Summary:

- Growth is the key part of the AT&T Inc. strategy that makes the debt manageable and the dividend sustainable.

- Mr. Market has worried about both the dividend and the debt without examining the underlying growth strategy.

- “Good Enough” management brought all these worries “front and center.”

- The focus and detail orientation of the new management should eventually put a lot of worries to rest.

- The current solutions began years ago but were not apparent because AT&T is so large.

Ronald Martinez

The new AT&T Inc. (NYSE:T) has been subjected to a lot of examination about debt levels and possible dividend consequences. But much of what will happen depends upon some growth that has rarely been examined. This is a company that the market saw as a dividend play until the foray into some businesses crumbled. That left the company with a fair amount of debt as well as a lack of future focus. Of course, a lack of business focus will nearly always put the future of the dividend in doubt.

Businesses tend to survive and prosper by overcoming challenges and “changing with the times.” Managements that settle for “good enough” while putting the company on cruise control often do not survive. Or worse, if they do survive, the company probably will not. A driven, detail-oriented focus appears to be essential for the long-term success of the business.

Warner Bros. Discovery (WBD) is busy proving that the focus and detail orientation was sorely lacking. The steady drumbeat of news, write-offs, and layoffs is designed to restore the business focus that is needed for those divisions to be successful in the future.

But the new management began a few years ago to grow the company even as the divestments were being planned. Large companies grow like a mile-long train leaving the station. First, there is a lot of noise (and there sure was with ATT). Then, the train slowly begins to move. It takes time to get to full speed. Large companies go through roughly the same steps when moving from no focus to a focused growth.

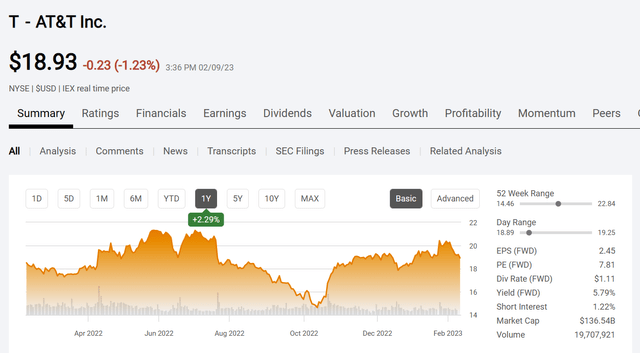

AT&T Common Stock Price History And Key Valuation Measures (Seeking Alpha Website February 9, 2023)

Once the AT&T Inc. divestiture program was largely completed in spring, an observer can see where the market worried about a lack of cash flow to support the dividend. So, there evidently was a complete lack of focus throughout the organization that the market expected to be fixed immediately after the divestitures were completed. That dip in the AT&T stock price in the fall most likely represented a buying opportunity due to market impatience. Clearly, the third quarter report reassured investors.

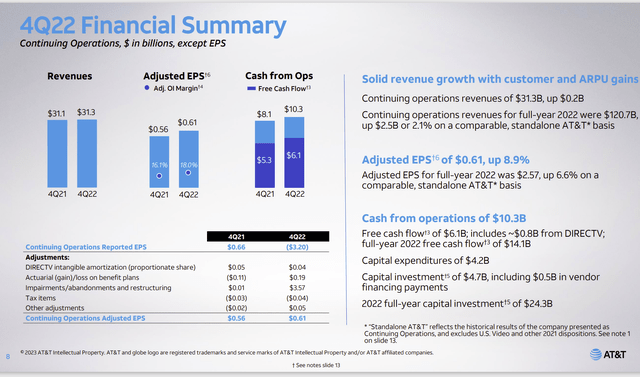

AT&T Fourth Quarter 2022, Financial Results Summary (AT&T Fourth Quarter 2022, Earnings Conference Call Slides)

The market was all excited about the free cash flow figure. This follows a reassuring third quarter. But it would not be unreasonable for the company to either delay debt repayments or even take on some debt if a profitable opportunity to expand the business merited such a step. Admittedly, that would not excite the market (to say the least). But it takes time to put a focused recovery in place that involves repaying debt while growing the business.

Management has promised to decrease the debt with expanding cash flow. But the conflicting goal is to also get the company into “growth mode.” For a company of this size, that often means single-digit increases each year. It also means that the company will become a growth and income play. Often that turns out to be the best way to maintain a dividend. Companies that settle for maintenance mode often require a whole lot more due diligence by the investor. I have never been a fan of “good enough” management. Just remember that, like the train, it takes time to get to that growth goal.

As management has noted, the start of the process that led to the cash flow in the third quarter (and now the fourth quarter) actually began some years ago. It took all that time to get things going in the direction that would lead to the cash flow improvement shown above. Had the market been focused upon that cash flow progress since the beginning of the project, there is no doubt that the market would have given up a long time ago. Instead, it is far more likely that the market was focused upon the divestitures.

This points up to another issue with large companies. Management must plan years in advance to keep the good news coming as the market expects it. This management appears to be up to that task. The prior management clearly was focused upon acquisitions but really lacked a proper plan for taking advantage of at least some of the acquisitions made. Evidently that management expected those acquisitions to “run themselves.” Clearly, that will not be the case in the future.

Restoring Shareholder Trust

This is an issue that has crept into conference calls and management comments elsewhere. A quick review of the “road shows” and also management meetings with shareholders (called “updates“) appears to have the goal of reassuring the market that there will not be material unpleasant surprises.

Somehow it appears that the market got the idea that communication was not what it should be. This usually occurs with the threat of dividend cuts or poor stock price action. For income investors, a dividend cut can be a particular disaster.

Now that AT&T Inc. management appears to be focused upon meeting industry challenges while establishing a growth and income strategy, there also appears to be a need to reassure the market that the company will not be going backwards. This is one of those “closing the barndoor after the horse left” type activities.

If current AT&T management thought enough ahead of time to get the remaining business turned around so that decent news arrived not long after the divestitures ended, then this management is likely to continue to think well into the future to keep the good news coming. That kind of demonstrates the management focus needed to keep the company out of “hot water” in the future.

The Future

Despite worries about the debt and the cash flow, AT&T Inc. management appears to be fairly well down the road to getting the situation under control. Short of something unforeseen that is materially unfavorable, management appears to have a decent plan to keep the dividend while getting the business growing for some dividend growth in the future.

The wireless and other businesses are now thought of as basic necessities. They are therefore likely to be recession resistant. I taught at poor schools and many students have cell phones “first.” Sometimes I wondered if it was more important than food and clothing because (as a teacher) I would hear of families being evicted (as well as going without food); but I rarely heard of families losing cell phone service.

Probably the biggest risk to the business is that sometime in the future, wireless will have the capacity to take over at least some of the wired business. That would likely be a gradual transition. But a fast “overnight” transition would be a risk.

In any event, AT&T has exposure to both the wireless and the wired business. Right now, that appears to be an advantage with some synergies. It would also appear that management has plans should the future change to change with that future. That is really the best that shareholders can hope for.

Nothing is certain in this world. Good management tends to surprise to the upside and meet challenges “head on.” That appears to be what this AT&T Inc. management is finally doing. Management meeting challenges is what makes investments relatively safer. AT&T Inc. is, therefore, likely to outperform expectations in the future.

Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

I analyze oil and gas companies, related companies and AT&T in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.