Summary:

- Lucid Q4 revenues fall short of street estimates.

- 2023 vehicle production guidance not that impressive.

- Cash burn continues at alarming rate.

JHVEPhoto

After the bell on Wednesday, we received fourth quarter results from Lucid (NASDAQ:LCID). The luxury electric vehicle maker has struggled to ramp production as quickly as once hoped, leading to significant revenue shortfalls and large cash burn. Unfortunately for investors, the Q4 report showed that those recent troubles aren’t really improving, making it appear that 2023 will be another tough year for the company.

For Q4, revenues came in at a little more than $257.7 million. While this number was up dramatically from the year ago period’s figure of just $26.4 million, it did miss street estimates by almost $16 million. The soft revenue print is even more disappointing when you consider that Lucid, like many others, already released its delivery figures, so analysts have been able to crunch their numbers a bit. Also, the Q4 2022 average revenue estimate had come down from $833 million to $273 million over the past 14 months, and Lucid still missed by a decent margin.

The main problem for Lucid currently is that low volume production is leading to dramatic losses. The cost of revenues alone was over $615 million, which was more than twice the top line’s reported figure. Gross margins did improve to negative 139%, but that’s not sustainable for any business. It doesn’t help Lucid that key competitor Tesla (TSLA) slashed prices across the board earlier this quarter, which will only toughen the sales environment for Lucid.

The company’s operating losses also continued to increase, coming in at nearly $750 million for Q4, up more than 54% over the prior-year period. Because revenues have finally started to rise a bit, the operating margin percentage did improve sequentially by about 60 percentage points, but still was heavily negative at nearly 291%. The bottom line GAAP loss of 28 cents per share did beat street estimates for 42 cents, but Lucid had a more than $255 million benefit from the change in the fair value of its common stock warrant liability that limited net losses for the quarter to around $473 million.

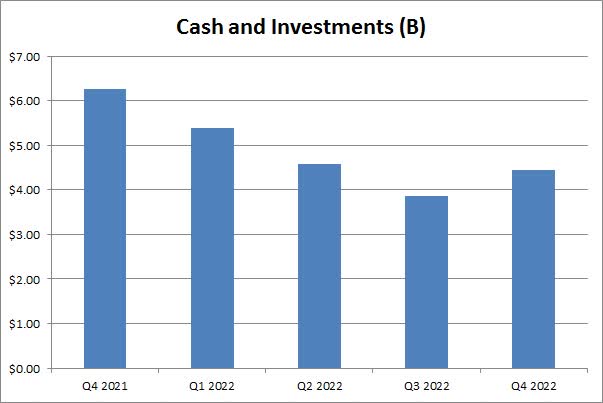

Automotive investors know that this industry is very capital intensive, and it’s hard to start a company from scratch. With Lucid reporting these massive losses each quarter, cash burn has been tremendous in recent years. The chart below does show a sequential increase in the company’s cash balance, but that comes with a major asterisk. Lucid raised more than $1.5 billion in Q4 via stock sales, while reporting free cash flow of negative $938 million for the three month period, more than double the year ago amount. For the full year, cash burn was more than $3.3 billion.

Lucid Cash Balance (Company Earnings Reports)

Last year, Lucid twice cut its production forecast for the year, going from 20,000 units to just 7,000 units. While it hit that figure in the end, deliveries did not even reach 4,400 vehicles. Investors were hoping for a big 2023, but it doesn’t look like that will be coming just yet. Management announced 2023 annual production guidance of 10,000 to 14,000 vehicles. That seems a bit disappointing when you consider that the Q4 2022 production level annualized to almost 14,000 vehicles itself.

Going into Wednesday’s report, analysts were looking for revenues of $2.44 billion this year, up about 269% from their 2022 pre-Q4 report estimate of $663 million. The company’s ability to hit this year’s estimate will depend on its sales mix, as Lucid has begun selling its less expensive variants of its Air sedan. Since the Q3 report, the company’s backlog has come down by about 6,000 units to over 28,000, not including the 100,000 unit order from the government of Saudi Arabia.

It’s hard to make a case for Lucid in the short term, especially with these low production volumes. The company is focused on the luxury EV market, which isn’t exactly large. Tesla has the ability to cut prices further on its Model S and X vehicles if it so chooses, only making Lucid’s mission tougher. Tesla has an Investor Day next week where it plans to show off its third generation vehicle platform, leading some to believe that a new much cheaper EV model will be shown off. That would make the S and X even less of a factor for Tesla’s long-term unit volumes. Lucid will open reservations for its Project Gravity SUV in a few months, which will be a competitor to the Tesla Model X, but it will take several more quarters before we see a production ramp there.

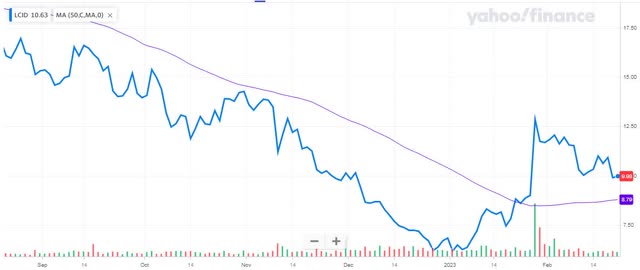

Going into Wednesday’s report, the average price target on the street for Lucid was nearly $14, implying significant upside from the near $10 close. However, shares did lose about 10% in the after-hours session. Trading just above $9 currently also puts shares only a couple of percent above the 50-day moving average (purple line below), which could add more selling pressure if the key technical trend line is lost.

Lucid Last 6 Months (Yahoo! Finance)

It’s hard for me to justify the current share price for Lucid, as you are talking about paying roughly 7 times this year’s expected sales even with the post-earnings fall. Tesla itself only goes for 6 times, and while Lucid may have more potential revenue growth in percentage terms, at least Tesla has profits and cash flow. Lucid also may need another capital raise in the next year or so if it cannot get its losses and cash burn down. The only good news is that the Saudi government is a big backer here, but I don’t see a total buyout coming unless the share price drops quite a bit from here.

In the end, Lucid announced another disappointing set of results. Not only did the company miss heavily-reduced revenue estimates, but operating losses and cash burn continue to worsen. This year’s production forecast, even at the top end, is still 30% below what the company originally guided to for last year, so the production ramp isn’t going too well. With another capital raise likely needed to support the company’s next vehicle launch, and the stock trading at a price to sales premium to Tesla, I could see further downside from here.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.