Summary:

- With yields on 6-month Treasuries having just crossed the 5% threshold, valuations may soon be in jeopardy if longer-term yields follow suit.

- Given Amazon’s high exposure to macroeconomic conditions, we see personal savings and consumer credit being headwinds.

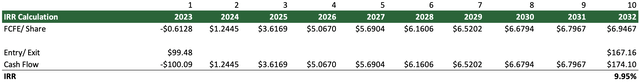

- According to our calculations, Amazon is currently achieving an IRR of less than 10%, suggesting that investors may want to wait until the stock is closer to $80.

- Although Amazon faces many headwinds, we think it should continue to receive a premium because of its strong business moat.

400tmax/iStock Unreleased via Getty Images

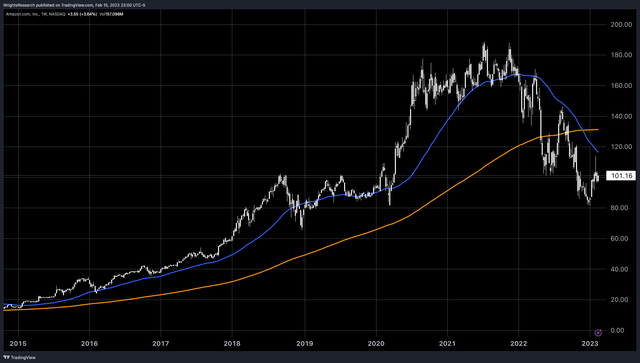

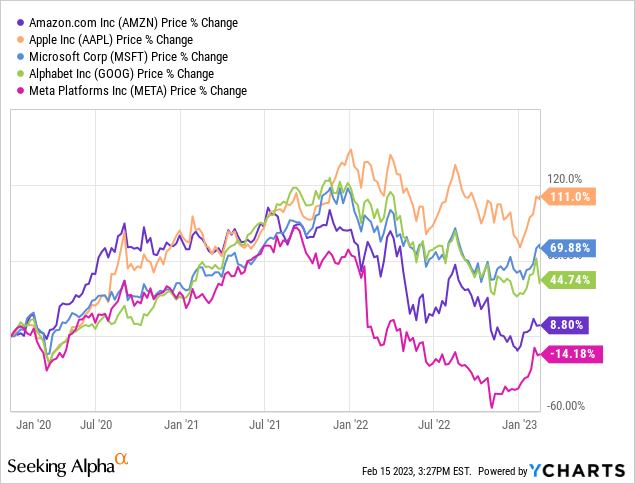

Amazon (NASDAQ:AMZN) has experienced a difficult few years, with the stock down about 50% from its all-time highs in 2021. In recent history, big tech and FAANG names were known for their relentless and unending rise in market cap, and were always considered a buy after a pullback.

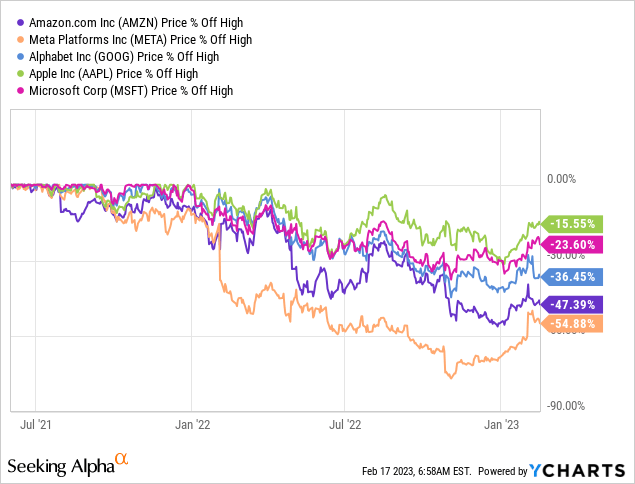

That was the case until 2022 arrived, and almost every FAANG rolled over. Amazon, however, seems to have seen the biggest mean reversion of all its peers, not counting Meta (META). At this point, with Amazon having already had such a mean reversion, some may consider it a shrewd investment. But we argue why investors should be very cautious in the current macroeconomic environment.

Investment Thesis

Amazon is currently in a very peculiar situation. Namely, in one of a secular downturn, with consumer spending expected to deteriorate rapidly. This comes after record levels of monetary expansion in 2020 and 2021. There are good reasons to believe that while the economy and small businesses were locked down in 2020 and 2021, consumers flocked to Amazon to spend their stimulus checks.

