Summary:

- Silicon Valley Veteran and audience favorite, Bertrand Seguin from App Economy Portfolio, joins this podcast.

- We take a deep dive into Google versus Microsoft race for AI domination.

- We also go over two stock picks that Bertrand is recommending for investors at this time.

Galeanu Mihai/iStock via Getty Images

|

Editor’s Note: This is the transcript version of the previously recorded show. Due to time and audio constraints, transcription may not be perfect. We encourage you to listen to the podcast embedded above or on the go via Apple Podcasts or Spotify. Check out App Economy Insights Here! This episode was recorded on February 15th, 2023. |

Transcript

Daniel Snyder: Welcome back to Investing Experts Podcast. I’m Daniel Snyder. In this episode, Silicon Valley Veteran and audience favorite, Bertrand Seguin from App Economy Portfolio, joins us in the hot seat as we dive into Google (NASDAQ:GOOG, NASDAQ:GOOGL) versus Microsoft (NASDAQ:MSFT) race for AI domination. We also go over two stock picks he is recommending for investors at this time. And one of them is a bold call against a specific Berkshire holding change in their latest 13F filing.

But first, just a reminder, anything you hear on this podcast should not be considered an investment device at times, myself or the guests might own positions in the securities mention. But this is for entertainment purposes only, and you should seek advice from a licensed professional before investing.

Lastly, a shout out to webbfam6 who just gave us another 5 star rating and review. If you’re enjoying these episodes, please do us a favor and leave a rating and review on your favorite podcasting app. It helps us climb the charts and lets us continue to bring these expert insights every week.

Now let’s get into the interview. All right, Bertrand. I got to say I love having you on the podcast. I follow you all across the Board, the data, the charts you put together, I mean, you are a content machine. But for the people that don’t know who you are, maybe just take a little bit of time up here upfront and kind of give us your background of how you got to where you are today?

Bertrand Seguin: Sure. Yes. Well, the long story short is I went to business school in France, started my career in financial audit, where I was at PricewaterhouseCoopers, where I did financial audit for a large – wide range of industries. Eventually, I was coached by a large gaming publisher called, Bandai Namco (OTCPK:NCBDF), that’s a Japanese company that invented Pac-Man for – if you don’t know, back in the 80s.

So very – one of the biggest mobile gaming companies in the world. They have IPs like Dragon Ball, namely that does very well around the world. And so I learned a lot of stuff being in gaming, being a financial executive in gaming. I was also involved in corporate strategy, so taught me a lot about M&A and just had aerodynamics and what matters when you make an investment in the corporate world. And that inspired me to really watch the gaming industry switch from analog to digital because when I first started in gaming, it was probably 2010.

So most of the revenue in 2010 in the gaming industry were still, like boxes on shelf. You buy up here at the time, that was PS3 games. And so it was replicated discs, right, in the box. And I watched firsthand the whole thing switched to digital. At first, we couldn’t believe that, right? Oh, wow. 20% of our sales from this game will come from digital platforms. Now people don’t mind not having a disc, that was a surprise at first, right?

But we came to that realization, it was still, like, 2012 or something, right, 2013. And the same for the rise of mobile. I’ve witnessed mobile becoming a de facto, like, place where people are switching their gaming experience with free to play games. People didn’t believe free to play games were a thing if you go back 10 years on and over that. So maybe 2010 was the beginning of the rise over AI for launching and the optical system growing.

So my point here is I looked at all these things firsthand and I’ve eagerly tried to apply this to other categories where I’m like, I know what work for gaming and gaming tends to be a few years ahead of the rest of the pack. And so what are other industries that are shifting to analog – from analog to digital in the same way, where there are investment opportunities or ways to really benefit from that trend.

And if you extrapolate that to the shift from cable to streaming, the shift from analog advertising to the full on digital advertising that we talked about today. If you think about the rise of AI, if you think about – we – it was Valentine’s Day yesterday. So we talk about Match Group (MTCH) and how matchmaking has become a full on digital business, where people spend money on dating app the same way they spend money on games, right?

So many businesses are flourishing now making extremely high margins out of business models that didn’t even exist 15 years ago. I’ve really enjoyed learning in that space, and this is where really I seek opportunities moving forward.

Daniel Snyder: Why don’t we just go ahead and dive into the meat and the potatoes of everything that’s going on right now? The world of AI, we want to hear from the man from Silicon Valley himself, be veteran. What is going on with Microsoft and Google right now? Do you favor one over the other? What should we be watching as investors?

Bertrand Seguin: I wanted to chat about Google and Microsoft and everything that’s going on in AI mostly because first of all, it’s still captivating, right? It’s been really top of mind. I think it’s pretty rare that we see such a big shift in terms of a potential competitive landscape that gets reshaped.

