Summary:

- The pandemic has ended, and the travel industry is ready to rebound in the coming years.

- Airbnb has disrupted the traditional travel industry and is in the perfect place to benefit from the travel industry rebound.

- Despite assuming Airbnb to reach performance on par with Booking Holdings, the leading company in the market, ABNB stock is still overvalued at today’s prices.

Giselleflissak

Investment Thesis

After three years of pandemic, the travel industry is ready to rebound and Airbnb (NASDAQ:ABNB), the second-largest travel company in the world, is in the perfect place to benefit from it.

Having disrupted the traditional travel industry with its alternative accommodations, Airbnb quickly reached the top of the industry, second only to the behemoth Booking Holdings (BKNG).

However, despite Airbnb being expected to keep growing at double digits rate in the coming years, reaching efficiency and profitability levels on par with Booking Holdings ones, the company still results overvalued at today’s prices if compared to an intrinsic value of $106 per share.

In today’s analysis, we will assess why Airbnb, despite strong growth ahead, does not represent a good investment opportunity in the current market conditions.

Business Model

Airbnb’s business model is based on connecting Hosts, people willing to offer any sort of accommodation and experiences, with potential Guests. Airbnb’s marketplace currently accounts for more than 4 million hosts that offered accommodations and experiences to more than 1 billion guests so far.

Revenues are generated from service fees collected from both hosts and guests as a contribution to facilitating the interaction between the two parties and are based on the gross value of the booking. Revenues are recognized at the moment of the check-in, and Airbnb is not required to perform any further obligation related to the stay other than bringing together Hosts and Guests with its platform.

Operating Performance

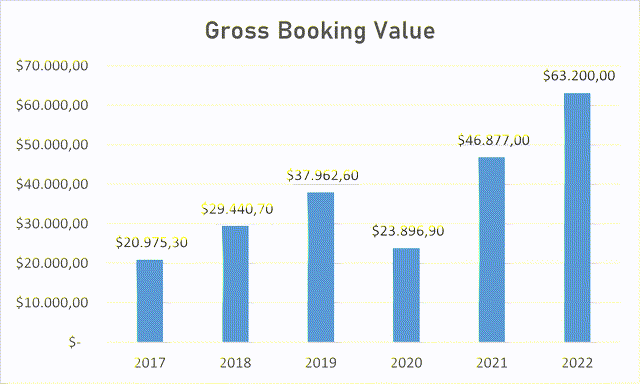

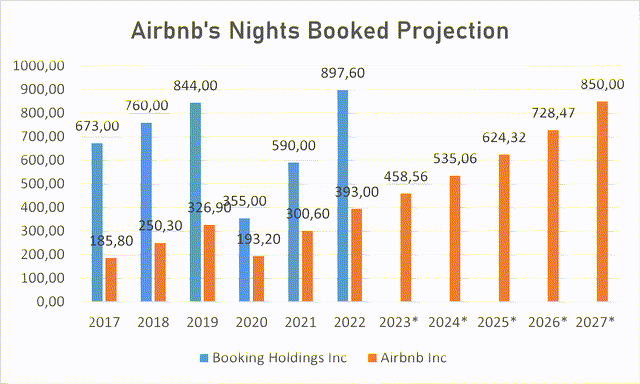

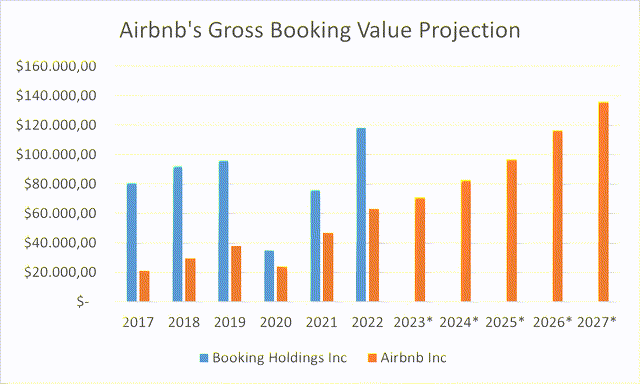

Looking at Airbnb’s past operating performances, from 2017 to 2022 total nights and experiences booked went from 185 million to 393 million, while the gross booking value, representing the value of all bookings inclusive of Hosts’ earnings, went from $20 billion to $63 billion.

