Summary:

- Exxon Mobil Corporation has continued to grow its valuable portfolio of assets, especially including the company’s production in both Guyana and the Permian.

- The company has been slightly growing its production, however, achieving higher margins for each unit of production is much more important.

- The company is continuing to invest in renewable energy but has yet to develop a business plan to replace its current cash flow in a changing market.

CHUNYIP WONG

Exxon Mobil Corporation (NYSE:XOM) (“ExxonMobil”) had one of the strongest years on record, pushing its market capitalization towards $500 billion. The company invested heavily through the last several years, and it’s built up a substantial low-cost portfolio. As we’ll see throughout this article, we expect the company to be able to use that portfolio for substantial shareholder returns.

ExxonMobil 2022 Performance

The company has performed incredibly well in 2022, supported by strong crude oil prices.

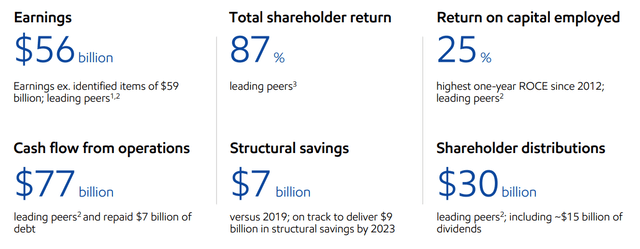

ExxonMobil Investor Presentation

The company earned a staggering almost $60 billion on a market capitalization of more than $450 billion. The company earned $7 billion in structural savings and had a massive $30 billion in shareholder distributions ($15 billion in dividends). That was total shareholder distributions of just over 6.3%. The company earned double-digits of free cash flow (“FCF”) supporting its portfolio.

Despite this incredibly strong performance, we feel it is unlikely for the company’s performance to continue given the drop in Brent crude prices to just under $85/barrel.

ExxonMobil Cash Flow

The company’s cash flow has remained incredibly strong, enabling strong investments in its business.

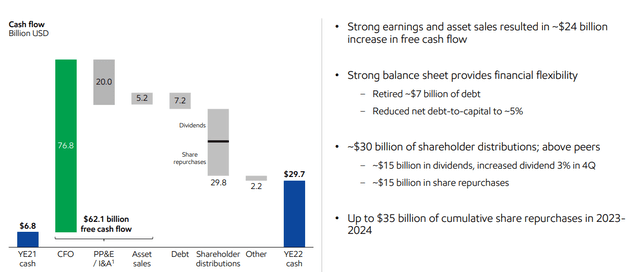

ExxonMobil Investor Presentation

The company generated substantial FCF throughout 2022. After massive capital expenditures, the company had $62.1 billion in FCF, although it is worth noting that number is more like $57 billion when you exclude the company’s asset sales. We expect the company to maintain $20+ billion in capital spending outside of FCF.

The company repaid $7.2 billion in debt and gave shareholders almost $30 billion. It still ended the year with an extra $23 billion in cash in the bank account on top of those shareholder returns. That’s a roughly 13% FCF yield for the company. The company expects roughly $35 billion in share repurchases over the next 2 years, which will save dividends and drive returns.

ExxonMobil Project Breakdown

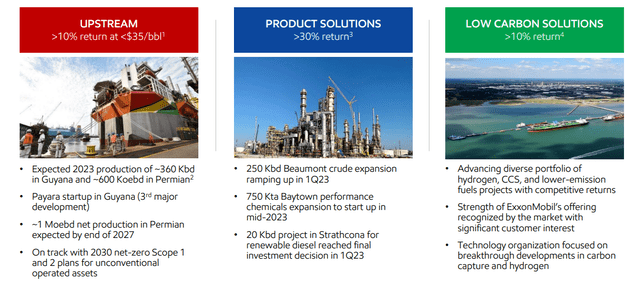

The company’s project breakdown shows continued execution across its portfolio.

ExxonMobil Investor Presentation

The company’s largest upstream segments are its Permian Basin and Guyana operations. The company expects attributable production of 360 thousand barrels/day from Guyana as production continues to ramp up. We continue to expect that over the next several years, Guyana’s production will top 1 million barrels/day of low-cost production.

