Summary:

- A year ago, I predicted Alphabet would see a significant earnings decline within two years, and the price would fall -30% to -40% off its highs.

- That prediction was correct, and last October I raised Alphabet stock from a “Sell” to a “Hold”, and shared the price I would be willing to buy it in 2022.

- The 2022 buy price came close, but didn’t hit. This article shares an updated estimate for 2023’s earnings, and the price I would be willing to buy the stock in 2023.

winyuu

Introduction

About a year ago, on February 24th, 2022, I wrote a “Sell” article warning investors about the downside risk of Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) stock titled “Apple & Alphabet Will Not Side-Step A Deep Bear Market“. I followed that article up a few months later on June 28th, 2022 with another “Sell” article titled “Risk Of An Earnings Miss Is High With Google Over The Next Year“. I was essentially the only stock analyst out of dozens writing about Google, to be consistently bearish on the stock during the first half of 2022.

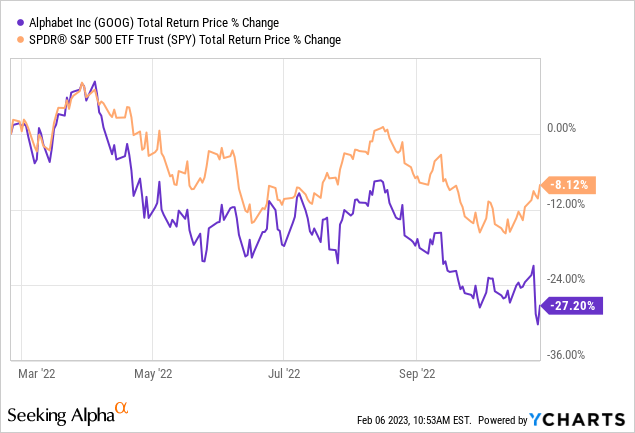

But, since I’m a long-only investor, being bearish doesn’t really do me much good (other than potentially avoiding buying or holding overvalued stocks before they fall). It’s also worth pointing out that I’m hardly a perma-bear on Alphabet, either. After the stock price had come down, on October 28th, 2022, I wrote a “Hold” article on Google titled “Google Missed Earnings As I Expected; Here Is The Price I’ll Start Buying“. Here is how the stock price performed between my first “Sell” article and the publication of my “Hold” article.

In my October article, I shared the price at which I would be a buyer of Google stock through the end of the fiscal year 2022. Here is what I had to say:

The price at which it would cross the 12% 10-year CAGR expectation and achieve a margin of safety is $74.85, and I would likely be a buyer if the stock hits that price. Right now, I would give it about a 50% chance of falling below that price if we have a recession next year, which is my base case. I plan to stick with this $74.85 buy price through the current quarter, and then I’ll make adjustments after the next earnings report for 2023.

Google’s lowest price since the publication of that article was $83.45, so I still haven’t bought the stock. But now we are into 2023, so I will be looking forward into the new year in this article and I will share an updated buy price. Before we get into that, however, I will quickly review how we got to where we are today, and why I was able to better estimate Google’s consistent earnings misses all of last year:

Seeking Alpha

The Background

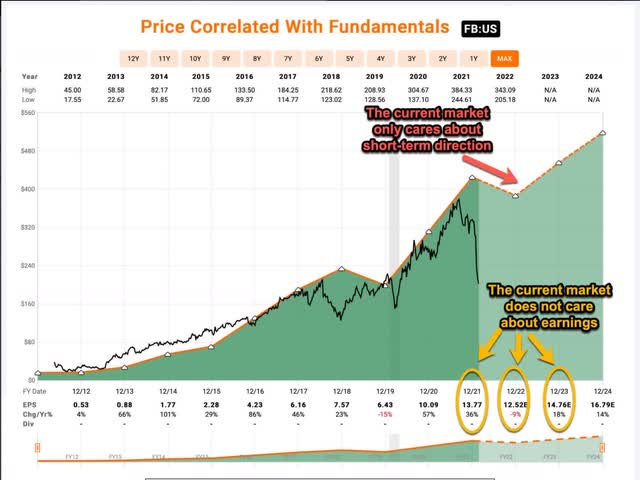

In my first Google warning article about a year ago, I pointed to Facebook’s (META) earnings and stock price pattern that followed. Here is the chart I shared in that article:

FAST Graphs

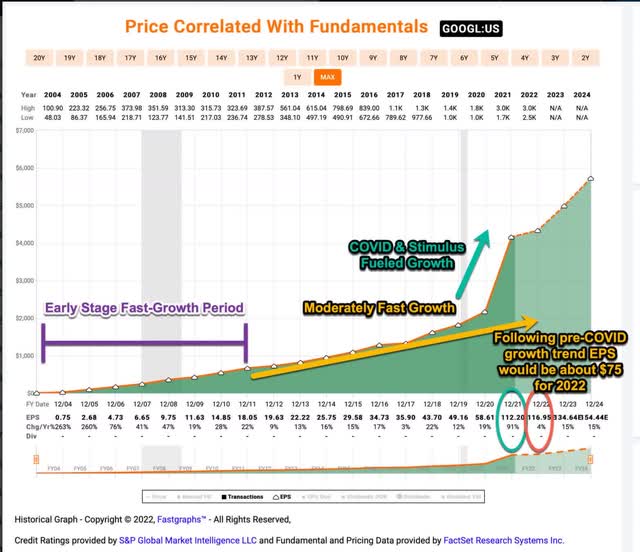

What I was pointing out here is that when the earnings of a fast-growing business change direction and go negative, the stock market tends to disproportionately punish the stock price. And because the “Boom” caused by the pandemic and stimulus money in 2020 and 2021 was likely to end in 2022 and be felt into 2023, this very same pattern was very likely to happen to Alphabet. Here is the chart I shared on GOOG in the same article:

FAST Graphs

I need to do some translating due to Google’s 20:1 stock split that occurred after this article was published. Analysts were expecting about $5.85 per share in 2022, which was 4% EPS growth, and $6.73 per share in 2023, which was an additional 15% EPS growth. I really took issue with the 2023 projections:

Alphabet’s previous EPS trend would have had them earning about $75 [$3.75 split adjusted] per share in 2022, and right now analysts are expecting about $116 [$5.85 split adjusted] per share. As with Apple, these additional stimulus earnings will likely help adjust the previous trend upward a bit, and that money will continue to circulate in the economy for a while, so, perhaps EPS won’t fall all the way down to the previous trend line, but I think for analysts to expect $134 [$6.73 split adjusted] per share of earnings in 2023 is wildly optimistic.

Later in the year, in my October article, I updated the previous EPS trend numbers to include the inflation we’ve had the past few years:

If I assume 7% inflation on top of regular earnings growth, I get $4.23 per share for this year. That might end up being a little low, but it will be much closer than the $5.85 analysts were expecting back in February.

In the end, 2022’s earnings came in at about $4.56 per share. That’s not too far away from the previous long-term trend, plus extra inflation, of $4.23 I estimated. Now, I expected all along that the previous baseline of earnings growth might end up being a little on the low side for 2022. But 2023 seemed like a much clearer case of analysts being really far off in their expectations. One year ago, they were expecting $6.73 per share which I described as “wildly optimistic”. Let’s see what they expect now:

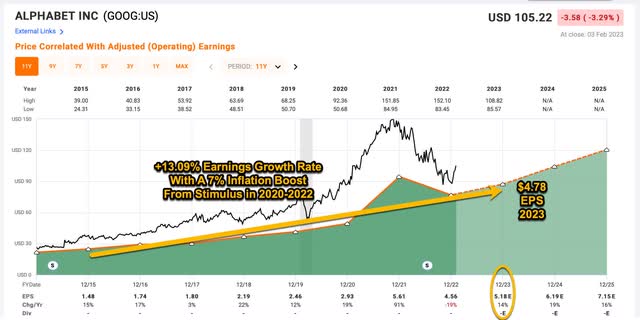

FAST Graphs

Okay, now analysts are expecting a much lower $5.18 per share in 2023. Using my method of extrapolating the pre-pandemic trend, plus including a 7% inflation boost from stimulus money over the past few years, I get a baseline EPS expectation of $4.78 for 2023, which is at least in the same ballpark as analysts now.

