Summary:

- Opendoor’s business model may be flawed, especially in the current market.

- Macro conditions continue to deteriorate.

- Profitability and revenue will remain under pressure.

Thomas Barwick

Article thesis: Opendoor (NASDAQ:OPEN) faces multiple headwinds, which are likely to push the revenue and profitability lower. These factors include decreasing prices, increasing inventory, a slowdown in sales, and homes being on the market longer. Therefore, just because the valuation is currently cheap, doesn’t mean OPEN stock is cheap, and it could be a classic value trap.

The global real estate industry continues to struggle, and as interest rates keep rising, a number of real estate-related stocks are under pressure. Opendoor, which primarily deals in buying homes, making upgrades, and then re-selling on the open market is one of those companies. The company has been growing at a relatively quick pace, with high levels of revenue, but it remains to be seen whether the actual business model can be made profitable. The Federal Reserve is expected to continue to raise rates for the foreseeable future, tightening liquidity conditions, which means that home prices are likely headed down for a while.

While the valuation currently may seem cheap, the reality is Opendoor business model is likely not sustainable for the near future.

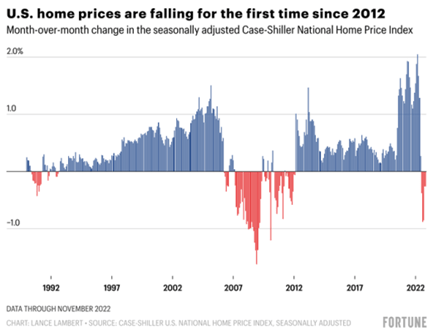

Case-Shiller Home Index (Fortune Magazine)

Opendoor’s Model Facing An Inventory Transition

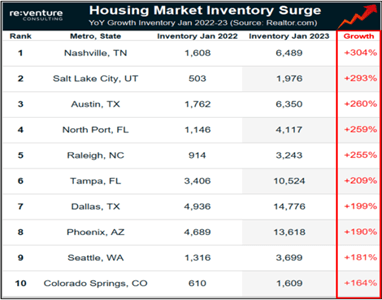

The latest quarter saw the company post significant losses, as unfavorable market conditions continued to take hold. The first and foremost factor that is affecting the homeownership market is that previously tight supplies of homes, and tight inventories are now going the other way, with excess supply. Home inventories are significantly exploding on the market, and this provides opportunities for the likes of Opendoor to significantly improve their business operations since they act more like a middleman, that refurbishes homes. This market dynamic provides both positives and negatives, with the only positive being, that cheap homes may be profitable when the real estate market finally starts to see price gains again, which is not likely to be soon.

Housing Market Inventory (re:venture)

Furthermore, US home prices are now witnessing a significant decline as well. For Opendoor this could affect their balance sheet inventory, and the losses would have to be marked down. The latest quarter saw a net profit loss of $900 million, this means prices of homes continued to decline. Management is working on clearing the inventory, but this is likely to come at the price of further losses, as market conditions continue to decline.

CEO- “It has required us to operate with urgency and discipline to manage risk and overall inventory health at the expense of margins. Despite the challenges, we’ve been able to increase the resale velocity of our existing inventory and have significantly increased spreads on new acquisitions.”

Management is clearly looking to ensure that it gets its inventory offloaded, as the new cycle of home prices continues. It is therefore likely that home prices are going to continue to decline for the foreseeable future, which means if the company continues to buy new inventory, it will be facing a market that is likely headed downward for a bit.

Further adding to the woes, are single-family sales, which are clearly facing pressure, as sales continue to decline. This decline is leading to a clear increase in inventory, which is then likely to affect the market further. If the company cannot clear its inventory despite stating in its latest stockholder letter that it plans to clear 20% of its inventory within 14 days, it may have to further write down those losses.

“Today, more than 20% of our homes listed on Exclusives go into contract within 14 days, demonstrating the strong momentum we’re driving with our direct buyer base.”

This means that as long as home prices continue to decline, losses are more likely than not. The company has not indicated any real strategy in its earnings call that states how it will manage to resell values in the coming quarters, which means that they are increasingly dependent on its buyer-seller marketplace, or on buying properties that are well below market price, which then provides them a margin. Until then I expect losses to continue for the next few quarters.

How Will Market Place Add Value?

Marketplace is an attempt to provide an end-to-end service where buyers and sellers can come together to transact in real estate. Management has not indicated how it plans to ensure that its product is different than that of its competitors, such as Zillow, which already has significant market penetration. Zillow itself has had profitability issues in the past, and while many startups have tried to create an online mode, questions remain about the viability of an online model. For now, the Marketplace product is not a factor investors can heavily rely on to turn things around.

The reality is Opendoor’s model might be flawed, it relied on what many speculators relied on pre-2008, which was continuously rising prices. Acting as a mix between a contractor and a home reseller is not a business model that always goes well.

Where Are The Finances Headed?

Opendoor’s reliance on reselling, combined with falling home prices, increasing inventory, and declining demand for single-family homes, put the business model at risk. This means that for the next couple of quarters, both revenue and margin are likely to be under pressure. Revenue during the latest quarter already witnessed a decline from the first quarter in 2022, where total revenue came in at $3.8 billion.

As the conditions continue to deteriorate in the market it is likely that the next few quarters will also reflect similarly in the company’s finances. This means that revenue might continue to decline further falling below $3 billion, which might mean on the current run-rate that total revenue in 2023 could be around $12-13 billion, which means that the forward price-to-sales would decline to 0.05, which indeed seems like a rock-bottom valuation if taken at face value.

While such a low price-to-sales might be tempting for investors, profitability is not likely to be on the horizon for the near future. This means that the company, which is currently running on 5% gross margins, is not likely to see a turnaround anytime soon.

Gross Margins Indicate A Poor Business Model

While you can forgive a lack of net profitability, a 5% gross margin clearly indicates the company is facing an uncertain future. Peak gross margins hit around 10-11% in recent times when real estate prices were rising significantly, but considering now we are in a higher rate environment, which may be around for a few years since labor markets remain tight, it is likely that we are looking at a business model, which may never be profitable on a net profit basis, mainly due to the fact that such low gross margins leave very little room for the company to meet its costs.

In conclusion, the company is facing both unfavorable conditions and a business model which may not be profitable in the near future. While I do not recommend selling, the risk-reward may point to investing elsewhere.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.