Summary:

- CEO Dan Schulman surprises the market with his unexpected announcement of retirement by the end of 2023.

- PayPal is aiming for a massive turnaround in its adjusted EPS growth before Schulman hands over the mantle of leadership.

- PYPL is cheap at only 12x NTM EBITDA and with potential for operating leverage recovery.

JasonDoiy

PayPal Holdings, Inc. (NASDAQ:PYPL) delivered a robust FQ4’22 earnings release yesterday (February 9), as CEO Dan Schulman announced his decision to step down by the end of 2023.

While we were surprised by his decision, the transition was well-planned. Schulman has made great pains to explain that the board will have sufficient time to plan for his transition, and he’s also willing to stay on “slightly longer,” if necessary. As such, it should help with the optics compared to abrupt departures that could suggest a strategic change.

Moreover, Schulman’s decision to leave at the end of FY23 is also timely, as he aims to engineer a sustainable turnaround of PayPal’s earnings growth after a tumultuous 2022.

Accordingly, PYPL investors endured the worst hammering in its stock performance, falling nearly 80% from its July 2021 highs toward its lows in December 2022.

However, PayPal’s solid H2’22 operating performance suggests that operating leverage was lifted, even as PayPal’s total payment volume (TPV) growth slowed further in 2022.

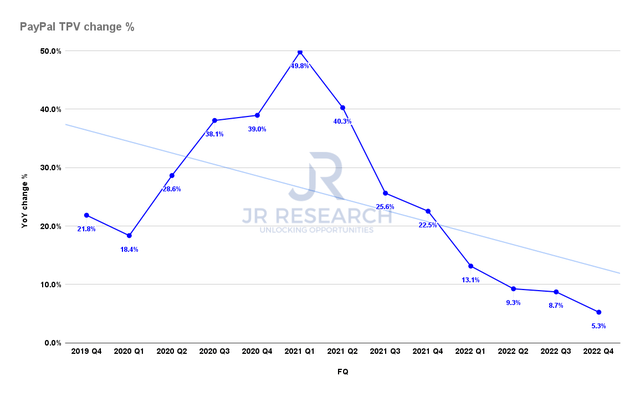

PayPal TPV change % (Company filings)

As seen above, PayPal’s TPV growth fell 5.3% in Q4’22 but was still ahead of its previous guidance. Moreover, as macro headwinds and high inflation rates persisted, consumer spending weakened further in late 2022.

However, management’s FQ1’23 outlook suggests better days ahead, even though the Fed could remain hawkish. Management estimated an adjusted EPS growth of 24% in FQ1 and a full-year adjusted EPS growth of 18%. Hence, investors should expect a more robust H1’23 performance from PayPal.

Notably, management articulated that its cost assumptions have baked in a “potential recession in Europe and the US, and high inflation.” It also reflects a lower FX neutral (FXN) revenue growth of “mid-single-digit” in FQ1, relative to its guidance of a 9% FXN revenue increase.

We believe those prudent assumptions are appropriate. However, management stressed that they would not be guiding for a full-year revenue outlook, given the uncertainties from the macro and inflationary headwinds.

Moreover, even though job growth has been robust, it could also compel the Fed to maintain its elevated rates for longer, increasing the risks of a more severe downturn (Yardeni – 8 February brief). Hence, investors need to assess whether the downside risks could impact PayPal’s ability to drive further operating leverage improvement against its baseline assumptions.

Given the rally in consumer discretionary stocks in 2023 that also lifted PYPL from its December 2022 bottom, we assessed that market operators anticipate a less hawkish Fed by the end of 2023. Therefore, if the inflation data continues to disappoint, forcing the Fed to turn more hawkish, raising rates above its 5.1% median terminal rate guidance could cause more volatility for PYPL.

In addition, eMarketer forecasts indicate that retail sales growth in the US could weaken further in 2023, dropping to 2.9%, before inflecting higher from 2024.

Therefore, the critical question investors need to evaluate now is whether such headwinds have been reflected in its price action and valuation?

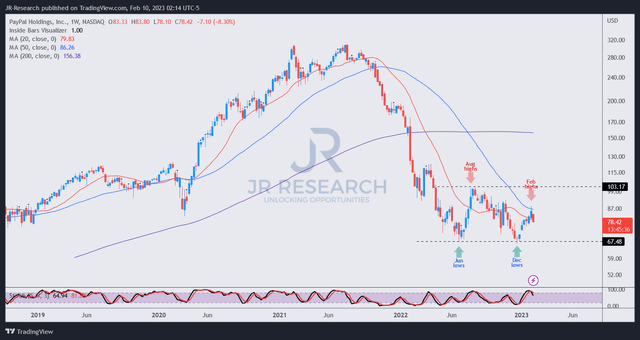

PYPL price chart (weekly) (TradingView)

PYPL last traded at an NTM EBITDA multiple of 11.9x, well below its all-time average of 22.4x.

With the potential for operating leverage gains built against appropriate baseline cost assumptions, we believe PYPL’s valuation is not aggressive.

Sure, bears could argue that PayPal is facing more intense competition, which was also highlighted in its earnings conference. Investors should note that Apple (AAPL) is slated to launch its BNPL as the Cupertino company broadens its penetration into newer growth verticals as its core iPhone growth slows. Blessed with an installed base of 2B devices (although they may have been overstated), Apple’s progress needs to be watched closely.

Despite that, we believe significant pessimism had already been reflected in its valuation, even though the current price action is not ideal.

Investors who missed PYPL’s December lows should expect further downside volatility if they decide to add now.

Notwithstanding, we believe PYPL is in the early stages of a sustained medium-term recovery, bolstered by the liftoff from tech and discretionary stocks. As such, it augurs well for Schulman to lead PayPal to a more robust recovery before handing over the reins to his successor.

Rating: Buy (Reiterated).

Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking to strategically enter the market and optimize gains?

Unlock the key to successful growth stock investments with our expert guidance on identifying lower-risk entry points and capitalizing on them for long-term profits. As a member, you’ll also gain access to exclusive resources including:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!