Summary:

- The management team at The Walt Disney Company is due to report financial results covering the first quarter of its 2023 fiscal year.

- Leading up to that point, investors need to keep a close eye on certain metrics, including headline news and key growth and operating metrics.

- Absent some major change, the company looks like a great prospect for investors moving forward.

Wirestock/iStock Editorial via Getty Images

After the market closes on February 8th, the management team at entertainment conglomerate The Walt Disney Company (NYSE:DIS) is expected to announce financial results covering the first quarter of the company’s 2023 fiscal year. Leading up to that point, I remain optimistic about the company. After all, I must be optimistic by definition considering it’s one of only 9 holdings in my portfolio. This does not mean that there aren’t certain risks that investors should pay attention to. And in general, there are items that the company will report on that will have a big role to play in how shares perform moving forward. So long as none of these come in really bad, upside for the company should still exist. But investors would be wise to pay attention to these developments so they can judge themselves.

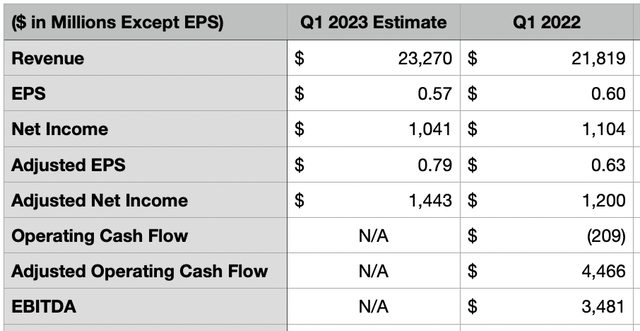

A look at headline expectations

The first thing that investors will initially be drawn to would be the headline news items reported by management and how they fared compared to what analysts anticipated. For instance, the current expectation is that the company will report revenue of $23.27 billion. If this comes to fruition, it would translate to an increase of 6.7% over the $21.82 billion reported for the first quarter of 2022. For a company as large and well-covered as Disney, you might think that analysts would have a pretty good handle on what exactly sales will be. But there is always a risk of the firm missing when it comes to expectations. This actually occurred during the fourth quarter of the company’s 2022 fiscal year. Sales of $20.15 billion came in materially higher than the $18.53 billion reported one year earlier. However, this still managed to miss analysts’ expectations by $1.29 billion.

Author – SEC EDGAR Data

On the bottom line, the market is not as optimistic. Earnings per share are forecasted to come in at around $0.57. That’s down from the $0.60 per share reported the same time one year earlier. The actual dollar amount for profits, in this case, would be around $1.04 billion compared to the $1.10 billion reported for the first quarter of the company’s 2022 fiscal year. Even though sales are expected to increase, it’s likely that inflationary pressures are what’s weighing on analysts’ expectations. On an adjusted basis, however, earnings are forecasted at $0.79 per share. This would actually be up from the $0.63 per share reported one year earlier. If this comes to fruition, it would translate to net profits, on an adjusted basis, of $1.44 billion. That’s meaningfully higher than the $1.20 billion reported just one year earlier. Although analysts have not come out with any estimates on other profitability metrics, investors should be paying attention to those as well. For context, during the first quarter of 2022, operating cash flow was negative to the tune of $209 million. But if we adjust for changes in working capital, it would have been substantially higher at $4.47 billion. For that same time, EBITDA for the company came in at $3.48 billion. Though not exactly headline news, market participants will certainly be paying attention to these metrics.

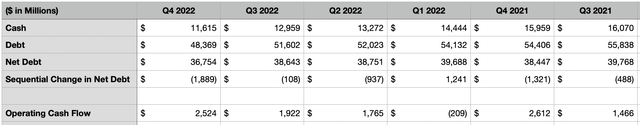

Author – SEC EDGAR Data

The operating cash flow for the company will be incredibly important when it comes to determining how much, if any, the company gets to reduce debt by. As of the end of the latest quarter, Disney reported net debt of $36.75 billion. In every quarter since at least the third quarter of 2021, with the exception of the first quarter of 2022, net debt for the company decreased sequentially. It wouldn’t be surprising then, given that in the first quarter of 2022, net debt for the company grew by $1.24 billion, to see some sort of increase as well relative to the final quarter of 2022.

