Summary:

- Alphabet reported mediocre full year results for fiscal 2022, but still solid top line growth.

- When looking at the different segments, Google Cloud still reported high growth rates and also have high expectations for the other segments.

- ChatGPT and other companies focusing on AI can be seen as increased competition for Google, but the strong moat will help Alphabet to defend itself.

- The stock is probably undervalued already, but I see further downside risk.

400tmax

About two weeks ago, Alphabet (NASDAQ:GOOG) reported annual results for fiscal 2022 and the company missed on earnings per share as well as revenue expectations. Of course, missing by $440 million on revenue when reporting $76.05 billion is not such a big deal and GAAP EPS missed by $0.14.

In the following article, we are looking at the challenges Alphabet is already facing and look at the annual results and talk a little bit about share buybacks. And in the second part of the article, we are focusing on ChatGPT and if it could be a competition or threat for Alphabet (especially Google).

Full Year and Quarterly Results

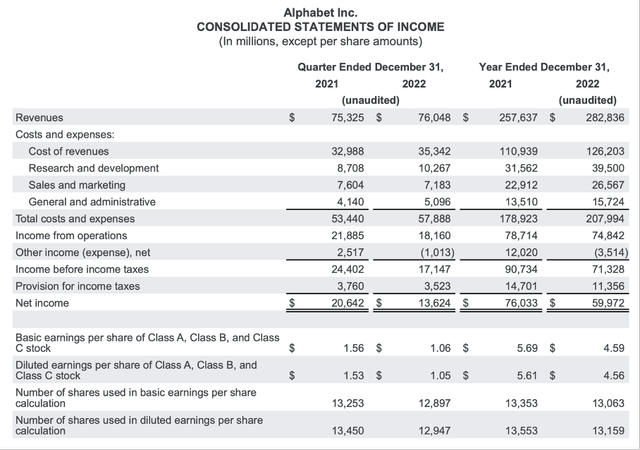

We start by looking at the full-year results for fiscal 2022. Revenue increased 9.8% year-over-year from $257,637 million in fiscal 2021 to $282,836 million in fiscal 2022. In constant currency, revenue increased 14% year-over-year. And while the top line still increased, operating income declined slightly from $78,714 million in fiscal 2021 to $74,842 million in fiscal 2022 – resulting in a decline of 4.9% YoY. And finally, diluted earnings per share declined from $5.61 in fiscal 2021 to $4.56 in fiscal 2022 – a decline of 18.7% year-over-year.

Alphabet Q4/22 Earnings Release

When looking at the results for the fourth quarter of fiscal 2022, revenue still increased slightly from $75,325 million in the same quarter last year to $76,048 million this quarter – resulting in 1.0% year-over-year top line growth. In constant currencies, revenue increased even 7% year-over-year. But operating income declined 17.0% YoY from $21,885 million in the same quarter last year to $18,160 million and diluted earnings per share declined even 31.4% YoY from $1.53 in Q4/21 to $1.05 in Q4/22.

Segments and Growth Potential

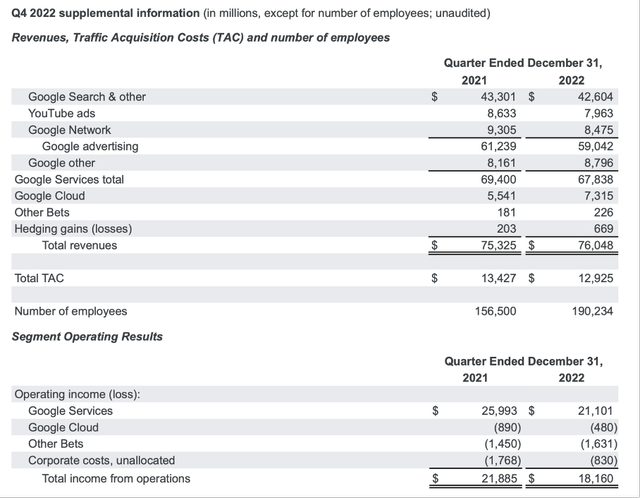

When looking at the different segments, we can start by looking at the advertisement segment. And when looking at the core business – Google Search – we saw revenue declining slightly from $43,301 million in the same quarter last year to $42,604 million in Q4/22. Revenue was negatively impacted by advertisers pulling back spendings in “Search” in the fourth quarter (compared to the previous quarter) and while retail and travel increased, finance was declining.