A lot of people refer to [Jeanne Palmer] [ph] at the time the iPhone was announced and he looked at his own market share and didn’t feel him really threatened by it. And was pretty comfortable that people need a keyboard on their phone or things like that. So that’s kind of reminiscent of this space, and it begs the question. Are we seeing a similar shift right now? And I hope today, we can chat about why it may or may not be the case, but that’s the kind of [indiscernible] we’re seeing.

And so the big announcement that Microsoft has made, of course, was right after the huge success that we’ve seen from ChatGPT. So after two months – after a proper launch to consumers, it took two months for the app to reach 100 million users, but that’s the big headline, right?

Everybody cares about ChatGPT more than they care about Bing, right? But the thing is, Microsoft has had their search asset with Bing for a very long time with an estimated 3% market share of their search markets compared to 93% for Google. So it’s a small piece of the pie, but the whole excitement is around, oh, what if Microsoft Power has been with ChatGPT, and now you’re looking at something that can eat away at the market and really, really thrive.

And so the core thing to consider first is Large Language, right? Large Language Models or LMM, they are what hours those conversational AI, so an AI you can chat with and back and forth with questions and answers.

And so when you think about LMM, that’s just a deep learning algorithm, right, where it uses a massive dataset, basically the Internet, right, in the case of ChatGPT. And it can then recognize, summarize, translate, predict things based on trends, things like that.

So it’s like a financial analyst, if you will, who would have all the data about earnings of a company and they can regurgitate what’s going on, maybe trend lines, margin trends, things like that.

What has been captivating is the allegations of a code red, right? At Google, I’m sure you heard about that. The code red being the beginning of a big red flag internally at Google similar to a fire alarm, where they believe their existing business model may be threatened by the rise of this new incumbent, which is also happens to be one of the biggest companies in the world.

So it’s an interesting dynamic, right, so that Microsoft takes as a role here, both incumbent and large player, rising emerging force. And when you look at the PR that has been happening, it’s really fittering Microsoft right now because Microsoft came out with a very big flashy announcement. It was the $10 billion investment in OpenAI. The announcement that Bing will incorporate ChatGPT technology.

And that’s right after that, Google had to come up with its own press release and all its own events where they showed that they also had that capacity internally and they would launch a product that has similar features or at least for options to search with a conversational AI aspect to it. And that one is called Bard if you haven’t heard of it.

When you look at this dynamic, the impression was, oh, Google is rushing to catch up, right? To add insult to injury here, there was a clear mistake in the demonstration of what Google Bard is capable of. And that was if you don’t know, it was basically a question about what’s – what was the first exoplanet discovered or what exactly when was the first exoplanet discovered and there was a wrong answer provided it.

In certain ways that wrong answer would have also been provided by a Google search. It was essentially a human mistake from a website. And so it was not necessarily Bard making a mistake, but the headline was there for everybody to see oh, this new product from Google made a mistake.

One could argue this wiped out $100 billion from Google’s market cap because the day this lunch happened, maybe people were also underwhelmed by the announcements. We have yet to see it more product that would compete directly with ChatGPT. But for that Google Bard announcement, we saw the stock tank almost 10% and $100 billion being wiped out.

This should have happened to Microsoft, and I’ll tell you why. The – in the Microsoft, very creative announcement with fetching the [indiscernible] came, we had very clear layout of what’s being plus hedge those hedge in ChatGPT will achieve. They made this announcement.

However, there were several mistakes as well in Microsoft presentation, and people are only catching up to these mistakes right now in the past 24 hours. They were, in particular, a pet vacuum review that was demonstrated literally wrong information about what the products can – the products can do. And they went through GAAP earnings reports. And the financial statements summary had several numbers that were completely wrong.

And as someone who’s into going to the fundamentals, pulling company data. If you tell me that some numbers may or may not be wrong, that renders this search engine completely useless, right, with you. That day plus ChatGPT product is not really for prime time. That begs the question, what is all the fuss? What the fuss is all about? And so when you think about the dynamics at play, the biggest questions right now are around, what is Microsoft trying to achieve? And what can be the actual impact for Google? And that’s really what I’m interested in.

Daniel Snyder: And so you’re saying Google actually has an opportunity here maybe with Google Cloud and being able to store all of their data and process as well.

Bertrand Seguin: It’s very clear that Google with Google Cloud is threatening Microsoft. If you don’t know, Google Cloud not only includes their cloud infrastructure services in order to Azure and AWS, but it also includes Google Workspace, which is a direct competitor to Office, right, for Microsoft Office 365. It’s in Microsoft’s interest to challenge Google on its search initiatives because it may pull away some resource from Google Cloud, which is currently still running at a loss.

