Summary:

- Algonquin’s stock is currently under pressure and offers a favorable stock valuation compared to its historical valuation and compared to others in the industry.

- Algonquin’s financial strength has weakened and therefore the company will sell assets, reduce its dividend and cancel its dividend reinvestment plan.

- Since historical financial performance has not been pretty, I am somewhat skeptical about the future.

- I think it is too early to get in, a good time to get in is when the debt ratios are more favorable after the sale of the assets.

Laurence Dutton

Introduction

When I see rising dividends per share, a high dividend yield and a low stock price, I always try to see if this is a good buying opportunity. Algonquin Power & Utilities (NYSE:AQN) offers a high dividend yield of 9.2%, but risks loom over the future dividend.

Algonquin Power & Utilities’ share price fell sharply in late 2022 from $11.50 to $6.50 at its lowest. Now the stock has recovered somewhat and is moving up and trades at $7.80 per share.

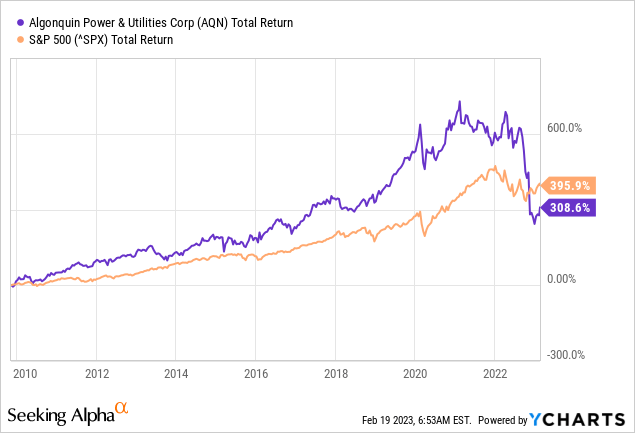

Overall, AQN outperformed the S&P500 from 2010 to 2022. The stock is now down 47% from its April high. Is this a buying opportunity or has the storm not yet subsided?

Weak Financial Strength

Algonquin came out with third-quarter earnings well below analysts’ consensus. The company expects adjusted net earnings between $0.55 and $0.61 per share for fiscal 2023, below consensus estimates of $0.70. To strengthen its financial strength, Algonquin has cut its dividend, canceled its dividend reinvestment plan (DRIP) and will sell assets.

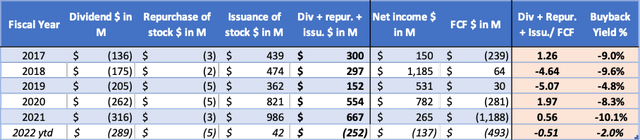

The company has $114M in cash but a huge $7.7B debt load (of which $462M is short-term debt). In the next section I tabulated net income and free cash flow. Free cash flow was only slightly positive for 2 years. Net income showed a better picture, with its all-time high net income in 2018 of $1.2B. Its net income averaged $583M over the past 4 years. So now we can get a picture of his large debt compared to its earnings. Net debt is extremely high at 13x net income.

A large debt may not be a problem when interest rates are low. Now interest rates are much higher, putting the company at risk when it has to refinance its debt at a higher interest rate. Management is doing a good job of reducing debt by selling assets, but I don’t think this will increase the stock price soon. The debt is just too large now.

Dividend Is Not Sustainable, Lower Dividend Per Share

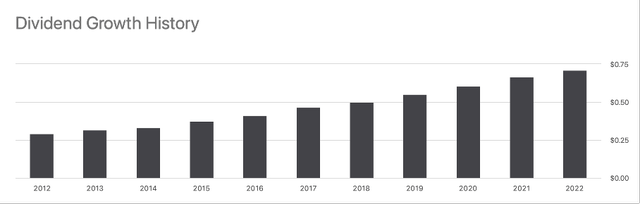

Algonquin Power & Utilities offers a high dividend yield of 9.2% at its current share price. And the dividend per share has risen steadily over the past 10 years. Last year, the dividend per share was increased by 6%.

Dividend Growth History (AQN’ ticker page on Seeking Alpha)

The cash flow statements tell us that the company has increased its dividend payout year after year, but it has also issued many shares because of its DRIP, making the net return to shareholders negative. Net income fluctuates widely and free cash flow was deep in the red in 2021. The steadily growing dividend per share masks the fluctuating net income and free cash flow. Its DRIP and dividend payout are not sustainable in the long run because they are much higher than the earned free cash flow. The DRIP is now cancelled to maintain the BBB credit rating.

