Summary:

- Transocean has recently reported its 4Q 2022 and total 2022 earnings results.

- Such figures were broadly expected by the general market. Earlier on RIG’s management also warned of a not-so-good 4Q2022.

- RIG stock has also corrected somewhat from its multi-year highs.

- The management remains optimistic.

- I am bullish on Transocean and really hope there would be no serious recession in the near term.

joebelanger

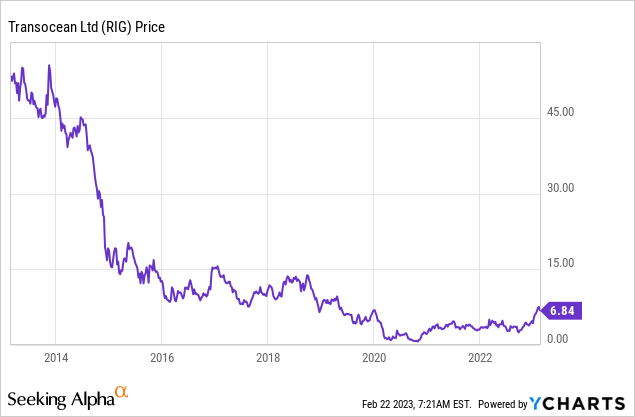

Transocean’s (NYSE:RIG) stock has been recently doing very well with the stock price rising by about 40% as of the time of writing year-to-date in 2023. The offshore driller’s results were announced and they disappointed the market participants although there is nothing to worry about, it seems. The day after the results announcement Transocean’s stock price plunged substantially. However, the results were roughly in line with analysts’ expectations. The company’s CEO Jeremy Thigpen held a press conference commenting on RIG’s financial performance, its backlog, and the management’s expectations. I am bullish on RIG. Here is why.

Transocean Q4 earnings results

On the surface, it looks like Transocean’s earnings results were quite poor.

Here is an excerpt from the company’s website:

-

“Total contract drilling revenues were $606 million, compared to $691 million in the third quarter of 2022 (total adjusted contract drilling revenues of $625 million, compared to $730 million in the third quarter of 2022);

-

Revenue efficiency was 98.0%, compared to 95.0% in the prior quarter;

-

Operating and maintenance expense was $423 million, compared to $411 million in the prior period;

-

Net loss attributable to controlling interest was $350 million, $0.48 per diluted share, compared to $28 million, $0.04 per diluted share, in the third quarter of 2022;

-

Adjusted EBITDA was $140 million, compared to $268 million in the prior quarter; and

-

Contract backlog was $8.5 billion as of the February 2023 Fleet Status Report.”

It looks clear the revenues, the EBITDA, and the net earnings were all substantially worse compared to 3Q2022. However, there were reasons for this underperformance. First, contract drilling revenues for 4Q2022 plunged by $85 million to $606 million, because of reduced activity for five rigs that were idle in the fourth quarter. But this was quite expected. The management warned about this in their 3Q2022 presentation. Second, the net loss was not a result of poor operations. There was a higher interest expense in 4Q2022 – it totaled $263 million, compared with $96 million in the prior quarter. It was a non-cash expense of $157 million resulting from “a fair value adjustment of the bifurcated exchange feature embedded” in RIG’s exchangeable bonds. These were even issued in the 3Q2022.

So, the earnings were reasonable and widely expected. That is why the market’s reaction does not make much sense, in my opinion. As my fellow Seeking Alpha contributors and I mentioned several times before, offshore drillers’ earnings are quite predictable. Therefore, the management’s outlook is much more important here.

RIG’s management’s outlook – key takeaways

The company has plenty of liquidity and bankruptcy seems to be off the table. During this conference call, I was personally more interested in Transocean’s operational outlook, that is the day rates, the contracting activity, and rig reactivations.

