Summary:

- PayPal seems too cheap to ignore, with a free cash flow yield of 6.08% heading into earnings.

- Recent cost savings could realistically add another $4 billion to PayPal’s market cap, according to our estimates.

- Looking at key fundamental measures, PayPal appears undervalued, both relatively and absolutely.

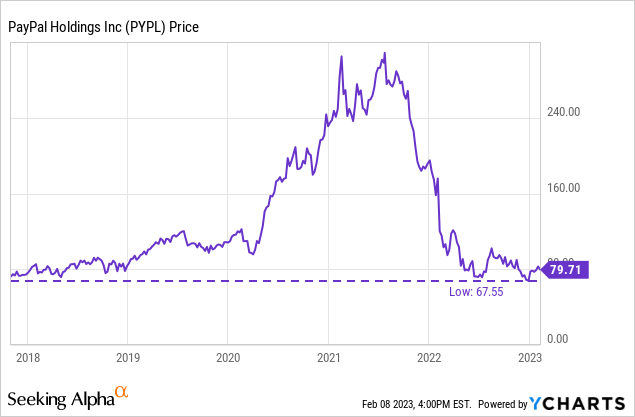

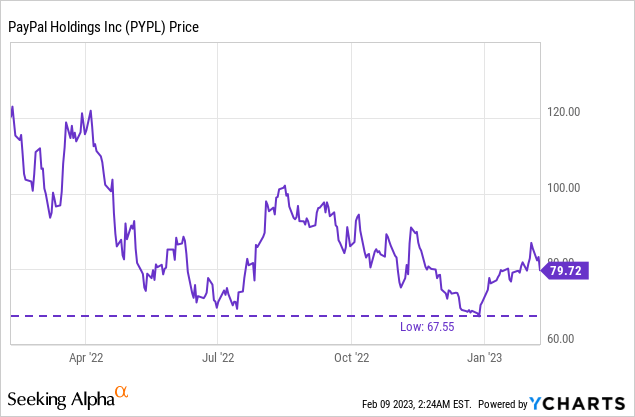

- The stock appears to have tremendous support at the $67 level, over a multi-year time horizon and is close to 15% from that support level.

- Nevertheless, competitive threats and mostly farcical management actions make the stock a fairly cautious buy, with the fourth-quarter report revealing the damage done by their actions.

hapabapa

PayPal (NASDAQ:PYPL) recently announced that it will cut about 2,000 jobs, or about 7% of its workforce, making it one of the later companies to announce layoffs ahead of the macroeconomic turmoil. These announcements come just before PayPal’s earnings report on Feb. 9 after trading hours, and could mean a lot for earnings.

We examine the effect of these cost savings on the long-term valuation of the stock and its future earnings as a more mature, efficiently run company. Currently, we believe that the exaggerated bearish sentiment around the stock, combined with its cheap fundamentals on both absolute and relative basis, makes it too cheap to ignore and can be considered a cautious buy ahead of earnings.

Cutting Costs

According to the CEO, the announced layoffs were mainly due to “dealing with the challenging macroeconomic environment,” as he shared the following message:

While we have made substantial progress in right-sizing our cost structure, and focused our resources on our core strategic priorities, we have more work to do. We must continue to change as our world, our customers, and our competitive landscape evolve.

On the timeline of layoffs of the 2,000 people, or 7% of the workforce, the CEO had the following to say:

These reductions will occur over the coming weeks, with some organizations impacted more than others. We will treat our departing colleagues with the utmost respect and empathy, provide them with generous packages, engage in consultation where required, and support them with their transitions.

Comparing this event to Meta (META), which laid off 11,000 employees, they estimate the savings to be about $1.5BN per year. If the same figures apply to PayPal, that would mean cost savings of about $273 million. In another estimate, we could also estimate efficiencies by measuring SG&A costs.

PayPal, for example, did $4.55 billion in SG&A over the past 12 months. If we take 7% of SG&A costs, that would equate to $318.71 million in potential savings. Neither figure is likely completely accurate, but it does give an idea of the impact of these layoffs.

The most significant effect, however, would be on PayPal’s bottom line. A cost reduction of $250M may not seem like much for a company that generates more than $27BN in revenue annually, but it could ultimately greatly affect its valuation. If that $250M were to flow directly into earnings, with no negative impact on revenues, at an average multiple of 16x, it would represent a realistic $4BN added value in terms of market capitalization.