YouTube

Revenue from YouTube ads also declined from $8,633 million in Q4/21 to $7,963 million in Q4/22. And YouTube is still during its shift to YouTube Shorts – similar to Meta Platforms (META) switching to Reels. YouTube Shorts are now averaging over 50 billion daily views (up from 30 billion in Q1/22) and monetization is also ramping up, but the company is still early in its monetization efforts.

When talking about YouTube, management is focused on four aspects. Ramping up shorts, accelerate engagement on a large screen and investing in subscription offering. YouTube Music and Premium were surpassing 80 million subscribers recently (but this number is also including those users just being on trial). The fourth (and long-term) effort is to make YouTube more shoppable. People should be able to shop from the creators, the different brands and content they love.

Google Other

“Google Other”, which is including revenue from Google Play (app purchases), hardware sales (like the Fitbit products) or YouTube non-advertising (like subscriptions) increased revenue from $8,161 million in the same quarter last year to $8,796 million this quarter. And 7.8% year-over-year growth stemmed mostly from hardware revenues and YouTube subscriptions.

Cloud

One of the biggest contributors to revenue growth is still Google Cloud with revenue increasing from $5,541 million in Q4/21 to $7,315 million in Q4/22 – 32.0% year-over-year growth. And while the segment is still not profitable, it could reduce its operating loss from $890 million in the same quarter last year to $480 million this quarter. Management is seeing continued momentum and customers increasingly choosing BigQuery as it unified data lakes, data warehouses and advanced AI/ML into one system.

Alphabet Q4/22 Earnings Release

And finally, Google is going to focus more on retail – a segment it does not yet have a strong standing in. Like I mentioned above, management is focusing on making YouTube more shoppable. But management is thinking even broader. It is on a multi-year mission to make Google a core part of shopping journeys. Google wants to improve consumer experiences by a more visual, immersive, and browsable search and it wants to convince more and more merchants to participate in the free listings. In 2022, Google already saw an uptick in merchants – especially smaller businesses.

Share Buybacks

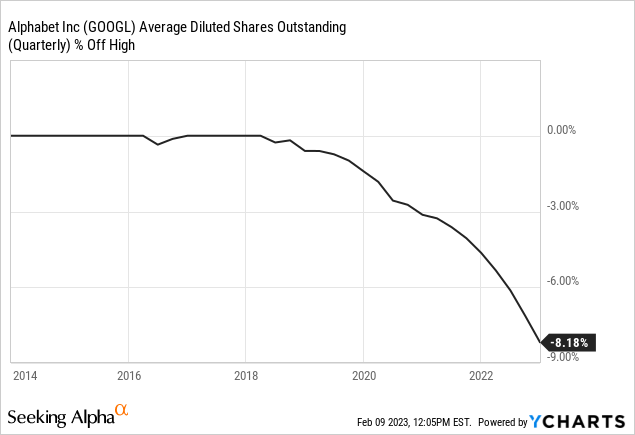

Similar to other major technology companies, Alphabet is also buying back shares with an aggressive pace. In fiscal 2022, the company spent $59,296 million on share buybacks – even more than in the previous year ($50,274 million spent on share buybacks in fiscal 2021). The number of outstanding shares peaked in 2018 (with 14.10 billion shares) and since then the number has been declining constantly and the number was reduced by 8%.

And in fiscal 2022, free cash flow of $60,010 million was barely enough to finance the share buybacks, but as the company is paying no dividend and has very little debt on its balance sheet, it can use its free cash flow for share buybacks.

And as long as Alphabet doesn’t find better ways to use its cash, it can also use $21,879 million in cash and cash equivalents as well as $91,883 in short-term investments on the balance sheet for share buybacks. We will get back to the question if Alphabet is undervalued right now, but if management sees its own stock as a good investment, it could use at least part of these liquid assets for share buybacks.

And when already looking at the balance sheet, we can also mention $14,701 million in long-term debt Alphabet has on its balance sheet, but this amount is only a fraction of the annual operating income (or free cash flow) and could easily be paid back by the cash on the balance sheet – therefore we should not worry.

Wide Moat vs. Challenges

And while there have been many different news stories in the last few weeks, the dominating topic was artificial intelligence and especially ChatGPT. This already become obvious when reading the earnings call transcripts of the major technology companies. Bloomberg stated that mentioning “artificial intelligence” during earnings calls spiked during this earnings season and Alphabet is no exception: The term “AI” was mentioned 47 times during Alphabet’s last earnings call – compared to 10-15 times in the previous two earnings calls.