Google has invested heavily in its cloud infrastructure to be able to compete with Amazon (AMZN) and Azure, and it’s the third contender. Right now, it’s still growing faster that – so it is catching up. For context in Q4, Microsoft grew 30%, 31%, with Azure and Cloud and Google Cloud grew 32%, so slightly faster, but it’s still a distant burden.

Circling back to what Microsoft’s main goal is, I think we see the main reason for Google into twofold. The #1 is market share erosion and #2 is the gross margin or the margin profile of search that could dwindle for Google.

When you think about the market share erosion, that’s very simple, right? If you have 93% market share, while the other 3%, it wouldn’t take that much for the slight shift to occur. There is the CFO of the search business that includes Windows. Phil Ockenden is his name. He mentioned that every percentage point that Microsoft gains in the search category would net $2 billion in revenue, right? That tells you everything you need to know there.

Microsoft is at about $6 billion annually from search give or take based on these numbers. There is a clear interest there, and they can do it without seeking a very high margin because this is all incremental for Microsoft. This is all engraving on top of their existing business lines.

Meanwhile, Google has to be highly protective because they – this is key to their business. It was about 56% of Google’s revenue in Q4. And so they have to be protected on that.

On the market share side, I do want to point out that there are so many things that go against the ID that Google searches that, right, or anything like that. But first, we have to consider what exactly does a Bing plus ChatGPT competes with, right? Google search includes things like Gmail, things like Google Maps. Any kind of ads you see when you search through the Google Play Store, Google Lens, right? Those things, they don’t even involve an AI, conversational AI.

So that part is irrelevant. So they don’t necessarily break it – break down what part is what in their search advertising, but there are all these properties that are included in there. Google Search itself has multiple layers on mobile. It’s not necessarily threatened by the same type of search at you see on desktop, right?

So the ChatGPT plus Bing is more of a desktop research thing. It’s been well documented that Google doesn’t seek to make money on everything you do through its ecosystem. They want to retain their user in the ecosystem. Some aspects of the conversational AI maybe at a low margin or a lower margin profile and that doesn’t necessarily mean the thesis around the strength of Google Search is completely flipped, right?

Daniel Snyder: What about the cost to run all of these things, though?

Bertrand Seguin: And that brings me to the second challenge around the margin and the margin profile of the search category. So the – what you may hear about if you don’t know yet, but you’ll hear more about them, they are the inference costs. And so inference is the compute cost, if you will, when you run live data into a machine learning algorithm.

So to try to make it simple, if I type in Google, Amazon Q4 earnings, it’s going to put a link to the Investors Relation website and MO [ph] set, right? So that’s a really low cost for the compute power that needs to run behind it. But if I ask, what are the main takeaways from Amazon’s earnings according to tech analysts? Now the data that the system has to go through, to sift through, to give me a proper answer that is summarized with the right numbers with just the key points I need to know, the compute cost is much higher.

And so if there is a new expectation that most search as that kind of delivery, of course, it will adversely impact the margin profile. But what is important to keep in mind is that not all searches require that level of breakdown, right? Sometimes you just want to know at what time is the movie tonight. Sometimes you just want to know how much is the flight cost right now to fly over to Vietnam or whatever that may be.

So it’s – where Google makes the big difference is and when you search for a trip, when you search for options to buy something. And so it’s not always going to challenge the revenue side of things, it will challenge at least to an extent the cost side of things.

But one very important point that was recently made by ARK Invest. They’ve made bold claims, right? ARK Invest is known for making wealth claims on Tesla or things like that, but they made a good point this week on Wright’s Law and basically the same logics, you could apply to the main conductors where the inference cost, inference cost related to compute, the compute power basically required to get those research done is expected to decline significantly in the upcoming years to a point where it become really, really small.

And so maybe that challenge on the gross margin, which is top of mind right now as we watch the story unfold, is not going to matter as much just like 12 months to 24 months from now. If we see those inference cost drop 50%, 70% as the – just the overall infrastructure evolves and production scale, which I think once you have that in mind, you can make an educated decision on whether you still believe Google will keep its share or give away some of its share, give away some of its margin.

But it’s a little bit overdone in my view in terms of a massive shift that, like, we’ve seen with the launch of the iPhone because of Google’s ownership of the Android ecosystem, its lead on mobile and things like that.

And maybe one last point on the artists that are really eager to watch is traffic acquisition cost. We talked about this last time we shared together, Daniel, which was would somebody else decide to enter Google’s Fray by paying Apple (AAPL) billions of dollars $20-plus billion it would cost to be the search engine by default on Apple devices.

Microsoft gives Google a rent for voice money on the traffic acquisition cost, that could really challenge the market share. And so those are gigantic amounts, right? If Google pays give or take in 22 apparently, Google paid close to $20 billion in traffic acquisition cost to be the default engine on Apple devices.