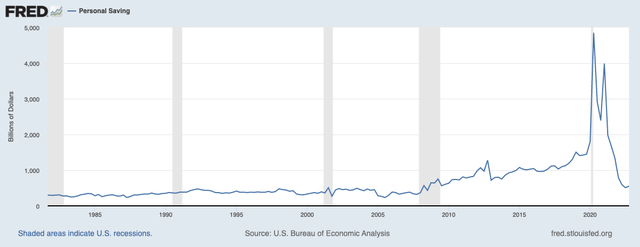

Now, two years later, personal savings are once again at historic lows and consumers are once again reluctant to spend. The record spending of the past two years will also make for difficult year-to-year comparisons.

It’s no surprise that Amazon is very sensitive to macroeconomic changes, with currently more than half a trillion in annual revenue. While personal savings can be a good indicator, we also like to look at the state of credit, in an economy driven by credit more than ever.

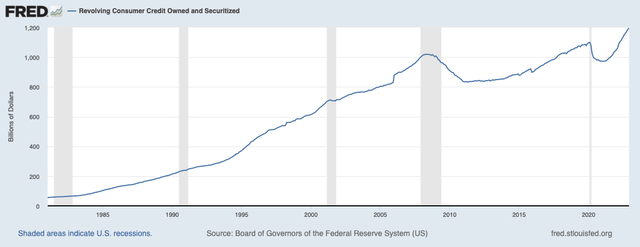

Consumer revolving credit, mostly based on credit card balances, is also back to its highest level ever, after a big drop during the pandemic, when monetary expansion allowed consumers to pay off debt. Perhaps it’s no wonder the economy continues to heat up, since consumers apparently have not tapped out yet.

This was also reflected in the producer price index just released, which showed a monthly increase of 0.7% in January, much higher than the 0.4% expected. Retail sales also crushed expectations, after rising 3% in January, the biggest increase in nearly two years.

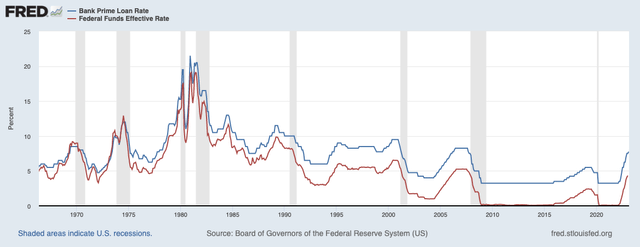

But that could soon come to an end, as the Federal Reserve will act even more hawkish on what they say looks like stronger-than-expected inflation. Higher rates could be especially toxic for smaller companies, which typically can only borrow above the prime rate, already currently at 7.75%. If the Fed raises rates to a terminal rate of 5.25%, this minimum Prime Loan Rate is expected to reach about 8.25%, similar to 2006 and 2007 levels.

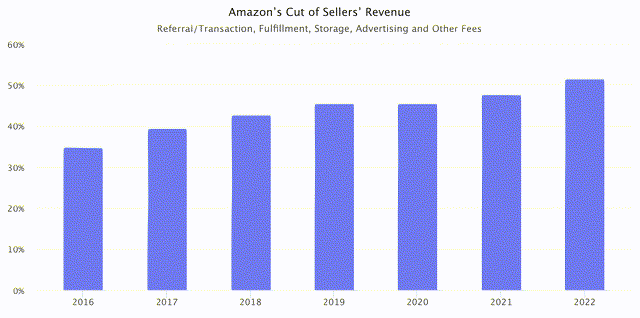

Amazon increasingly relies on third-party sellers, which currently make up about 60% of its sales base. In March 2022, Amazon reported that “nearly two million small and medium-sized businesses are Amazon’s third-party sellers.”

A recent case study also pointed out that Amazon’s cut of sellers revenue accounts for an increasing proportion, recently exceeding 50%. In addition to charging a base fee that can range from 8% to 15%, sellers also use Amazon FBA for fulfillment and pay for advertising on Amazon. It is both a guess for us and Amazon how much more value they can squeeze out from this source.

