Summary:

- Amazon keeps driving automation with robots such that cost declines can continue.

- Efficient communication is used in Amazon meetings with the 6-page memo format.

- The valuation looks attractive for long-term investors.

Daria Nipot

Introduction

Amazon (NASDAQ:AMZN) has a culture that stresses a focus on customers, long-term thinking, innovation and operational excellence. Efficiency can be defined as maximum productivity with minimum wasted effort. My thesis is that Amazon uses efficiency to meet their cultural objectives. Stories of them increasing efficiency in meetings by using 6-page memos instead of PowerPoint presentations are legendary. They are in the midst of making their logistics business more efficient by increasing automation with robots.

Logistics

The costs of logistics are very high right now as we are in the early innings where Amazon is still trying to figure out how to use robots efficiently and economically. @skorusARK tweeted that Amazon now has more than 500,000 robots. A February 1st Fortune article notes that Amazon may have more robot workers than human workers by 2030 per ARK Invest CEO Cathie Wood. She says the cost declines could be prodigious as automation takes hold:

If you look at the cost declines, which drive all of our models…for every cumulative doubling in the number of robots produced, the cost declines are in the 50–60% range.

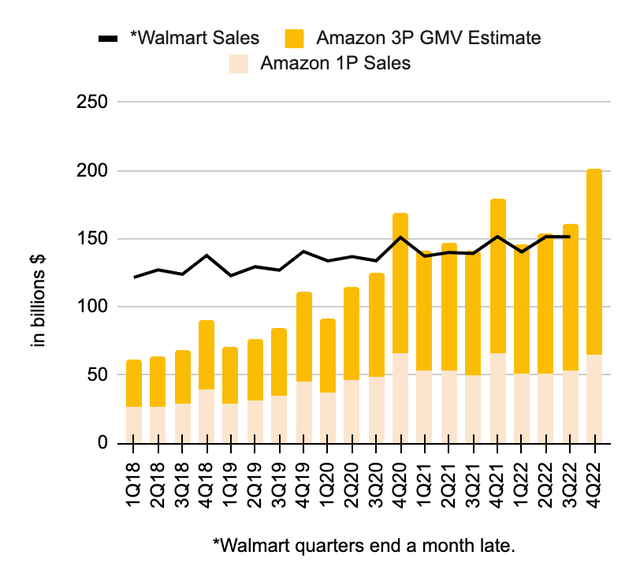

Even small improvements with cost declines have broad implications when we consider the amount of merchandise in the Amazon ecosystem. Amazon’s 2022 10-K says they have about 1,541,000 full-time and part-time employees and we know a substantial number of these employees are in logistics. Combining 1P sales and 3P GMV, Amazon is moving more merchandise through their logistics ecosystem than Walmart:

Amazon volume (Author’s spreadsheet)

The 3P GMV estimate above is 3.75x 3P sales.

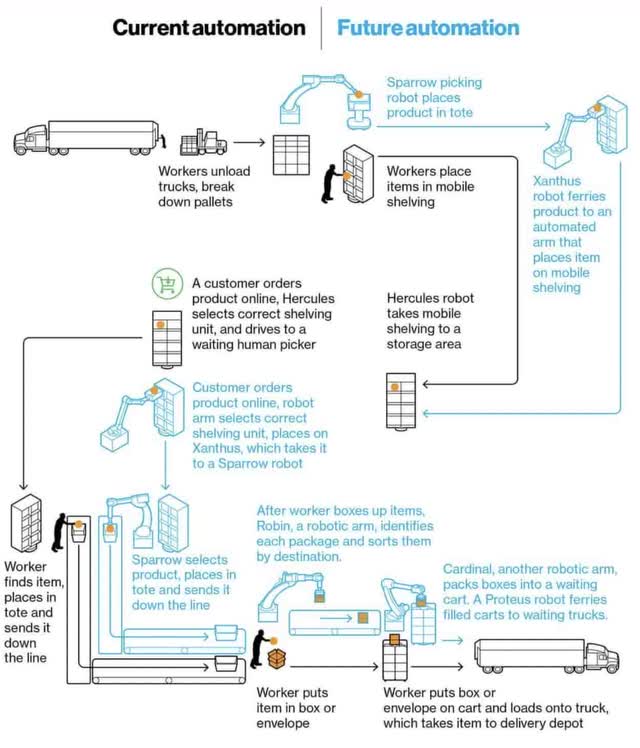

There are already many robots in place but limitations exist in some areas such as parts of the process where human hands can be very efficient. I found the Amazon automation illustration in a December Bloomberg article to be very helpful and this is how I think about it:

1. Human workers unload trucks and break down pallets when products arrive.

Current: Human workers then place items in mobile shelving so that a Hercules robot can take the mobile shelving over to a storage area.