So if Microsoft comes in and says, I’m going to pay up about $30 billion for this, then, yes, the entire landscape changes, but it’s highly speculative at this point. And who knows what Apple would want to do, right? But those are the things that will be the tentpole events that could really challenge a lot of things that I said today on market share, if that makes sense.

Daniel Snyder: So I’m glad you brought that part of about reducing the cost to compute all of this. Because I was reading earlier about who – it was Brian Nowak of Morgan Stanley. He one [ph] is so far is to say that if Google wound up seeing half of his queries using natural language integration, it could raise the company’s cost as much as $6 billion and cut earnings before interest and taxes by up to 6%. And you’re saying that they’re going to find ways to reduce those costs.

So does it kind of make sense? I mean, we think about search now, right, you go to Google, you go to Bing, you search, you see ads right away at the top of the results. I mean, if you get rid of those ads because of it’s something like ChatGPT, which I think a lot of investors have been playing around with trying to figure out what it is, there’s no ads there.

So are they going to be able to cut the cost based off of using things like renewable energy to power these data stations? Or I mean, what’s the – what is the thing that investors should be watching in regards to how these companies plan to cut those costs to make this thing not bleed into their financials of it?

Bertrand Seguin: Yes. No, those are excellent points. I think that’s where the – at least marginal impact on the gross profit coming from search will exist, especially in the short-term. And Wright’s Law says those things about how cost is supposed to steadily decline as we increase the raw like production size and the infrastructure underneath it. So it remains to be seen, right?

So maybe it seems – it will seem that just two years, three years down the line with that these costs were down to decrease and that generative AI would not cost as much as it does in 2020 – it did in 2022. Even assuming the states right now of $6 billion impact, yes, it impacts the again, the short-term. But I would gauge that Google would be willing to sacrifice that short-term gross profit because what is at stake is much bigger, right, is that – right to point out to that retention within the ecosystem.

So, of course, from the valuation angle, if you start building models and extrapolates the margin profile over time, then some of the pressure on Google’s price and evaluation is warranted, right? You could say, at least until we have more clarity, there are a range of outcomes as increased. And with that, as an investor, you could say, well, I need to be paid more to wait, right, because now the downside risk is as increased, right? And I think that’s where it comes into play where you have to consider more outcomes. And that’s how I think about it.

So it’s not going to be black or white, right? It’s not going to be there. That’s it, $6 billion, and it’s going to get worse from there. It’s probably going to be less from there if we believe in Wright’s Law and give credence to our invest analysis on that. And if not, it would – Google would still be a business up and running with a lot of things going on under the hood. If this is then what, right? Is it the end of the world? Most likely more likely than not. It’s not the end of the world for Google.

Daniel Snyder: Yeah. So I have to ask you if an investor came out to use somebody in your service and was like, hey, we’re looking at the AI race. Obviously, you just gave a great summary of pretty much everything that’s going on. You had to choose Microsoft or Google. If you had to put your name behind one, which one should we be focusing on right now?

Bertrand Seguin: Yeah, good question. And I’m biased. I have to start with that because I’m – I’ve been in the gaming industry for the past decade and I’ve been watching the industry switch to mobile and watch Google really take over the world into with Android and become the mobile OS winning besides Apple.

And so I have been all along very disappointed with Microsoft’s failure to embrace the mobile world. And Microsoft has done tremendous job in so many other areas, right, to be a giant it is today. But it failed at mobile, it failed on the hardware, it failed on software side. And instead, it’s one in other things that were completely unrelated. I was an early investor in LinkedIn, for example, that was bought actual right by Microsoft.

And so I think they made a great move there. I still think they make the right move with Xbox even though it will take time for them to fully deliver around their premise with their cloud service. But overall, as far as search goes and as far as AI-powered search goes, I have my money with Google every day of the week because even if it can lose some of its mindshare right now if there is a clear evidence that and early evidence that ChatGPT plus Bing delivers whilst Google has yet to come out with a solution. Then it could see a slight shift.

But I do think that it’s reasonable to believe Google will come out with at least as competent tools to do search real AI to put it simply. And that’s when they do, I don’t think people will be eager to switch from Chrome, right, that people have been using and are very attached to, to Microsoft Edge and to rebuild their entire Internet’s desktop funnel through Microsoft Edge. I’m very – I doubt it. I doubt this would be meaningful. And Microsoft would struggle to enter the mobile space, right?

So that’s where a lot of search is going on. And for as long as Google owns that ecosystem and has a way to be the default engine there, it will be very hard to for Google to gain significant market share where it matters. So that’s for search.

With that being said, if we switch to the AI-powered cloud, I think this is a plaza [ph] because Google Cloud is still distant third, right? And even though they are going to use AI apply to their entire cloud services, I think Microsoft is making fantastic moves with Azure and everything powered by AI within Azure and that their large customers are very happy with it.

