Summary:

- Recent 13F disclosure shows that Li Lu’s Himalaya Capital Management added a substantial amount of Alphabet Inc./Google shares.

- These transactions illustrate Li Lu’s investment style that can benefit us all: invest for the long term, hold a concentrated portfolio, and focus on value.

- In particular, the market has mispriced Google’s intrinsic value the way I see it, making its true P/E even lower than on the surface.

BeritK/iStock via Getty Images

Thesis: Li Lu and Google

Li Lu is a well-known Chinese-American investor who has gained fame for his successful investment career and close relationship with Warren Buffett. He is an investor that I have followed and studied closely. And to me, the following are the most salient features of his investment style are the following. And the thesis of this article is to use his positions in Alphabet Inc. (NASDAQ:GOOGL, NASDAQ:GOOG), or Google, stock to illustrate these features.

- Long-term Holding: Li Lu is a long-term investor who looks for companies with durable competitive advantages, strong management teams, and solid growth potential. He typically holds positions for many years, allowing him to benefit from the compounding of returns over time.

- Concentrated Portfolio: Li Lu is known for his willingness to make concentrated bets on a handful of companies in which he has high conviction. He believes that this approach allows him to fully capitalize on his best investment ideas.

- Value Investing: Li Lu is a deep-value investor and looks for companies that he believes are undervalued by the market. He focuses on analyzing a company’s financials and business model to identify situations where the market has mispriced a company’s intrinsic value.

His recent 13F disclosure already demonstrates the first two features clearly as you can see from the following chart. His Himalaya Capital Management LLC, with almost $2B under management, invests in only a total of 5 positions (if you consider GOOG and GOOGL to be equivalent holdings). And as seen, he just more than doubled his position in GOOGL during the 4th quarter of 2022.

And next, I will also explain why his GOOGL investment also serves as a good demonstration for his value investing style. I will analyze why the market has mispriced its intrinsic value.

Google: Intrinsic value mispriced

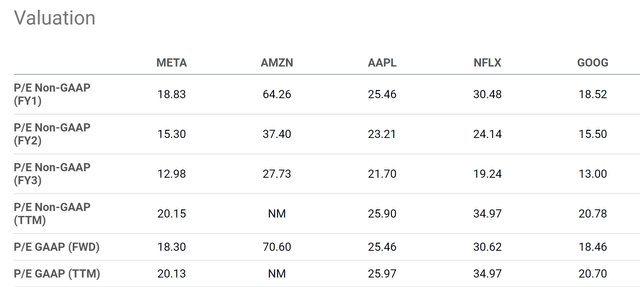

At the time of this writing, GOOG’s P/E ratio (price-to-earnings) is quoted in a range between 18.5x to 20.5x (depending on the source you use) based on its accounting earnings. It is already in a range that I think is very reasonable given the company’s strong profitability and competitive advantage.

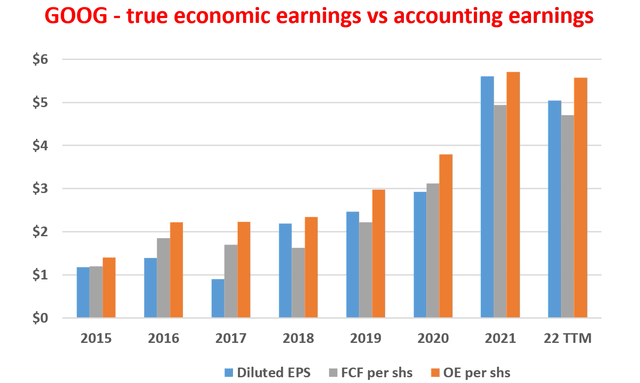

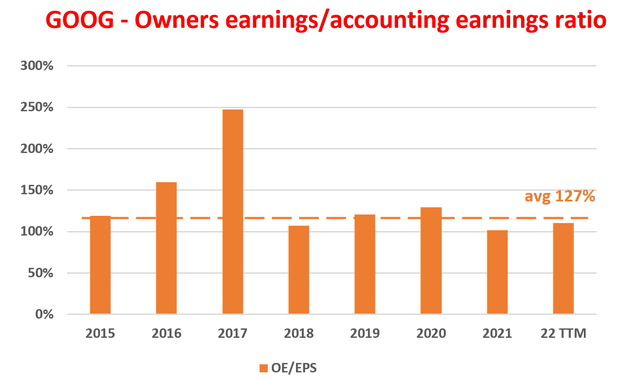

However, it is often the case that the accounting earnings may not fully reflect a company’s true earning power, i.e., its owner’s earnings (“OE”). And in GOOG’s case, the former underestimates the latter by a substantial amount. As shown in the following chart, GOOG’s free cash flow (“FCF”) per share has consistently exceeded its earnings per share (“EPS”), with FCF conversion rates averaging over 100% in the past decade. This suggests that the accounting EPS has underestimated the company’s true earning power.