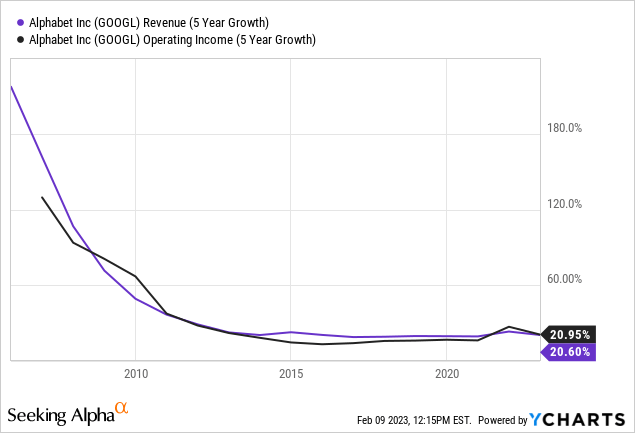

When trying to answer the question if ChatGPT from OpenAI or Ernie from Baidu, Inc. (BIDU) could be a competition for Alphabet we should remind ourselves about the strong moat Alphabet has around its business – especially Google Search. And back in 2013 Stanley Druckenmiller called Google the greatest business model he knows. The moat already become visible when looking at the numbers. One of the characteristics of a wide moat company is stability and consistency in its results. Of course, growth slowed down and Google is not reporting the same growth rates as in the first years, but growth rates are surprisingly stable around 20% in the recent past.

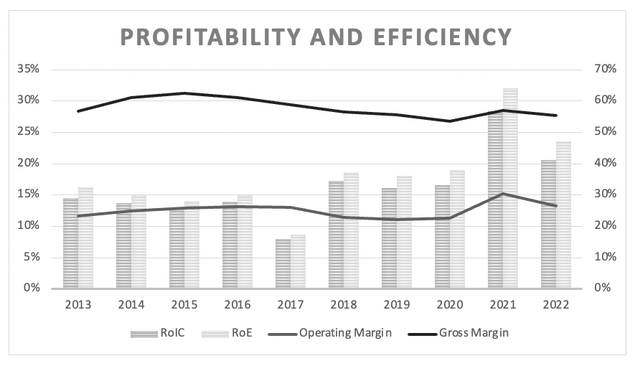

And when looking at the company’s margins we also see consistency. While the gross margin could be described as slightly declining in the last ten years, we should see both as stable over time. Additionally, Alphabet is reporting an above-average return on invested capital – in the last ten years it was 16.22% and in the last five years RoIC was 19.81%.

Alphabet Operating Metrics (Author’s work)

These numbers clearly indicate an economic moat around the business. In my first article, I described the economic moat of Alphabet in more detail, which is based on a strong and recognizable brand name, cost advantages and especially the network effect.

But now it suddenly seems like Alphabet has a serious competitor with ChatGPT. According to different numbers, ChatGPT is the fastest growing consumer-application in history, and it apparently has already more than 100 million monthly active users in January 2023. I could not find a number on how many daily or monthly active users Google Search has but found estimates above 4 billion monthly active users. Right now, there are about 4.9 billion people using the internet around the world and considering that almost everybody is using a search engine and Google has a market share of 85% to 96% (depending on the device) we could assume about 4 billion monthly users (we also must exclude countries like China or Russia).

Why it could be a problem?

It seems right now as if the AI war is heating up and competition is increasing. Baidu for example announced it will launch its ChatGPT-like bot called “Ernie” in the coming weeks. And while Alphabet doesn’t have to worry much about Baidu (as the company is only operating in China, a market to which Alphabet has no access to), Microsoft (MSFT) partnering with OpenAI could be the bigger challenge for Alphabet. So far, Google had a market share of 88% in the United States with competitor Bing being only around 7%, but analysts estimate that Microsoft could gain market shares by the move to include ChatGPT in its Bing search. And first numbers are already indicating Bing is gaining traction. On February 9, 2023, the number of App downloads for Bing spiked and the number of daily active users increased from about 370k on February 2, 2023, to 570k on February 9, 2023.

