Summary:

- Meta has been facing strong competition due to the rapid growth of TikTok.

- We could see TikTok face increasing restrictions or outright bans in US and other important markets due to the challenging geopolitical environment.

- Meta will gain from any headwind faced by TikTok as it could lead to rapid migration of customers to Reels and also allow faster rollout of monetization.

- The potential of rapid ad growth on Reels has not been priced in Meta’s stock which should allow further bullish momentum in the next few quarters.

- Despite the bullish run, Meta stock is still quite cheap compared to Big Tech companies and the company is showing the potential of good revenue and margin growth.

grinvalds

Meta (NASDAQ:META) has made a big bet on Reels platform to retain the customers who have moved to TikTok. However, the rapid changes in geopolitical environment could be a bigger tailwind for Reels compared to its own initiatives. The US government has already made a partial ban on TikTok for federal devices. As we enter the Presidential election cycle there could be louder voices advocating a total ban on TikTok due to national security concerns. Any crisis similar to the recent spy balloon incident could deteriorate the relations between US and China which would give further impetus to a ban on TikTok. It is likely that European Union and other Western countries would follow US in banning TikTok.

Meta has reported year-on-year ad impressions growth of 23% while the average price per ad dropped by 22%. A big reason behind this trend has been the increase in customer engagement on Reels. Meta has not started aggressive monetization on Reels platform and this would be a top priority for the management in the next few quarters. A partial or total ban on TikTok would help to reduce the competition for Reels. Meta stock is trading at less than 20 times its PE ratio which makes it a good bet to take advantage of a possible bullish sentiment.

Impact of Reels

There has been a lot of talk about the massive losses sustained by Meta due to its Reality Labs initiative. However, the company has also faced headwinds due to the growth of Reels. More time spent by users on Reels means less time spent on Stories, Feed, and other platforms which are monetized at a higher rate. In the recent quarter, the company reported a staggering decline of 22% in average price per ad. Some of this decline was due to stronger dollar headwinds. However, the impact of Reels can clearly be seen in the overall ad monetization ability of Meta.

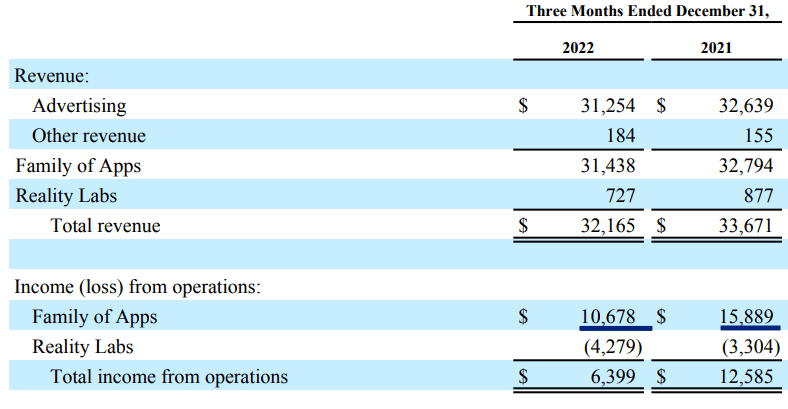

Company report

Figure 1: Impact of Reality Labs on total income is less than the decline in advertising revenue.

The losses in the Reality Lab segment increased from $3.3 billion in the year-ago quarter to $4.3 billion in the recent quarter. That is an additional 1 billion dollars of loss. On the other hand, the overall income declined by a whopping $6 billion. Hence, we can see that Reality Labs is not the main reason while the biggest damage is done due to lower growth in advertising and massive cost surge. Meta is already working on bringing expenses in line with revenue growth by undertaking headcount efficiency. But it would still need rapid improvement in Reels monetization to reignite growth in advertising revenue.

TikTok ban is likely

TikTok was already facing headwinds in the previous White House administration. We have seen a massive change in national security thinking by all the governments in the last year. It seems unlikely that TikTok will be able to sustain operations in the present state in US, European Union or other Western countries in the near future. It takes a small geopolitical incident to cause a rapid ban on an app like TikTok. In 2020, there were border skirmishes between India and China which led to an immediate ban on TikTok despite the fact that the app had a massive following in this region.