Same Price, Different Fundamentals?

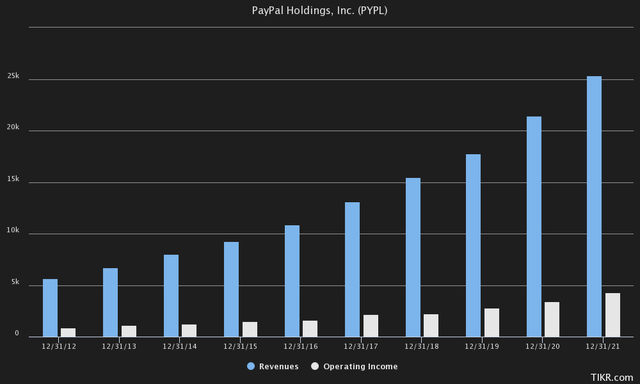

After a huge frenzy in 2020 and 2021, the stock amazingly plummeted back to the 2017 trading range. Paradoxically, PayPal’s intrinsic value has changed dramatically since then, despite the fact that the stock is still trading in that same price range.

Now, more than 5 years later if we look back, the company did $13.01BN in revenue in 2017. By comparison, in the past 12 months it did $27.05BN in revenue. That’s double the revenue, at such a size, and yet no change in the share price. Much more growth may have been factored into 2017, but it does speak to the bearishness of current investors looking at PayPal.

Not only did they more than double revenue, they nearly doubled operating income, from $2.20BN to $3.82BN. As things stand now, we think investors are more likely to judge PayPal as a company in decline, rather than a company that we believe is simply mature.

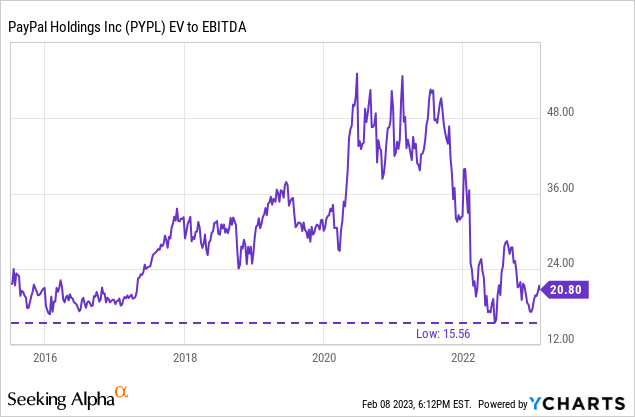

As a measure of valuation, we both like EV/EBITDA and P/FCF. Applied to PayPal, on an EV/EBITDA basis, it is trading close to the 15.5x multiple it reached in mid-2022. It is currently close to the low it has traded at in the past since inception, and always seems to have reached a low around that 16x EV/EBITDA multiple.

This provides the current downside protection we can expect. Unless profits disappoint and EBITDA drops significantly or balance sheet conditions change significantly, we think the expected downside is around 20% from current levels.

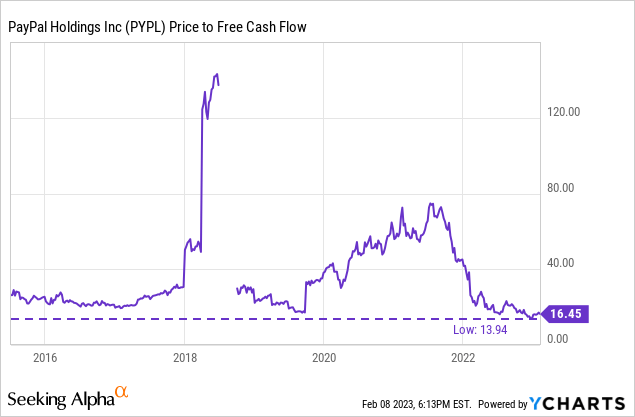

Since EBITDA can sometimes hide a company’s true profitability, fortunately the cash flow statement usually reveals the truth. On a P/FCF basis, PayPal is again trading close to the low it reached last year of about 14x free cash flow.

From inception to 2019, the lowest P/FCF multiple PayPal actually reached was about 19x, with the stock bottoming out at 17x P/FCF at the end of 2019. We are not saying that free cash flow can’t deteriorate, or that the stock could trade at a lower multiple, but it does indicate that market participants are generally bearish on the stock, and that it may be ready for a bounce.

