potential and will likely generate over $5-600 million in ticket sales each.

- Disney’s Parks and Experiences department had an impressive 73% increase in revenue in 2022, and investors could see further revenue growth in 2023.

- Linear Networks revenue will likely stagnate or decline by 3-4% by the end of 2023 as the consumer and ad spending trend changes.

FelixCatana

Investment thesis

The Walt Disney Company (NYSE:DIS) is reporting its next quarterly earnings next week (February 8 premarket). In this article, I try to give a realistic expectation for investors buying or already holding DIS what to expect for 2023 in its different revenue segments. I believe DIS has a strong economic moat, has significant upside potential, and the stock is undervalued. Even in case of a recession or declining consumer confidence, I believe the company can stay strong and its different revenue streams can compensate for the potential revenue decline in some segments such as linear networks.

What to expect from Disney in 2023

Direct to Consumer

According to the SVOD Forecasts Update report by Digital TV Research, Disney+ will acquire 146 million new subscribers worldwide between 2021 and 2027 (part of this already happened), whereas Netflix will add 60 million over the same period. Approximately 106 million people from 13 Asian countries will be signing up for Disney+ through their access to the Hotstar brand. This also means that Disney has the potential to add 30-40 million subscribers across its streaming services – Disney+, Hulu, and ESPN+ – in 2023, then the growth will start to slow down by the end of 2023 beginning of 2024.

As part of its plan to be profitable through streaming services by 2024, the company has indicated that it will focus more on generating returns. It means raising prices (what they did last December) and controlling the growth of content costs (what they are focusing on right now), yet subscriber numbers are still expected to be a major factor in their goal of achieving success. The Disney management anticipates that losses incurred by the Direct-to-Consumer (DTC) business would reduce over time, and Disney+ is projected to become profitable in the fiscal year 2024 unless there is significantly less consumer spending and economic slowdown. Investors should anticipate an uptick in subscriber numbers and a gentle rise in content costs in the upcoming quarterly results as Disney aims for profitability. According to Wells Fargo, Disney+ and the DTC segment is likely to achieve positive operating income before depreciation and amortization in the fiscal quarter ending June 30, 2024.

Disney’s latest pricing model in the U.S. makes the Disney Bundle, consisting of Hulu and ESPN+, even more, appealing to purchasers. Leadership appears to be actively pushing for bundle packages, as it helps with customer retention rates. In addition, we do not know anything about the success or failure of the newly introduced ad-supported tiers, which can be a pleasant surprise for investors if the numbers come in as projected previously in 2022. We will see the first impressions and ad revenue numbers soon in their quarterly earnings, and I am certain that in the earnings call the new ad-supported tier will be mentioned several times and investors will be given further details and future expectations from Bob Iger.

Movies and content sales

Box office revenues will support Disney in 2023 as well. The last quarter finished strong with the new Avatar movie. Walt Disney’s Avatar: The Way of Water recently made cinematic history by being the sixth movie to reach $2 billion in global box office revenue. It joins an illustrious club of movie successes such as Avatar, Avengers: Endgame, Titanic, Star Wars: The Force Awakens, and Avengers: Infinity War. At the beginning of 2023, Phase 5 of the Marvel Cinematic Universe was launched. Ant-Man’s sequel is coming up within weeks, and this will be followed by Guardians of the Galaxy Vol. 3 in the summer, both of which have great box office potential and likely generate over $5-600 million in ticket sales. Disney stands a good chance of achieving a $1 billion box office success with the release of The Little Mermaid. Live-action remakes have been quite successful in the past, and both 2019 releases crossed the $1 billion mark.

Parks and experiences

Disney’s Parks and Experiences department had an impressive 73% increase in revenue in 2022, allowing them to return to pre-pandemic levels. The majority of the growth was due to higher prices, but the number of visitors was still behind pre-pandemic numbers. Investors anticipate that Disney will be able to capitalize on this growth even further in 2023 as the number of visitors grows hand in hand with higher ticket prices. This year marks Disney’s 100th anniversary, and they are celebrating the occasion by hosting a series of events in their parks during winter and spring, which started on 27th January. There will be exclusive decorations, food items, and attractions that will be a delight for all Disney fans and park visitors. In addition, limited merchandise is already on sale for the year-long anniversary which can further boost merchandise sales. With this milestone being celebrated, the company is set to experience better than usual attendance figures despite the current lower consumer confidence figures.

Initially, Disney World in Florida restricted the number of people allowed into an attraction to approximately 30% of its maximum capacity. These restrictions were eventually removed, but staff numbers, further development, and economic issues have maintained these attendance limitations. The management has started to address these issues and I think the staffing and capacity problems will fade away by the second half of 2023. Disney has recently announced updates to its reservation system and annual pass holder program, this being in response to the high levels of criticism from its customers due to the lengthy wait times and high costs of tickets. However, if the company cannot solve these issues fast, it can suffer a small decline in revenue growth in its Disneyland in Florida.

It is expected that parks and resorts will be a lucrative source of revenue for investors in 2023. Guggenheim published a report a couple of weeks ago, predicting that visitor turnout at Disney Parks in the first quarter would be 13% higher than before, thanks to an uptick in travel volumes as seen by TSA checkpoints and apps like Park Experience being more widely downloaded. The largest risk for the parks and experiences segment is the overall health of the economy and consumer confidence. As it seems now, the major investment banks are still not sure if the U.S. will be able to avoid a recession. Goldman Sachs projects that the probability of a recession in 2023 ranges from 45% to 55%, however, James Gorman, CEO of Morgan Stanley, strongly believes that the U.S. can avoid a recession. If a recession happens Disney parks will likely experience a revenue growth decline possibly a stagnation in 2023.