Airbnb’s gross booking value (Bloomberg)

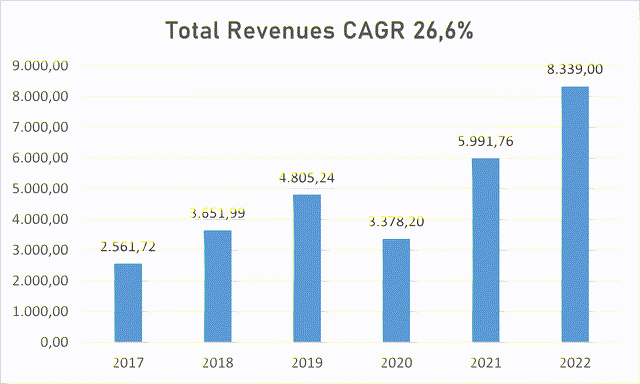

Airbnb’s median take rate for the period, representing the percentage of gross booking value turned into revenues, was 12.7%, and translated into revenues growing at a compound annual growth rate (‘CAGR’) of 26.6% in 5 years, from $2.5 to $8.3 billion.

Airbnb’s revenues (TIKR Terminal)

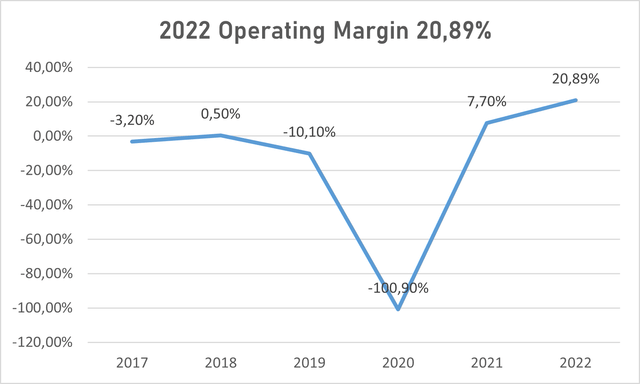

Airbnb managed to turn profitable in 2021 and in 2022 had an operating margin of 20.8% equal to an operating income of $1.74 billion. Given the low invested capital levels, the return on invested capital (‘ROIC’) was impressive in the last two years, respectively 48% and 317%, but rarely sustainable in the long run.

Airbnb’s operating margins (TIKR Terminal)

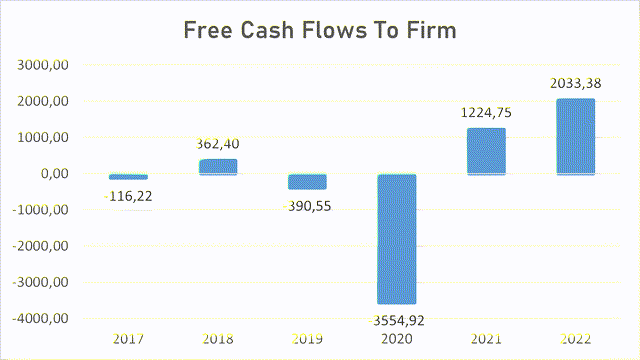

Along with high efficiency and profitability, Airbnb managed to deliver strong free cash flows to the firm (‘FCFF’) in 2022 equal to $2 billion.