At a multiple of 16.45x free cash flow, for example, the return on free cash flow would total 6.08%. When you compare that to the average free cash flow yield of the S&P 500, which was just over 2% last year, it speaks volumes.

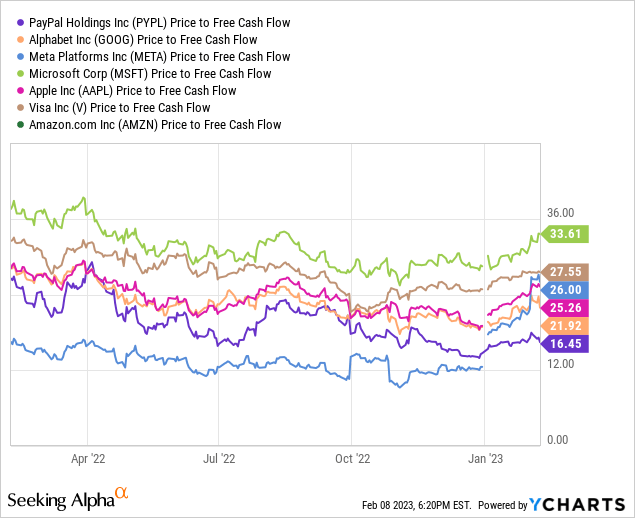

A second measure is PayPal’s relative valuation. Looking at other tech giants, since PayPal used to be among the largest tech companies and was worth about $360BN at its peak in 2021, we can judge a few things.

In the past, PayPal traded close to its peers, trading close to the average tech free cash flow multiple of about 25x. By the end of 2022, 2 companies were trading separately from that multiple, mainly Meta and PayPal. We think that PayPal, like Meta, is currently suffering from excessive bearish sentiment on management’s actions, and could quickly return to the baseline.

Meta, just as PayPal first announced layoffs and reaffirmed its focus on efficiency during its most recent earnings call last week. Perhaps PayPal will reiterate this conviction during this earnings call. Now that this bearish sentiment is over, Meta is again trading at about the same average as its industry peers, currently at 26x free cash flow.

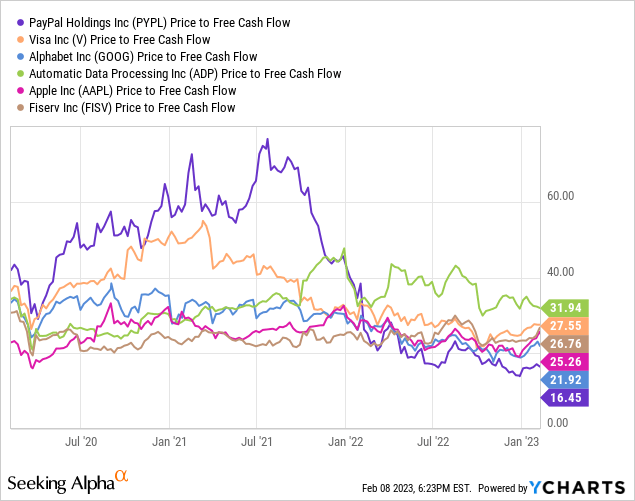

Even looking at PayPal’s direct and rather indirect competitors, the bearish sentiment is really bottoming out. The only direct competitor trading against the current PayPal multiple was Fiserv at the end of 2014 at a P/FCF multiple of about 16x. Alphabet (GOOG) with Google Pay is currently the closest to PayPal, which has its own problems on another front, namely artificial intelligence in search.

For those reasons, a 20x P/FCF multiple seems sensible to us, which would put PayPal at a valuation of $113.16 billion or $99.26 per share.

As a third way of valuing, let’s say PayPal is at peak growth. By this we would mean that PayPal maintains its current stable free cash flow. If we know PayPal’s future cash flow, and the discount rate, we can calculate what the future discounted free cash flow will look like. As a discounting mechanism, we can use long-term Treasuries.

Currently, the yield is 3.61% at 10 years and 3.69% at 30 years. For our calculation, since short-term Treasuries are closer to 5%, we use 4% as the long-term discount rate to get a conservative measure. If we take free cash flow of about $5.66 billion and divide that by our 4% discount rate, that leaves $141.5 billion of discounted free cash flow that can be returned to investors.