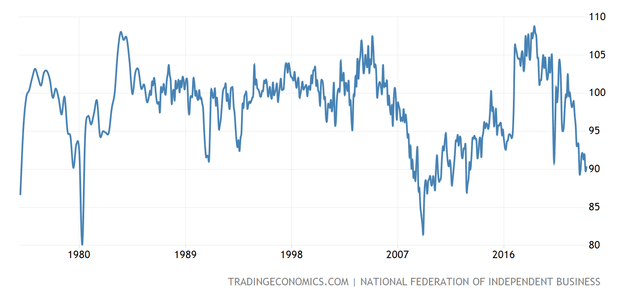

One last word on small businesses: the US small business optimism index reflects these macroeconomic conditions, with the index currently appearing to be heading for the 2008 low.

National Federation of Independent Business, Tradingeconomics

“Amazon Cannot Continue Like This” Syndrome

Although Amazon is experiencing certain headwinds, we still think it is very premature and irrational to believe that the company has already reached its terminal growth and should trade at a deep discount. We believe Amazon can trade at a premium.

Justified in terms of its great moat and robustness, perhaps also why Warren Buffett owns the stock. Sometimes it is worth paying a premium for a company that can stand the test of time, because nothing lasts forever. Look at IBM (IBM) and GE (GE), for example, and what divine status they had not so long ago. Why was Coca-Cola such a great stock? In our opinion, not because of its insane short-term growth, but because of its longevity. It was also great at passing on longer-term inflation, as perhaps is the same with Amazon.

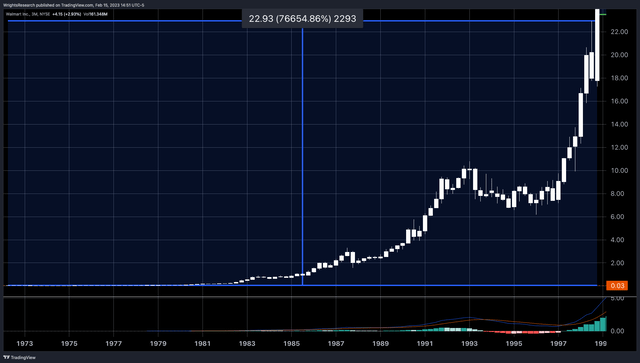

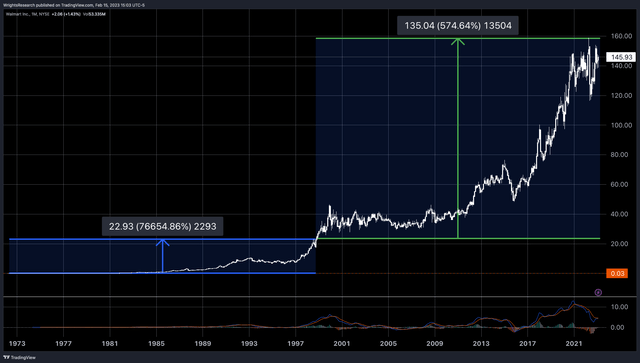

Value investing in theory sounds easy. Doing it successfully over the long term is the actual challenge. And that challenge includes knowing when to sell. Take Walmart (WMT) as an example.

The stock had multiplied a whopping 766 times in its first 26 years, from $0.03 in 1972 to nearly $23 in 1998. Bank then, some people probably said that you were crazy to believe that the company can grow any further, and is rather in decline. Well, from 1998 to today, the stock rose another 574%.

Not the spectacular growth we were used to seeing, but still a CAGR of over 8% for a stock that was thought to be “too mature,” or “ripe for disruption”. Amazon, currently listed for 26 years, is perhaps the same story, and has a lot more of prime time ahead of it.

That expansion could take many forms, just as investors could not have foreseen the rise of AWS a decade ago. Amazon is active on multiple fronts, especially in robotics and automation.

They are even making great strides in autonomous driving with Zoox. Another great example is Kiva’s robots, which Amazon bought up some time ago and essentially barred from providing services to other companies. This kind of vertical integration, and increasing control over its supply chain, will provide tailwinds in the coming years.

Amazon recently did the same and has a large stake in Rivian through investments currently worth $3.27BN. Rivian, similar to Kiva, currently only supplies its electric vans to Amazon, again demonstrating how Amazon is guarding its huge moat and staying ahead of the competition.

Gravity At Work: Mean Reversion

There’s a saying we like to use: interest rates work like gravity. And Amazon seems to be the company feeling this gravity the hardest.

