Summary:

- Amazon is taking too much flack after 4Q-22 earnings.

- The stock looks very attractively priced based on sales.

- Strong guidance for 1Q-23 doesn’t get enough credit.

4kodiak/iStock Unreleased via Getty Images

My expectations for the earnings performance of Amazon.com, Inc. (NASDAQ:AMZN) have not been met. With that said, I believe the market is making a huge mistake by prematurely discounting Amazon’s growth potential.

Yes, Amazon missed profit expectations in the fourth quarter, but the company’s guidance for 1Q-23 is not bad, nor is the growth potential of AWS, a segment that reported a slowdown in growth in 4Q-22.

What I like best about Amazon right now is the valuation, which has resulted in a significant multiple compression of Amazon’s sales multiple due to negative investor sentiment.

As long as AMZN remains as despised as it is now, I will shamelessly indulge my greed by loading up the truck below $100.

Profit Miss Is Exaggerated, Investors Should Look At AWS’s Growth Potential

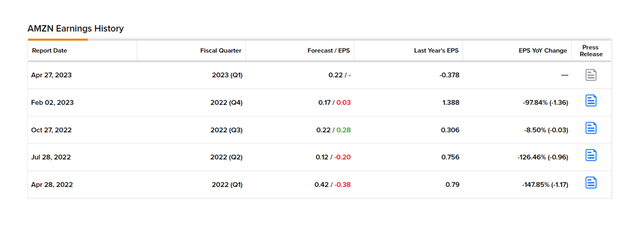

Amazon’s fourth-quarter profits fell far short of expectations a little more than a week ago. The company reported adjusted profits of $0.03 per share, well below the $0.17 per share consensus estimate. The earnings report called Amazon’s growth potential into question once more, and the stock price has dropped back into the double digits.

Earnings History (Amazon.com Inc)

Amazon’s stock is currently trading at $97.96, and it has had 5 down days since the company reported earnings. As investor sentiment has deteriorated, I believe the drop represents an opportunity to emerge as an aggressive buyer of Amazon stock (which I am).

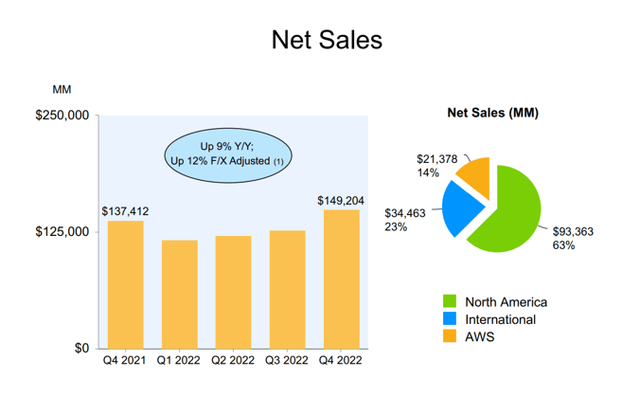

Leaving aside the profit miss, I believe the earnings release demonstrated far more strength than investors are willing to admit. To begin, Amazon reported 9% YoY net sales growth and 12% on an FX-adjusted basis, a decrease from the third quarter, when net sales rose 15%. Amazon’s total net sales were $149.2 billion in the fourth quarter, which was higher than expected.

Amazon guided for $126.0 billion in net sales in 1Q-23, so Amazon did quite well in terms of sales growth, despite a profit miss that I believe received undue attention. The net sales picture indicates that all segments are experiencing healthy growth, with eCommerce sales increasing 7% YoY to $119.6 billion. Again, eCommerce net sales accounted for more than 80% of total net sales, with Amazon’s cash cow AWS accounting for the remainder.

Addressing The Elephant In The Room: AWS’s Slowing Growth

The fact that company executives have made comments about AWS’s slowing growth, which some investors have used to sell Amazon’s stock into the weakness, has hurt Amazon’s stock price more than anything else post-earnings. Amazon executives also warned that AWS growth would slow further in the first quarter as companies cut AWS spending to control costs amid a broader slowdown in the sector.