Future: The Sparrow picking robot then places products in tote and a Xanthus robot ferries products to an automated arm that places them on mobile shelving which ends up in a storage area.

2. We have an item ordered online by a customer.

Current: The Hercules robot selects the correct shelving unit and drives to a human picker. The human picker finds the item, places it in the tote and sends it down the line.

Future: A robot arm selects the shelving unit pertaining to the order and places it on a Xanthus robot which takes it to a Sparrow robot. The Sparrow robot selects the product, places it in tote and sends it down the line.

3. The item is placed in a box or an envelope.

Current: A worker puts the box/envelope on a cart and it loads onto a truck.

Future: The Robin robotic arm identifies boxes/envelopes and sorts them by destination. The Cardinal robotic arm then packs boxes/envelopes into a waiting cart. A Proteus robot then ferries filled carts to waiting trucks.

Here is the illustration that shows the way increased efficiencies are coming with future automation:

Logistics automation (Bloomberg Illustrator Chris Philpot)

If my read is right with the above illustration steps then Amazon is moving to a system where pretty much everything can be done by robots from the time humans unload the truck and break down pallets to the time humans put items in boxes/envelopes. In other words, it looks like Amazon is moving to a new system where human involvement could be as little as unloading trucks, breaking down pallets and putting items in boxes/envelopes.

These improvements with robots will not happen overnight and we are still seeing the impact of over-investments that were made during the covid pandemic. It is helpful to remember that former CEO Bezos said the following in the 1Q20 release:

If you’re a shareowner in Amazon, you may want to take a seat, because we’re not thinking small. Under normal circumstances, in this coming Q2, we’d expect to make some $4 billion or more in operating profit. But these aren’t normal circumstances. Instead, we expect to spend the entirety of that $4 billion, and perhaps a bit more, on COVID-related expenses getting products to customers and keeping employees safe. This includes investments in personal protective equipment, enhanced cleaning of our facilities, less efficient process paths that better allow for effective social distancing, higher wages for hourly teams, and hundreds of millions to develop our own COVID-19 testing capabilities.

The Bezos Blueprint book by Carmine Gallo does a nice job explaining the way Amazon focuses on efficiency. Simplicity is key in terms of communication and author Gallo cites the Mythical Man-Month book that influenced former CEO Jeff Bezos to keep things simple with small teams whenever possible. The Bezos Blueprint book also notes that PowerPoint slides can be a trap because they appear to simplify things but in reality they can cause confusion. They are not good storytelling tools seeing as key explanations can be filtered out, any sense of relative importance can be flattened and the interconnectedness of ideas can be ignored. Using the more efficient 6-page memo format, Amazon was able to innovate in ways the world has never seen in order to bring about efficiencies in logistics that will become more evident in the long run.

