Summary:

- Microsoft and Alphabet are much larger than Baidu.

- It is very early in the chatbot development cycle.

- Baidu seems undervalued compared to MSFT and GOOG.

- Chinese character-based language may present a unique set of problems to Baidu competitors.

jittawit.21

The AI (Artificial Intelligence) market is awash with news about high-tech competition in the chatbot market. Alphabet Inc. (GOOG), Baidu, Inc. (NASDAQ:BIDU), and Microsoft Corporation (NASDAQ:MSFT) have all been in the headlines with the current version of their proprietary chatbot engine.

We now know all chatbots have names making them easier to reference around the kitchen table. Google has “Bard”, Baidu “Ernie” and now due to an enterprising student at Stanford we know that deep down inside, Microsoft’s chatbot is named (maybe) “Sydney”.

Even a luminary such as Bill Gates has chimed in on the utility of chatbots and even admits he has used them to write poetry!

Although they are undoubtedly in their infancy, chatbots have great potential for learning and interpretation. Exactly how long this will take to come to fruition is still up in the air but there is no doubt chatbots will be extremely influential over time.

From an investment standpoint, the question remains is it time to pick a chatbot investment or are we too early in the process to determine a clear winner, assuming there is only one?

In this article, we will compare all three companies to determine whether it is possible to pick a sure investment winner at this early stage of development.

GOOGL, MSFT, and BIDU Stock Key Metrics

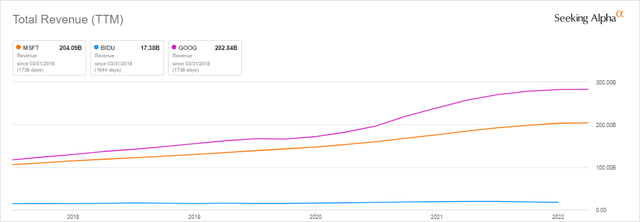

One of the most notable differences between the three companies is their relative size. If we look at the following table it is easy to see that both GOOG and MSFT have a huge revenue advantage over Baidu with TTM (Trailing Twelve Month) revenues in the hundreds of billions compared to the rather paltry $17 billion of Baidu. Pretty much no contest there.

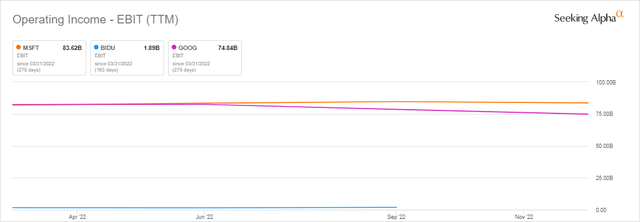

Another worthy financial metric compared would be Operating Income (EBIT). In this case, GOOG and MSFT seem even more dominant with EBIT 30-40 times that of Baidu.

And finally, how many engineers does each company have available to work on chatbots if needed?

Microsoft has at least 5,000 engineers working on AI while Alphabet has 27,000 engineers total though I am unable to find a number working on AI alone. Baidu has a total of 45,000 employees so the total number of engineers is certainly considerably less than that.

Of course, an unknown would be how much help, if any, Baidu would receive or has received from either the Chinese government and/or the CCP (Chinese Communist Party).

How Do Their AIs Compare?

At this early stage, it is difficult to determine which chatbot is the best at least from an investment point of view. Obviously, Alphabet did its reputation no good with the recent Bard fiasco, but at this stage that is pretty much meaningless except from a PR standpoint. Remember, AI is much more than chatbots and many companies have been involved in AI development for many years. Just a few examples would be Apple (AAPL), Meta Platforms (META), and even Tesla (TSLA).

What Should Investors Interested In AI Consider?

Investors interested in AI need to understand AI will be everywhere, it will be all-encompassing, and that no company will be without it one way or another. They will either develop some proprietary version of AI for their own purposes or they will buy it from someone else like MSFT, GOOG, or Baidu.

AI investments should be chosen by selecting the innovators in each category for example in EVs it would be Tesla in a landslide with its robotics, FSD (Full Self Driving), and battery technology. In chatbot, it is too soon to tell.

How Do GOOG, BIDU, and MSFT Stock Fundamentals Compare?

As we have seen under the key metrics paragraph above, if size matters Baidu is not competitive.

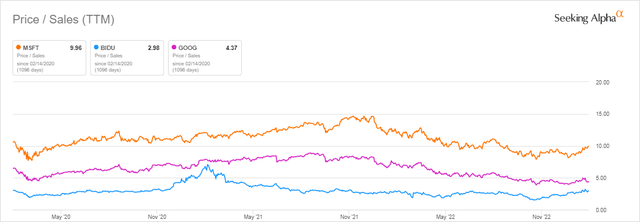

But looking closer at some metrics such as price to sales, we can see that Baidu appears to be considerably undervalued compared to MSFT and GOOG.

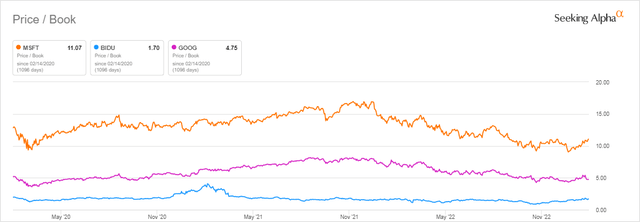

Also, on the basis of price-to-book comparative values are even more distorted.

Keep in mind Baidu has one huge advantage over MSFT and GOOG – 95% of the Chinese search market. That’s 1.4 billion people that are more than likely going to stick with Baidu than Bing or Google in spite of whatever influence individual chatbots may have on their individual markets.

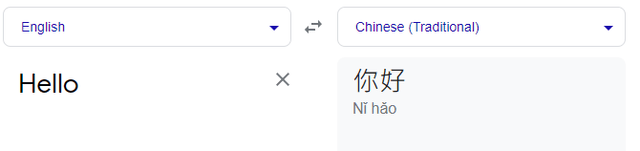

The fundamental reason is the character-based language used by Chinese and other Asian nations does not lend itself to MSFT or GOOG chatbots.

Here is a simple example of the problem for MSFT and GOOG:

I think Bill Gates would agree, writing Chinese poetry via chatbots is a much more complicated endeavor and would vastly favor Baidu over Microsoft and Alphabet.

Is Google, Microsoft, or Baidu Stock A Better AI Buy?

We can assume that AI means many different things to different people. The interest in chatbots is certainly increasing but we are very early into their full-fleshed development and use.

With their enormous size, reach and finances both Microsoft and Alphabet will certainly be formidable competitors not only with each other but with other potential competitors such as Baidu.

Taking into account the seemingly ever-increasing competition between China and the west, I think it is likely Baidu will be given whatever help it needs, technical and financial, to compete with the western behemoths, MSFT and GOOG.

Therefore, I rate Baidu a buy for long-term investors although I would keep the dollar percentage small. This is due to what I call the “Chinese put”, the concept that we never really know what is going on in China and how much influence the Chinese government has over individual companies.

I would rate Microsoft and Google as Hold.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you found this article to be of value, please scroll up and click the “Follow” button next to my name.

Note: members of my Turnaround Stock Advisory service receive my articles prior to publication, plus real-time updates.