Summary:

- On January 24th, the stock of renewables pioneer NextEra – now the U.S.’s largest utility company – dropped 8.8% on news the head of its FP&L unit was retiring.

- The retirement and subsequent stock drop came on the heels of a Bloomberg report that the company had violated Florida’s campaign finance laws.

- While NextEra refutes the allegations, even if true, a ~$14.5 billion haircut to the company’s market cap is arguably an overreaction.

- Shares are a Buy based on a diverse portfolio of power-generating assets, a leading position in renewables, and perfectly positioned to receive a lion’s share of IRA Act tax credits.

Florida Power and Light solar trees at Young Circle Arts Park in Hollywood FL felixmizioznikov/iStock Editorial via Getty Images

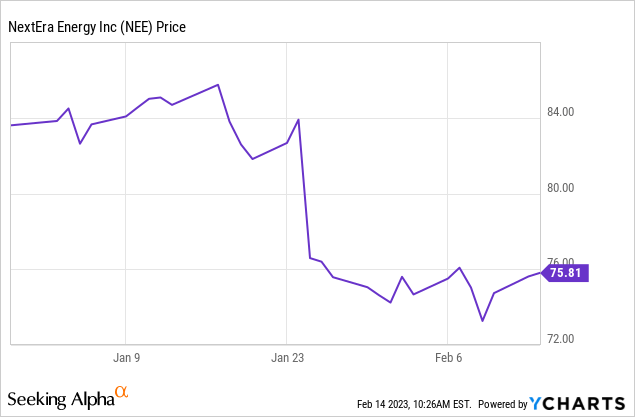

In late January, the stock of renewables pioneer NextEra (NYSE:NEE) took a big haircut (see below) on news that Florida Power & Light’s CEO, Eric Silagy, was retiring along and coincident with a Bloomberg report that the company was conducting an internal probe to see if it had violated Florida’s campaign finance laws. A relatively soft Q3 EPS report didn’t help. With respect to the allegations, the company said it found no evidence of wrongdoing. But the developments spooked investors and brought back memories of past utility company scandals. Regardless, and even if true, the ~$14.5 billion reduction in NEE’s market cap was arguably a massive overreaction. I say that because NEE has a nicely diversified portfolio of power-generating assets that generate strong and stable cash flow. Meantime, NextEra is in an excellent position – and arguably better than almost all others in the entire utility sector – to benefit from money pouring into clean energy investments due to what I refer to as the Biden Administration’s Clean Energy Act – also known Inflation Reduction Act, or “IRA”. Being the #1 U.S. utility by market cap, and with the largest set of renewable assets in the business, a large chunk of that money will go to NEE in the form of tax credits to build out significant new renewable energy power generation and transmission capacity.

The Stock

As can be seen in the graphic above, and unlike a typically big sell-off on overreaction to news, NEE’s stock has yet to recover any of the big drops. Some investors might say the sell-off was long overdue considering the stock still trades at an above-market forward P/E of 24.4x and yields only 2.25% – significantly lower than the broad utility sector as measured by the SPDR Select Utilities ETF (XLU), which currently yields 3.02%.

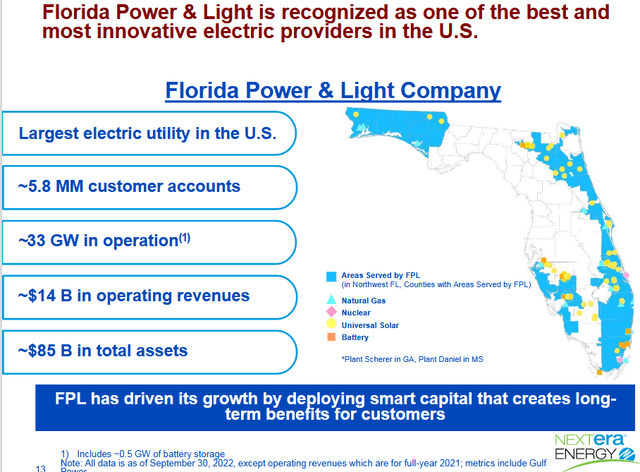

It’s easy to see how investors got rattled by the news at FP&L. After all, FP&L is the largest electric utility company in the U.S. and is located in one of the country’s fastest-growing states. A significant threat to that business would certainly be material.

However, NEE has a nicely diversified portfolio of electric power generation assets which – in addition to substantial solar and battery backup capacity – include natural gas and nuclear base-load capacity. That being the case, FP&L has certainly been a key cog in NEE’s growth engine:

The allegations of wrongdoing (see the Bloomberg link referenced earlier) centered around FP&L back in 2021 and 2022. Allegedly, FP&L was working with a political consulting firm to defeat candidates who backed a proposal to promote rooftop solar in the state. FP&L was concerned that rooftop solar would undermine the company’s utility business. The allegations include reports that money was secretly funneled into campaign contributions for third-party “ghost candidates” who did little actual campaigning but were intended to siphon votes away from two Democrats that NEE wanted to defeat.