It’s worth noting that my method here does not account for a potential recession. Chances are, if we have a recession, EPS will struggle to hit my expectation. However, we are also seeing cost-cutting at Alphabet as well, and that is something they haven’t done historically either. For now, I will generally assume these roughly balance each other out. Alphabet is a high enough quality business, as long as I can get a good price, I’m okay holding through a recession, even if it’s not the very best price I might have been able to get if I waited for a recession discount.

With this background in mind, I will be using an earnings estimate of $4.78 per share and an earnings growth estimate of +13.09% going forward after 2023 as my baseline for the valuation analysis that follows.

Google Stock — Market Sentiment Return Expectations

In order to estimate what sort of returns we might expect over the next 10 years, let’s begin by examining what return we could expect 10 years from now if the P/E multiple were to revert to its mean from the previous economic cycle. For this, I’m using a period that runs from 2015-2022.

Google’s average P/E over this time period has been 24.87. Using the current price, and a $4.78 EPS estimate, I get a current P/E of 21.61. If that current P/E were to revert to the average P/E of 24.87 over the course of 10 years, and everything else was held the same, Google’s price would rise and it would produce a 10-Year CAGR of +1.83%. That’s the annual return we can expect from sentiment mean reversion if it takes 10 years to revert. If it takes less time to revert, the return would be higher.

Business Earnings Expectations

We previously examined what would happen if market sentiment reverted to the mean. This is entirely determined by the mood of the market and is quite often disconnected, or only loosely connected, to the performance of the actual business. In this section, we will examine the actual earnings of the business. The goal here is simple: We want to know how much money we would earn (expressed in the form of a CAGR %) over the course of 10 years if we bought the business at today’s prices and kept all of the earnings for ourselves.

There are two main components of this: the first is the earnings yield and the second is the rate at which the earnings can be expected to grow. Let’s start with the earnings yield (which is an inverted P/E ratio, so the Earnings/Price ratio). The current earnings yield is about +4.63%. The way I like to think about this is, if I bought the company’s whole business right now for $100, I would earn $4.63 per year on my investment if earnings remained the same for the next 10 years.

The next step is to estimate the company’s earnings growth during this time period. I do that by figuring out at what rate earnings grew during the last cycle and applying that rate to the next 10 years. This involves calculating the historical EPS growth rate, taking into account each year’s EPS growth or decline, and then backing out any share buybacks that occurred over that time period (because reducing shares will increase the EPS due to fewer shares).

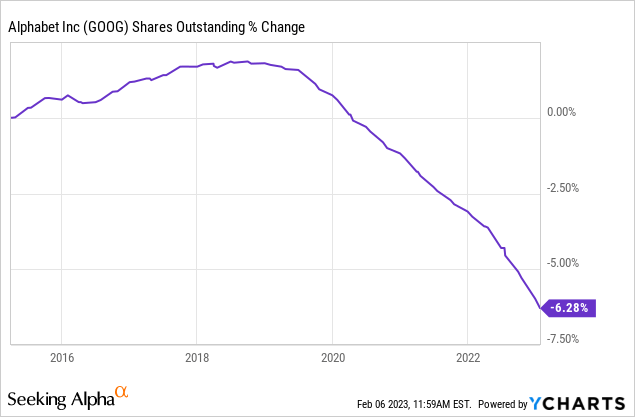

Alphabet has bought back about 6% of the company since 2015 on average. Since most of these buybacks took place in 2020 or after, and I am using the pre-2020 earnings growth rate, I won’t be adjusting for these buybacks in this analysis, but normally I would. Leading up to 2020, earnings averaged about 13.09% earnings growth, so that is the long-term average growth rate after 2023 I will assume, which I think is a pretty fair estimate.

