Summary:

- GameStop has had a really rough year or so, with the meme stock crashing as many predicted it would.

- Given how far shares have fallen, some speculators may feel emboldened, but it would be a mistake to turn bullish on the firm.

- Fundamentally, it is a mess and it deserves to fall a lot further, even in light of some bottom line improvements.

Massimo Giachetti

Some companies deserve to fall significantly from the price at which they are trading at. And after they fall, sometimes they deserve to fall further. One good example of a company that has taken quite a tumble over the past several months but that still deserves further downside is video game retailer GameStop (NYSE:GME). Although the company has demonstrated some improvement on its bottom line recently, sales continue to fall and its overall profitability data looks very discouraging. It is true that the company has a significant amount of cash on hand. That is keeping the boat floating for now. But if something doesn’t change before too long, investors can expect further downside for the stock.

The pain isn’t over yet

Over the past year or so, I’ve written quite a bit about GameStop. In my most recent article, I talked about the then-hyped partnership with the now-defunct FTX, a partnership that has since been ended by the video game retailer. In addition to this, I talked about the very few positive attributes of the company, such as the surplus cash it had on hand. But for the most part, its financial data was looking rather painful. This led me to keep the ‘strong sell’ rating I had on the stock, a rating that reflected my belief that shares should significantly underperform the broader market for the foreseeable future. Since then, that’s exactly what the company has done. While the S&P 500 is up 2.1%, shares of GameStop have seen downside of 25.4%. And since I first rated the company a ‘strong sell’ back in January of 2021, the stock is down 77.8% compared to the 9.1% rise the S&P 500 experienced.

After seeing a massive downturn like this, I can understand why some investors might be hopeful that the bottom is in. Based on the data available, I don’t believe that’s the case. To see what I mean, we need only point to data covering the third quarter of the company’s 2022 fiscal year. This is the only quarter for which new data is available that was not available when I last wrote about the business. Sales during that time came in at just under $1.19 billion. That’s 8.5% lower than the nearly $1.30 billion generated the same time one year earlier. This plunge in revenue came from two of the companies operating categories.

The hardware and accessories category, for starters, saw revenue drop 6.4% year over year, declining from $669.9 million to $627 million. Slowing demand on certain previous generation hardware, combined with supply chain constraints for the latest generation hardware, impacted sales here, as did foreign currency translation. Software sales also took a beating, falling nearly 19% from $434.5 million to $352.1 million. Management attributed this to a decline in sales from new software releases. But beyond that, they didn’t really provide much in the way of detail. To me, this is the most problematic area for the company. This is because I believe that, if the firm is to survive, it must do so by transitioning more toward a software-oriented business model. So to see weakness on this front is certainly an issue. The only bright spot for the company involved its collectibles category. Revenue here actually managed to increase year over year, rising by 7.9% from $192.2 million to $207.3 million. But even after that increase, it represents only 17.5% of the firm’s revenue.

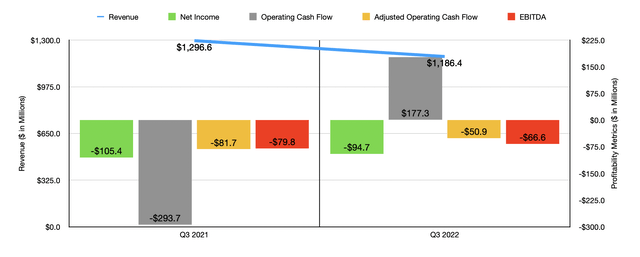

To say that the third quarter was bad all around isn’t entirely accurate. Profits and cash flows were significantly negative, making the situation a net negative in and of itself. However, the company has done well to improve its bottom line to some extent. Net income, for instance, ended the third quarter of 2022 at a negative $94.7 million. That compares to the negative $105.4 million generated one year earlier. Other profitability metrics largely followed suit. The one exception was operating cash flow, which spiked from negative $293.7 million to $177.3 million. But on an adjusted basis where we ignore changes in working capital, it would have improved more modestly, turning from a negative $81.7 million to a negative $50.9 million. Also on the decline was EBITDA. According to management, it went from negative $79.8 million to negative $66.6 million.

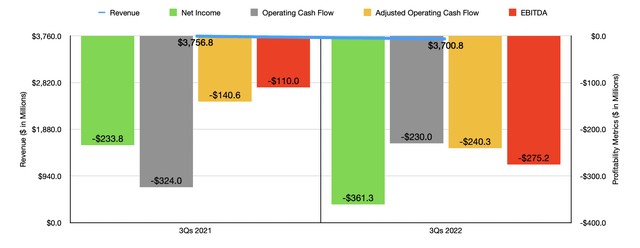

The third quarter is interesting in and of itself because the improvements experienced on the bottom line were different than what the company experienced for the first nine months of 2022 as a whole. Yes, sales still did decrease year over year, dropping from $3.76 billion to $3.70 billion. However, the net loss for the company during this time worsened, turning from $233.8 million to $361.3 million. Operating cash flow went from negative $324 million to negative $230 million. But if we adjust for changes in working capital, it would have worsened from negative $140.6 million to negative $240.3 million. And over that same window of time, EBITDA transformed from negative $110 million to negative $275.2 million.

