Summary:

- The inventory-to-sales ratio is coming back in line with historical measures however it’s not entirely there yet;

- Sam’s Club has turned around as Sam’s has posted comp growth of over 10% for the last 11 quarters;

- WMT is an inflation beneficiary as “average ticket” has averaged 9.9% since January ’20 or past 12 quarters, but it also crimps margins from a supplier perspective;

- The stock is fairly valued according to Morningstar but internal inventory improvements could help drive the stock higher;

Justin Sullivan/Getty Images News

When Walmart reports their fiscal Q4 ’23 financial results before the opening bell on Tuesday morning, February 21, 2023, analyst consensus (per IBES data by Refinitiv) is expecting $1.51 in earnings per share on $159.78 billion in revenue for expected year-over-year (y.y) growth of -1% and +5% respectively.

If consensus is exactly met, Walmart will have grown revenue 6% y.y while EPS will have fallen -6% in fiscal year, ’23.

Fiscal year 2024, which is the current year, is expecting $6.50 in EPS on $626.7 billion in revenue for expected y.y growth of 7% and 6% respectively.

There seems to be a bullish consensus coming into Tuesday morning’s earnings release, which can work against traders, but the 2024 consensus at least in terms of the present numbers is looking for another year of mid-single-digit (or rather ordinary) growth.

Fiscal Q3 ’23 or last quarter for Walmart was actually pretty strong, with Walmart comping (ex gas) +8.5%, the highest quarterly comp since January 22’s quarter, while Sam’s Club continues to show solid improvement.

Don’t Bury the Lede:

After peaking at $160 last Spring ’22, Walmart’s stock took gas on what the company blamed on inflation, but if you look at the metrics, particularly WMT’s inventory-to-sales ratio, whatever the issue was (goods inflation, supply-chain, bloated or over-ordering inventory), it was being reflected in that metric:

WMT’s inventory-to-sales ratio (WMT earnings reports )

Click on the spreadsheet and enlarge it, and readers will see since the January ’21 quarter, Walmart’s inventory swelled and sales slowed.

The important aspect for readers to understand is that the inventory turnover ration has gradually improved now for 3 straight quarters since hitting it’s worst level exactly a year ago.

Tuesday morning’s release also laps the worst comp for the inventory-to-sales ratio.

Why this metric is so important will be covered shortly.

Walmart’s EPS and Revenue estimate revisions:

Walmart EPS estimate revisions (IBES data by Refinitiv ) Walmart revenue revisions (IBES data by Refinitiv )

The “tale of the numbers” tells readers that while 2024 and 2025 EPS estimate revisions continue to decline, Walmart revenue revisions continue to be revised positively.

From this we can infer Walmart has margin issues, but it could also be a function of that “inventory-to-sales” number referenced earlier.

For a retailer the size of Walmart, readers probably have no idea how critical it is for a company that’s expected to generate $626 billion in revenue in the coming 12 months, to turnover that inventory at a highly-efficient rate.

Although you learn it in the CFA exam process, I wouldn’t expect readers to know too that “changes in working capital” is one of the largest components of the “cash-flow-from-operations” on the Statement of Cash Flow.

And for a retailer the size of Walmart this is H-U-G-E.

Walmart upped their buyback in the Q3 ’23 earnings announcement last November ’22 to $20 billion, which is a good indication that they expect working capital, working capital likely driven by inventory improvement, to continue to positively contribute to Walmart’s cash-flow.

But the first attached spreadsheet in the 6th – 7th paragraph shows us that while progress has been made, it’s also imperative for Walmart to return to sales growth that is greater than inventory growth and sustain that positive difference over time.

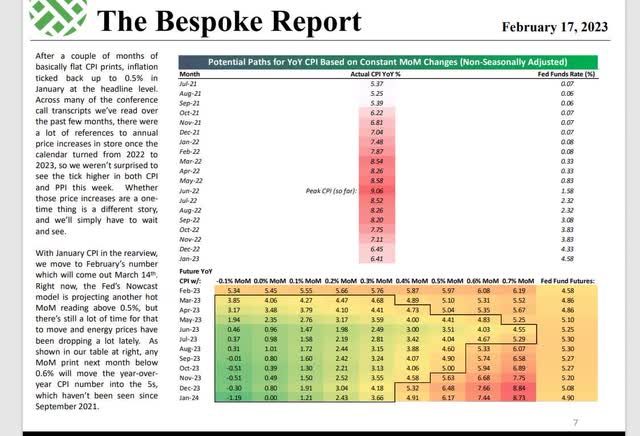

CPI inflation trending down (Bespoke chart)

This table from this weekend’s Bespoke Report shows that CPI continues to trend lower.

Walmart’s pricing power in the face of slowly decelerating inflation, is impressive.

However Walmart is not immune to this “disinflation pressure” either. Eventually Walmart pricing will or should actually help contain grocery and CPI inflation.

Summary / conclusion: It was the New York Times famed Saturday business writer Joe Nocera who wrote in the early 1990’s that Walmart might be one of the critical reasons that inflation was remaining contained under the Greenspan Fed, and in what was a pretty decent economy back then.

The fact is with $660 billion in expected revenue this year, and their broad consumer reach and footprint, Walmart in many ways is the US retail economy, but the ascendence of Amazon particularly after 2008, really pressured Walmart and certainly didn’t make life easier.

Getting inventory management back and track and getting sales to grow faster than inventory is a must for the retail giant, and could generate some upside in the stock.

Ecommerce is now 13% of total Walmart revenue (can’t recall where i read that – probably a conference call note) but consumer inflation is both an assist to Walmart revenue and a negative contributor to margins.

The biggest worry around the stock is that the above-listed EPS estimates for 2024 and 2025 continue to decline, even though revenue estimates for the same years are seeing positive revisions.

Trading at a 20x multiple for expected mid-to-high single digit EPS growth over the next few years Walmart trades exactly like the consumer staple sector of which it is a component. If investors get that inventory turnover improvement that should happen over the next few quarters, that should improve cash-flow and free-cash-flow and help investors get over the 17x cash-flow valuation and 63x free-cash-valuation.

Walmart’s Board is likely to increase the dividend another $0.04 a year to $0.60 a share in the near future.

Clients are long a small position in the stock from when it came apart in June – July ’22. Walmart has lagged the SP 500 badly since January 1 ’20, underperforming the SP 500 by 800 bp’s for the time period from 1/1/20 to 2/17/22.

Disclosure: I/we have a beneficial long position in the shares of WMT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.