So I would say that this is – it’s two different, very different segments of their business, and they – I think they will both win on their respective segments. It doesn’t have to be one over the other. It just depends on what layer of the AI stack we’re talking about.

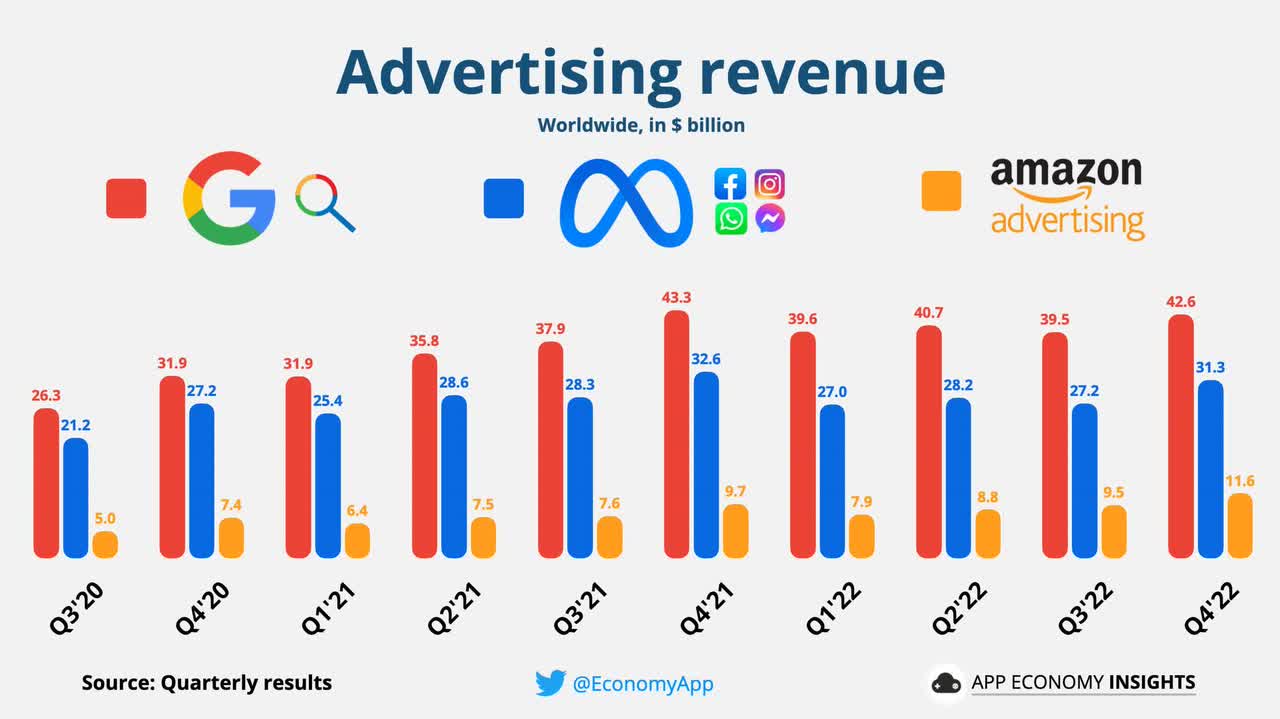

Daniel Snyder: But I want to take a step back a second. Mentioning earlier about how you go to search and Google gets a lot of ad revenue from their search. You put out a great chart recently, and we’re going to put it in the show notes here on Seeking Alpha of the different advertising revenue numbers that Google or Meta or Amazon make every single quarter.

I think if people are thinking about how the search functionality might change over time, what’s going to happen to this ad revenue for these companies? And maybe you just want to walk us through the chart a little bit if there’s anything you want to point out as well.

Bertrand Seguin: Yeah, yeah, yeah. And I would say the reason why I built that this chart is to help people digest and contextualize the advertising revenue landscape right now, because it’s easy to get first in the headlines and you have to dig deep inside a 10-Q or a 10-K to really break down well what is what?

And so because there were so much talk about how Microsoft is disrupting everything, and this is the new search giants, I wanted to also reassess that, well, this is the state right now of the market. Amazon has been doing it. We’re so much talking about Microsoft that Amazon is disrupting search because they’re on track to – they just made 27% of Google search revenue was Amazon advertising revenue in Q4 2022.

So they’ve built a business that is more than a quarter of the biggest advertising business offers. And that’s more than a double run two years ago. If you consider Q3 2020, which was only $5 billion in revenue from Amazon advertising, it has become almost $12 billion in revenue in the last quarter.

So fascinating to watch Amazon advertising, I think everybody knew it was happening and people are making the same assumptions on Apple and its capacity to deliver a $30 billion run rate in the next three years. So we are seeing slowly like those large ecosystems find a way to monetize their audience and to really make a difference.

