Summary:

- Exxon Mobil is very well positioned to continue benefiting from current energy supercycle by being very efficient in its expenditures, both operating and capital.

- In the past, the company has generated profits even when crude oil prices were low thanks to strong management. Dividends were paid consistently even during shocks in crude oil prices.

- Management is confident in nearest future: buyback pace to accelerate from $15 bln per year to $17.5 bln.

- My DDM valuation suggests the stock has an upside potential.

JHVEPhoto

Investment thesis

Exxon Mobil (NYSE:XOM) demonstrated record breaking financial results for FY 2022 by being well-prepared and positioned for a massive rally in crude oil prices during last year. I believe XOM stock is still attractively valued given strong energy market fundamentals together with company’s improving balance sheet and growing free cash flows which enabled management to increase payouts to shareholders via both buybacks and dividends.

Company information

Exxon Mobil is a vertically integrated company operating across the oil and gas value chain. Company’s activities include exploration, production, refining, and marketing of oil and gas products. This deep diversification enables company to mitigate risks associated with volatility in commodities prices.

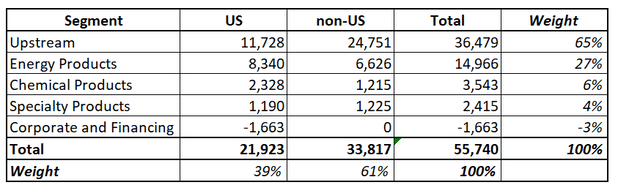

Major share of earnings (65%) come from Upstream division followed by Energy products (27%) in 2022. Share of Chemical and Specialty Products from total earnings is much less significant for the company.

Author’s calculations

Financials

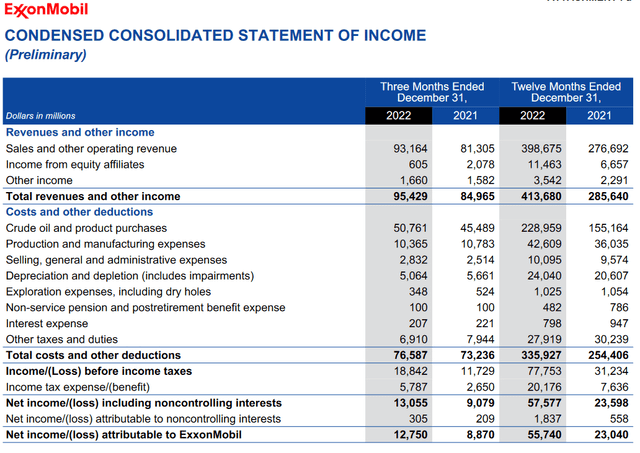

On January 31, 2023 the Company reported its 4Q 2022 financial results. XOM quarterly revenues demonstrated a beat versus consensus estimates by $4.66 billion and also beating on EPS by 12 cents per share. Higher earnings reflect higher crude oil and natural gas prices and increased production.

Exxon Mobil

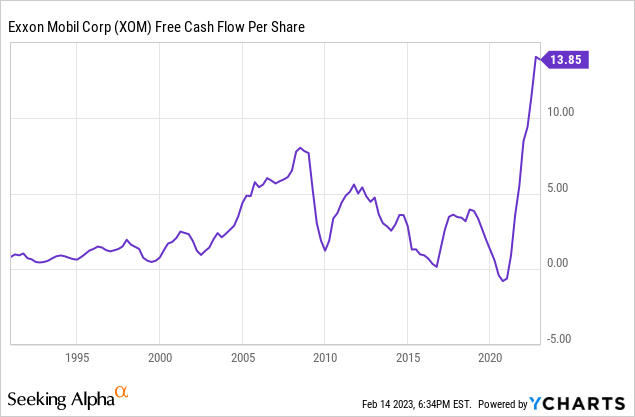

Since XOM is a cyclical company, it would be very useful to zoom out and compare current company’s financial performance to the last energy supercycle to assess whether management’s strategic initiatives are working or not. In November 2020, the company revisited its capital spending plans towards prioritizing investment in high-value assets and, based on XOM’s free cash flow, it worked. Company’s free cash flow is strong, from the below chart we can see that 2022 was by far record year in terms of free cash flow per share, even much higher than during previous energy supercycle.