Airbnb’s free cash flows to the firm (Personal Data)

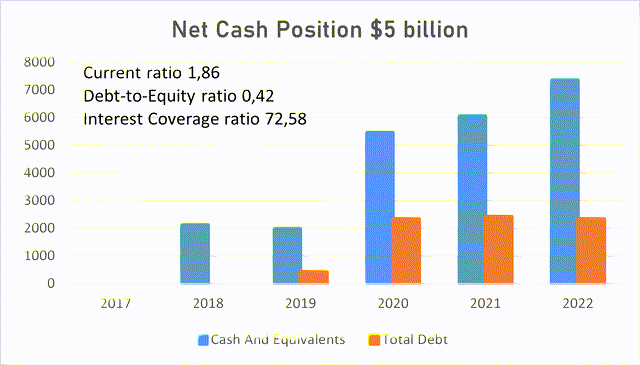

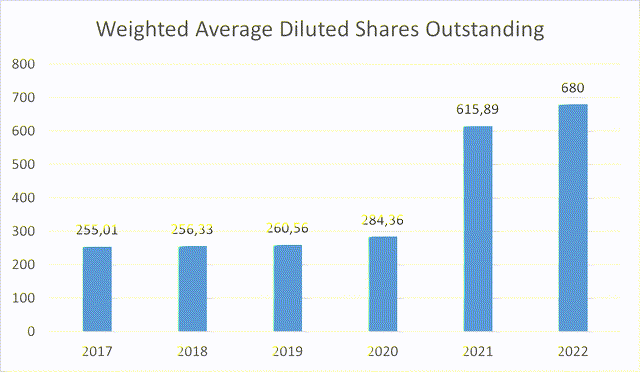

Financially, Airbnb is very solid with a net cash position of $5 billion, partially derived from IPO proceeds, and strengthened by a current ratio of 1.86, a debt-to-equity ratio of 0.42, and an interest coverage ratio of 72. However, having turned public at the end of 2020 they kept issuing shares, diluting investors’ values.

Airbnb’s financial position (TIKR Terminal)

Airbnb’s outstanding shares (TIKR Terminal)

Competition & Risks

Having a look at the online travel agency industry, with a total market share of 38%, including KAYAK and Priceline, Booking Holdings is the undiscussed market leader with almost 900 million nights booked last year and revenues expected to reach almost $17 billion in 2022. Following we have Airbnb with a market share of 25.97% and in third place Expedia (EXPE) owning 24.22% of the market including its subsidiaries Vrbo, Hotels.com, and Trivago with revenues equal to $11.6 billion in 2022.

Despite only three companies dominating the market, the online travel industry is highly fragmented, with multiple platforms competing with each other to acquire hosts and guests.

By attracting new hosts, the number of accommodations available increases, attracting new guests that will in turn attract new hosts willing to list their accommodations on the most active platform. Fierce competition will limit companies’ efficiency and profitability, forcing them to keep investing in marketing, in order to attract more hosts and guests, and in technology, to improve their platform to offer the best experience to their customers.

DCF Model

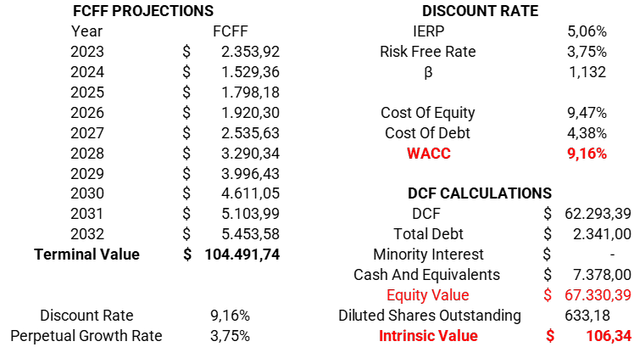

I use the discounted cash flow analysis method to value companies. The aim of a DCF analysis is to determine the present value of expected cash flows generated by the company in the future. The first step is to project the growth rate at which revenues will grow in the future. Secondly, we will need to assume the degree of efficiency and profitability at which the company will turn revenues into cash flows.