By that measure, PayPal is also currently trading below its intrinsic value unless underlying fundamentals deteriorate significantly. In other words, at $141.5BN, we believe PayPal’s intrinsic value is $124.12 per share. Looking at free cash flow, management is cleverly using it to buy back shares: over $5.06 billion worth of shares were bought back in the past 12 months alone.

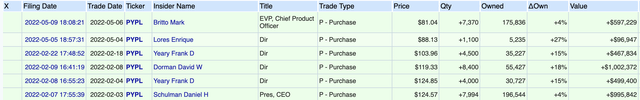

Another bonus is that management also bought shares on the open market in 2022, around the same price range where we think intrinsic value lies. Management and insiders have typically been big sellers, especially at the high levels we saw in 2020 and 2021, but only bought around this $80 range in 2017, 2021 and 2022. On the other hand, we could still cite the earlier lack of current insider ownership as a red flag, with management perhaps not as aligned with shareholders as usual.

Risks

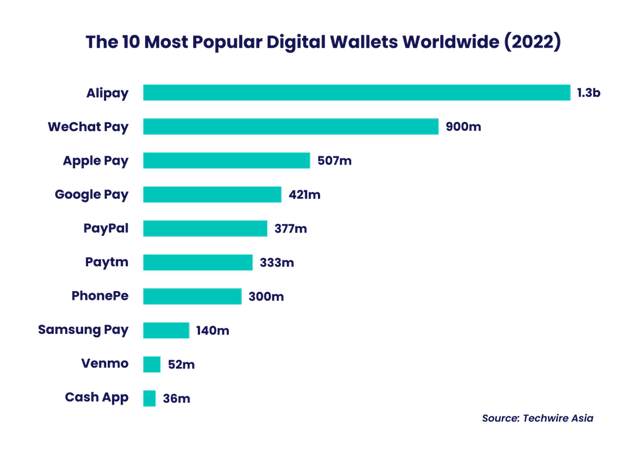

One risk not to be underestimated is that PayPal faces a lot of competition from large tech companies launching their own payment platforms, such as Apple Pay (AAPL), Alipay (BABA) and Google Pay. This may also be reflected in the bearish sentiment around the stock.

We would especially look for meaningful deterioration over a longer period, perhaps a 1-year period. Currently, PayPal is no longer a growth company, but we think the valuation against a company in decline is an overreaction. As a stagnant company, at 20x free cash flow, the valuation seems much more logical to us, as it would still trade below industry peers.

The biggest risk we are definitely concerned about is management, and the kind of shenanigans they have been pulling lately, with drastic consequences. In the fourth quarter, for example, management thought it was a great idea to issue a radical policy allowing them to fine users $2,500 for spreading “misinformation.”

It may have been the first time that a user agreement evoked so much resistance, but these drastic measures by PayPal were not taken lightly. When a dangerous noose is hit and people insist on their right to free speech, they revolt en masse on social media, believing they can use this policy against people because of their political beliefs, because any violation would be decided “at PayPal’s discretion.”

The news went viral, and Twitter, for example, was flooded with screenshots of people closing their PayPal accounts and declaring that they would never use the payment processor again, presumably because it was inconsistent with their political beliefs. We think this specifically prompted PayPal to respond immediately by reversing this policy. It remains to be seen how much destruction of active users this policy caused, and for those risks, we think PayPal should be approached with great caution, despite our buy rating.

These antics by management, politicizing the company in one direction, was, in our opinion, a very poor choice by management, which should have remained politically neutral.

The Bottom Line

PayPal is just too cheap to ignore, looking at their fundamentals from EBITDA to Free Cash Flow. In our opinion, investors are too bearish on the company, much like Meta, which recently saw a significant bounce after management also announced efficiency improvements.

Everything seems to align: insiders have previously bought shares from the open market around this range, they are finally committed to efficiency and are using their huge free cash flow base to buy back shares. Also from a technical analysis perspective, PayPal has proven to have tremendous support around the $67 level all the way back to late 2017. Earlier in 2022, it bounced off this support level twice. Currently, PayPal is trading about 18.02% above that support level.

For risk management, we usually prefer to buy a stock within 10-15% of major support levels, and like to set a stop-loss if the support should break, to limit our downside movement. That is also why, if the stock goes below $77, we would love this story even more by getting into that 15% range of its long-term support levels.

Disclosure: I/we have a beneficial long position in the shares of AAPL, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.