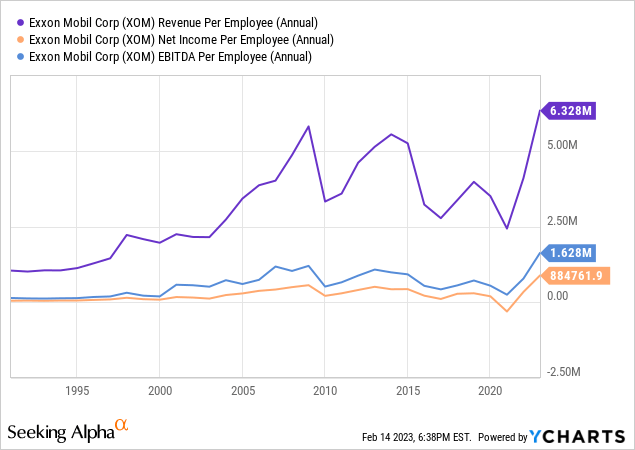

It is important to mention that in 2019 the company completed corporate reorganizations, moving from functional companies to businesses organized along the value chains. According to Darren Woods, the CEO, this reorganization allowed XOM to reduce overhead and provided much closer oversight for each business, which was a critical first step in streamlining the businesses to structurally reduce cost. In order to cross-check Mr. Woods’ words, I believe that looking at company’s per employee financial performance would be a sound exercise. Looking at the below chart we can see that company’s financial metrics per employee expanded significantly during recent years and are well above previous energy supercycle levels.

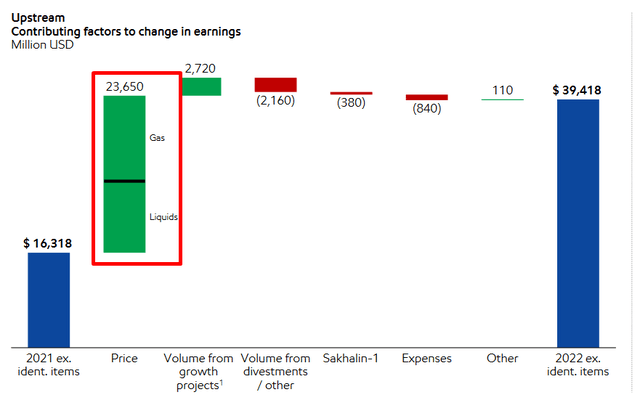

It is also obvious that company’s performance heavily depends on commodities prices, and FY2022 success was mainly due to high crude oil and natural gas prices in 2022. From the below waterfall we can see that, by far, the major factor of earnings growth in upstream segment was favorable change in price.

Exxon Mobil

Commodities prices are highly dependent on supply and demand for oil and gas consumption. In 2022 energy markets faced rapid growth in demand due to borders reopening as governments across the world started cancelling strict COVID-19 quarantine measures. Also last year was disruptive for global supply due to sanctions against Russian energy commodities after the invasion of Ukraine.

For the energy market as a whole I believe that it has strong fundamentals for nearest next years. The biggest driver for oil and gas prices in 2023 is highly likely to be China’s reopening which will result in increased oil demand. International Energy Agency [EIA] expects oil demand is set to rise by 1.9 mb/d in 2023, to a record 101.7 mb/d, with nearly half the gain from China following the lifting of its Covid restrictions. According to latest OPEC report:

Key to oil demand growth in 2023 will be the return of China from its mandated mobility restrictions and the effect this will have on the country, the region and the world

From the supply side we also hear good news for energy bulls, for instance, starting March 1 Russia to cut oil production by 5% as a response to recent sanctions package which set price cap for Russian oil and related products. And it is only a short-term effect of sanctions. Long-term consequences for Russian oil production are highly likely to be much worse. For example, according to BP’s “Energy Outlook” publication, oil giant’s analysts forecast that Russian oil output can decline more than 40% by the year 2035 due to restrictions on access to technology and investments.

Recent news also suggest that OPEC does not have spare capacity to increase output, moreover the cartel’s production in January 2023 decreased slightly in comparison to December of 2022.

Given XOM’s management strong capital allocation decision making as well as new optimization and streamlining programs of the company, I firmly believe that the company will continue getting benefits from current energy supercycle which is also far from its end.

Valuation

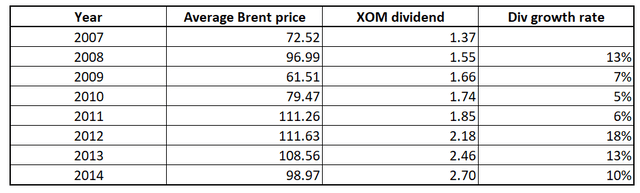

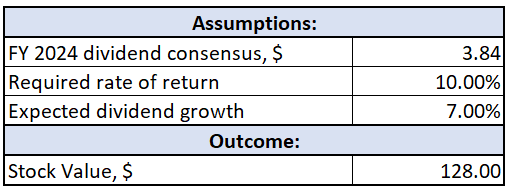

For valuation of XOM, I implemented a Dividend Discount Model [DDM] where I need the following three assumptions: company’s dividend, discount rate and dividend growth rate. For company’s dividend I use FY2024 dividend consensus of $3.84 per share. With the discount rate I prefer to be more conservative, so I rounded up GuruFocus’ assessment of 9.12% towards 10% for the purposes of my valuation exercise. Forecasting dividend growth rate based on recent years, in my opinion, would not be fair because of low energy prices cycle. So, to calculate fair dividend growth rate for XOM, I analyzed dividend hikes during previous high energy prices cycle.