Algonquin’ Cash flow highlights (SEC and author’s own calculations)

Looking at the future of the dividend, we do not see a positive picture either. 11 analysts expect a dividend per share of $0.44 for this year, down 38%. The expected dividend yield is 5.6%, a high dividend yield, but the falling dividend per share is worrisome.

Stock Valuation Seems Favorable

Now we come to the valuation of the stock. To understand its stock valuation, we usually look at common metrics such as the PE ratio or the price-free cash flow ratio. For Algonquin, this method could not be used because the company will sell its assets to increase its financial strength. Another problem is that the PE ratio does not give us a clear insight into the valuation of the company because debt and cash are not included in the PE ratio.

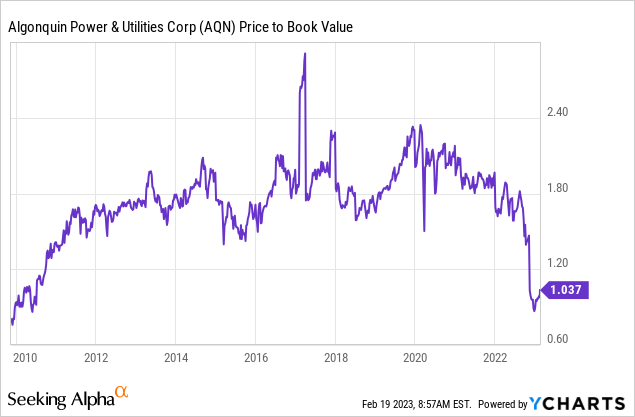

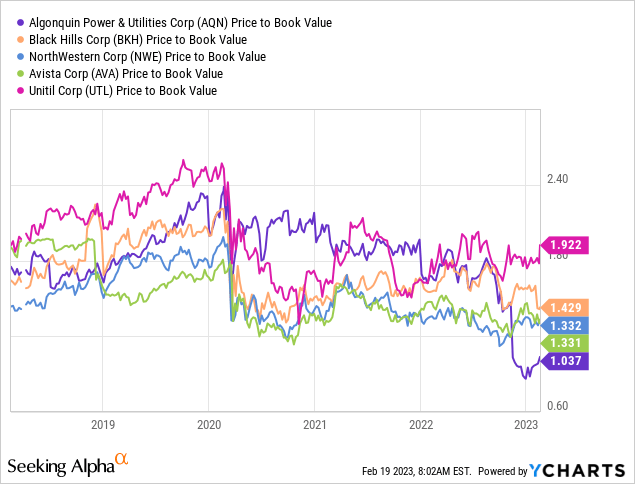

Therefore, the price-to-book value ratio seems to be a good choice for its valuation. The market capitalization is currently equal to the book value, and looking at the bigger picture, we see that the company previously traded much higher. Only in 2019 was the PB value more favorable than now. From its historical perspective, we see a favorable valuation of the stock.

Looking at the P/E of others in the sector, Algonquin is trading favorably compared to its competitors. This is not without reason, of course, as there are some stormy clouds hanging over Algonquin.

Algonquin will sell some assets to improve its financial strength, but this will only be beneficial if these assets are sold at or above book value. But I don’t think this will be the case. Potential buyers might bid favorably because they know Algonquin needs to sell assets to improve its financial strength, so they will not pay a top price for its assets.

Conclusion

Algonquin’s stock is currently under pressure and offers a favorable stock valuation compared to its historical valuation and compared to others in the industry. Now its market capitalization is equal to its book value. Algonquin’s financial strength has weakened and therefore the company will sell assets, reduce its dividend and cancel its dividend reinvestment plan. The forward dividend yield is still high at 5.6%, slightly higher than others in its sector. Free cash flow was only slightly positive for two years and debt rose rapidly. Net debt is extremely high at 13x average net income. Management is doing a great job to reduce its debt load now. Still, I do not see a positive outlook for the company, nor do we know whether these assets will be sold at book value or above. Since historical financial performance has not been pretty, I am somewhat skeptical about the future. I think it is too early to get in, a good time to get in is when the debt ratios are more favorable after the sale of the assets.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.