Valuation

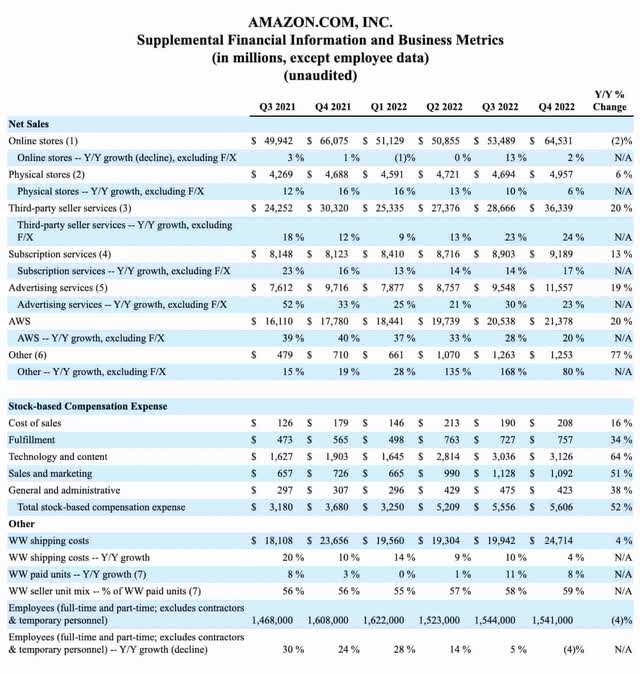

The most important segments increased nicely in 4Q22. Per the 4Q22 release, AWS grew 20% from $17.8 billion in 4Q21 to $21.4 billion in 4Q22. 3P sales went up 20% from $30.3 billion in 4Q21 to $36.3 billion in 4Q22. Advertising climbed 19% from $9.7 billion in 4Q21 to $11.6 billion in 4Q22 and the climb was 23% if we ignore the impact of F/X. The advertising gain is especially laudable when we consider that Google’s advertising shrank a little bit from $61.2 billion in 4Q21 down to $59 billion in 4Q22. In addition, Meta’s advertising revenue slipped a bit from $32.6 billion in 4Q21 down to $31.3 billion in 4Q22:

Segment revenue (4Q22 release)

The above revenue growth from these 3 key segments is wonderful but unfortunately expenses have grown as well such that the operating income fell from $24,879 million in 2021 down to $12,248 million in 2022. I didn’t like this part of the 4Q22 call:

In aggregate, we invested approximately $7 billion in 2022 across Amazon Originals, live sports and licensed third-party video content included with Prime. That’s up from about $5 billion in 2021. As a reminder, these digital video content costs are included in cost of sales on our income statement. We regularly evaluate the return on the spend and continue to be encouraged by what we see as video has proven to be a strong driver of Prime member engagement and new Prime member acquisition.

Yes, Prime boosts sales but I’d like to see how they measure the ROI of specific investments in movies and sports.

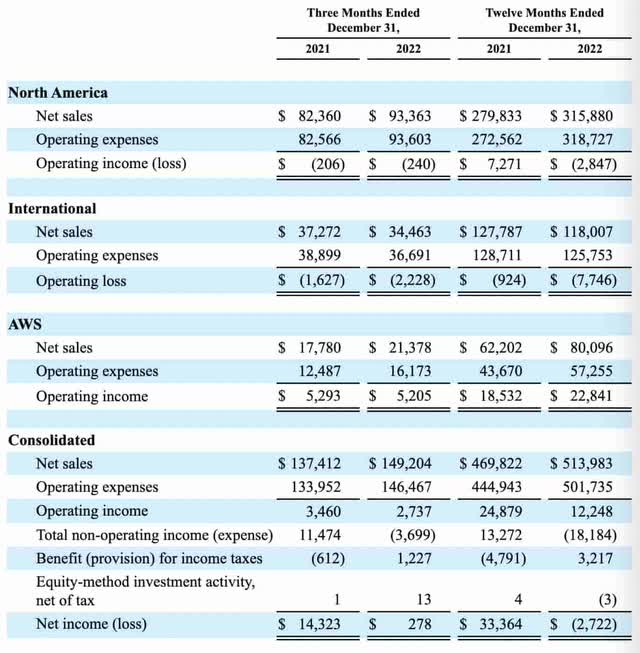

It was disappointing to see in the 4Q22 release that operating income for North America declined from $7,271 million in 2021 down to $(2,847) million for 2022. Also, operating losses worsened for International going from $(924) million in 2021 down to $(7,746) million in 2022. Fortunately AWS operating income climbed from $15,532 million in 2021 up to $22,841 million in 2022:

Operating income by geography (4Q22 release)

CEO Andy Jassy explained part of the reason for operating income declines in the 4Q22 call as he told us that they’ve built a UPS type business in the last few years:

And as Brian touched on, it’s important to remember that over the last few years, we’ve — we took a fulfillment center footprint that we’ve built over 25 years and doubled it in just a couple of years. And then we, at the same time, built out a transportation network for last mile roughly the size of UPS in a couple of years.

Former CEO Jeff Bezos opened the 2004 letter to shareholders with powerful statements about free cash flow (“FCF”):

Our ultimate financial measure, and the one we most want to drive over the long-term, is free cash flow per share. Why not focus first and foremost, as many do, on earnings, earnings per share or earnings growth? The simple answer is that earnings don’t directly translate into cash flows, and shares are worth only the present value of their future cash flows, not the present value of their future earnings. Future earnings are a component – but not the only important component – of future cash flow per share. Working capital and capital expenditures are also important, as is future share dilution. Though some may find it counterintuitive, a company can actually impair shareholder value in certain circumstances by growing earnings. This happens when the capital investments required for growth exceed the present value of the cash flow derived from those investments.