Alphabet is already fighting back. However, the introduction of Bard was overhasty and might have done Alphabet more harm than good. The stock price tanked that day and the company lost $100 billion in market capitalization. It seems a bit like Alphabet panicked as it was already reported that management realize the challenge (and maybe the threat) several weeks ago arising with the release of ChatGPT and issued a “Code Red”.

Why we shouldn’t be concerned

However, instead of panicking, Alphabet should reflect on its strengths and when asking the question if ChatGPT could be a threat for Google (and Alphabet) we also must keep in mind that ChatGPT can’t really replace Google. While ChatGPT seems to be better in generating ideas, longer texts or construct arguments, Google is much better is finding information. Especially accurate and current data can’t be found by ChatGPT. And Google is much better in presenting information in a more appealing way, while ChatGPT will offer only text. And of course, Google is offering many different services – we can search for pictures, watch videos on YouTube or use Google Maps.

Aside from ChatGPT being no replacement for the different services Google is offering, it would be a huge mistake to underestimate Alphabet considering its “AI strength”. Alphabet is focusing on artificial intelligence for a long time and CEO Sundar Pichai made this clear during the last earnings call:

AI is the most profound technology we are working on today. Our talented researchers, infrastructure and technology make us extremely well positioned, as AI reaches an inflection point.

More than six years ago, I first spoke about Google being an AI-first company. Since then, we have been a leader in developing AI. In fact, our Transformer’s research project and our field-defining paper in 2017, as well as our path-breaking work in diffusion models are now the basis of many of the generative AI applications you’re starting to see today.

Google will also provide new tools and APIs for developers, creators and partners and the network of people that will contribute to Google is hard to match by any competitors – simply due to the huge number of people using Google. It makes much more sense for developers and creators to build on the work of Google instead of a smaller competitor. Google is also working on bringing large language models to Gmail and Docs.

And finally, we should not ignore that Alphabet is generating huge amounts of free cash flow it can use to either buy competitors or spend huge amounts on research and development to stay competitive in this “AI war”.

Intrinsic Value Calculation

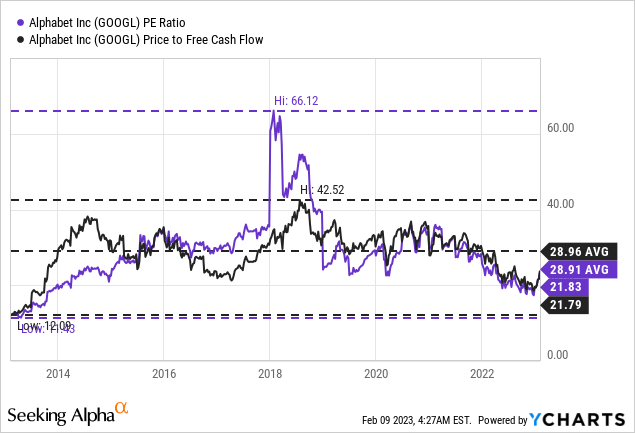

It also seems like Alphabet is trading for reasonable valuation multiples – despite the challenges Alphabet is facing. When just looking at the price-earnings ratio or the price-free-cash-flow ratio, Alphabet is neither cheap nor expensive. Right now, it is trading for 21.8 times earnings as well as 21.8 times free cash flow. And while the stock has been trading for lower multiples 10 years ago, this is one of the lowest valuation multiples in the last ten years and clearly below the 10-year averages (28.96 for P/FCF and 28.91 for P/E).

When using a discount cash flow calculation to determine an intrinsic value, we can use the free cash flow of the last four quarters as basis ($60,010 million) as well as 12,947 million outstanding shares and a 10% discount rate. When calculating with these assumptions, Alphabet must grow about 5.5% annually from now till perpetuity to be fairly valued.

In my last article I wrote that Alphabet is already undervalued but might decline further. Right now, the stock is trading almost for the same price level as at the end of October. I would still argue that Alphabet is at least fairly valued and might already be undervalued. But I still think Alphabet could decline further in the quarters to come.

Conclusion

I am not really bearish about Google and certainly are not saying to short it. However, the combination of a slowing down economy and the company suddenly facing a real threat via ChatGPT (and let’s see what other companies like Baidu come up with) the stock price could tumble in the coming months and generate a real buying opportunity.

I would therefore rate Alphabet as a hold right now. The stock is not really expensive – however I see some challenges. And although the fundamental business of Alphabet is pretty resilient (in my opinion), we could see the stock price decline.

Disclosure: I/we have a beneficial long position in the shares of BIDU, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.