The company also has a massive low-cost base in the Permian Basin. The company originally had a long-term business plan here, however, it slowed it down substantially as a result of the COVID-19 impact on oil prices. Still, however, the company has hit 600 thousand barrels/day of production. It still has the ability to hit 1+ million barrels/day of production.

The company is aiming for a $10/barrel breakeven for this massive operation, competitive with the largest onshore operations in the Middle East. The company is expanding production solutions with new and complex factories. The company’s expertise in the situation provides it with >30% annualized returns.

In low-carbon situations, the company is still targeting double-digit returns. The company has a diverse portfolio of assets in this situation, although it is focused more on renewable hydrogen and CCS, where its expertise can shine over raw renewable projects. Still, the company has the potential to become a major player here.

ExxonMobil Forecasts

The company’s guidance for the next several years helps to highlight the strength of its continued cash flow.

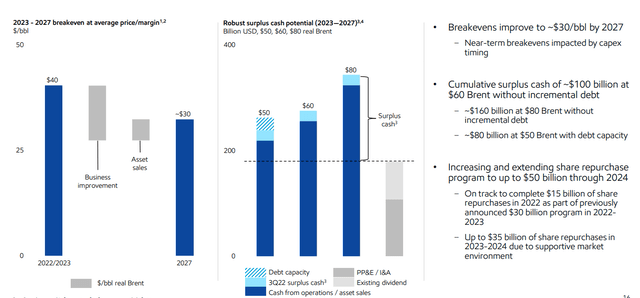

ExxonMobil Investor Presentation

The company expects breakeven prices to be at roughly $30/barrel by 2027. That’ll be supported by a combination of business improvements for the company, but it’ll also be hurt by the company’s asset sales. Still, it shows that the company’s breakeven will remain substantially lower than forecasts for oil prices, enabling strong cash flow.

The company’s forecast for surplus cash flow is $100 billion at $60 Brent, or $160 billion at $80 Brent. As an average for the next 5-years, we expect that the $160 billion number is much more realistic for investors. The company expects a 2-year repurchase program of $35 billion but thinks it can grow it towards $50 billion.

That’s a substantial amount of repurchases that can help the company to reduce its dividend expenses and drive future shareholder returns.

Our view is that the company can use that cash flow to drive 36% in shareholder returns over the next 5 years. That’s roughly 7% in annualized returns. It also shows how expensive ExxonMobil’s stock has become; the company needs $80/barrel to perform. The company is still cheaper than peers but it’s not that cheap.

Crude oil stocks are a long ways away from where they sat just a few years ago.

Our View

ExxonMobil has a unique and impressive portfolio of assets. The company has a clear path, from its own guidance, to generate mid-to-high single-digit shareholder returns at $80 Brent. All of that is exciting to see, however, it’s no game-changer. The company’s investors have clearly reset the valuation from where it was a few years ago.

We feel that ExxonMobil’s unparalleled downstream portfolio and substantial opportunity for low-cost upstream production expansion show its financial strength. The company can continue to generate massive direct cash flow. Its utilization of its expertise to become a leader in CCS, etc., is also promising. However, it’s clearly not at the scale required.

The company has substantial long-term risk, however, at this time. In the field of its competitors, we still have a “cautious buy” rating based on its potential.

Thesis Risk

The largest risk to our thesis is, of course, crude oil prices. ExxonMobil’s forecasts are based on $60/barrel Brent adjusted for inflation. That’s roughly $25/barrel below current rates and shows substantial room for improvement.

Conclusion

Unfortunately, it’s much less fun being an energy investor these days. Several years ago, as others were panicking, there was opportunity everywhere to be found. That’s no longer the case. At the present time, ExxonMobil needs crude oil prices of $80/barrel Brent simply to justify its valuation. However, there’s still opportunity to be found.

Specifically, ExxonMobil is looking to build an operation in the Permian Basin that can rival the largest onshore Middle Eastern oil operations in efficiency. At the same time, the company has massive expertise that it can use with its downstream operations to expand margins. Exxon Mobil Corporation is using that same expertise to fight climate change, but not nearly at the needed scale.

Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.