If true, this is certainly not a good look for a company that has positioned itself as a leader in the transition to renewable clean green energy. However, I seriously doubt that – even if true – any potential fines and/or impact to the company’s actual FP&L operations are going to be anywhere near the $14.5 billion reduction in market cap due to the big drop in the stock price last month. After all, that would be more than an entire year’s worth of FP&L’s revenue. That said, no doubt rooftop solar – if deployed in large numbers across the state – would, obviously, have a negative impact on demand for FP&L’s baseline grid. On the other hand, rooftop solar could open up additional opportunities for NEE in the battery backup and micro-integration markets – that is, enabling consumers to operate on a two-way grid by selling surplus rooftop solar energy power to NEE.

The Clean Energy, or IRA Act

As most of you know, the Biden Administration’s Inflation Reduction Act, or what I call the “Clean Energy Act”, includes $370 billion in investment tax credits to do everything from building out an electric recharging grid, to building more robust transmission assets that can better adapt to the intermittency of renewable power generation, and to significantly increase the amount of clean green solar, wind, and battery backup capacity. All of these initiatives are right in NEE’s wheelhouse, as arguably no other major U.S. utility company has the years of depth of experience in these areas as compared to NextEra. Nor the scale.

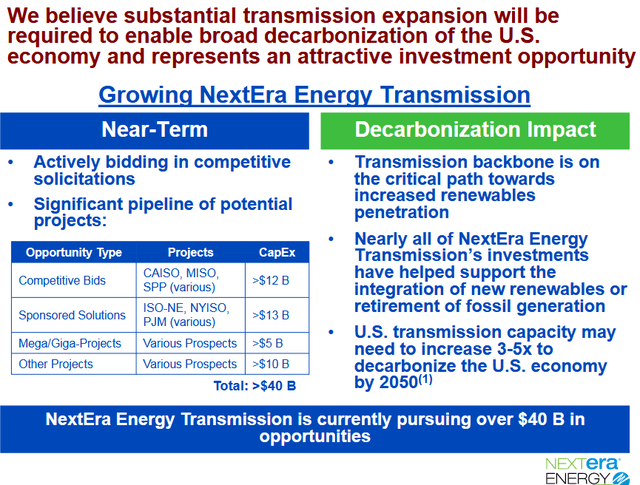

Indeed, in a November Presentation, NextEra reported it had already identified ~$40 billion worth of attractive investment opportunities in the transmission category alone in order to more optimally integrate renewable electric power generation capacity onto the grid:

As mentioned earlier, much of this transmission capacity is going to be eligible for tax-credits under Biden’s Clean-Energy Act. This is a multi-year and very positive catalyst for NextEra, as well as its MLP – NextEra Energy Partners (NEP).

Summary & Conclusion

Yes, despite the big drop in the stock price in late January, NEE still trades at a premium to the broad utility sector. But, in my opinion, it should. NextEra is the largest electric utility company in the U.S. (by far). That being the case, the company is going to get a lion’s share of the Clean Energy Act’s tax credits for building out renewables, transmission, and infrastructure tax credits. This is a multi-year and positive catalyst for a company that also boasts significant natural gas and nuclear power assets. NEE is a buy and could be considered as a core long-term portfolio holding for those investors looking to have exposure to the U.S. utility industry as well as excellent dividend growth potential.

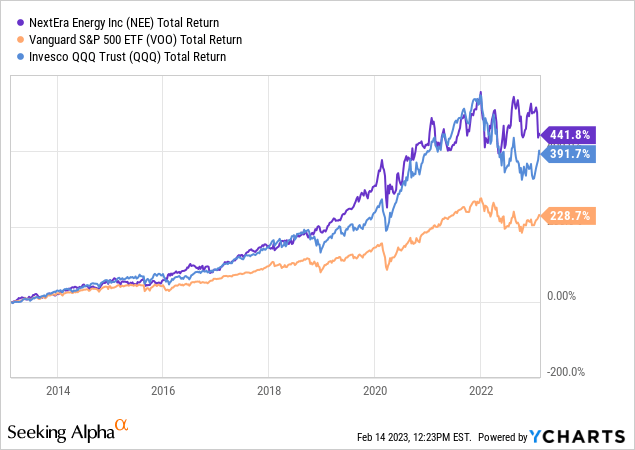

I’ll end with a 10-year total returns comparison between NEE, the Vanguard S&P 500 ETF (VOO) and the Nasdaq-100 (QQQ):

Note that NEE has outperformed the triple Qs by ~50% over the past decade and bested the S&P 500 by 210%+. It has obviously been a great utility company investment vehicle. I doubt the performance will be as dominant over the next decade, but it is likely to leverage a big cut of IRA Act’s tax credits into excellent returns for shareholders.

Disclosure: I/we have a beneficial long position in the shares of XLU, VOO, QQQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am an electronics engineer, not a CFA. The information and data presented in this article were obtained from company documents and/or sources believed to be reliable, but have not been independently verified. Therefore, the author cannot guarantee their accuracy. Please do your own research and contact a qualified investment advisor. I am not responsible for the investment decisions you make.