Another major crisis like the spy balloon can lead to voices promoting TikTok ban on both sides of the aisle in the US. There is also a possibility of China providing lethal aid to Russia in the Ukraine war which can also lead to a backlash on major apps like TikTok.

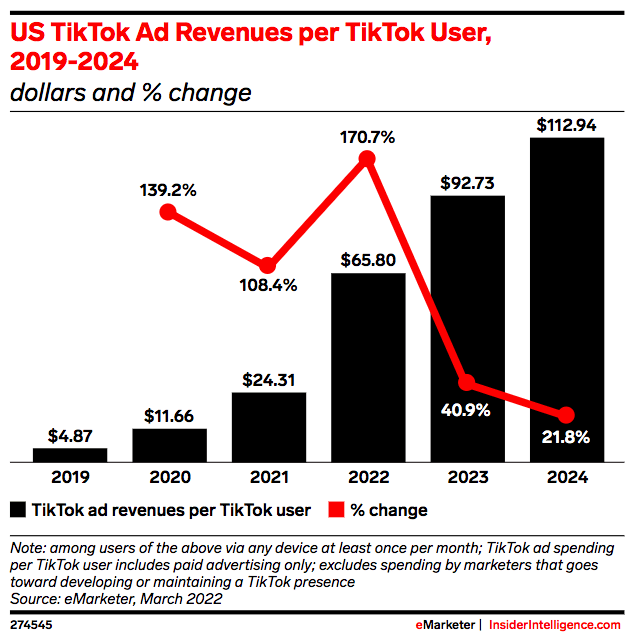

eMarketer

Figure 2: Massive growth in TikTok revenue per user in US.

While Meta has also had its fair share of struggles with regulators in every region, it is likely to be considered a lower threat to national security, privacy, data mining, and other issues. National security is also likely to become a central issue in the presidential race which would increase the likelihood of TikTok facing a total ban or significant restrictions on operations.

Beyond ad monetization

If Reels is effective in increasing the customer base and ramping up the ad monetization on the platform, it will boost the long-term bullish thesis for the company. Meta has regularly faced doubts about the strength of moat around its social media empire. Any new challenge to Meta raises the possibility that it can become another Myspace.

The company faced a strong challenge from Snapchat’s Stories feature but it was able to build a good ad-generating Instagram Stories platform. Reels could be the best example that Meta is able to learn from newer social media apps and build a similar platform within its own ecosystem.

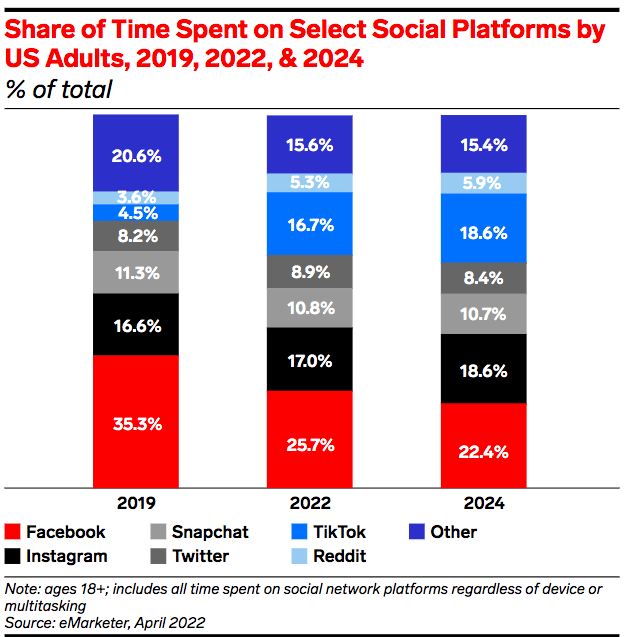

eMarketer

Figure 3: Impact of TikTok’s growth of Facebook’s platforms.