Of course, we have Meta in the chart that is the second biggest one. Mehta has been relatively flat in the past two years, right, there. It has its some share of challenges because users are not growing anymore. So it has to find other ways to increase its average revenue per user. But…

Daniel Snyder: And Apple has completely demolished them, right?

Bertrand Seguin: Yep, yep. So that for those who don’t know Apple launched the AppTrackingTransparency, which basically makes it more difficult for platform to monetize its audience, because they have – they don’t have the same capacity to triangulate or to see where – what our other sites that someone has been to before hopping on Facebook, for example, or Instagram.

So they show you less relevant ads, which therefore cost less for the advertiser. And so I don’t put in the chart YouTube because I thought it was on its own really big and still writing not in Q4, but still like an incoming platform. But YouTube alone is $8 billion revenue from Google, right? And they’ll have zero impact from the ChatGPTs of the world. But just putting it out there, the Google – YouTube is about 11% of Google’s overall revenue alphabet, I should say.

And so what I love with this dynamic at play is it fairly shows that well, midtown is waiting for its second wind. We’ll have to see if it happens and it may not be on the advertising side. Probably Reels taking over what has been the more, like, legacy platforms revenue, the – what we call the feed, right, or Facebook feed when you next call.

Meanwhile, it’s still Google. This is still very much a growing business, but that’s maybe will face its first, like, a setback in the upcoming quarters if it loses market share. But I see the use of Google Lens increasing significantly, the potential for Google Lens to be shoppable. There are other ways Google can really make this Google Search element of Thrive. But I wish they broke it down more.

So that we have a better sense of how big is Google Map out of Google search? How big is Gmail? And those things are almost their own separate media empires that’s that will be worth studying because they follow different rules in terms of a pretension and monetization.

Daniel Snyder: It’s an interesting point that you bring up about Amazon. I mean, on this chart, I looked back at Q3 of 2020 and it was bringing to $5 billion of advertising revenue. And now Q4 2022, they’re at $11.6 billion. I mean, that’s an easy double in the next – last two years, and that’s based off of Twitch and the Amazon store, right?

Bertrand Seguin: That’s correct. Yes. Twitch is probably relatively small out of that, but we don’t have the exact breakdown unfortunately.

Daniel Snyder: And then you also have Google here. You said Google Search’s revenue for ads is down 4% year-over-year, but it sounds like you’re still all in with Google. And I think that’s a nice natural transition. We want to obviously talk about the two stocks that you are saying are a great opportunity right now.

The first stock is Taiwan Semi (TSM), which I want to start with because we just saw the 13F filing from Berkshire (BRK.A, BRK.B) that they dramatically reduced their stake in Taiwan Semi. So why do you say that it’s still a great opportunity at this moment in time?

Bertrand Seguin: Yeah. When you think about the dynamic at play of the AI race, Taiwan Semi is just one of many. And so I think over the past year, I’ve been more inclined to look again in the semiconductor industry just because it is suffering right now from supply chain movements that followed the pandemic, right? And after shortages, you see a glut.

And essentially, short-term fundamentals get hurt with potential slowdown. The first half of 2023 will probably look very ugly for TSMC. And so it really comes down to your time horizon, right? And for companies like TSMC, but also NVIDIA or AMD, what you’re seeing right now is you have to kind of hold your nose and look at the performance realizing, okay, this is going to look bad right now, but five years down the line, those companies that are powering literally everything we talked about today, right?

So the competition between Google and Microsoft around whether it’s on the cloud side of things or the search side of things. All these compute power that is needed to get there they are the picks and shovels, right? Especially for TSMC because they are really building the hardware, right? That’s going to power all this.

And so there were quite a few developments that were interesting to me in terms of their expansion to the U.S. kind of derisking slightly the geopolitical aspect of it, which will always exist no matter what, right? That’s something to keep in mind, TSMC is based in Taiwan. And so you never know what could happen in terms of the situation for Taiwan and how it is considered on the geopolitical landscape.

But all that said, TSMC is a lot cheaper than it used to be as when you look back at the past two years, it was not a by definitely throughout 2021 and early 2022. But for the past three months, three, four months, it looks appealing because there are good developments in terms of Apple being determined to have TSMC ramping up things in the U.S. with the financials long-term looking healthy as ever and the valuation becoming more palatable with if you look at the EBITDA multiple because it’s kind of easier to watch a trend with the EBITDA.

You can see that it’s under the end of the spectrum of the past 20 years, right? Something like 7 to 10 times EBITDA actually depending on the time of the day you’re looking and the time of the month. But this is – I added it to my portfolio 1st of January decision, so it’s up 25% since then, but don’t think I’m a genius. Everything is up 25% since the beginning of the year.