Author based on Seeking Alpha data

Furthermore, FCF itself is a conservative measure of OE, as it subtracts all capital expenditures (“CAPEX”) from operating cash flow (“OPC”), while only maintenance CAPEX should be subtracted from a business owner’s perspective. As a result, the OE per share, represented by the orange bars in the chart, is even higher than the FCF per share as seen.

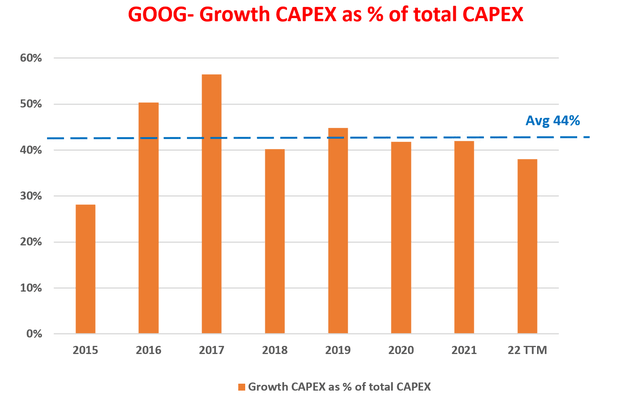

The key insights here have been provided by Warren Buffett decades ago. The gist is that the portion of CAPEX spent on growth should not be considered a cost, as they are optional. The chart below shows the delineation of GOOG’s maintenance and growth CAPEX using Bruce Greenwald’s approach detailed in his book entitled Value Investing. The resulting data reveal that about 44% of GOOG’s CAPEX is dedicated to growth, which should not be considered a cost. And this explains why GOOG’s OE is consistently and significantly higher than both its FCF and accounting EPS. On average, GOOG’s OE is about 27% higher than its accounting EPS, as shown in the second chart.

All told, GOOG’s P/E ratio based on accounting earnings is already reasonable, its valuation based on its true earning power is even more attractive, as its owner’s earnings exceed the accounting EPS, as I will examine more next.

Author based on Seeking Alpha data Author based on Seeking Alpha data

Google’s true P/E

As just noted, the current accounting P/E of Google stock is approximately between 18.5x and 20.5x. It is 18.46x based on its FWD GAAP EPS as seen. And it is 20.7x based on its TTM GAAP EPS. However, taking into account that its OE exceeds its accounting EPS, its true P/E is even lower. As mentioned above, its OE is about 27% higher than its accounting EPS in the past decade. And using 2022 TTM financials, its OE is about 112% higher than its accounting EPS. Using this ratio, its OE-based P/E would be in a range of 16.5x to 18.3x only.

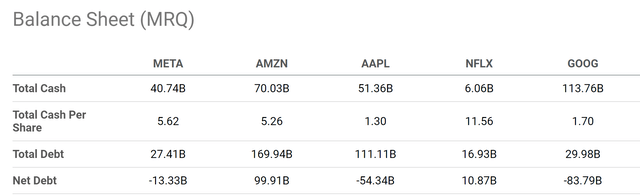

Finally, bear in mind that GOOG also has a sizable net cash position – truly sizable even by the standard of the FAANG companies. As seen, it has $113B of cash on its balance sheet at the end of the most recent quarter, the largest sum among the FAANG. Its net debt is negative $83.8B. The cash position translates to about $1.7 of cash per share, about 1.8% of its current share price. Thus, if we take out the cash position from the share price before calculating the P/E, its P/E would be in the range of 16.2x to 17.9x.

Risks and final thoughts

Google certainly faces some competition risks, both from other search engines and also from social media platforms, which now serve as important advertising channels. There are also some privacy concerns and regulatory risks. Google collects a large amount of personal data from users, which has raised concerns about privacy and data protection. And as a direct consequence of the privacy concerns, it has been almost constantly subject to various antitrust and other regulatory investigations, and some of these have resulted in fines and other penalties.

However, I think all the risks are more than properly compensated in its current valuation discounts. And Li Lu’s recent actions on his position seem to reflect this view as well. To me, his Google position clearly illustrates his investment themes: invest for the long term, hold a concentrated portfolio, and focus on value. Furthermore, I also believe Li Lu likes companies with a strong sense of mission and purpose. Google’s mission to organize the world’s information and make it universally accessible and useful aligns with Li Lu’s belief in the way I see things. Besides the ESG (environmental, social, and governance) consideration, investing in companies with a clear sense of purpose also makes good business sense as well – as they are more likely to succeed over the long term.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.