We can see that rapid growth in TikTok has hurt Meta and will continue to hurt the company in the near term according to research report by eMarketer. But as mentioned above, the political headwinds for TikTok will be quite strong in the near term. If Reels is able to grab even 50% of TikTok’s market share under a partial or total ban on the app then Meta’s overall market share in terms of consumer time spent should exceed the 2019 level mentioned in eMarketer’s report.

Impact on stock

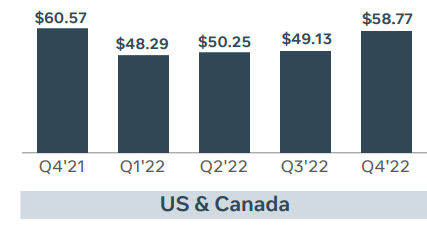

Meta stock has bounced back after hitting a low last year. However, good performance by Reels can still drive the revenue, margin, and stock price higher. Facebook’s average revenue per user in US and Canada was $58.77 in the recent quarter. For the entire year, it was close to $205. At the same time, eMarketer has estimated that TikTok’s average revenue per user in US would be $92 in 2023 and $113 in 2024.

Company report

Figure 4: Facebook’s average revenue per user.

Hence, we can see that any shift in customer base from TikTok to Reels would be highly profitable for Meta.

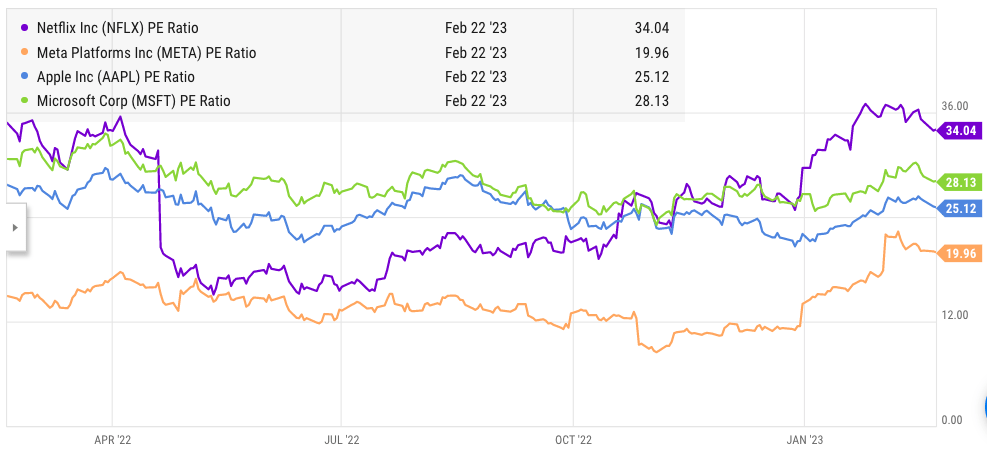

YCharts

Figure 5: Comparison of PE ratio of Meta, Apple, Microsoft, and Netflix.

Despite the bullish run in the last few weeks, Meta stock is still quite cheap than other big tech stocks like Apple (AAPL), Microsoft (MSFT), and a lot cheaper than Netflix (NFLX). Meta is likely to see a rapid improvement in revenue growth as Reels monetization kicks in. The cost-cutting measure undertaken by the company should also help in improving margins. This can help the stock reach a better valuation multiple and build on the current bullish run.

Investor Takeaway

Meta is focusing on monetization of its Reels platform. It will get a massive tailwind from the challenges faced by TikTok. It seems unlikely that TikTok will survive the geopolitical tensions, especially because it operates in the highly sensitive data-gathering industry. Most of the market share of TikTok could be swallowed by Reels and YouTube’s Shorts. A higher customer base and lower competition should allow better monetization and ad rates within Reels.

Meta stock is trading at less than 20 P/E ratio which makes it a good bet even if some of the key initiatives of the company do not meet expectations. The cost-cutting measures have already been announced and we should see the full impact of layoffs in the expenses of 2023. Better margins and healthy revenue growth could drive the stock higher in the next few quarters.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.