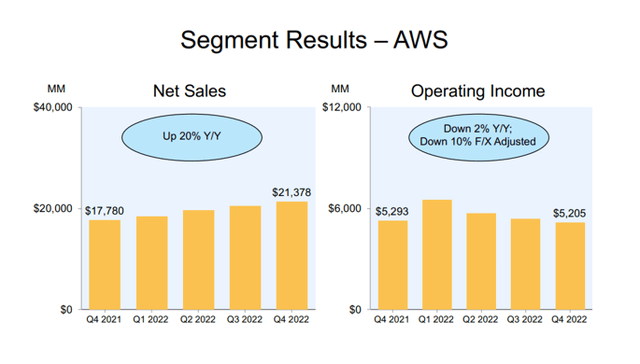

AWS is Amazon’s cash cow, and it delivered a string of record quarters during the pandemic. AWS reported net sales of $21.4 billion in the fourth quarter, representing a 20% YoY increase. Operating income was $5.2 billion in the fourth quarter alone, down 2% YoY and 10% in FX-adjusted terms.

AWS Could Be A $100 Billion Sales Business In 2023

In my opinion, investors undervalue AWS’s sheer size and the potential for incremental sales growth. AWS’s LTM sales totaled $80.1 billion, resulting in operating profits of $22.8 billion.

AWS is extremely profitable for Amazon, and I believe that despite some customers cutting costs right now, AWS will continue to be Amazon’s cash cow, putting up significant growth numbers in the long run.

It would not be unreasonable to expect AWS to generate slightly less than $100 billion in net sales in 2023, implying total growth of 25% YoY and operating income of $22-25 billion.

Last year, AWS’s net sales increased 29% YoY, implying that even if demand slows, AWS has a chance to become a $100 billion, highly profitable annual business for Amazon.

Amazon Is A Steal

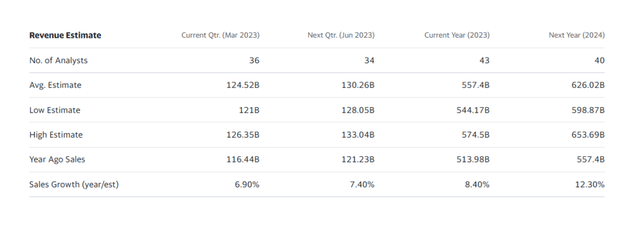

The market anticipates 12.30% sales growth for Amazon in 2024, with total sales of $626.02 billion, corresponding to a sales multiple of 1.7x.

Amazon has a market value of $1.1 trillion, which means the company will not grow as quickly as it did in its early stages more than two decades ago, but in my opinion, it is pretty impressive that a company with a market value of more than a trillion dollars could grow its sales by double digits next year.

The majority of this growth will come from AWS, but that doesn’t change the fact that Amazon is growing, albeit slowly. Last year, Amazon’s sales growth was valued much higher than it is today: AMZN was valued at roughly twice the current sales multiple. I don’t see why Amazon couldn’t challenge its previous high and return to a 2021-like valuation in the next two or three years.

Revenue Estimate (Yahoo Finance)

Why Amazon Could See A Lower Valuation

I am happy to admit that I am not entirely neutral toward Amazon, and that I may be overly optimistic about AWS, which is clearly facing some growth headwinds.

However, slowing growth may be a temporary phenomenon because businesses tend to increase their spending in better economic times, which is why I believe investors are overreacting right now.

Yes, I could be wrong about AWS, and the segment’s growth could slow for more than one quarter, but AWS will continue to grow much faster than the eCommerce business.

My Conclusion

I believe there are times when an investor should pounce and times when an investor should reduce stock purchases. When investors and valuations are driven by optimism (as they were last year), it is time to be cautious; however, when the market pendulum swings the other way and investors become overly cautious, it is time to be greedy. Amazon is a steal at a compelling sales multiple, slowing AWS growth or not.

I believe that two or three years from now, investors will be asking themselves why they did not profit from the selloff.

With Amazon trading below $100, I can’t help but be greedy for one of the world’s best-managed, customer-oriented multi-line businesses.

Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.