But I still feel like pretty good about that entry point, and it’s my – be an opportunity again later this year. All I know is that I found it hard to argue against owning Taiwan Semiconductor in a well-balanced portfolio because it has that international exposure. It is the raw compute power around the rise over AI. And that that’s really how I think about it.

I find it harder to defend not to own it. And then we won’t go deep into the – when exactly to buy and what should be the red flags. I do that monthly with my subscribers, but at least for how it was trading in the past three months, I’m pretty happy. I started buying some shares.

Daniel Snyder: I was going to ask you, I mean, played in devil’s advocate, right, because people like to do that. You brought up the geopolitical side of things. But what also about, I mean, it feels like almost every month they’re coming out and announcing that they’re spending more and more on CapEx, right? And it takes them forever to build these boundaries even the Arizona plate and trying to get the 3-nanometer started and then eventually there’s, as we all know, there’s going to be like a 2-nanometer and a 1-nanometer and whatever is after that. Like, it takes so long to progress through that and there’s so much capital spend. Like, we know the backlog is pretty full. But, I mean, that’s a long time, time horizon. And if China decides to invade Taiwan, does that disrupt the operations and the build?

Bertrand Seguin: It could. I think this is all about, like, can there be a steady flow of trade, right? And if trade changes, and now you have everything that goes out of Taiwan that sees complications. Yeah, I think the potential China invasion of Taiwan makes the position sizing in key, right?

So the – when we talk about risk, we switch the conversation to a very different one, which is portfolio management, risk management and position sizing. Meaning, would I have 20% of my portfolio in TSMC? Probably not, right? Because they are – there it’s all about again going back to this notion of the range of outcomes.

If there is a wide range of outcomes with a possible, like, a really negative one that involves that investment being a very challenge, then it’s not necessarily smart to build a very large position because we want to factor your downside risk, right? So that’s kind of like how I cannot remove the risk. But I can monitor it by adjusting the size. So that’s how I generally think about that.

And on the CapEx side, I would say, that’s the nature of the beast, right? It’s just part of the business we’re in here. This is one of the most profitable businesses in the world by far. So the operating margin in and off of 50%. So I don’t perceive the CapEx as too big of an issue because it is well documented with the track record that it is money well spent.

So it kind of, again, makes you hold your nose in the short-term. But if the data is here and again, I’ve been in the mobile gaming industry or sometimes you spend a ton to acquire users, but you’re only going to make money from them two, three years down the line for those who retain and become heavy spenders. That’s how you work, right? You work with the full life cycle, you see where it’s going to get you and you spend that money when you have all the data and intelligence to know you’re doing the right thing. So that’s how I think about it.

Daniel Snyder: Now let’s go ahead and get into that second stock pick that we were going to talk about today. And that’s a software company, right? Why don’t you go ahead and just announce what it is and what’s the thesis here behind this one?

Bertrand Seguin: Yeah. Sure. I do a deep dive every month for members of the Economy Portfolio, where I go into the details of why I think a company looks special. And so the company you have covered two weeks ago for the February stock ID, it was Monday.Com (MNDY).

And so if you search for a kind of a software tool that helps you collaborate and be productive, you must have seen gazillion ads that come on YouTube and elsewhere because they are very aggressive with their sales and marketing. So the long story short is one of my favorite thing to do is to find businesses that look like the big successes of today, but how it looks like maybe 10 years, five years to 10 years ago.

And so, productivity and work, what they define themselves as a work OS, a work Operating System, meaning where you organize your work as a company, small or big. And you have other companies that succeeded in that field like ServiceNow or Workday that have become software giants, right?

And interestingly enough, if we walk back Memorial Lane, Daniel, and we go back 10 years ago, 2013, ServiceNow and Workday look exactly like Monday.Com today. To a T, you wouldn’t believe it, I pulled a few charts for my members, but the revenue growth rates, the margin profile, operating margin on a GAAP basis, the cash flow margin everything is basically the – they were like Monday.Com, and they had everything looking the same. And if you look forward now, so 10 years later, well, if Monday can follow that path, we’re looking at a 10x to 20x.

So am I saying it’s going to do 10x or 20x? I don’t know. I really don’t. But I like my – oh, it’s here and I focus on what I can control. So if I note the ingredients of the recipe are in the pot, I think I’m going to have a good meal, but that’s the theory around like putting things together here. What – it’s hard to invest in software companies that are unprofitable in this current environment.

However, even though we have a potential liquidity crisis and interest rate being higher and discount rates changing a little bit how you think about valuation, those things are temporary. They are cyclical. And even though we could stay in this cycle for five, 10 years, who knows?