Streaming is king

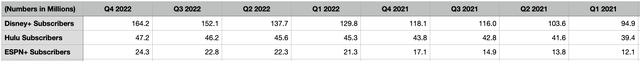

Those who follow my content on Disney closely will know that the part of the company I am most excited about is the streaming business. Naturally, I think that this portion of the firm will continue to exhibit attractive growth for the next couple of years. The current goal for the company, for instance, is to grow its Disney+ subscriber base to between 215 million and 245 million by the end of 2024. As of the end of the final quarter of 2022, the service reported 164.2 million subscribers. This was up around 39% compared to the 118.1 million reported the same time one year earlier. The company also exhibited attractive growth when it came to ESPN+, with the number of subscribers jumping 42% from 17.1 million to 24.3 million. And over that same window of time, the number of subscribers on Hulu rose about 8% from 43.8 million to 47.2 million. To be fair, both ESPN+ and Hulu have been showing signs of slowing growth as of late. But even sequentially compared to the third quarter, their subscriber numbers were up 1.5 million and 1 million, respectively.

Author – SEC EDGAR Data

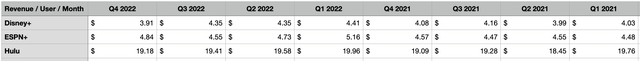

The number of subscribers will be the most important metric that the company reports in my opinion. And investors should also be paying attention to guidance for the 2024 fiscal year. After all, the company has already lowered guidance for that year from the original 230 million to 260 million previously anticipated. Another downward revision would prove problematic. However, another important metric that investors should be paying attention to is the amount of revenue generated per subscriber. For Disney+, this number is likely to shrink here over a year because of the rapid growth it’s experiencing in lower-income markets. For instance, during the final quarter of 2022, the number came in at $3.91 per month. That was down from $4.12 per month reported one year earlier. But there is the potential for growth in revenue per user from both ESPN+ and Hulu. For context, a change of even $0.10 per subscriber per month for Disney+, assuming a terminal subscriber base of 230 million, would impact revenue for the company and, by definition pre-tax profits, by $276 million annually.

Author – SEC EDGAR Data

Look for the pain points

Outside of streaming, investors would also be wise to pay close attention to the parts of the company that were harmed the most from the COVID-19 pandemic. Some of these are still recovering and have shown some rather positive signs in recent quarters. Some of the biggest improvements might come from the theatrical distribution side of the company. As more people head to the movies and more films come out, there is the potential for a substantial rise in sales. This is especially true when you consider the December 16th release of Avatar 2: The Way of Water that has brought in more than $2 billion from the global box office. For context, in the first quarter of 2022, theatrical distribution revenue for the company was only $529 million.

Author – SEC EDGAR Data

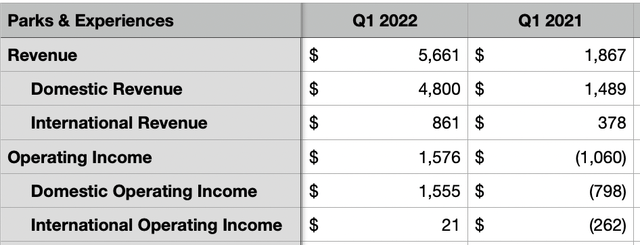

The other part of the company that was hit hard by the pandemic was the entire suite of operations involving its theme parks and resorts. Already though, the company has been demonstrating some rather strong results on that front. For instance, total revenue for both its domestic and international Parks & Experiences operations in the final quarter of 2022 came in at $6.08 billion. That was up substantially from the $4.17 billion reported one year earlier. Operating income during this time also roared higher, shooting up from $22 million to $815 million. For context, overall revenue associated with all of the theme park operations of the company, inclusive of $448 million associated with park licensing revenue and other activities, was $5.66 billion in the first quarter of 2022. Profits for these operations totaled $1.58 billion.

Takeaway

At this time, I have Disney rated as a ‘strong buy’. In truth, I have been disappointed by its share price performance since buying it. Fortunately, I have taken the opportunity to build up my stake in the firm over time, resulting in a modest 2.5% profit compared to my weighted average purchase price. However, this still makes it the third worst-performing company out of nine in my portfolio. Because I believe in the firm and I believe that its best days lie ahead, I continue to hold the stock. But this does not mean that the outlook for the company will always be positive. Investors should always evaluate the data reported by any company that they own or are interested in owning. Because, after all, the fundamental picture could change in the blink of an eye. I don’t think that we are in for any real pain by any means for this quarterly release. In fact, I think the opposite will occur. But for now, all I can do is keep a watchful eye and wait.

Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!