Those who are bullish about the company will point out that the improvement in the third quarter could be a sign of better times ahead. This could very well be correct. However, the decline was really just attributable to changes in interest income, as well as the drop in sales. Those who are bullish about the company may also point out that management has been successful in accruing a sizable war chest of cash in excess of debt totaling roughly $1 billion. But when you consider how much cash the business has already hemorrhaged, this excess will not last for long. Hopes and NFTs and crypto also seem to be diminishing. In the third quarter, management said that its NFT Marketplace revenue was immaterial to operations. Of course, it was only launched in the second quarter of 2022, so there could still be some time for this to play out. But so far, this doesn’t appear to be likely.

In addition, it’s no secret that one of the problems facing GameStop is weakness in the video game market. For eleven straight months, through the month of September of last year, overall revenue in the space was down year over year. In October, the industry saw sales remain virtually flat year over year. But then, in November, the industry reported a 3% rise in sales year over year. This came even as content sales dropped 5%. It was driven, then, by a 45% surge in hardware sales, with both the PlayStation 5 and Nintendo Switch leading the way. Accessories revenue also increased during this time to the tune of 10%. In December, growth continued, with overall industry revenue up 2% compared to the same time one year earlier. This came even as content sales dropped 1% and as accessories revenue dropped 2%. Just like with November, a ramping up in preparation for the holiday season resulted in hardware sales climbing, this time by 16% year over year.

Investors are certain to view this as a positive for GameStop. And it’s possible that this could help to boost sales and bottom line results to some degree when management reports fourth-quarter results. Even analysts at JPMorgan Chase (JPM) espoused positive sentiment regarding the space, viewing gaming as an affordable way to be entertained during a recession. Some may view the short interest in the company as a near-term catalyst. But I’m not all that convinced. As of February 10th, short interest totaled 21.6% of the company’s float. However, this is only marginally higher than short interest was as far back as September of last year when it totaled 18.5%. Between then and now, interest has remained in a fairly narrow range mostly between those two points.

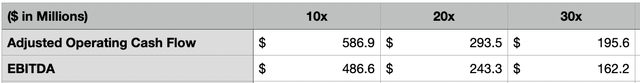

Even if the company does survive, the big question investors need to ask themselves is what it will ultimately be worth. With a market capitalization of $5.87 billion as of this time, GameStop is far from being cheap. As a hypothetical, I created the table below. In it, you can see how much cash flow or EBITDA the business would need to generate each year in order for it to be at least fairly valued, with one example showing a price to operating cash flow multiple and an EV to EBITDA multiple of 10 each. The more generous scenario calls for these multiples to be 20, while the most liberal one calls for them to be 30. Unless GameStop becomes incredibly healthy and achieves rapid growth, it’s very difficult to imagine the stock being pricier than that.

What this shows is that, even in the best case where investors decide to pay significant multiples for the business, cash flows would have to be monumental. Operating cash flow would need to be as high as $195.6 million, while EBITDA would need to be around $162.2 million. At a multiple of 20, these numbers should be $293.5 million and $243.3 million, respectively. And at a multiple of 10, we are talking $586.9 million and $486.6 million, respectively. The track record of the business has not indicated the capacity to achieve anything even remotely close to these levels.

Takeaway

From what I can see, GameStop has fallen hard in recent months. But this doesn’t mean that the pain is over. In my opinion, shares deserve to fall significantly further than what we have experienced already. Of course, this picture could change based on management’s own actions and how successful those actions end up being. Although I am incredibly bearish about the firm in the long run, I don’t view something like bankruptcy as being very likely at any moment. Even though the company is hemorrhaging cash, it does still have just over $1 billion in cash in excess of debt. This is down from the $1.37 billion reported one year earlier. So clearly, the picture is worsening. But even burning through cash at the rate that it has would give it a couple of years before bankruptcy would be probable. Because of the large amount of cash the company has on its books, it also has a tremendous amount of liquidity. Its current ratio, for instance, comes in at 1.63. But this does not mean that the company is an obvious and robust asset play. While it does have a tremendous amount of cash, its overall net assets come out to $1.25 billion. And more likely than not, those assets are worth less than they are on the books for. This means that, long-term, downside for investors even in the event of an unwinding of operations would be significant. All of these factors, combined, make this a clear ‘strong sell’ candidate in my book still.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!