The evaluation right now is at a point where it could get cheaper, but it’s not going to be a lot cheaper because at some point, you just have multiple that just make sense given the revenue growth rate and where the margin profile should be at scale. The way to think about it is how does the company look at scale? So they spend a ton of money to acquire users that do sales and marketing expenses.

However, down the line, they know that more than offset all these costs because people who get acquired and enter the ecosystem eventually spend money and they spend more money over time as they grow their teams on the platform. And that’s how you know that down the line, you’re going to get a beautiful margin profile for the business that is going to return value to shareholders.

And so that business, specifically Monday.Com reason why I do care about it in this environment is that they almost have $1 billion rather than $853 million on their balance sheet. Barely any long-term debt. So these guys can fund their growth as much as they want, and they’re already cash flow positive. They are already generating multiple cash flow margins above 10%.

And so they generate cash through their business already. They have a ton of cash on their balance sheets if they want to acquire or close it statistically or just be more aggressive or hire more, they can do that. They have two Co-Founders that are still heavily – they are both CEOs, they are Co-CEOs, and they are still what I like to find in companies is to find CEOs or Founders that have skin in the game. Meaning that the success of their company is still very much important to them and in their best interest.

So we’re talking about more than 30%, 32%, I believe. They’re still owned by the management team here. So this is – those are all the ingredients I really look forward to fund relatively smaller companies that can go 5x to 10x because they have all the – all these ingredients. So small company, they usually go with a smaller position. We just touched on the range of outcomes and the position size. So, typically, Monday would be a relatively smaller position coming.

However, I really do like the odds when I look at other mature businesses. No guarantee again that they’re going to follow that pattern. Not every company can end up being ServiceNow, right? But the – it’s Maya Angelou, who says prepare for the worse, hope for the best. I mean, be unsupervised by anything in between. So that that’s where we are for Monday.

Daniel Snyder: I thought that one Monday.Com was an interesting stock pick just because I was looking at it on Seeking Alpha. Even I’m looking at it right now, the quant is a strong buy as well. Wall Street has a buy rating on the stock, Seeking Alpha authors have a buy rating on the stock. The short interest is 18.5% and the stock is up 41% year-to-date. I’m recording this February 15th.

So, I mean, it’s just, like, maybe somebody’s listening into this right now. Is your word of advice to this is still a great entry point, but we’re expecting this for years and years down the road or wait for a pullback and then grab an entry? What would you say to those people?

Bertrand Seguin: Yeah. Well, first of all, not a financial adviser. I know I don’t make recommendations, as you well know, but I do share how I invest, right? And so I bought Monday on the 1st of February, which was my last light trailer going with my deep dive. So, yes, it’s up 28% as I look in this corner. There’s my screen right now.

So it’s actually done very well in the past two weeks just because the market has been growing for just in general, investors are more comfortable being risk on right now with potential inflation going down and other things at stake. But does it need silver? While I intend my hope when I bought two weeks ago is to go for a 10x to 20x over 10 years if everything goes really right.

And so is it swept 30% up and down 40%, [ph] I wouldn’t invest anymore? Of course not, right? So I still have it on the very high end of my watch list, and I will continue to build up my position in this year. And, yeah, it’s – I don’t think about it on just the 10%, 20% move that changed my mindset when I find a company that is special, talking about leadership, talking about culture, talking about the unit economics, those things don’t change from a quarter to the next or based on a 10%, 20% move. So I still put it right there at the top of my watch list. Yes.

Daniel Snyder: Bertrand, thank you for taking the time to speak with us today. Like I said earlier in episode, you’re a content machine, you’re always putting out complete update as every month. You’re creating these amazing data charts that I really highly encourage everybody to go look at. I mean, it makes the income statement, the balance sheet, everything is just so much simpler when you look at it. But I got to ask you for the people listening, where can they read your research?

Bertrand Seguin: Yeah. Thank you for asking. So I’m basically on Twitter @EconomyApp. That’s where I post a lot of my charts. I try to keep them pretty and entertaining, so that people can grasp businesses in seconds. It takes me hours to create them, so I hope people enjoy them. And my portfolio service, which is really where I share the unique video of where I actually invest my money is my premium service on Seeking Alpha like whole equity portfolio where I have the committee of hundreds of investors who we discuss things like what we talked about today, Google, Microsoft, AI, and so on.

So really, this is what I’m most grateful for having a community of like-minded investor joining and tag you along, and that’s why I enjoy so much what’s – what we built now on Seeking Alpha and epically, post service is very special plates for me to share my thoughts.

Daniel Snyder: Just a reminder, everyone, if you enjoyed this episode, leave a rating or a review on your favorite podcasting app. And we’ll see you again next week with a new episode and a new guest.

|

We encourage you to listen to the podcast embedded above or on the go via Apple Podcasts or Spotify. Check out App Economy Insights Here! |

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.