Next, I’ll apply that growth rate to current earnings, looking forward 10 years in order to get a final 10-year CAGR estimate. The way I think about this is, if I bought Alphabet’s whole business for $100, it would pay me back $4.63 plus +13.09% growth the first year, and that amount would grow at +13.09% per year for 10 years after that. I want to know how much money I would have in total at the end of 10 years on my $100 investment, which I calculate to be about $193.38 including the original $100. When I plug that growth into a CAGR calculator, that translates to a +7.00% 10-year CAGR estimate for the expected business earnings returns.

(When it comes to pure 10-year business earnings CAGRs, 7% is actually what I consider the long-term average the market tends to pay, so, just based on this metric, Google is almost exactly fairly valued by the market based purely on earnings trends.)

10-Year, Full-Cycle CAGR Estimate

Potential future returns can come from two main places: market sentiment returns or business earnings returns. If we assume that market sentiment reverts to the mean from the last cycle over the next 10 years for Alphabet, it will produce a +1.83% CAGR. If the earnings yield and growth are similar to the last cycle, the company should produce somewhere around a +7.00% 10-year CAGR. If we put the two together, we get an expected 10-year, full-cycle CAGR of +8.83% at today’s price.

My Buy/Sell/Hold range for this category of stocks is: above a 12% CAGR is a Buy, below a 4% expected CAGR is a Sell, and in between 4% and 12% is a Hold. A +8.83% expected CAGR makes Google a “Hold” at today’s price, and pretty close to the mid-point of what I would consider “Fair Value”.

The price at which it would cross the 12% 10-year CAGR expectation and achieve a margin of safety is $84.58, and I would likely be a buyer if the stock hits that price in 2023. This is only about -18% lower than where the stock trades today. This buy price should stand for most of 2023 unless analysts lower their earnings expectations below mine due to some big Alphabet misses or something of that nature. So, it’s possible that if there is a big earnings miss at some point and the prices dive below my listed buy price, I might take an extra day or two to recalibrate my earnings expectations before immediately buying. If this happens, I’ll write an article sharing my updated approach.

Conclusion

I think 2023, assuming we avoid a significant recession, will be a year that, by the time we reach the end, we’ll pretty much know where Alphabet’s new earnings baseline will be post-pandemic and post-stimulus. There are still two big factors that remain, though. One of those factors, of which I was pretty much the only stock analyst to write about last year, is the resumption of student loan repayments. This was a big economic risk that never happened in 2022, and that was bullish for the economy. It is one of the only remaining pandemic stimulus policies that is still in effect in 2023. We will probably get a court ruling by mid-year 2023 as well as a reaction from the White House on the ruling. The bottom line for me is that if student loan repayments begin as planned halfway through the year, it will put the US economy into a recession soon after. And then, of course, the US economy could go into a recession anyway, at least partially due to rapidly rising interest rates and their lagged effects on the economy.

Considering all this, I think my “buy price” for Google has an above-average chance of hitting this year at some point, and I have probably been a little less conservative with this buy price than some of my buy prices for other stocks. So, while I think my current buy price for the stock has a pretty good chance of hitting, I also think if it does hit, there is a good chance it won’t necessarily be near the ultimate bottom for the stock price in a recession. That’s just something I would keep in mind if Google’s stock hits my buy price sooner rather than later.

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you have found my strategies interesting, useful, or profitable, consider supporting my continued research by joining the Cyclical Investor’s Club. It’s only $30/month, and it’s where I share my latest research and exclusive small-and-midcap ideas. Two-week trials are free.