Linear Networks

CTV media investment is estimated to rise by 14.4% in the upcoming year, coupled with increased spending in other digital channels. Conversely, expenditure on conventional cable and broadcast channels will likely decrease by 6.3%, based on IAB’s projections for linear TV. That is why I expect dropping linear network revenue for DIS in 2023 but I think the DTC segment growth can compensate for the linear networks decline. I expect faster DTC growth both nominally and percentage-wise than the slowing and declining of linear networks. The amount of money being invested in streaming services will be rising following the fact that streamers occupied a larger portion of total TV time than cable for the first time in the U.S. in July 2022, and this trend is very likely to continue. The main questions and risks are for Disney if the linear networks revenues are temporarily declining or if this segment is destined for slow death in the next 10-15 years.

DIS Stock Valuation

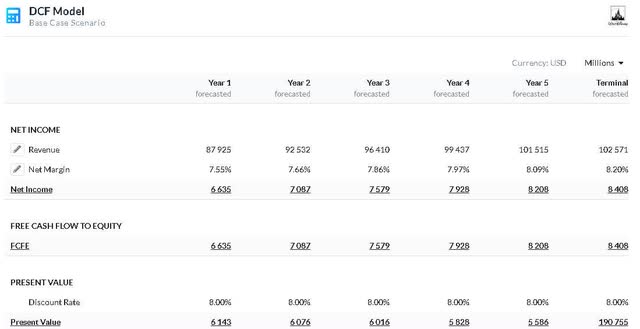

According to the Discounted Cash Flow (“DCF”) valuation, DIS stock is worth an estimated $120.86, which is slightly higher than the current market price of $112.94; suggesting that DIS is undervalued by 7%. However, in the long term, I think Disney is much more undervalued than the DCF model initially suggests.

I believe there is a strong growth potential in Disney for the upcoming years. Their current EPS is way below the pre-pandemic levels and it is realistic to say that the EPS recovery will continue in 2023 and 2024 as the DTC segment will bring in substantial revenue. Analysts estimate a 28% EPS growth over the next fiscal year to an average of $5.29 per share. This is quite close to the 2016-2017 levels before the Disney+ hype. I also strongly believe that as parks, movies, and DTC revenue increases that the EPS for 2024/25 will continue to climb.

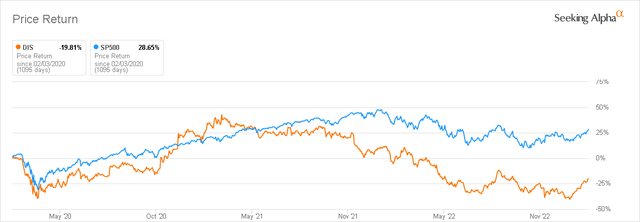

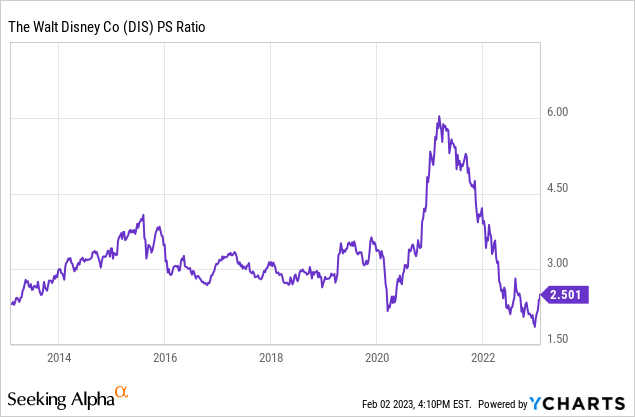

The reverse-to-mean market theory by John Bogle is also in favor of Disney. In the last 2 years, the stock has seriously underperformed the market. And if the underlying fundamentals are stable the reverse will happen; it is only a matter of time. As I see it right now, the stock has started to recover (possibly there will be some drops in the short-term depending on park revenues and DTC revenue growth) but the company’s economic moat is strong, and the revenue streams are stable even with the declining cable revenue. Its price-to-sales ratio is also at very attractive levels.

Seeking Alpha

My next idea might sound crazy, but over the next few years, I am sure more and more investors will ask the same question. I firmly believe that Disney will reinstate its dividend in the next 4-5 years after DTC becomes profitable. Disney had been a reliable dividend payer for decades, but the pandemic killed the dividend. However, if investors start to see great revenue numbers, stable growth, and a profitable DTC segment, reinstatement of the dividend will likely be on the table. I am not expecting it to be realistic in the next 2-3 years, but over the long term, I rate it as a very probable scenario.

Final thoughts

The Walt Disney Company is going through a transition from a traditional entertainment company to become a new-generation direct to a consumer tech company. I believe that the transition is going well despite some bumps along the journey, but as soon as the DTC segments start to generate net positive cash, the Disney stock price should recover. At the moment, the biggest risk is that both the parks and experiences segment and the cable network will grow significantly less than previously expected. I continue to hold The Walt Disney Company stock for the long term. What do you think? Would you include DIS stock in your portfolio for the next 4-5 years?

Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.