It’s refreshing to reread these words from former CEO Bezos when thinking about valuation. The emphasis on looking at FCF “per share” is key as is the statement about future share dilution being important. Iconic investor Bill Gurley tweeted on January 4th about the fact that RSUs are abused but Amazon is set up to minimize abuse as stock-based compensation (“SBC”) isn’t a high percentage of revenue:

RSU reality: 95%+ of RSUs are sold on vest date. Ask any public CFO. They are not an “ownership in the business” vehicle. They are a cash-like payment hidden in a construct companies hope you will “ignore.” Which is why they are abused way more than with actual cash payment.

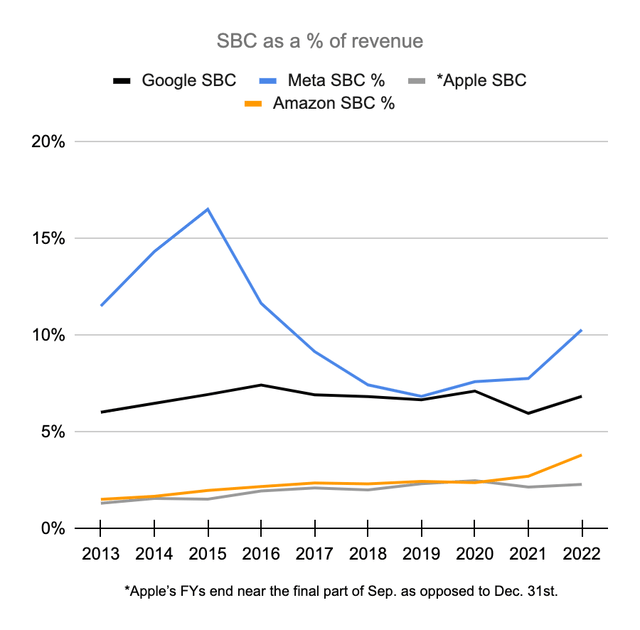

These critical thoughts make it obvious that former CEO Bezos always considered the implications of SBC. This is part of the reason why Ben Hunt’s November 2022 article was able to point out issues at Google (GOOG) and Meta (META) but not at Amazon. Here is a comparison of SBC as a percentage of revenue:

SBC as a % of revenue (Author’s spreadsheet)

These companies above have better profit margins than Amazon’s product business so looking at SBC as a percentage of revenue alone doesn’t tell the full story. Importantly for Amazon, 1P sales go under “product” whereas 3P sales go under “service.” Per the 4Q22 call, 3P comprised a record 59% of overall unit sales in 4Q22. Product sales have become a smaller part of Amazon’s overall revenue over the years falling from 82% in 2013 down to 47% in 2022. The respective numbers behind the percentages were product sales of $60,903 million on total revenue of $74,452 million in 2013 and product sales of $242,901 million on total revenue of $513,983 million in 2022. I believe one of the reasons Amazon keeps things under control with compensation in general and SBC in particular is because they insist on communication being efficient.

Per the 2022 10-K, AWS finished the year with operating income of $22,841 on revenue of $80,096 million which was up from operating income of $18,532 million on revenue of $62,202 million in 2021. I believe AWS is worth about 20 to 23x operating income which comes to a range of about $455 to $525 billion. I believe the rest of Amazon is worth about 2 Walmarts. The 10-Q for Walmart through October 2022 shows that there were 2,696,800,054 shares outstanding as of November 29, 2022 such that the market cap is $382 billion based on the February 3rd share price of $141.71. I believe the rest of Amazon is worth about twice this amount which is about $750 to $780 billion. Rounding to the nearest $25 billion, I think Amazon is worth about $1,200 to $1,300 billion

Amazon’s 2022 10-K says that as of January 25, 2023 there were 10,247,259,757 shares outstanding. Multiplying these shares by the February 3rd share price of $103.39 gives us a market cap of nearly $1,060 billion. My valuation range is higher than the market cap so I think the stock is undervalued for long-term investors.

Meta is touting 2023 as the year of efficiency as they define this to mean getting costs under control. Using a broader definition of efficiency, Amazon has been efficient for decades and I expect this to continue as it is part of their DNA. Forward-looking investors should continue looking for hints to see which new investments are paying off. Hopefully a nascent business will be revealed soon similar to the way in which Amazon started breaking out AWS in the 1Q15 filing. Obvious candidates are logistics and healthcare but these aren’t the only possibilities.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Disclosure: I/we have a beneficial long position in the shares of AMZN, BABA, GOOG, GOOGL, META, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.