Efficiency is represented by the operating margin, and profitability by the ROIC. Having the revenue projections and future operating margins, we obtain the EBIT and, after subtracting taxes, we get the net operating profit after taxes. The ROIC is used to determine the reinvestments needed to support future growth, determining how much profit the company generates from every dollar reinvested into the company.

Future cash flows are calculated by subtracting the reinvestments from the net operating profit after taxes. The higher the growth rate, the higher the reinvestments needed to support it, hence the lower future cash flows will be.

The last step of a DCF analysis is to apply the discount rate to future cash flows, usually calculated using the weighted average cost of capital (‘WACC’).

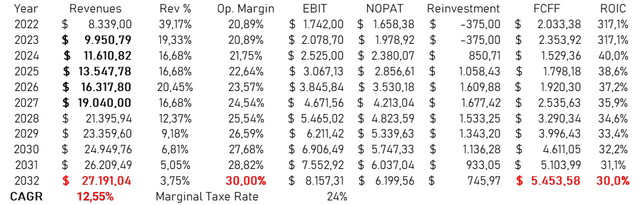

Projections

Trying to project Airbnb’s future performance, we will assume Airbnb to confirm itself as one of the top players in the online travel industry, following Booking Holdings’ path, both in terms of nights booked, take rate, efficiency and profitability, but still re-imaging behind it as Booking Holdings will continue leveraging on its size and brand notoriety to keep maintaining its market share.

Assuming Airbnb will reach Booking Holdings’s nights booked, around 850 million, in the next five years and assuming they will maintain their gross booking value per night of $160, way higher than Booking Holdings’s average one of around $121 per night, we can expect Airbnb’s gross booking value to reach almost $140 billion 5 years from now.

Airbnb’s nights booked projections (Personal Data)

Airbnb’s gross booking value projections (Personal Data)

The next step is to project Airbnb’s future take rate, and once again, knowing that Booking Holdings’s average take rate of the last five years is 15.6%, we can assume Airbnb to have a take rate of around 14%, greater than its current 12.7%, but still lower than Booking Holdings’s one given its leading position in the industry.

With these assumptions, Airbnb revenues are expected to reach $19 billion by 2027, and after that, we can assume growth to start to slow down as the company reach its steady state. Therefore, by 2032 we can expect revenues to triple in 10 years and reach $27 billion, growing at a CAGR of 12.5%.

Moving on to efficiency and profitability, continuing with our story of Airbnb following Booking Holdings’s path, we can expect Airbnb to reach an operating margin of 30% by 2032, lower than the average operating margin of Booking of 35%, which again will capitalize on its greater economies of scale.

As regards the ROIC instead, given that Airbnb’s business model doesn’t require heavy capital investments we can expect the company to maintain high profitability going into the future, expecting a ROIC of 30% by 2032, lower and more sustainable than the current levels. We are expecting Airbnb to achieve higher profitability than Booking Holdings, which had an average ROIC of 28% in the 10 years before the pandemic.

With these assumptions, Airbnb’s FCFF are expected to reach $5.4 billion by 2032, greater than current Booking Holdings FCFF expected to be around $4.7 billion.

Airbnb’s performance projections (Personal Data)

Valuation

Applying a discount rate of 9.16%, calculated using the WACC, the present value of these cash flows is equal to an equity value of $67.3 billion or $106 per share.

Airbnb’s intrinsic value (Personal Data)

Conclusion

Given my analysis and assumptions, Airbnb stocks result to be slightly overvalued at today’s prices. Despite assuming Airbnb to equal Booking Holdings’s performance, reaching the top of the online travel agency industry, the current market price of the company doesn’t permit Airbnb to be considered a good investment opportunity.

The travel industry is highly competitive and sensible to the overall state of the economy, buying Airbnb at these prices won’t give us investors enough margin of safety in case the assumptions made are not met in the future, increasing the downside risk exposure.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.