To start with, Thigpen noted the current utilization rate for active or warm-stacked rigs is nearing 100%. At the same time, Jeremy Thigpen was very clear the company would only reactivate rigs if it is profitable to do so. In other words, the client would have to pay Transocean’s reactivation costs and also the appropriate day rates. Reactivating cold-stacked rigs may require up to 12 months. But the management does not exclude doing so since the offshore drilling market is getting very tight. According to the conference call, in some regions, offshore drilling activity is predicted to further rise by 40%. Most of the fixtures get awarded in South Africa, Mexico, and Brazil. But the equipment supply is not here to match this demand. So, it seems likely the day rates would go further up.

Valuation

In the comment section of my previous article on RIG my valued readers and I discussed Transocean’s stock price target. It is indeed very hard to predict the stock price of a company generally, especially given the economic uncertainty we are facing now.

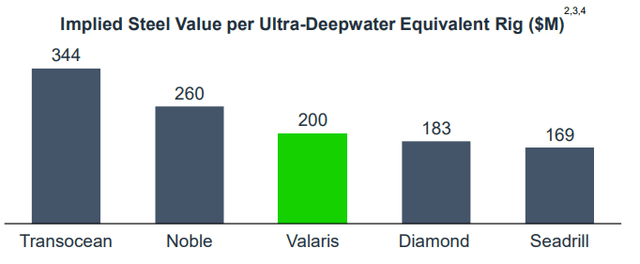

Sometimes offshore drillers are valued according to the implied steel value per UDW equivalent rig measure. This is calculated using the market value of equity, the book value of debt, potentially underfunded pension liabilities, newbuild capital commitments and NPV of reactivation costs, less cash, and NPV of backlog.

According to this indicator, Transocean seems to be the most overvalued driller of all.

Source: Valaris’ presentation, slide 28

At the same time, Transocean is the offshore industry’s leader with the largest fleet. It is also the company with the largest backlog of approximately $8.5 billion. So, in some respects RIG is superior to its peers.

I am sure it sounds obvious to many of you but a stock’s just like any other asset’s market price does not always reflect its intrinsic value. Earlier on, for example, I wrote about silver and the fact its market value should be greater than it currently is. That is mainly due to market manipulators that are artificially holding the prices down. A similar situation was happening to Transocean in the autumn of 2020 when everyone predicted its imminent bankruptcy. The stock options and the bond markets showed substantial activity spikes at the time. The company was not actually on the brink of bankruptcy even though its stock collapsed to $0.69 at the time. The point I am making is that markets do not always reflect the true value of an asset. If the market shows more optimism for Transocean, then its stock might reach double digits very soon.

Let us imagine a fantastic number of say $20 per share. After all, as you can see from the diagram above, between 2014 and 2016 the stock price was even over and above that amount. True, the backlog was 2 times higher than it is now. As reported by my fellow contributor Fun Trading, in 2015 the quarterly backlog was over $18 billion. But as Jeremy Thigpen pointed out, offshore drillers are now facing the best time since 2014. In the past 2022, Transocean added almost $4 billion in backlog, a record-high addition since 2014-2015. If the backlog keeps recovering at a fast enough pace, the stock price might even reach $20 per share. It does not sound very plausible but given the positive dynamics, it might happen.

Risks

Investing in a company after a brilliant rally always carries its risks.

To start with, in spite of the cash raises and the rising backlog, Transocean is still an indebted company. Meanwhile, interest rates around the world are rising. It is still a big question whether there will be the Fed’s “soft landing” or not. But it will be more difficult for indebted companies to service their debts anyway. The problem obviously affects Transocean. The rising rates might mean there will be a recession soon enough, which will be bad news for the stock market generally, including RIG. If that happens, the oil prices will also be affected.

However, we should not forget the supply factor. I personally believe the supply of oil should stay muted thanks to OPEC’s desire to support higher prices, low supplies from Russia, and also the fact it is impossible to quickly fix all the oil infrastructure that remained idle during the pandemic.

Conclusion

Sure, the reported earnings results were almost in line with the analysts’ expectations and the management’s forecast. The company is still not overvalued, given the positive momentum. Even higher day rates are likely ahead and the management might even be paid for the clients to reactivate the rigs if the positive trend continues. Two main risks I personally see are the company’s debt and a possible recession ahead. If the latter does not happen, we might see further stock price growth.

Disclosure: I/we have a beneficial long position in the shares of RIG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.