Summary:

- Chevron announced strong earnings but proved the thesis that it remains susceptible to crude oil prices.

- The company announced massive share buybacks, but it still needs cash flow to pay the buybacks.

- The company’s dividend is reliable, but we don’t expect strong long-term shareholder rewards past that level.

JHVEPhoto

Chevron (NYSE:CVX) is one of the largest oil and gas companies in the world. The company has a market capitalization of more than $300 billion, with an almost 3.5% dividend yield. Yet, despite its impressive portfolio of assets, and recently announced $75 billion buyback, the company’s earnings show how it’s overvalued at present prices.

Chevron’s 2022 Results

Chevron achieved blowout 2022 results, but without the same kind of supply shortages, it seems unlikely to continue.

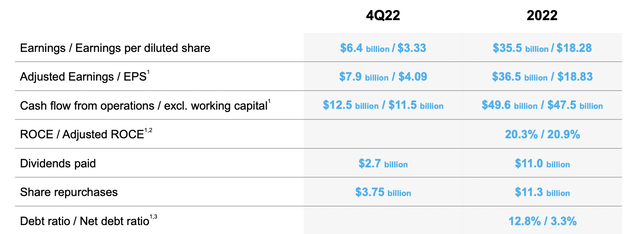

The company earned a staggering $35.5 billion throughout the year, giving the company a P/E of roughly 10. The company’s CFFO was just under $50 billion, with the company’s capital investments, taking its FCF to roughly 10%. The company’s dividends are just a hair over 3.5% with the company’s share repurchases taking its shareholder yield to just over 7%.

The company’s debt ratio remains incredibly manageable, a sign of its overall strong financial position. However, its barely double-digit earnings in a bumper year also indicate its lofty valuation.

Chevron’s Financial Performance

The company’s financial performance indicates that it’ll struggle to provide long-term viable shareholder returns.

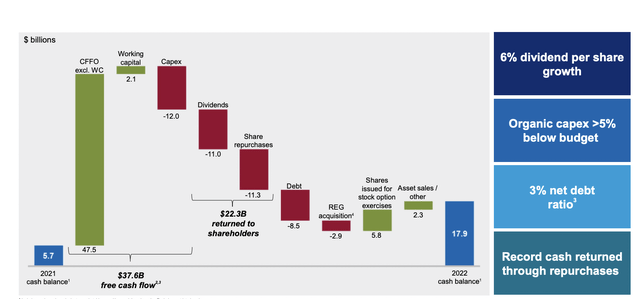

Chevron earned just under $38 billion in FCF throughout the year, a 12% FCF yield during a booming year. The company returned just over $22 billion of this, or roughly 7% to investors and used most of the remainder to pay down its debt and improve its overall financial position. The company’s net debt ratio is very manageable, and it’s continued to invest.

The company’s financial improvement through 2022 was impressive.

Chevron’s Own History

Chevron’s history tells the tale of how the company is overvalued and will struggle to drive future returns.

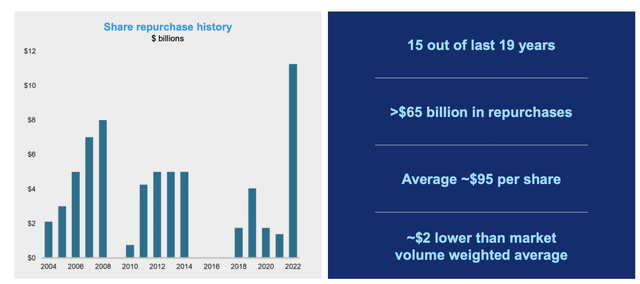

Chevron’s own share-repurchase history, the volatile source of its shareholder returns after its 3.5% dividend, is based on crude oil prices. Its volatility is clearly indicated above. The company’s 2022 share repurchases of several % were clearly a record to the tune of more than $10 billion. However, its prior year share repurchases have remained volatile.

Since 2004, or an 18-year period, the company has repurchased approximately $65 billion of its shares or roughly $3.5 billion annualized. That’s a roughly 1% annualized yield on top of the company’s dividend, meaning a total shareholder yield of just under 5%. That long run shareholder yield is minimal given the company is returning the majority of its cash flow to shareholders.

The company’s average repurchases of $95/share are strong given recent share prices, but they’re historically high.

Chevron’s Guidance

Chevron’s guidance helps to highlight how the company’s share price is overvalued.

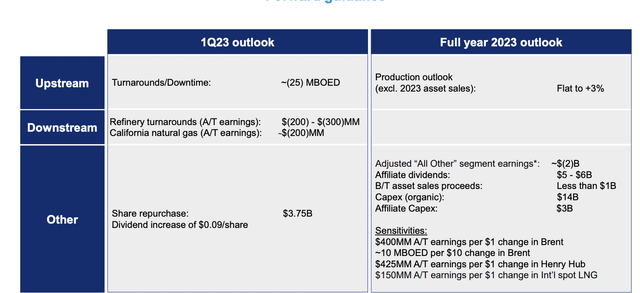

The company expects mostly flat production. Dividends are expected to be 3.6% and even if the company annualizes its share repurchases, that would still mean share repurchases of roughly 4%. That would be a total yield of just under 8% for the year. That’s a struggle for the company to be earning at the peak of current oil prices.

We expect the company’s earnings to trend downward as oil prices return towards a long-term normal, pushing down the company’s ability to earn sufficient cash flow to justify its valuation.

A Great Company At A Bad Price

Chevron is a strong company. The company’s management has made numerous good decisions. The company built up a substantial asset portfolio, including impressive and expensive Australian assets well before the rest of the market did. Its steady and intelligent decision-making has resulted in a loftier valuation than many other companies.

Unfortunately, now the company is too expensive. We don’t see a path for it to go beyond its current offering of mid-single-digit long-term shareholder rewards.

Thesis Risk

The largest risk to our thesis is that Chevron has the ability to outperform in a higher-priced environment. That’s clearly evident from the company’s profits over the last year. Assuming prices remain higher than we expect for the long run, that can help support substantial shareholder returns and justify the company’s valuation.

Conclusion

Chevron is a great company and the company had an incredibly strong 2022. It generated massive shareholder rewards through a massive share repurchase program along with continued dividends. As oil prices remained higher, the company’s large portfolio benefited incredibly well. However, its history also shows how volatile that cash flow is.

We expect oil prices to drop down to a new long-term normal. The company has hit an incredibly lofty valuation in the markets. Despite having a good business with strong assets, its valuation is just too high. We expect the company will struggle to generate above mid-single-digit returns at its current valuation, making it a poor investment.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.