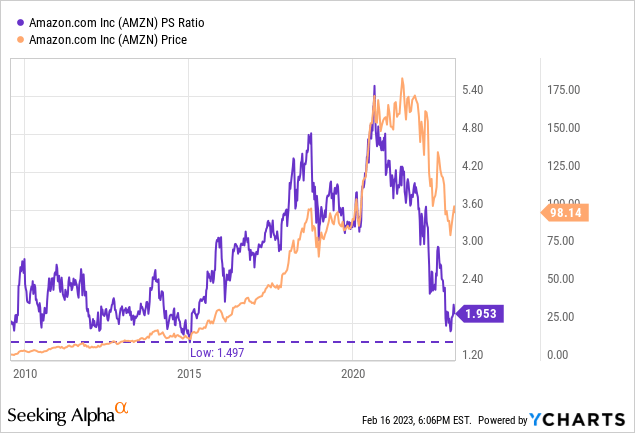

The stock is still trading at 2018 levels, but much progress has been made. At its current price, the stock is essentially even fully discounted from all the benefits and growth Amazon received during the pandemic. On a P/S ratio, Amazon appears to be trading near its historically low P/S ratio, and near 2009 and 2015 levels.

So this mean reversion could be seen as positive, because if margins return to healthier levels, Amazon could receive a huge boost. Looking at all other large-cap tech stocks, Amazon is still the most mean-reverting stock, outside of Meta.

But Meta is a different story, because we think Amazon’s business model/moat is much better than Meta’s, which faces strong growth problems and competition from other social media platforms.

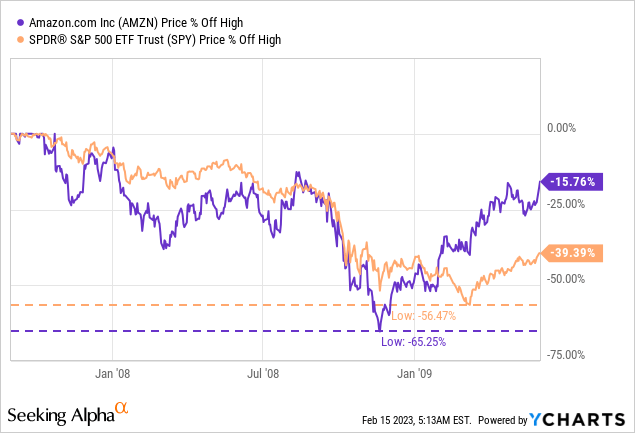

As an example, during the 2008 recession, Amazon, although a much smaller company, saw a decline of about 65.25%. Which makes us think, now that Amazon has fallen about 50% from its all-time highs, how much more there is to fall. At least it offers investors some protection against downside risk, as Amazon has already fallen hard relative to its sector peers and broad-based benchmarks.

Interest Rate Turmoil

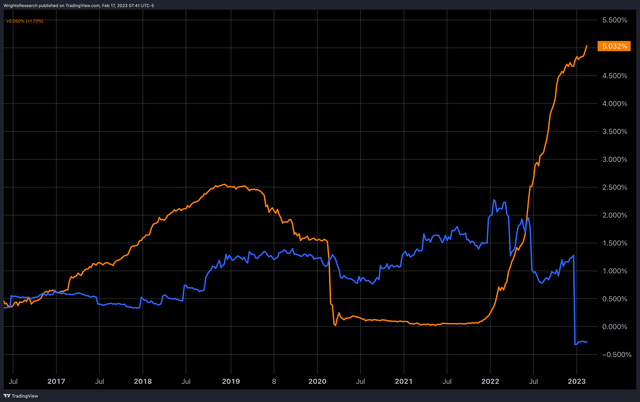

As interest rates continue to move higher, this is also having a negative impact on equity valuations, as they are likely to receive higher discount rates. And looking at Amazon’s earnings yield, in blue, and the current yield investors are getting on 6-month Treasury bonds in yellow, the divergence has never been greater in recent history.

Even when compared to the S&P 500, which currently trades at a P/E multiple of 21.8x, representing an earnings yield of 4.57%. If longer-term interest rates, such as the 10-year yield, which stands at 3.88%, move higher, it could mean that stocks are in a very dangerous zone. If that 10-year return reaches the return on earnings of the S&P 500, you are in fact taking a lot of risk and only getting paid for growth.

The margin pressure, a rather temporary headwind, is likely to dissipate in the near future. But the macroeconomic environment may remain like this for a while.

Thus, investors should certainly ask themselves whether they believe that interest rates will eventually fall, return to previous levels or remain high for longer, as the Fed is currently indicating. For example, James Bullard gave a rather bearish message to market participants yesterday:

My overall judgment is it will be a long battle against inflation, and we’ll probably have to continue to show inflation-fighting resolve as we go through 2023

He even questioned the lagging effects of monetary policy, which is one of the most bearish statements we have heard, since lagging interest rate changes are currently one of the main factors keeping the Fed from continuing to raise interest rates at the huge pace of 2022.