Author’s calculations, Statista.com

As you can see from the table, dividend growth rate during last energy supercycle varied within 5% to 18% range. To be on the safe side I preferred to select lower end of the range, so my estimation for dividend growth rate for DDM is 7%.

Incorporating all the assumptions above into my DDM calculations I arrived at a fair value of $128 per share which indicates about 10% upside potential.

Author’s calculations

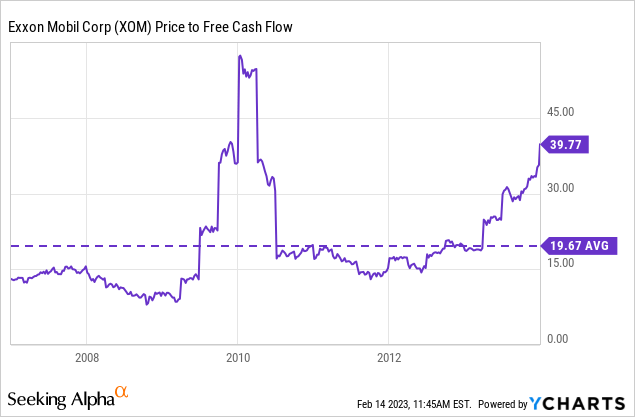

To assess the reasonableness of DDM outcomes I also used historical multiple assumptions. If we take last energy supercycle which was between 2007 and 2013, on the below chart we can see that during this period average Price to Free Cash Flow ratio was 19.67. It is far higher than current level of 8.60.

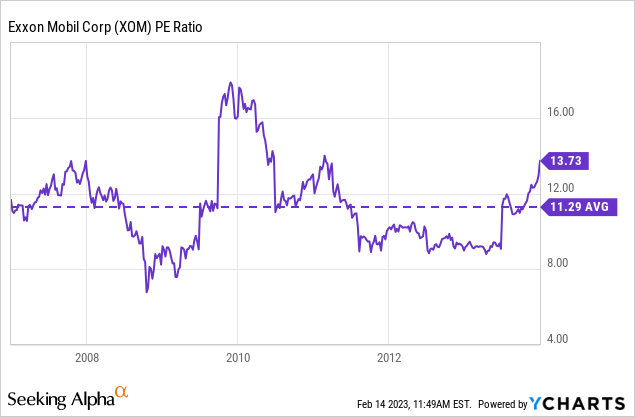

From the P/E perspective, historical average between years 2007-2013 also suggest that XOM still has upside potential. Currently P/E is at 8.9 level, while from the below chart we can see that during last high energy prices cycle average P/E was above 11.

To sum up, my DDM suggests that the stock is currently undervalued by around 10% and historical multiples analysis evidence the same.

Risks to consider

In terms of risks, XOM is mainly facing risks inherent to any oil and gas company. The company’s financial performance is highly dependent on commodities prices, and their decline can adversely affect revenue and earnings.

The oil and gas industry is highly regulated and new regulatory requirements can unfavorably affect operating costs and decrease profitability. In addition, there is growing public concern about the impact of fossil fuels on the environment, and introducing measures to reduce greenhouse gas emissions is the global trend.

Exxon also faces geopolitical risks as the company operates in many countries worldwide. Political instability, wars, and changes in government policy can affect the company’s ability to produce and transport oil and gas resulting in business interruptions and adverse financial effects.

Oil and gas exploration and production is a complex and risky business, and XOM faces a variety of complexities including resources availability and feasibility of production together with the environmental impact of operations. The company must invest in new projects to replace declining reserves, and there is always a risk that exploration efforts will be unsuccessful and result in financial losses.

Bottom line

To conclude, I believe XOM is a best positioned player in oil and gas industry which is highly likely to benefit from multiple tailwinds for commodities prices in 2023. Despite the shares strong bull run in 2022, I see upside potential for XOM based on the company’s strong financials, optimized capital spending together with favorable energy market fundamentals. The stock is a buy with 10% upside potential as well as dividends safe and growing.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.