I have argued consistently for front-loading of monetary policy, I think we could have continued that at this past meeting. (James Bullard)

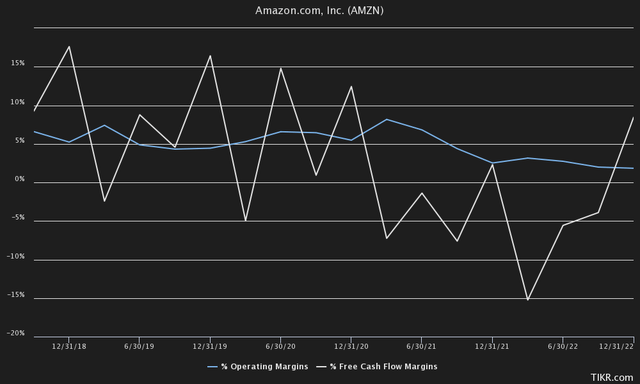

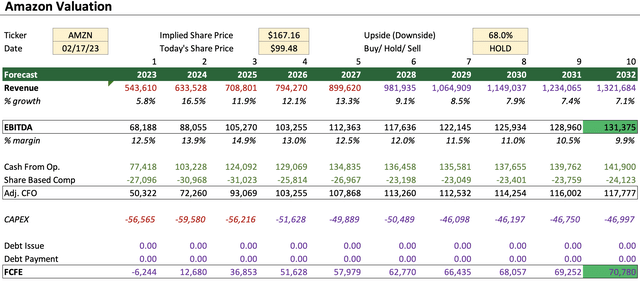

We discounted these concerns and think Amazon is still on track to generate about $131BN in EBITDA and $141.0BN in cash from operations. We adjust this CFO to reflect share-based compensation, which is currently quite high at Amazon.

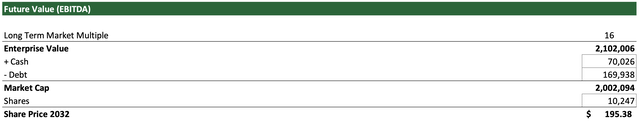

At an EV/EBITDA multiple of 16x, this leads to an EV of about $2.10T, a market cap of $2.0T or a price of $195.38 per share by 2032.

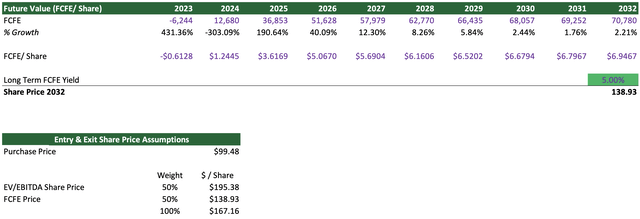

From a free cash flow perspective, we believe Amazon has the potential to generate about $6.94 per share in FCFE by 2032. For the earnings yield, we believe that in recent history Amazon mostly traded at a 3% FCFE yield, such as in 2013 and 2017.

Currently, to account for higher rates, we take precaution and apply a long-term FCFE yield of 5%, as the 10-year yield currently trades around 3.89%. We arrive at a price per share of $138.93 in 2032 on an FCFE basis.

Based on both valuations, we think a price per share of $167.16 is a reasonable estimate for Amazon to trade in 2032, taking into account that interest rates remain high in the near term. Plugging that into an IRR calculator yields an IRR of 9.95% for the next 10 years.

The Bottom Line

Now that Amazon has gone through a decent mean-reversion back to its support levels, which date back to early 2018, Amazon technically looks like a compelling buy. We think investors are currently too focused on just a few quarters of results and guidance, and Amazon could surprise to the upside when their internal headwinds dissipate.

However, a prolonged rise in interest rates poses a serious threat to the company in the near future. With an IRR of 9.95%, we consider Amazon reasonably priced and would wait to invest more in the stock until it is closer to its support at $80. We usually prefer to buy stocks within 10-15% of its support levels and set a stop-loss if it breaks that support level.

Since the insiders themselves have not hesitated to sell the stock either, we also believe that the management team does not see the stock as an absolute steal either, and rather reasonably valued.

In conclusion, we currently give a hold rating and would assign a buy rating based on currently available information if the stock trades below $88 per share.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.